| MUFG’s recognition |  Offering assistance for the creation of growing industries, which are the drivers of economies, and vibrant venture startups is essential to avoiding economic stagnation and securing sustainable growth. Our financial functions are expected to play an important role as such endeavors require a financier capable of risk-taking. Offering assistance for the creation of growing industries, which are the drivers of economies, and vibrant venture startups is essential to avoiding economic stagnation and securing sustainable growth. Our financial functions are expected to play an important role as such endeavors require a financier capable of risk-taking. |

|---|

Main Initiatives

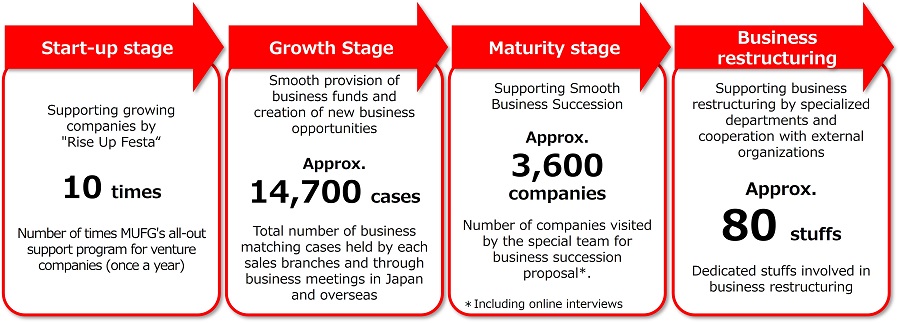

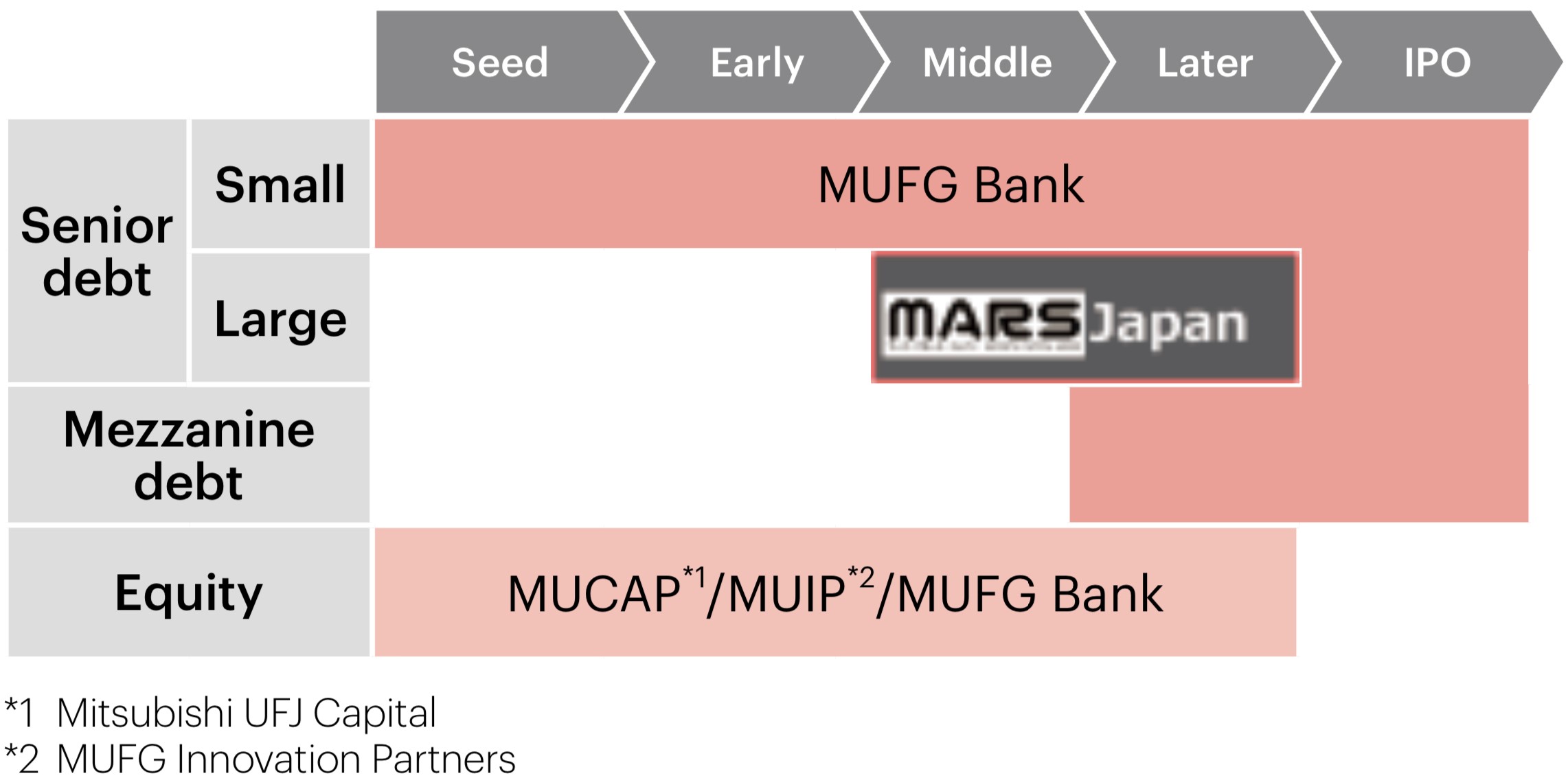

Supporting Every Business Stage

Hosting of “MUFG ICJ ESG Accelerator in Tokyo”

In tandem with Inclusion Japan, Inc., which is engaged in ESG investment in the venture field, we held the "MUFG ICJ ESG Accelerator in Tokyo" program in May 2023.

This marks the second time the program has been held by a Japanese bank, following the first in Osaka in fiscal 2022. The program is aimed at facilitating collaboration across a range of players from startups and business corporations to venture capital and other investors in order to accelerate business development endeavors toward the realization of carbon-neutral and circular economies. In fiscal 2023, of 81 Japan and overseas venture startups applying for this program, 11 companies were selected as finalists. MUFG has since engaged these companies in discussions alongside its cosponsoring partners to co-create new businesses.

Going forward, MUFG will help startups move forward steadily toward the commercialization of their endeavors, working in tandem with them to assist their efforts to discover growth opportunities and launch innovative businesses.

Holding the 10th Rise Up Festa

As part of these efforts, since 2014 we have held Rise Up Festa in which we take full advantage of our network and abundant knowhow in management support and other fields to assist venture startups that take on novel or unique business endeavors over the medium- to long-term.

