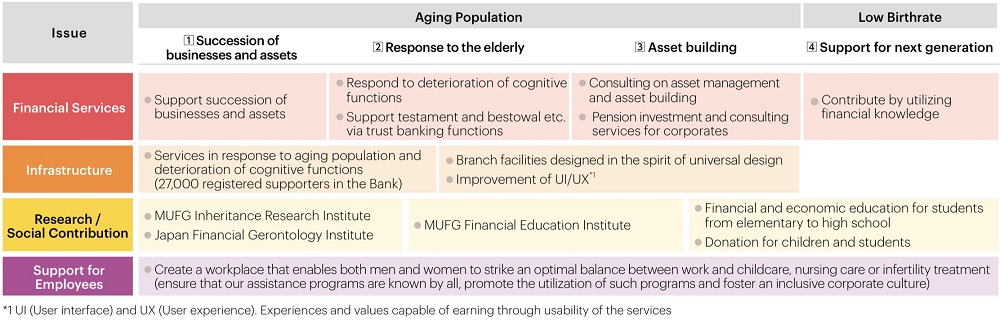

MUFG strives to enhance its financial products and services backed by comprehensive capabilities afforded by the Group to meet evolving and diversifying customer needs in the face of changes in social structure due to the aging population and low birthrate. We also engage in research and social contribution activities for the same purpose.

Moreover, we are developing channels specifically designed to make access to our services easier for elderly customers. At the same time, we constantly work to enhance customer convenience by upgrading our apps and other digital-driven tools supporting non-face-to-face channels to improve their operability and design.

| MUFG’s recognition |

![]

L](/dam/csr/materiality/index_img_004_en.jpg) Leveraging our comprehensive financial service capabilities is important in order to meet evolving and diversifying customer needs in the face of changes in social structure due to aging population and low birthrate. Leveraging our comprehensive financial service capabilities is important in order to meet evolving and diversifying customer needs in the face of changes in social structure due to aging population and low birthrate. |

|---|---|

The aging population and low birthrate may lead to economic stagnation and a decline in growth potential, leading to the shrinkage of both funding demand and interest margins, a situation that could, in turn, have a particularly negative impact on the traditional commercial banking businesses. The aging population and low birthrate may lead to economic stagnation and a decline in growth potential, leading to the shrinkage of both funding demand and interest margins, a situation that could, in turn, have a particularly negative impact on the traditional commercial banking businesses. |

Main Initiatives

Main Initiatives in Each Issue Category

Succession of Businesses and Assets

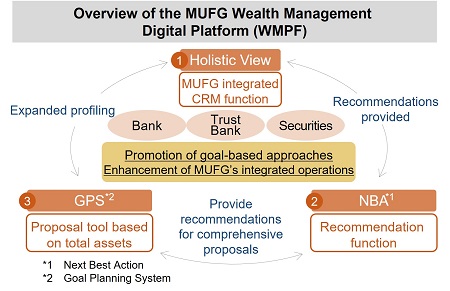

Utilization of the MUFG Wealth Management Digital Platform (WMPF)

MUFG Wealth Management aims to be a trusted brand that can serve as a good partner to support customers' lives for generations to come and to provide Group-wide comprehensive solutions, from banking and trust to securities, to our customers so that they can achieve true wealth at various stages of their lives.

Utilizing the WMPF, a digital tool used across the Bank, the Trust Bank, and the Securities, and Wealth Canvas, for which some GPS functions were made available online in October 2022, we will come to understand customers' life goals and propose optimal solutions based on their total assets using the Group's comprehensive strengths to meet the diverse needs of individuals, their families, and businesses, such as asset succession, business succession, and asset management.

MUFG Inheritance Research Institute

The Trust Bank has established the MUFG Inheritance Research Institute in order to conduct research studies on asset management for an aging society and on smooth transfer of assets to the next generation.

In fiscal year 2022, we held the second symposium of "Diversifying Lifestyles and Future Inheritance", based on our recognition of issues concerning people without family members and interview surveys on the psychology of those who have their will. Anticipating issues that an aging society faces, such as cognitive decline, we engaged in exchanges of ideas with industry, government, and academia on judging testamentary capacity and on the utilization of digital technology.

We will continue to provide practical information from a neutral standpoint with the aim of resolving social issues, such as smooth asset management and asset succession, through symposiums and the publication of various reports and columns.

Started Tsunageru Toshin Service (Gift During Life/Asset Succession)

In July 2022, the Trust Bank started new Tsunageru Toshin service (gift during life/asset succession) designed for individual customers.

It is a new service that contributes to the realization of long-term asset management through two approaches: Gift during life, which allows the younger generation without sufficient funds to invest due to education and housing expenses, to start investing in investment trusts early on by using gifted funds; and asset succession, which allows the next generation to continue managing investment trusts without having to convert inherited investment trusts into cash at time of inheritance.

