| MUFG’s recognition |  Providing more customers with opportunities to access financial services and investment not only contributes to improving the growth of economies but also allows for MUFG to secure an even more robust foundation for growth. Providing more customers with opportunities to access financial services and investment not only contributes to improving the growth of economies but also allows for MUFG to secure an even more robust foundation for growth. |

|---|

Main Initiatives

Capturing Digital Financial Needs in Asia

MUFG has positioned Asia as our second “home market” and has been proactively pushing ahead with investment in the ASEAN region with the aim of capturing opportunities arising from the region’s burgeoning economic growth. To date, MUFG has invested in four commercial banks in Thailand, Indonesia, Vietnam and the Philippines, completing the development of an extensive commercial banking platform encompassing ASEAN countries in April 2019. Based on this platform, we have striven to deliver solutions unique to MUFG while helping each partner bank enhance its corporate value.

On the other hand, the use of conventional financial services has yet to become widespread in the region. Meanwhile, fintech companies and others providing digital-driven financial services powered by data and AI technologies are rapidly growing businesses. These companies accommodate financing needs among the underbanked and unbanked individuals as well as SMEs with the potential to become bank customers, thus accelerating the trend of financial inclusion.

Investment in Digital Financial Players

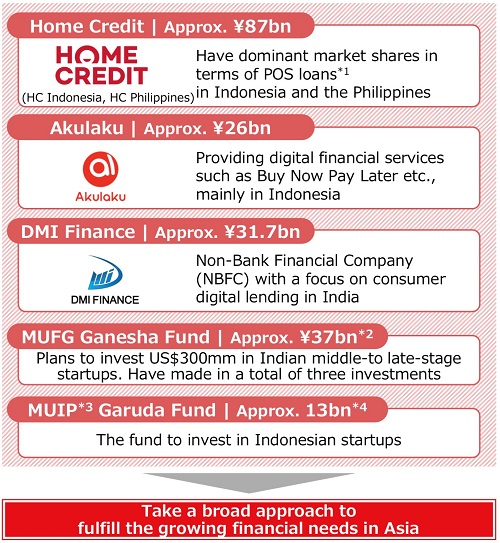

In Asian countries, digital financial services utilizing data and AI technology are emerging. In order to capture these digital financial needs in Asia in a diversified manner, we decided to acquire Home Creditʼs operation in Indonesia and the Philippines and to invest in Akulaku and DMI Finance.

In addition to these investments, we also made investments through funds and executed a total of three investments through the MUFG Ganesha Fund, an investment facility for startups in India. We also established a new 100-million-dollar fund to invest in Indonesian startups.

Collaboration with Grab

MUFG signed a capital and business alliance agreement with Grab Holdings, one of the ASEAN’s leading digital platform operators, in February 2020, with the aim of securing the ability to provide next-generation financial services.

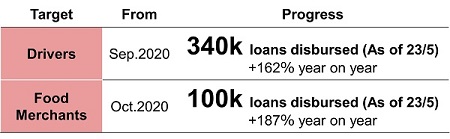

Partner banks collaborate with Grab by providing saving and loan products to underserved segments such as Grab drivers and Grab food merchants. By combining Grab’s dynamic data and partner banks’ expertise in finance, we are meeting the financial needs of new customers for partner banks, thereby further expanding our customer base and contributing to financial inclusion.

Provision of Microfinance through HATTHA Bank Plc.

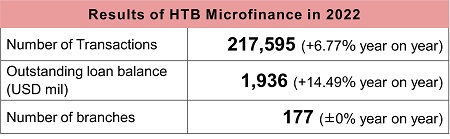

Krungsri (Bank of Ayudhya), our Partner Bank in Thailand, provides opportunities for customers in emerging and developing countries to access financial services through its microfinance institution in Cambodia, HATTHA Bank Plc (HTB), and others.

In addition to providing microfinance, HTB also provides financial education to those with low-income, which contributes to improving their living standards.

Effort to Promote Financial Literacy

Krungsri Financial Literacy: ‘Simple to Learn’ Project

Krungsri (Bank of Ayudhya) has initiated the “Krungsri Financial Literacy: Simple to Learn” Project since 2015 to promote basic financial knowledge and saving habits among primary school students in grades four to six throughout the country.

Krungsri adjusted its activities and collaborated with Office of the Basic Education Commission (OBEC), Equitable Education Fund (EEF) and the Bank of Thailand (BOT) to develop an online animated series, which featured easy-to-digest and entertaining financial knowledge. This series has been distributed to more than 28,000 primary schools and contributed to promote financial literacy among many children.

Provision of Financial Education by Bank Danamon to Improve Financial Literacy

- Danamon Financial Friday is a financial education series to help the audience navigating their financial life and challenges and give them the solutions through Bank Danamon products, services, and channels.