At the 10th Rise Up Festa in 2023, we solicited a wide-ranging business proposals in four areas seen as holding potential for growth. Of the more than 170 business plans submitted, eight companies were commended for particularly original and compelling plans.

- ● Achievement of a sustainable environment: Greentech, energy, materials, etc.

- ● Contribution to a healthy society and global health: biotechnology, life sciences, Healthtech, etc.

- ● DX in existing industries and creation of platforms: AI, robotics, utilization of satellite data, etc.

- ● Updating of cities and lifestyles: Smart cities, well-being, regional revitalization, space infrastructure, etc.

Financing Support for Energy Startup PowerX, Inc.

PowerX Inc. is an energy startup established in 2021. Possessing proprietary design and manufacturing technologies for storage batteries, the company is developing new businesses involving the evolution of power storage and transmission technologies. The company engages in the development and sales of stationary storage batteries and battery-integrated ultra-fast EV chargers, the nationwide roll-out of charging stations vital to the proliferation of EVs, and the manufacture of oceangoing "Battery Tankers" to store and transport electricity using storage batteries. PowerX is currently constructing one of the largest storage battery assembly plants in Japan to mass-produce low-cost, high-performance storage batteries.

The Securities provided support for project financing as the exclusive financial advisor for PowerX's Series A and Series B funding. Cumulative funding reached 15.26 billion yen (as of August 2023). PowerX will invest the funds in factory launches and the production and shipment of products including stationary storage batteries and battery-integrated ultra-fast EV chargers. The company has successfully achieved milestones including the announcement of its EV charging station business and the start of pre-orders for ship storage batteries. It plans to begin shipping EV chargers, stationary storage batteries, and other products in the fall of 2023.

