CEO Message

1.Retrospective on Our Tenth Anniversary

Strong progress as a comprehensive financial services group

A start made under tough conditions

This year marks the tenth anniversary of the establishment of the Mitsubishi UFJ Financial Group (MUFG). In 2005, the Japanese economy was in a modest recovery phase despite the fact that the financial industry was still dealing with the repayment of public funding it had received during the Lost Decade and its aftermath. Once this issue was resolved, the industry believed that it could realistically look forward to a new phase of growth, only to be plunged into the financial crisis of 2008. The birth of MUFG took place at an inauspicious and difficult time.

However, I believe that our response to the crisis, which so deeply marked the financial industry, allowed us to build our business structure. MUFG weathered the crisis successfully because of our strong capital foundation and lack of exposure to risky securitized financial assets such as subprime loans. The crisis also presented us with unprecedented opportunities. With an investment of US$9 billion, we forged a strategic relationship with Morgan Stanley and embarked on our long-held goal to create global investment banking capabilities.

Over the last ten years, we have made strong progress toward our original vision of being number one in terms of providing the best customer service, embracing a global outlook, and being one of the most trusted financial institutions in the world. We have solidified our position as the leading bank in Japan and we have become one of the leading global financial institutions. Leveraging our four key strengths: an integrated group, a global network, strong customer base and a firm financial foundation, we are moving steadily toward achieving our goal of becoming a leading provider of comprehensive global financial services.

Our competitive Group companies contribute to our comprehensive group capabilities

MUFG’s domestic business spans a wide range of financial areas including banking, trusts, securities, as well as credit cards and leasing. In each sector, our Group companies have carved out leading positions, in many cases unmatched by our competitors, and synergies with and between the Group companies allow us to provide seamless services to our customers. Over the past ten years, our investment banking capabilities have improved dramatically. We have been able to tap the expertise and experience of Morgan Stanley through the merger which created Mitsubishi UFJ Morgan Stanley Securities, and this company leads in the increasingly active business of Japanese company cross-border M&A. Like a world-class soccer team, we are combining the talents of individual players to generate higher levels of performance.

Global network and strong customer base

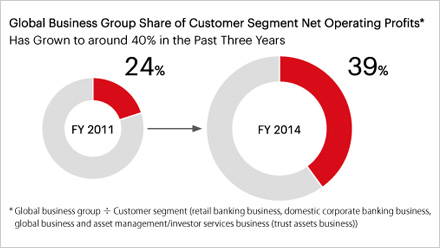

MUFG operates in over 40 countries with over 1,150 worldwide locations. Our workforce is becoming increasingly diverse and global with 50,000 of our 140,000 employees outside of Japan. As a result, overseas business increasingly drives our profits. In our customer segment (retail banking business, domestic corporate banking business, global business and asset management/investor services business (trust assets business)), the proportion of net operating profits generated by our global business group has increased from 20% three years ago to around 40% now.

In Japan, we have worked very hard to build and sustain trust with our customers, and our business now covers 40 million individual customer banking accounts and 400,000 corporate accounts. However, we know that financial institutions do not build trust with customers overnight, so we focus on long-term relationships. Over the past ten years, we have expanded our business to include not only Japanese companies, but also overseas corporations. Over 70% of our overseas corporate business profits now come from non-Japanese companies.

2.Results and Challenges from Our Previous Medium-Term Business Plan

Three years of steady progress toward our goal to become the world’s most trusted financial group

We have strengthened our domestic business over the past three years

The previous medium-term business plan, which ended in fiscal 2014, set out two main objectives: “enhance and expand global business as a driving force for growth” and “contribute to the revitalization of the Japanese economy.” Looking back on the past three years, we can see we have made steady progress on both of these objectives.

In Japan, the economy has offered limited opportunities for expansion and, as a result, the financial sector has been challenged by a period of market contraction. Consequently, our domestic profits have declined since the establishment of MUFG.

However, our goal has always been to contribute to the recovery of the Japanese economy and we have re-invigorated our domestic business to support that aim. Leveraging our group strengths, we have worked to provide our retail and corporate customers with products that meet their needs in a timely manner. We have also introduced a number of products and services that meet the diverse asset management needs of our retail customers. In the corporate sector, we have paid particular attention to SMEs, providing them with value-added services. These include consultation banking to address issues they may be facing and assistance with business continuity processes when new generations of management emerge. Together with improvement in the market environment and consumer sentiment that have been the result of Abenomics, we have been able to overcome some of the negative impact caused by prolonged low interest rates and to move our domestic business onto a path of solid recovery. This is perhaps the most significant achievement during our medium-term business plan.

Overseas business is the group growth driver

Our overseas businesses have continued to be our main growth driver with our global business group producing an annual net operating margin trending at over 10%. In order to provide comprehensive financial services including retail in North America and Southeast Asia, we merged Union Bank in the United States with the Americas business of Bank of Tokyo-Mitsubishi UFJ (BTMU); and in Thailand, we acquired the Bank of Ayudhya (Krungsri) and merged its operations with the Bangkok branch of BTMU. In addition, we have become the global number one in project finance for three consecutive years.

