To help develop a social infrastructure that is resilient against disaster and vitalize regional communities, MUFG is engaged in project finance and the formulation of funds, accommodating funding needs associated with the strengthening of aged infrastructure at home and abroad as well as the development of social infrastructure, especially in emerging countries.

Moreover, in the wake of the rapid popularization of digital technologies, we are striving to develop a solid financial system equipped with enhanced cyber security measures and capable of offering higher customer convenience. In this way, we are contributing to the safe and secure social transition to digital technologies.

| MUFG’s recognition |

Robust countermeasures against the aging of infrastructure at home and abroad are key to the creation of sustainable society, as is the construction of social infrastructure, particularly in developing countries. Robust countermeasures against the aging of infrastructure at home and abroad are key to the creation of sustainable society, as is the construction of social infrastructure, particularly in developing countries. |

|---|---|

For us to maintain trust and reliability as a financial institution and a component of social infrastructure, the proper handling of threats to safety and security is a requisite. It is therefore essential to strengthen security measures safeguarding informational assets and prevent financial crimes that have become ever more complex and sophisticated. For us to maintain trust and reliability as a financial institution and a component of social infrastructure, the proper handling of threats to safety and security is a requisite. It is therefore essential to strengthen security measures safeguarding informational assets and prevent financial crimes that have become ever more complex and sophisticated. |

Main Initiatives

Solving Social Issues Using Social Loans

MUFG is extending social loans, which require borrowers to use funds for projects aimed at resolving social issues via, for example, the development of railway infrastructure to mitigate traffic jams and reduce exhaust gas, the development of water-related infrastructure, and the construction of hospitals.

The John F. Kennedy Airport Expansion Project in New York City, the United States

In June 2022, MUFG signed a project finance agreement to support the expansion of New Terminal One at John F. Kennedy International Airport in New York City, in the United States.

With the growing number of users, the project will redevelop the existing Terminals One and Two into a single integrated terminal.

Acting as Financial Advisor as well as the Lead-Left Bookrunner, MUFG closed this deal totaling USD6.6 billion (approximately ¥880.0 billion), which will support a major infrastructure development project aimed at expanding one of the largest international gateway airports in the United States handling traveler traffic from around the world.

Financing for infrastructure and energy related projects is more likely to bring stable revenue even amid economic fluctuations. MUFG has long been a market leader in this field. In recent years, we have realized both robust balance sheet control and higher fee income through project financing by, for example, proactively promoting the Origination & Distribution business(note) and offering interest rate hedges with higher added value to our clients.

In recognition of the initiatives described above, MUFG was chosen in 2022 as “Global Bank of the Year” by Project Finance International (PFI), a leading publication company in the project financing industry.

Looking ahead, we will continue supporting projects that empower our stakeholders, by leveraging our world-leading specialist expertise, extensive experience, and our robust global network.

- A business model selling syndicated project finance assets to institutional investors and others

Installation of Mobility Infrastructure Using MUFG Assets

■ Installation of electric micromobility sharing stations at bank locations

At its Ebisu Branch, Sangenjaya Branch, and Osaka Building (annex) location, the Bank has installed stations for the LUUP electric micromobility (e-bikes, e-scooters, etc.) sharing service provided by Luup, Inc. (December 2022)

By installing the stations for customers and nearby residents making use of new modes of transportation with low CO₂ emissions, the Bank is contributing to greater convenience and to decarbonization.

- New sharing station installed at the Ebisu Branch

■ Installation of Gachaco standardized swappable batteries swapping station for electric motorcycle at MUFG PARK

At MUFG PARK, the Bank has installed a Gachaco station(note1) provided by Gachaco, Inc., a company jointly funded and launched by five companies: ENEOS Holdings, Inc., Honda Motor Co., Ltd., Kawasaki Motors, Ltd., Suzuki Motor Corporation, and Yamaha Motor Co., Ltd. (June 2023)

By supporting customers' use of battery sharing services for electric motorcycle(note2), the Bank aims to not only contribute to the realization of the decarbonized and recycling-based society but also to solve various social issues through exploration of the potential for versatile uses of the station at MUFG PARK, including use for food trucks and events and use as mobile batteries for disaster readiness.