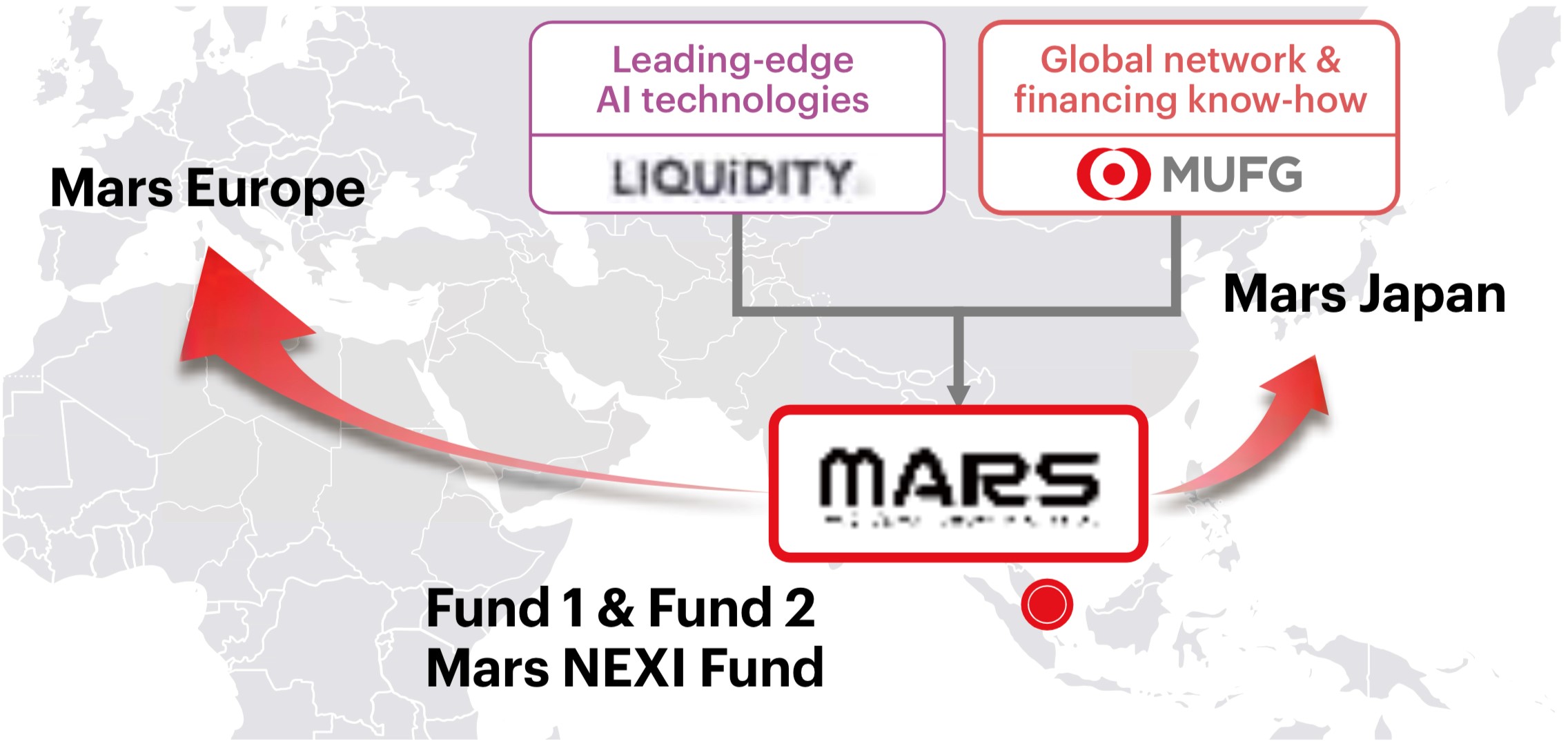

Mars—Supporting Startups via the Use of AI Technologies

Initiatives Undertaken by Mars Growth Capital

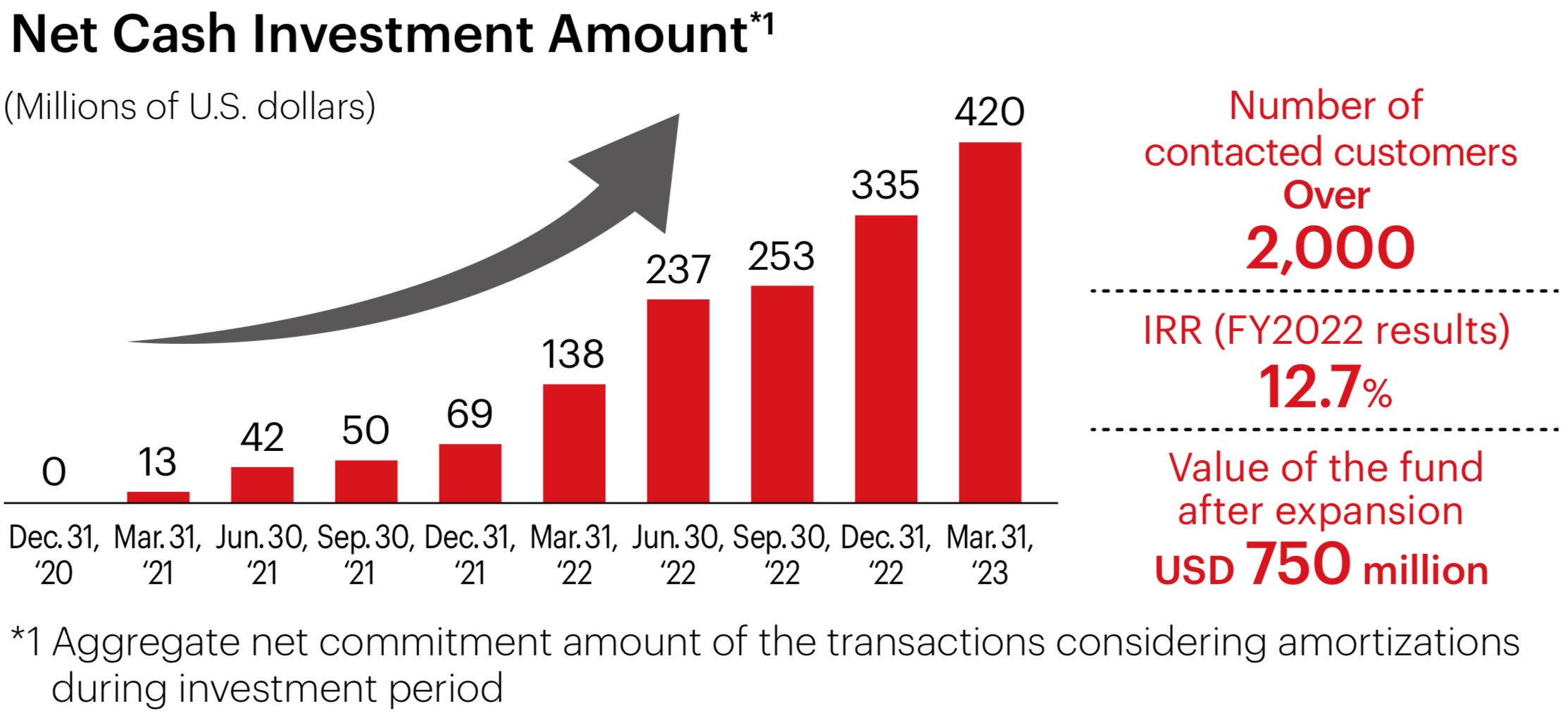

Mars Growth Capital (Mars) is a joint venture established by MUFG and fintech company Liquidity Capital. Currently, Mars is providing finance to startups based mainly in Asia.Since starting the business, Mars Growth Capital has provided loans to over 30 companies and are steadily expanding the business.

By conducting business in the form of a fund, Mars has taken on the challenge of new forms of loans not bound by the traditional bank screening methods of the past. Among the companies that Mars supports there are many startups employing technology to solve social issues, such as online educational services or medical services. Through the power of finance, Mars will support the growth of these companies.

