What western firms can learn from Japanese banking history?

It’s been eight years since Lehman Brothers filed for bankruptcy, that moment paved the way for the global financial crisis and cast a shadow over the global economy.

In the fallout, some of the world’s largest financial institutions had little option but to rely on government bailouts, while others sought help elsewhere. Back in September 2008, MUFG (Mitsubishi UFJ Financial Group) struck a deal to invest $9 billion in equity into Morgan Stanley - a deal which helped stabilise one of America’s largest financial firms.

In the years since, the financial regulators have remoulded the way companies do business implementing rigorous stress testing, introducing new regulation and de-risking assets. But 2016 has seen renewed concerns about global stability. Major financial institutions are facing billions of dollars in fines and lawsuits, raising concerns from the IMF and increasing calls for further government bailouts.

For example, during the late 1980s, soaring land prices in Japan and speculative property loans led to a financial bubble, which burst in the early part of the next decade.

The Japanese economy was plunged into recession, leaving many firms with irreconcilable balance books. But the financial organisations within MUFG (including Mitsubishi Bank, the Bank of Tokyo, Sanwa Bank and Tokai Bank) managed to escape the troubles relatively unscathed because of continued prudence and caution - an ethos that dates back hundreds of years and has roots in traditional samurai culture.

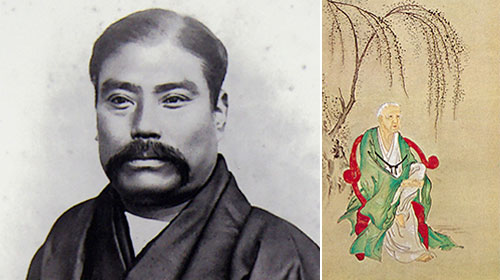

The history of Mitsubishi group can be traced back to 1870, the year Tsukumo Shokai (Mitsubishi’s predecessor) was established by former samurai Yataro Iwasaki, with the entrepreneur entering financial services in 1880 through the established the Mitsubishi Kawase-ten(Exchange Store) - the precursor to Mitsubishi Bank. While other elements of the group’s samurai origins go back even further to the 17th century through the Sanwa Bank and Konoike Money Exchange, as the Konoike family were too descendants from samurai.

Samurai were known for their absolute adherence to a unique code of ethical conduct, known as Bushidõ - or the “Way of the Warrior”. This code comprised of seven core virtues; rectitude, courage, benevolence, politeness, veracity, honour and loyalty.

For MUFG, these warrior principles have influenced and helped to shape the company philosophy and business vision: to be a foundation of strength, committed to meeting the needs of its customers, serving society, and fostering shared and sustainable growth for a better world.

In much the same way that the samurai ethos still prevails in modern Japan, MUFG’s core principles still govern the group today and act as a paradigm for its corporate culture and behaviour - underpinning the overall vision to be the world’s most trusted financial group. Just as samurai were governed by their stringent code, these principles are the management philosophies considered to be MUFG’s “DNA” and guide all of the business practices across the group.

This philosophy has become a business mantra; a commitment to this approach has allowed the group to weather economic turmoil, navigate political uncertainty and expand into unchartered territories.

left:Yataro Iwasaki, founder of Mitsubishi group and the Mitsubishi Kawase-ten (Exchange Store) (forerunner of Mitsubishi Bank)Source: The Mitsubishi Archives

right:Shinroku Konoike, founder of the Konoike Money Exchange (forerunner of Sanwa Bank)

Today MUFG has expanded, evolved and grown beyond recognition since the 19th century, operating today in over 2,300 offices in fifty countries across the world. Its traditional principles have remained a constant, allowing the group to steer clear of troubles and issues that have plagued other financial institutions in recent years.

Just as MUFG’s presence and footprint has grown exponentially across the globe, so too has interest from internationally-minded Japanese investors - a market MUFG services through samurai loans; a Yen-denominated cross border loan for non-Japanese borrowers. Over the past five years, Samurai loan volumes have almost tripled and as one of the leading firms in the market, MUFG arranged USD2.4 billion deals since 2012.

As financial organisations across the world re-examine financial stability, they could do well to remember the way of the warrior that has provided strength for centuries.

You can find out more about who we are and our history here.

From Meiji to Markets