Impact Investments based on the Sustainable Business Investment Strategy

There is an accelerating trend of "impact investing", which secures an appropriate financial return while generating environmental and social impact.

In order to maximize the positive impact on environmental and social issues and to discover business opportunities for MUFG in the field of sustainability, the Bank and the Trust Bank are promoting a new investment strategy that uses environmental and social impact in addition to economic factors in investment decisions, and is expanding impact investing.

In March 2021, the Bank became the first Japanese private financial institution to sign the "Operating Principles for Impact Management" which was developed mainly by the International Finance Corporation (IFC).

In July, the Bank decided to invest in the Climate Finance Partnership, and is actively pursuing impact investment opportunities.

Collaboration between the Trust Bank and First Sentier Investors (FSI)

ESG Investment

Investments that take into account ESG factors are expected to support companies and various organizations working to achieve a sustainable society and improve their long-term returns; thus, there is a growing interest in it, especially among institutional investors, such as public pension funds.

MUFG's treasury business diversifies the investment target to government bonds, foreign bonds, stocks, and corporate bonds, as well as green bonds and other types of investments. In order to strengthen MUFG's financial earnings and contribute to sustainable economic growth through ESG investments, MUFG is going to promote ESG investments by finding the right balance between risks and returns.

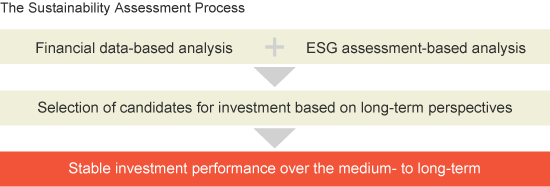

ESG Investment that Leads to Improved Medium- to Long-Term Returns and Reduced Risk

A consensus is starting to take hold that investing in companies with clear social responsibility policies and programs and strong corporate governance systems can increase returns over the medium- to long-term and reduce risk.

In addition, assessment methods that place higher value on corporate dialogue for verifying this nonfinancial information are also becoming more widespread.

Mitsubishi UFJ Trust and Banking Corporation, and its subsidiaries Mitsubishi UFJ Kokusai Asset Management Co., Ltd., MU Investments Co., Ltd., and Mitsubishi UFJ Asset Management (UK) Ltd., have formed the “MUFG Asset Management” (MUFG AM) brand as MUFG asset management companies. Through this, the Group aims to make a concerted effort towards actively engaging in solving social issues, while realizing sustainable business growth and enhancing the corporate value of companies receiving investment.

In May 2019, MUFG AM announced its principles for tackling the assessment management business as the “MUFG AM Responsible Investment Policy”, and has applied it since July 2019.

Promoting the Broader Use of Corporate Evaluations

Based on Nonfinancial Information

Drawing on its experience as a pioneer in ESG-based corporate assessment and asset management, the Trust Bank is working on creating and managing funds with selected equities that are expected to experience sustainable growth. These funds have grown in size as more investors have come to recognize their performance and management strategies. Through seminars and other events, we also educate participants about methods of selecting companies for investment based on ESG principles, and we work to promote broader use of corporate assessment methods based on nonfinancial information.

The Trust Bank also became a signatory to the international Principles for Responsible Investment (PRI) (See Note) to propagate PRI-based investing activities in Japan.

- The PRI was announced by the then-Secretary General of the United Nations, Kofi Annan, in 2006. The PRI is intended to address decision making issues related to ESG for investments, to improve the long-term results of investments, and to reduce risk.

The Trust Bank endorses the aims of the Japanese Version of the Stewardship Code (the Code), which was formulated by the Financial Services Agency for the purpose of increasing the medium- to long-term return on investment for customers and beneficiaries. In order to increase the return on investment, the Code encourages institutional investors to improve the corporate value and stimulate sustainable growth of the company they are investing in through constructive dialogue and other means. The Trust Bank has publicly declared its compliance with the Code and, in order to fulfill its stewardship responsibility, the Trust Bank has disclosed its policy in response to the Code on its website.