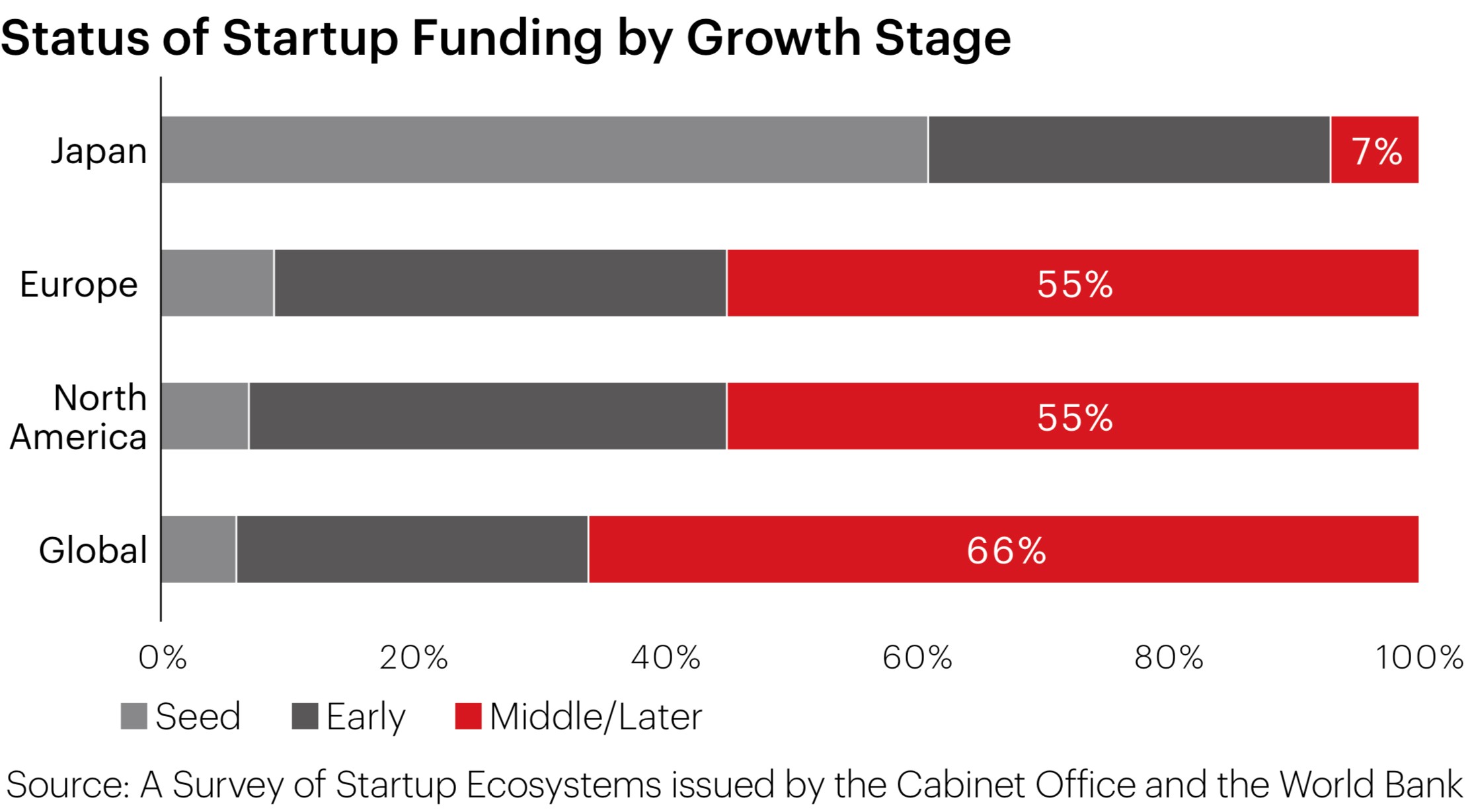

Launching Mars Japan

Pre-unicorn companies in middle or later stages often need to receive large-size debt financing to achieve growth. However, compared to countries abroad, Japan has far fewer major lenders capable of such financing. Because of this, domestic pre-unicorn companies tend to be dependent solely on equity-based fundraising, resulting in a great number of instances in which they choose to be listed before achieving sufficient business growth.

Aware of this situation, MUFG decided to launch Mars Japan, with the aim of extending financing to domestic startups in a way that leverages the AI-based lending screening model developed via startup financing in Asia. Through Mars Japan, we will provide promising pre-unicorn and unicorn companies in Japan with funds for securing business growth. By doing so, we will contribute to the creation of Japan-made, globally competitive unicorn companies and support their growth.

Furthermore, with financing as a starting point, we will extend comprehensive support backed by functions afforded by the Group and thereby accommodate the needs of startups that are aiming for an IPO or considering other business development measures.

Contributing to Development and Solutions in the Space Industry

The market scale of the space industry is 56 trillion yen in 2023 and will be 90 trillion yen(note) in 2030, making it one of the fastest growing markets in the world.

The utilization of satellite-based communications, location data, and earth observation data is expected to expand in more wide-ranging fields and to contribute to solutions to a variety of social issues.

The Bank engages in business co-creation investments that will contribute to the creation of new businesses and the achievement of sustainability in space. By providing knowledge and know-how concerning comprehensive financial services along with the wide-ranging network of the Bank, we will support the advancement of the space industry.

- Estimate by Mitsubishi UFJ Research and Consulting Co., Ltd.

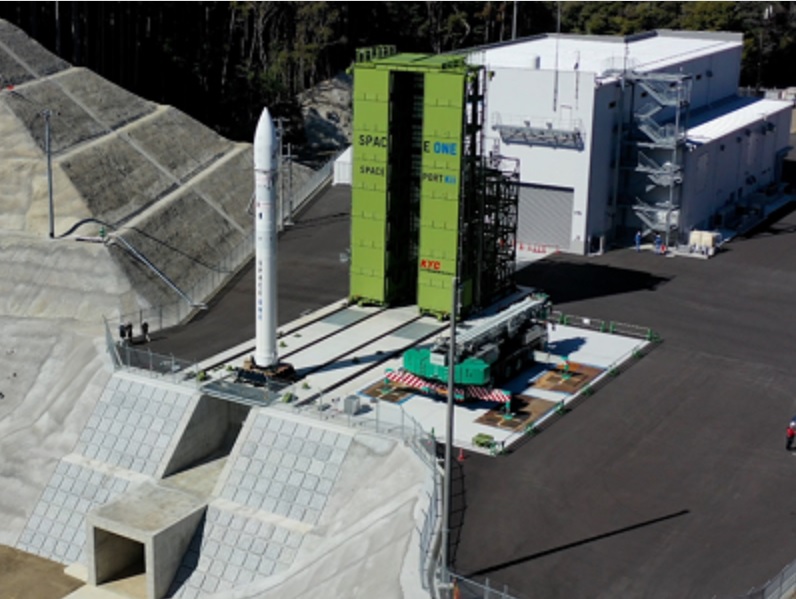

Support for a Small Rocket-based Satellite Launch Business: Collaboration with Space One

