Promotion and Expansion of Renewable Energies

Renewable Energy Projects Finance

The introduction of renewable energy as a clean energy source that replaces fossil fuels and the shift away from the use of fossil resources are advancing in countries and regions around the world.

Drawing on its solid track record, abundant know-how and extensive network at home and abroad, MUFG is acting as project finance arranger and lender for solar, wind and geothermal power generation projects. In these ways, we serve as a driving force behind the dissemination of renewable energy around the world. Thanks to these efforts, in 2019 we were able to secure second place in the global ranking of financial institutions serving as lead arrangers in financing for renewable energy projects. We have seized this position for a second consecutive year.

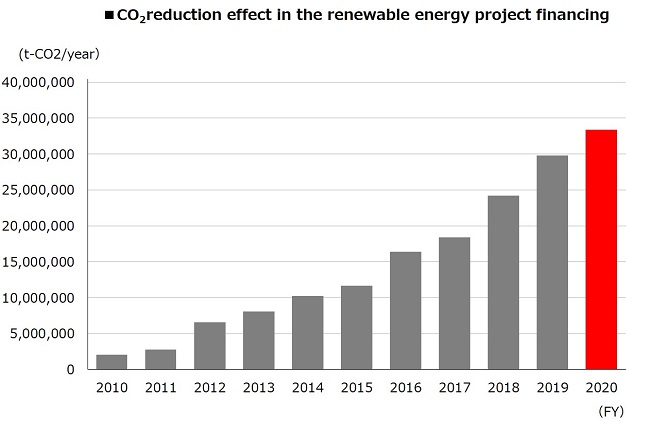

The following shows the CO2 reduction effect of project finance for renewable energy projects by all assets as of the end of each fiscal year.(This is the annual CO2 reduction effect calculated from the amount of electricity generated, facility utilization rate, and emission factors for renewable energy projects with outstanding credit at the end of each fiscal year. This value is after taking into account MUFG's contribution to credit.)

Establishment of a Solar Fund (Ecology Trust)

The Trust Bank has been offering solar funds every year since FY 2018 as an investment product.

The project has been well received by investors, who say that they now have a new investment option for solar power generation that produces a stable profit.

The Trust Bank has been actively investing in renewable energy with investment totaling 29 power plants, 288 MW, and 123 billion yen (excluding already established funds). The Trust Bank is also contributing to regional revitalization, by focusing on projects closely related to local businesses, governments, and residents.

17.9 billion yen

13,000households

Execution of Green Loans and Green Private Placement Bonds

Support Environmentally Friendly Management

Energy Conservation Support Loan (With 1% Interest Subsidy)

Environmental Accounting-CO2 Reductions and Economic Effect through Financing

Products and Services for Reducing Environmental Impacts

Evaluation Methodology and Loan-Related Product that Aligned with ESG Activities

"ESG Evaluation loans for J-REIT"

- Mitsubishi UFJ Research and Consulting offers evaluation and ratings to J-REITs which aspire and conduct ESG management.

The ESG evaluation methodology provided by MURC supports J-REITs in recognizing its current conditions and challenges regarding ESG activities.

Green Bonds Underwriting

- A company that supports the issuance of green bonds through the development of a green bond framework and other means.

- The Climate Bonds Initiative is an international organization based in London that works to promote investment in the projects and assets needed for a rapid transition to a low-carbon, climate durable economy. The Climate Bonds Parteners Programme supports investor and stakeholder activities and educational projects to grow sustainable green bond markets that contribute to climate change response and low carbon investment.

| Rank | Underwriter | Number of projects | Volume (hundred million yen) |

Share (%) |

|---|---|---|---|---|

| 1 | Mitsubishi UFJ Morgan Stanley Securities | 94 | 4,146.9 | 24.5 |

| 2 | Mizuho Securities | 96 |

3,720.7 |

22.0 |

| 3 | SMBC Nikko Securities | 98 |

3,204.3 |

18.9 |

| 4 | Nomura Securities | 73 |

3,003.1 |

17.7 |

| 5 | Daiwa Securities | 60 |

2,298.9 |

13.6 |