Approach to Sustainability

Sustainability Management

With the conviction that environmental and social sustainability are essential to achieving sustainable growth for MUFG, we will engage in value creation employing an integrated approach in which the execution of management strategies goes in tandem with the pursuit of solutions for social issues.

MUFG Way and Code of Conduct

MUFG Way

MUFG Way also is the foundation for management decisions, including the formulation of management strategies and management plans, and serves as the core value for all employees.

Code of Conduct

- Chapter 1 Customer Focus

- Chapter 2 Responsibility as a Corporate Citizen

- Chapter 3 Attitudes and Behaviors in the Workplace

Promotion of Sustainability

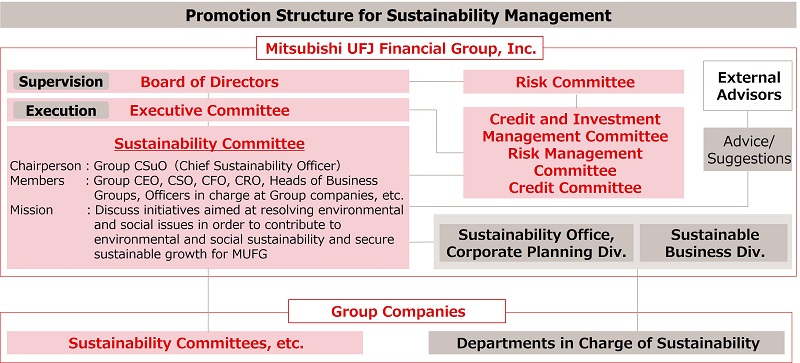

Sustainability Promotion Structure

MUFG Under the supervision of the Board of Directors, MUFG has established a system to promote sustainability centered on the Sustainability Committee.

This committee is chaired by the Group Chief Sustainability Officer (CSuO), who is responsible for all sustainability initiatives. Under the leadership of the Group Chief Strategy Officer (CSO), the CSuO continue the work closely with him to promote sustainability initiatives in conjunction with management strategies.

In principle, MUFG convenes the Sustainability Committee at least once a year to check and discuss the status of sustainability initiatives and to report the contents to the Executive Committee and the Board of Directors, which supervise the Committee. In addition, three external advisors have been invited to provide expert opinions on sustainability issues and risks at any time. These advisors exchange opinions with the members of the Board of Directors and provide advice and recommendations from their professional standpoints on MUFG's sustainability initiatives.

Roles of Each Position and Department

Group Chief Sustainability Officer (CSuO)

External advisor

Sustainability Office, Corporate Planning Division

Sustainable Business Division

Sustainable Finance

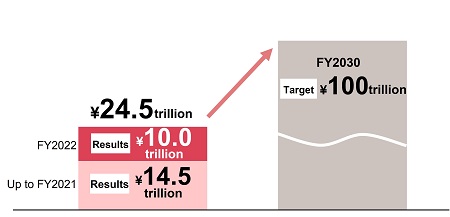

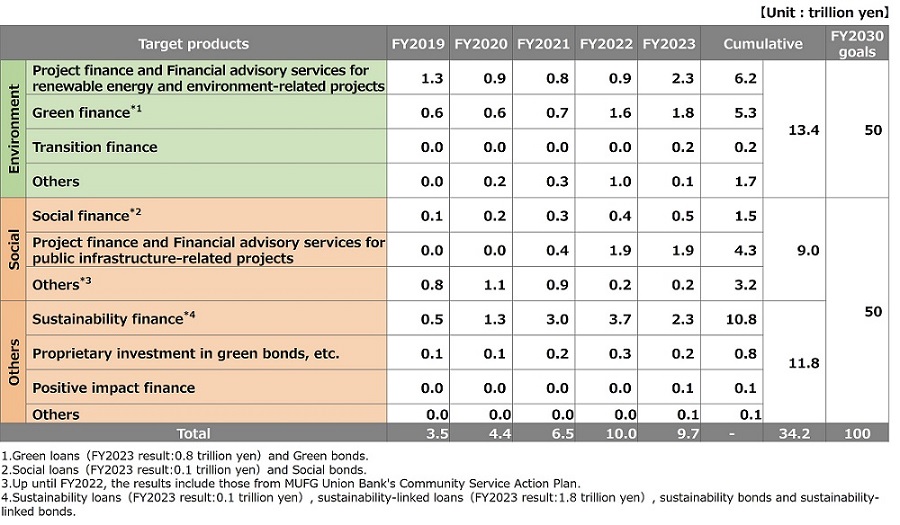

Target and Progress

Progress in Sustainable Finance Goals

Definition of Sustainable Finance

Environmental Area

- Businesses contributing to the adaptation to and moderation of climate change, including renewable energy, energy efficiency improvement, and green buildings (e.g. arrangement of loans and project finance for renewable energy projects, underwriting and distribution of green bonds).

Social Area

- Businesses contributing to the development of startups, job creation, and poverty alleviation

- Businesses contributing to the energizing of local communities and regional revitalization

- Fundamental service businesses, including those involved in basic infrastructure such as public transport, waterworks, and airports, and essential services such as hospitals, schools and police.

(e.g. Emerging Industrial Technology Support Program, loans for regional revitalization projects such as MUFG Regional Revitalization Fund, arrangement of loans and project finance for public infrastructure, underwriting and distribution of social bonds).