As an initial business co-creation investment in the space domain, in December 2022 we invested in Space One Co., Ltd., a company engaged in the satellite launch business using small rockets.

The ground-to-space transport business for artificial satellites, etc. is a foundation that supports space industry, yet Japan faces an industrial structure issue in the lack of rockets and sites capable of low-cost, high-frequency launches.

Space One has its own privately operated rocket launch site and is undertaking integrated operation that spans development to launch of small rockets carrying satellites.

With this investment as our starting point, the Bank aims to compensate for the above-noted issues and create new industrial clusters through cooperation with space-related companies and private business operators.

- Space Port Kii, the rocket launch site of Space One Co., Ltd.

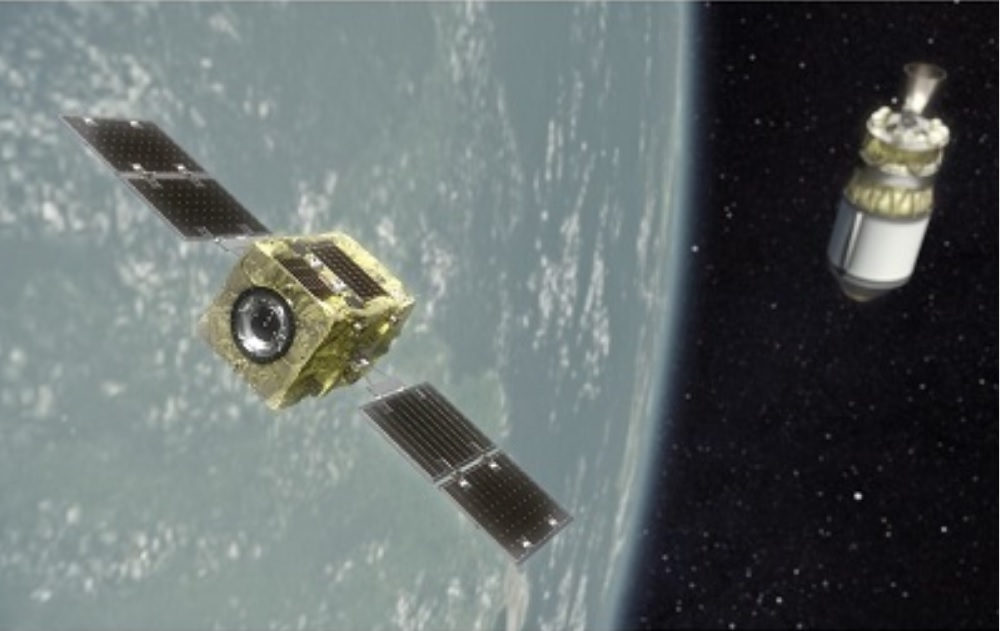

Support for Space Debris Removal and Other Orbital Services: Collaboration with Astroscale Holdings

As a second business co-creation investment in the space domain, in February 2023 the Bank made an investment in Astroscale Holdings, a company engaged in orbital services including the removal of space debris.

Future rocket launches are planned for tens of thousands of satellites, a vital element in space development. However, older satellites and other debris are increasing rapidly, exerting a serious impact on the sustainable development of space.

To achieve "space sustainability," we will contribute to the development of the space industry and the resolution of issues together with Astroscale Holdings, which aims to commercialize the business as a part of space infrastructure.

- Astroscale Holdings' ADRAS-J commercial debris removal demonstration satellite

Support for Regional Revitalization

「MUIC Kansai」

In February 2021, MUFG opened MUIC Kansai in Osaka, a membership-based innovation center, as an initiative to solve issues in the tourism industry and revitalize the Kansai economy.

The core function of MUIC Kansai is a “problem-solving programs” aimed at creating innovation, and MUIC Kansai provides a platform that can identify social issues to be solved, conduct a PoC, and implement the solutions in society in an integrated manner. In addition, the facility is equipped with co-working spaces and shared offices, available forvarious relevant events to provide opportunities for new business matching for co-creation from the perspective of both hardware and software.