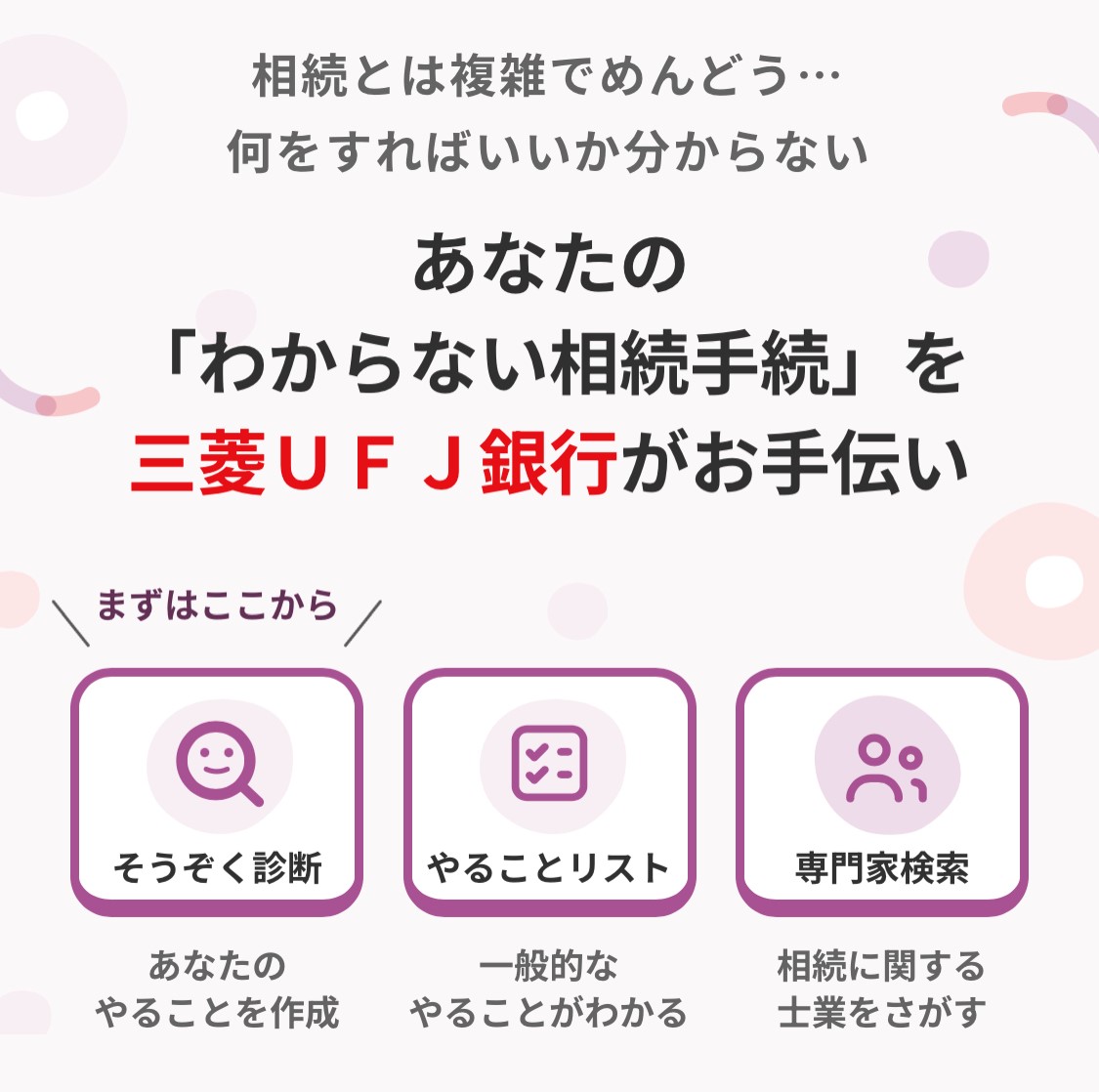

Release of the "Inheritance Guide" Online Service to Assist with Inheritance Procedures

In line with MUFG's Purpose, in July 2023 the Bank released the "Inheritance Guide" online service to assist customers with issues involving inheritance procedures.

The service lets customers create and manage to-do lists for inheritance procedures based on responses to about 20 questions, as well as view informational articles and search for related experts such as attorneys, tax accountants, and judicial scriveners. The service is freely available with no requirement to submit personal information.

Details are available below.

Response to the Elderly

Today, the value of financial assets held by elderly citizens has grown bigger than ever before, while an increasing number of people suffer from dementia. Aware of these circumstances, we offer not only trust products that serve as solutions for testament formulation and the advancement of assets but also robust services to help mitigate our customers’ looming sense of anxiety at the prospect of a possible aging-related cognitive deterioration.

