Medium-term Business Plan (FY2024-FY2026)

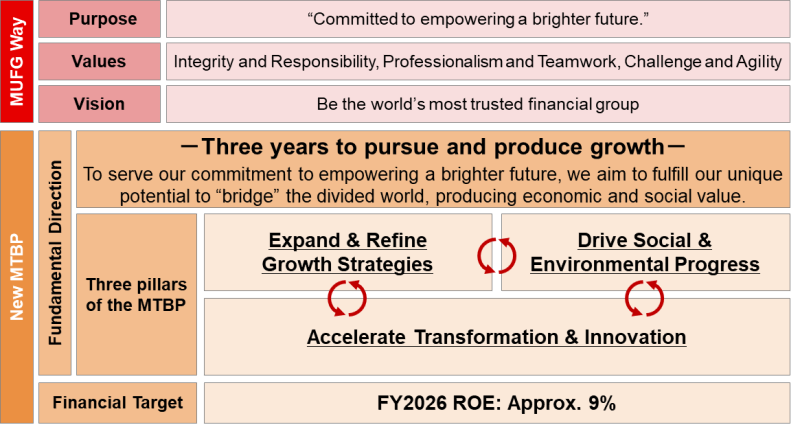

MUFG has established a new Medium-term Business Plan (“MTBP”) for the three-year period beginning in FY2024.

Since the three years of the COVID-19 pandemic, the business environment has changed at an unforeseen pace. AI and other digital technologies have rapidly developed and penetrated our daily lives, the social and economic structure is shifting towards clean energy, and work style and values have become more diverse. Meanwhile, divisions are becoming apparent through heightened geopolitical risk and a reversal of globalization.

In this era when social and economic structures are dramatically changing at a global scale, we believe that MUFG’s ability to facilitate connections, leveraging its extensive network and diverse solutions, can be maximized. By seizing this opportunity to achieve further growth and realizing our Purpose of being “committed to empowering a brighter future”, we will strive to meet expectations of our stakeholders.

Fundamental Direction

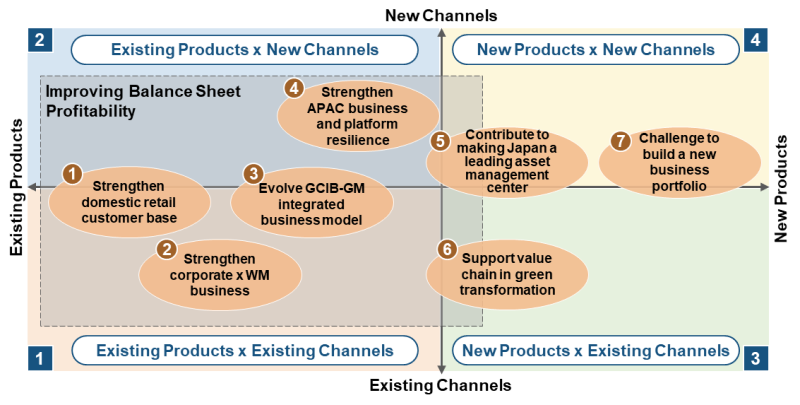

Three Pillars of the MTBP

(1) Expand & Refine Growth Strategies

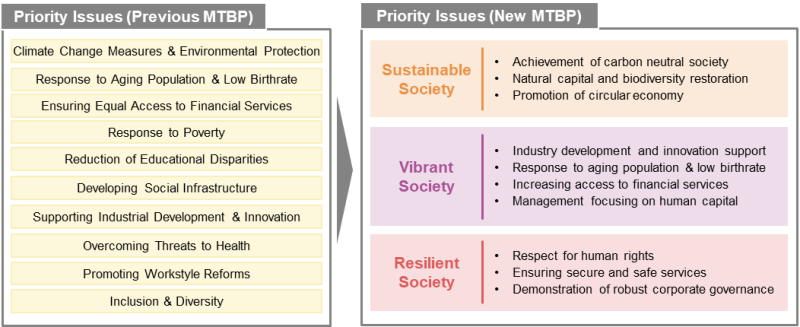

(2) Drive Social & Environmental Progress

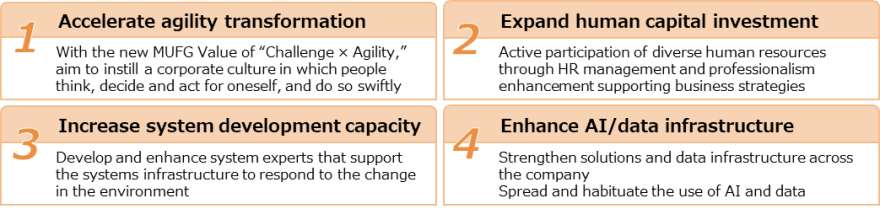

(3) Accelerate Transformation & Innovation

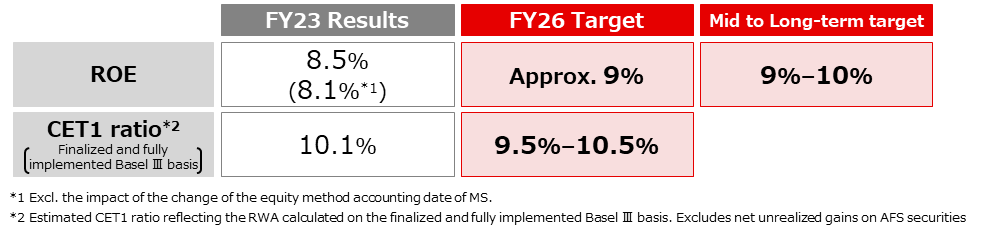

Financial Targets

Target for ROE / Capital management

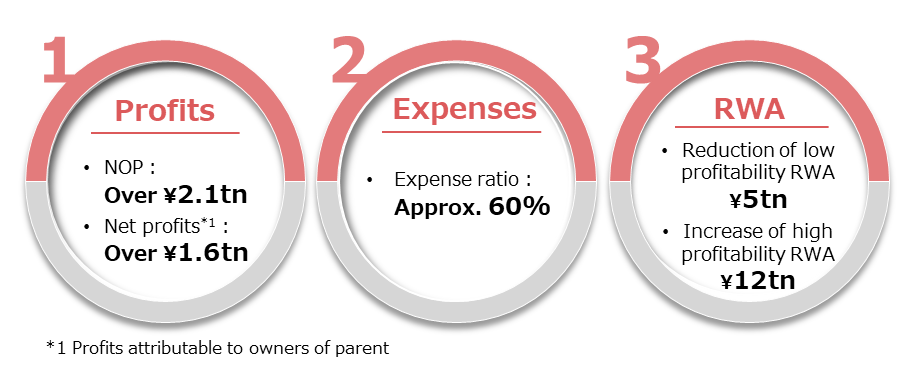

3 Drivers to achieve ROE target

Assumption of financial indicators

BOJ policy rate:0.1%, FF rate:approx.3%, Nikkei Stock Average:approx.Yen40,000, USD/JPY:upper-120s range