- Stations for freely swapping electric motorcycle batteries in town

- Users can swap the batteries that is low on power with the fully charged batteries sharing common specifications, an aid in solving issues including the hassle of slow charging and concern over running out of battery power on the go.

Efforts for Financial and Digital Platform Operator

Today, the contact points between businesses and their customers are more important than ever. As part of various online services, the Banking as a Service (BaaS) model, which embeds financial functions into digitized consumer activities, is gaining popularity, resulting in a growing call for financial services that are more convenient and attractive.

We are collaborating with multiple external businesses with large numbers of customer contact points to create a new model for financial services. By doing so, we aim to establish our standing as a financial and digital platform operator providing a safe, secure and reliable financial service platform accessible to a broad range of customers.

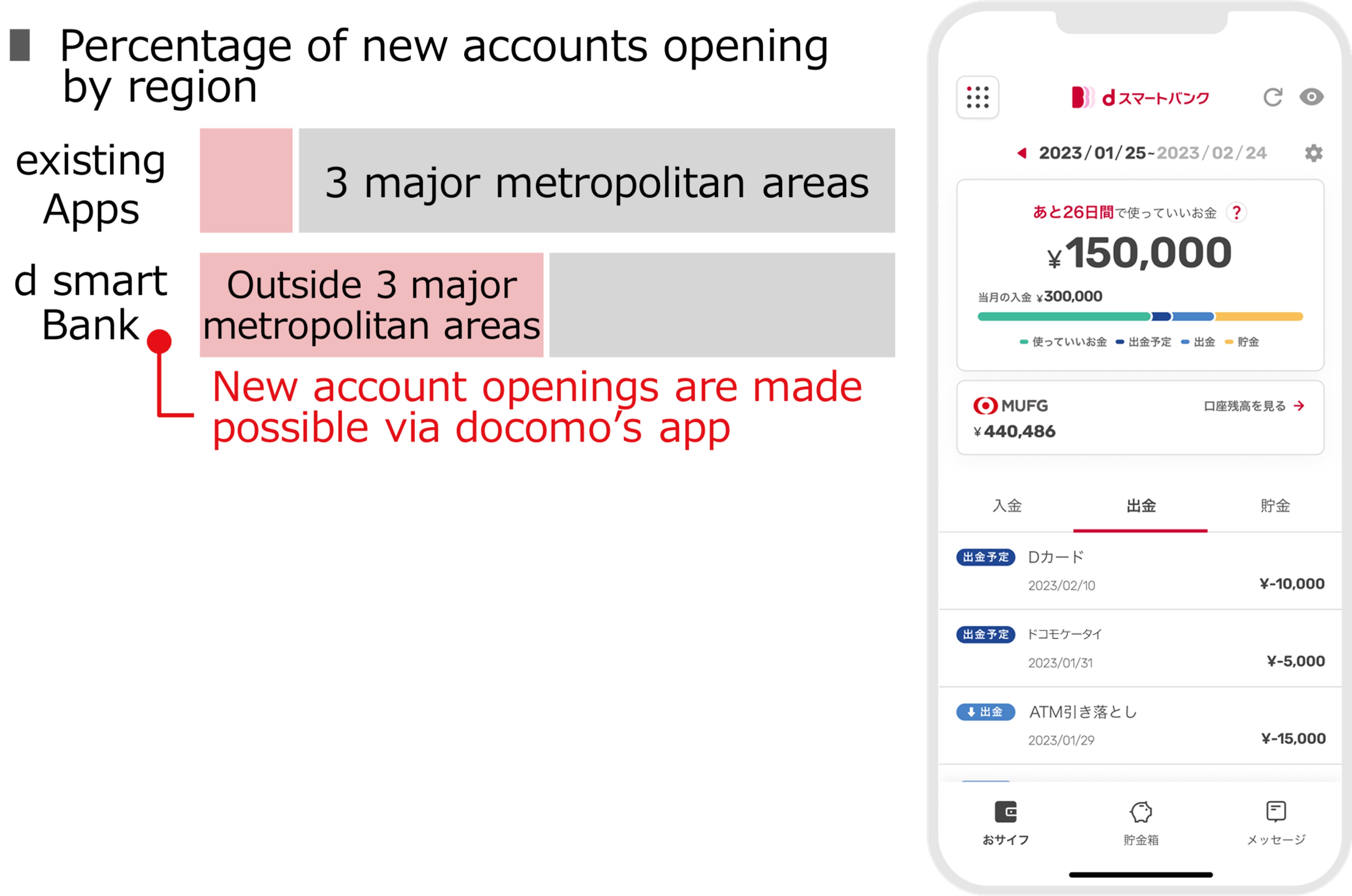

■ Digital account services (d smart bank)