Moreover, we endeavor to ensure that elderly customers can always enjoy access to safe and secure services. To this end, we promote training aimed at securing employee capabilities to accommodate customers with dementia. Today, more than 27,000 employees have received certification for provision of support for people with dementia.

Financial Gerontology

Excellent Club

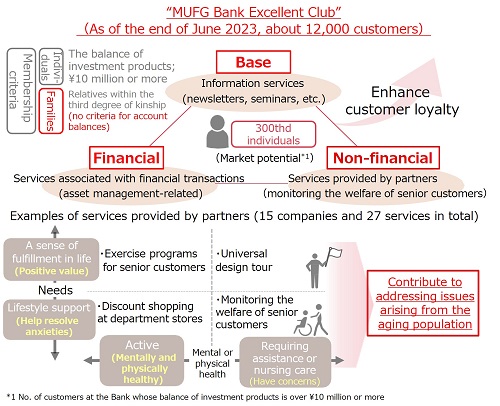

As lifespans increase and customers’ needs and questions concerning life plans diversify, financial institutions are expected to go beyond financial services to offer comprehensive solutions that include alliances with non-financial service providers.

Against this backdrop, in August 2022, the Bank launched the MUFG Bank Excellent Club, a free membership-based service based on the concept of “making 100 years of life 100 years of happiness.” As of the end of June 2023, about 12,000 customers have signed up as members. In addition to providing information such as bulletins and seminars, as well as providing MUFG financial services, we also offer non-financial services that enrich our customers' daily lives and support healthy lifestyles.

Please click the link below for service details and membership conditions:

The Trust Bank has already developed a similar membership service, “Excellent Club,” which is used by its 340,000 members and many others.

The Trust Bank:Excellent Club (in Japanese)

MUFG has positioned each Excellent Club as a platform for providing solutions for the elderly and will contribute to solving the issues faced by the aging society.

Started Housing Loan Products with Options Linked with the Assumed Residual Value of Properties

In the coming era of centenarians, the ways people live and design their lives are expected to become increasingly diverse and transcend the scope of conventional concepts centered on the three life stages of student, worker and retiree. In addition to flexibly accommodating needs arising from changes in modes of education and workstyles, financial institutions are being called upon to help customers secure funds for post-retirement living and to provide other financial solutions that enable, for example, housing loan borrowers to complete repayment even after retirement. In addition, amid the ongoing diversification of lifestyles, these institutions need to respond to the housing-related funding needs of customers wishing for flexibility in their choice of accommodation.

With this in mind, the Bank released housing loan products with options linked with the assumed residual value of properties. These products are designed to provide borrowers with various choices aligned with an increasingly diverse range of life design, for example, options to reduce monthly payments or to secure funds for future relocation.

Asset Building

MUFG offers consulting on asset management for customers from diverse age groups while offering an extensive lineup of pension asset management and consulting functions for corporate clients.

Since fiscal year 2021, we have offered “D-Canvas,” a smartphone app enabling persons enrolled in the defined contribution pension plans of our corporate clients to confirm the balance of plan assets and change products under our administration, and “Money Canvas,” a one-stop platform through which users can enjoy access to a diverse range of financial products supporting asset building. We plan further infrastructure enhancements, including improvements to UI/UX, that will facilitate asset formation for customers of all ages.

Money Canvas

MUFG Financial Education Institute

The Trust Bank established the MUFG Financial Education Institute for the purpose of providing practical and effective information on asset building and asset management from a neutral standpoint.

In fiscal year 2022, we conducted surveys on topics including withdrawal of retirement assets and changes in financial literacy. To make the survey findings widely useful for customers, we published research reports on the surveys on our website and communicated information through media appearances and other outlets.

While retirement asset building focuses attention on the accumulation stage during people's working years, our report "Considering the Withdrawal of Retirement Assets" takes up approaches to utilizing built-up assets following retirement. In addition to release on our website, our director of research spoke on topic of the report, with case studies included, at "Nikkei IR Individual Investor Fair 2022."

Support for Next Generation

Taking full advantage of its financial expertise, MUFG provides financial and economic education to young people. At the same time, we are actively supporting the sound upbringing of children and assisting students in their pursuit of higher education through donations and other means.

For example, MUMSS has been providing elementary school, junior high, high school and university students with programs aligned with the needs of learners at every educational stage, with approximately 3,300 students from 45 schools completing these programs in fiscal 2022. Since the beginning of fiscal 2023, MUMSS has also been providing new programs specifically designed for junior high and high school students.

Support for Employees

MUFG is working to create a workplace where both male and female employees can balance work with their childcare, nursing care, and fertility treatment.