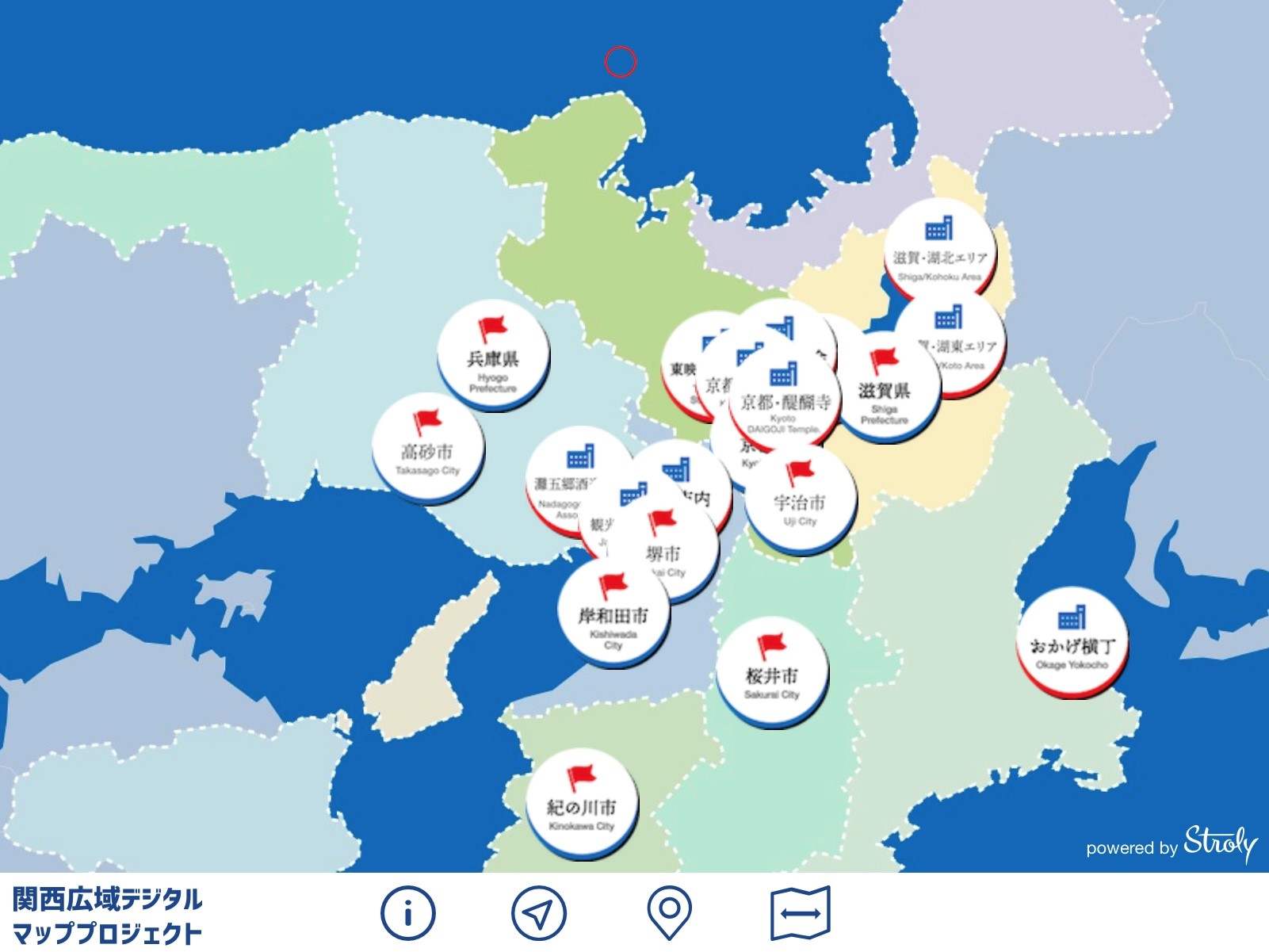

In FY 2022, we released a beta version (note1) of the Kansai Wide-Area Digital Map (Dig the Local, Kansai), a collaborative project with online map platform operator Stroly, Inc. and the KANSAI Tourism Bureau.

The beta version of this illustrated map, rich in design sensibility, is a platform that users can easily access online to intuitively grasp information on sightseeing and attractions in 10 Kansai area prefectures. Tapping area pins on the map calls up scenes before, during, and after travel on a fascinating illustrated map. It offers information found only on sightseeing maps from specific areas, letting users collect sightseeing information effectively and over a wide area.