Responding to Funds-Supplying Operations to Support Financing for Climate Change Responses

(Climate Response Financing Operations) at the Bank of Japan.

MUFG Bank

MUFG Trust and Banking Corporation

- Criteria for eligible investment or loans for Climate Response Financing Operations and disclosure of specific procedures for judgement on suitability(in Japanese) (PDF / 128KB)

- Outstanding of investment or loans for Climate Response Financing at the end of each fiscal year(in Japanese) (PDF / 174KB)

Issuance of Green, Social and Sustainability Bond

MUFG is the only issuer in Japan with a track record of issuing green, social, and sustainability bonds as the largest financial institution in Japan. The proceeds from bonds issued by MUFG will be used for sustainability-related financing.

Stakeholder Engagement

Stakeholder

In these rapidly changing times, all of our stakeholders are overcoming challenges to find a way to the next stage, toward sustainable growth. We at MUFG will make every effort to help realize these goals. This will be our unchanging purpose now, and into the future.

MUFG will continue to actively engage in constructive dialogs with stakeholders in order to gain new insights and deepen mutual understanding. We strive to build a relationship of trust and cooperation with our stakeholders by responding appropriately to their concerns and issues, and to help MUFG achieve sustainable growth and enhance its corporate value over the medium to long term.

| Key Stakeholder Groups | Policies for Improving Corporate Value |

|---|---|

Customers and partners |

Deliver both financial and non-financial solutions to help customers resolve challenges they are confronting through business operations that precisely align with changes in the business environment and leverage MUFG’s strength

(note)The Bank, the Trust Bank, MUMSS, NICOS and ACOM |

|

Serve as a component of the financial infrastructure supporting society by offering stable funding and making our solid operations and systems available to customers while contributing to the social transition to digital technologies

|

|

Discover opportunities from the pressing need to solve environmental and social issues, thereby becoming a pioneering company blazing a path into the coming era

|

MUFG Colleagues |

Promote corporate culture reforms focused on “speed” and “new challenges” by winning employee empathy toward “Corporate Transformation” via dialogue

|

Shareholders and investors |

Maintain highly transparent information disclosure and engagement in constructive shareholder dialogue while reflecting shareholder feedback in business management and strategies

|

Having Dialogues with Stakeholders

Opening of MUFG PARK

In June 2023, MUFG and MUFG Bank renovated a company owned sports ground in Nishitokyo City, western Tokyo, into a multi-use facility open to the public, called MUFG PARK. MUFG PARK is equipped with tennis courts, sports grounds, and a community library. A variety of events involving community residents are planned.

Under the concept of "offering a base for pursuing your own high quality of life," MUFG PARK hopes to become a force by empowering the region and society. It seeks to do so by tackling the preservation and handover of precious nature, support for the formation of communities, the creation of a resilient society equipped with strength, and other regional and societal issues that we should address on behalf of the next generation through dialogue with the community and participation by employees. We also aim to communicate to society, the varied experiences (know-how) and values cultivated in the facility.

Group CEO Joins with Employees from Three Group Entities in Indonesia in a Town Hall Meeting, Engaging in Vigorous Discussions

To improve employee engagement, we have been proactively holding town hall meetings attended by officers in Japan and overseas. For the same purpose, a growing number of departments and branches have recently taken the initiative of hosting roundtable talks and other events.

In September 2022, President & Group CEO Kamezawa flew to Indonesia to host a town hall meeting. Approximately 200 employees from three Group entities—the Bank’s Jakarta Branch, Bank Danamon, and Adira Finance (a subsidiary of Bank Danamon)— gathered at the venue.

Over the past decade, MUFG has placed utmost emphasis on executing investment in the country due to its high economic growth rate, with the acquisition of Bank Danamon being a prime example of this focus. While addressing attendees at the meeting, Mr. Kamezawa spoke in the Indonesian language to share MUFG’s Purpose of being “Committed to empowering a brighter future.” He communicated a powerful message with regard to his expectations for the concerted dedication of staff at three Group entities to work as One Team to empower a brighter future for Indonesia.

Also, a variety of questions from employees were addressed, encompassing such topics as diversity, equity & inclusion (DEI) and MUFG’s digital transformation (DX) strategy. The meeting was thus successful in improving employee engagement. Following the event, Mr. Kamezawa paid visits to neighboring Group bases and local financial authorities, attracting the attention of local media, with his activities covered in multiple news stories.

In this way, his travel to Indonesia helped demonstrate MUFG’s commitment to supporting Indonesia’s development.

Climate Change Initiatives Seminar

Positioning sustainability as one of the most important themes of our current Medium-Term Business Plan, MUFG has made significant progress in addressing climate change since the MUFG Carbon Neutrality Declaration in 2021.

In May 2023, we published a presentation on our website to highlight our progress along with major future initiatives, and held a Q&A session for institutional investors and analysts in live stream format.

At the Q&A session, we received questions about self-evaluation of efforts so far, MUFG’s approach to the climate change related shareholder proposals at the 18th Annual General Meeting of Shareholders, sustainable finance targets, and other topics.

Analysts and investors reacted positively to MUFG's initiatives and stance. They also recognized the importance of the event as an opportunity to interact with CSO and CSuO, and praised our presentation structure that provided specific responses and viewpoints regarding the shareholder proposals.