■ Addition of easy deferred payments to our product lineup

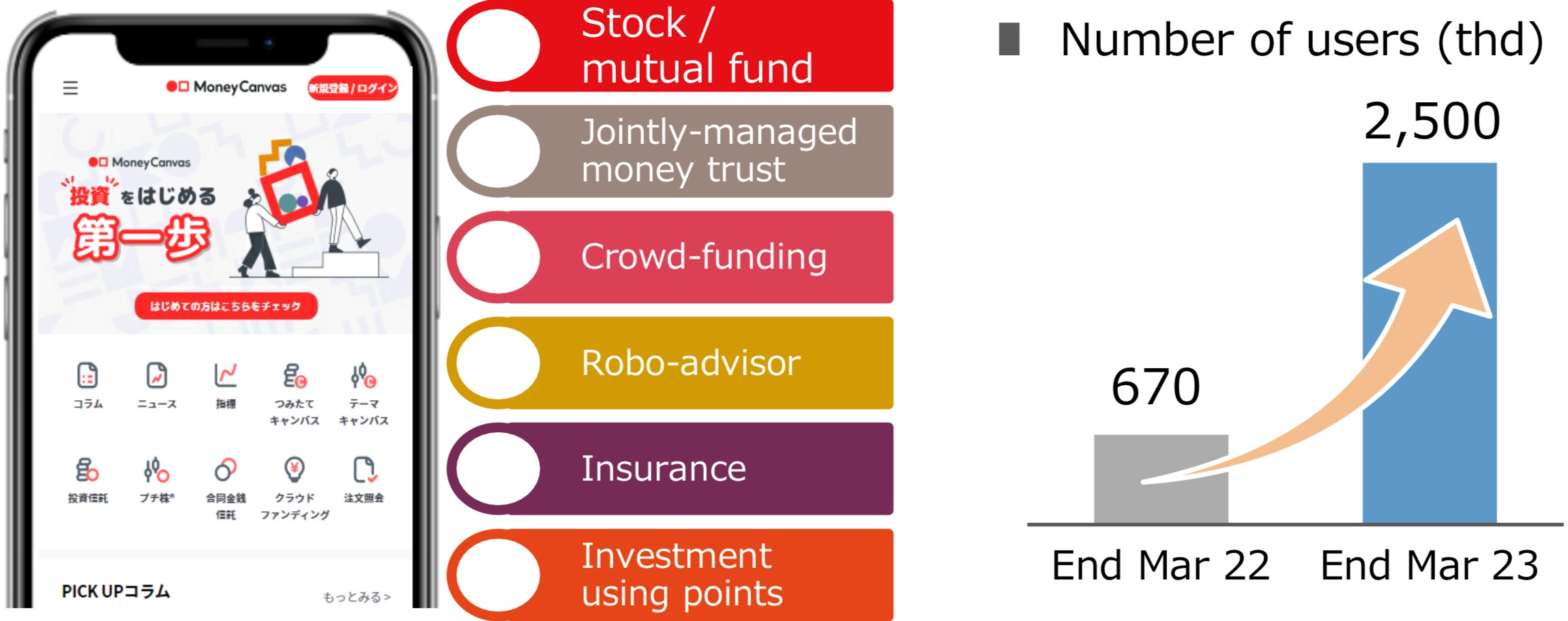

■ Money Canvas Asset management platform

■ Progmat: Digital asset platform

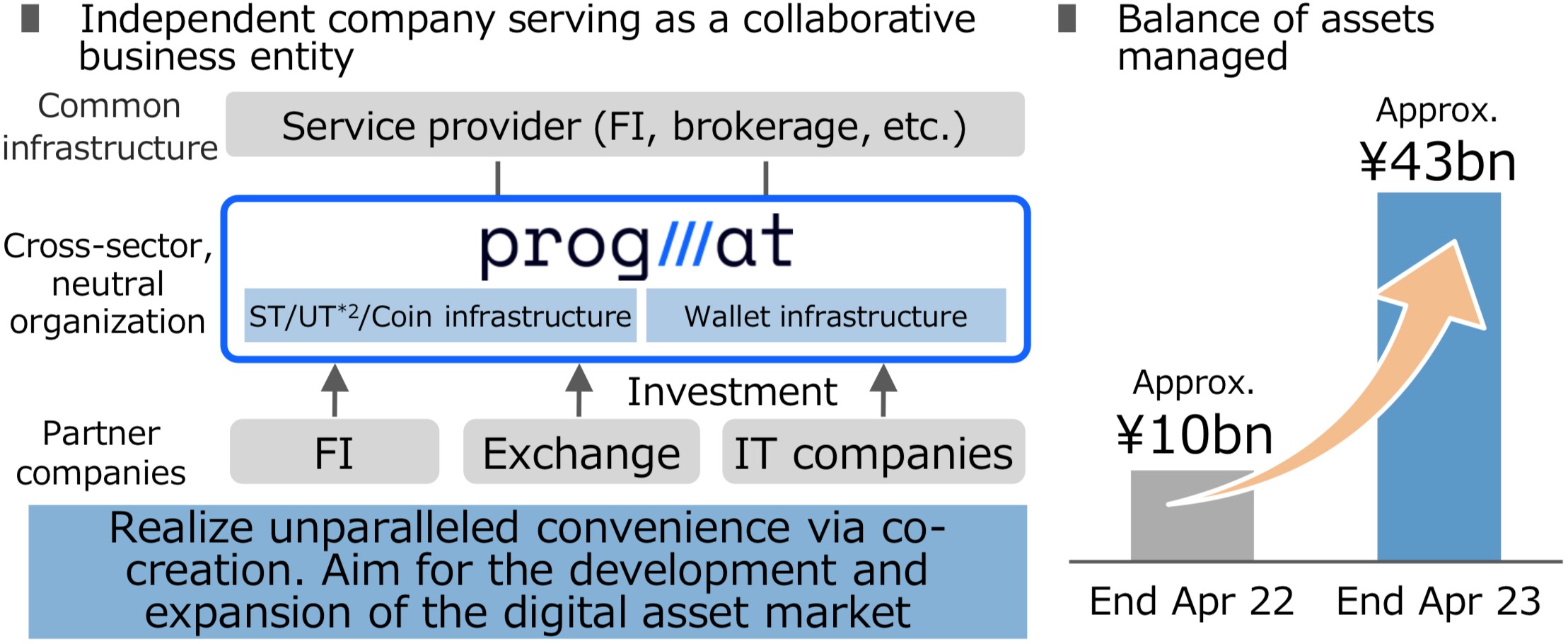

Our digital asset platform Progmat aims to develop and expand the digital asset market, achieving unparalleled convenience through co-creation. In addition to security tokens, Progmat has enhanced utility tokens and other digital assets, with its balance of assets under management breaking through 40 billion yen as of April 2023.

Based on the belief that achieving unparalleled convenience through co-creation among network participants is indispensable for the full-scale expansion of the digital asset market, we are pursuing our plan to make Progmat an independent company so that it can serve as a neutral cross-industry organization.

Security Measures to Counter Growing Threats

MUFG has set up a dedicated team focused on threat intelligence to centralize such related activities as impact analysis for newly found vulnerabilities or past experiences, and remediation for those impacts on a groupwide and global basis. Additionally, the team monitors systems for external stakeholders daily to prevent any flaws in security updates or configuration settings.

In step with the widespread popularization of electronic payment via such internet services as Internet banking, cybercrimes that target online services have become a social issue. MUFG is implementing a variety of initiatives to deliver safe and secure services to customers, such as ensuring robust online verification, thoroughgoing vulnerability countermeasures, threat intelligence, anomaly detection and suspicious-transaction monitoring.

As a financial industry-wide initiative, we engage in collaborative activities to share information on cyber security and enhance safety through Financials ISAC Japan(note1) and the Japan Cybercrime Control Center(note2).

- An organization for financial institutions cooperating on cyber security

- An organization for industry, academic, and government parties cooperating on cyber security