The project was the winner of the Kansai Inbound Grand Prize at the 6th Hanayaka Increasing the Appeal of KANSAI Award (note2), which recognizes initiatives that contribute to regional revitalization and to the attraction of global human resources and companies through the incorporation of inbound tourism demand.

In future initiatives, we plan to promote interregional round-trip travel to locations other than travel destinations through the maps, to draft tourism promotion measures in regions based on browsing and behavior data, and to strengthen PR for inbound tourists to Japan by releasing official information overseas.

- Sample software for users to try out before release of official version

- The Hanayaka Increasing the Appeal of KANSAI Award was established in 2016 as the main project of the Hanayaka Increasing the Appeal of KANSAI Forum sponsored by the Kansai Economic Federation and the Kansai Bureau of Economy, Trade and Industry. It commends initiatives that seek to contribute to regional revitalization and to the attraction of global human resources and companies through the incorporation of inbound tourism demand.

Signing of Partnership Agreement with ES CON FIELD HOKKAIDO

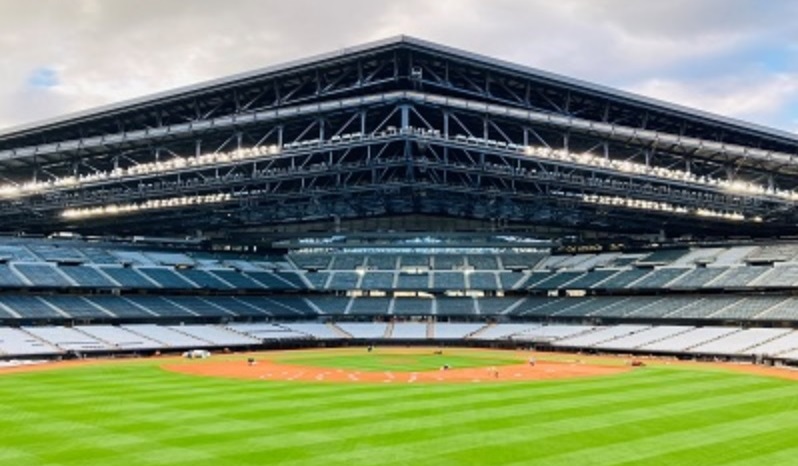

The Bank and Fighters Sports & Entertainment Co., Ltd. (hereinafter "Fighters") have signed a partnership agreement aimed at co-creating a business that combines finance with sports.

Fighters is a company that engages in the development and operation of HOKKAIDO BALLPARK F VILLAGE, the core of which is the new ES CON FIELD HOKKAIDO stadium that opened in March 2023. Centered on that core, we are promoting sustainable urban development that combines lodging facilities, commercial spaces, agricultural learning facilities, Certified Childcare Centers, residences, and more.

The Bank is taking part in new urban development and new business creation with a focus on sports at ES CON FIELD HOKKAIDO. Symbolizing this, the Bank obtained naming rights for the interview room and christened it "MUFG Co-Creation Room." While serving as a hub for the local community and varied stakeholders, the Bank is advancing MUFG's aim of the social implementation of innovation and the resolution of social issues through sports.

ALL JAPAN Tourist Area Regeneration/Revitalization Fund

Invigorating the domestic tourism industry is positioned as one of Japan's critical economic policies and is deemed key to facilitating regional revitalization. Moreover, it is seen as an essential growth strategy as the nation strives toward a GDP target of ¥600 trillion. With the number of visitors from overseas growing, the industry is seeing the creation of new and varied market demand and its potential is expanding. However, on the business front, the industry is faced with a number of challenges, including a shortage of accommodation due to an aging and insufficient supply of facilities, the graying of facility operators and a pressing need for management succession planning. Regional businesses are also being called upon to develop new sightseeing resources and meet increasingly diverse tourist needs.

To help the industry take on these challenges, the ALL JAPAN Tourist Area Regeneration/Revitalization Fund was instituted in April 2018. The first domestic private fund of its kind, this megafund is uniquely designed to facilitate investment that transcends regional boundaries. Alongside other leading business corporations representing various industries, MUFG will collaborate with regional financial institutions to operate the fund, thereby promoting a thriving tourism industry and invigorated regional economies in all 47 prefectures nationwide. By doing so MUFG will actively contribute to Japan's industrial development and economic growth.

The number of investment projects totaled 37 (15 real estate investments and 22 venture investments). Some of these projects are listed below.

We established a second fund in June 2023. We invited JTB Corporation as a new sponsor and strengthened the fund's solution functions. We will continue to be active as a platform for the tourism industry and for regional revitalization.