A further challenge has been to move our profit driver to the customer segment and away from the market segment where interest rates have made it difficult to generate gains on JGB sales. Our customer segment initiatives have helped to achieve this rebalance; this is another major achievement of the previous medium-term business plan.

Recognizing challenges in the previous medium-term business plan

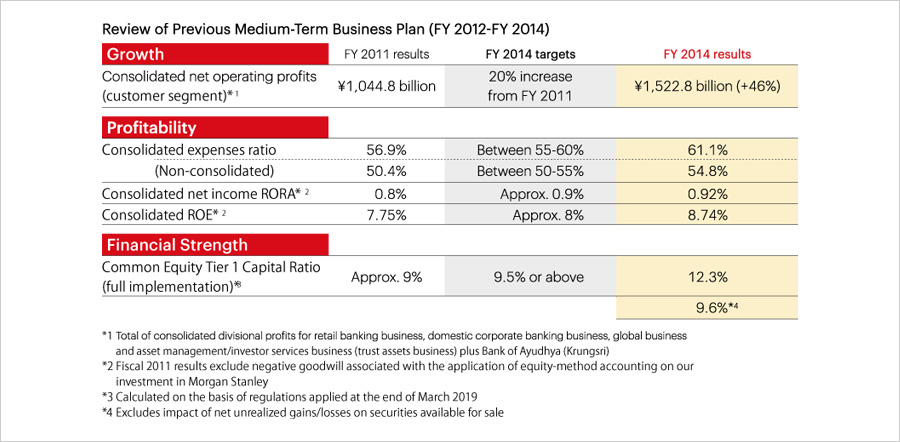

The previous medium-term business plan set a number of fiscal objectives based on growth, profitability and financial strength and we have worked steadily to achieve these goals. We succeeded in meeting targets for all categories with the exception of the consolidated expense ratio which was impacted by our aggressive investment in overseas business. We hit our target for the Common Equity Tier 1 Capital Ratio, which is a key indicator of financial health. This is the case even for the provisional figures which apply based on regulations to be implemented at the end of March 2019.

Three major challenges became evident during the implementation of the medium-term business plan. The first was improving productivity, which can be viewed from a triple perspective: enhancing per-capita employee productivity; improving return on investment; and further increases in capital efficiency.

The second challenge is to strengthen global corporate governance. Our overseas business profile is becoming more prominent as it continues to drive earnings and an appropriate response to global financial regulations is crucial. We need to be fully aware of and in compliance with, regulations in different markets and jurisdictions and to manage each region effectively from headquarters. Objective external viewpoints are crucial in strengthening corporate governance, whether they be customers, local communities, or regulatory authorities. We believe the role of independent non-executive directors as the representatives of these varied stakeholders is particularly important.

The final challenge is calibrating our business model to respond to changes in the environment. This is a perennial issue, but it will become more important. For instance, new industries emerge and companies reconfigure their businesses in order to compete globally. To support this, financial institutions will need to create a model based not only on lending, but also rooted in a diverse and robust business mix.

3.Long-Term Management Strategy

Consolidating our leading domestic position, aiming for Asian top league, US top ten

The next ten years

With all of these issues in mind, MUFG has framed its new medium-term business plan. We tried to predict the business environment ten years from now and then adopt measures for the next three years as a first step to meet the new challenges. Ten years from now, the aging of the Japanese population and the declining birthrate will still be critical problems and we have identified a number of additional key issues. Prominent among them are how to promote the role of women and seniors in society and how to nurture the next generation. The demographic and social structure will change along with transformative shifts including the evolution of compact cities and the explosive growth of information and communications technology (ICT). In this environment, the way we interact with customers will change and we believe the omni-channel format will become the effective way to do business (note1). In the corporate sector, new industries will transform the way in which companies emerge and the pace of globalization will increase.

In this new landscape, what course should MUFG follow? Our foundation remains the domestic business where we will continue to contribute to the revitalization of Japan and consolidate our position as the leader of the financial sector.

In our overseas business, we will maximize the potential of Bank of Ayudhya and MUFG Union Bank, aiming to be in the top league in Asia while targeting a top ten position in appropriate sectors in the United States. In global corporate banking we plan to strengthen our business model, shifting from the current loan-centered business to include areas like transaction banking (note2). We will also maximize asset efficiency through origination and distribution. The asset management business will become increasingly important as personal income levels rise and assets accumulate in regions with growing economies like the emerging markets. We want to build our presence and enhance our recognition as a financial group both domestically and overseas.

We will not only strengthen our operational platform through ICT, which we expect to be a key in transforming the financial industry, but also enhance our management foundation comprising better corporate governance and information systems.

- (note1)Providing services to customers through the best mix of branches, ATMs, telephone and Internet banking

- (note2)Business, such as deposits, settlements and trade finance, that works through trade flows

4.Our New Medium-Term Business Plan

Evolving to meet change while focusing on customer perspective, group-driven approach, and productivity improvements

Responding to change, implementing reform

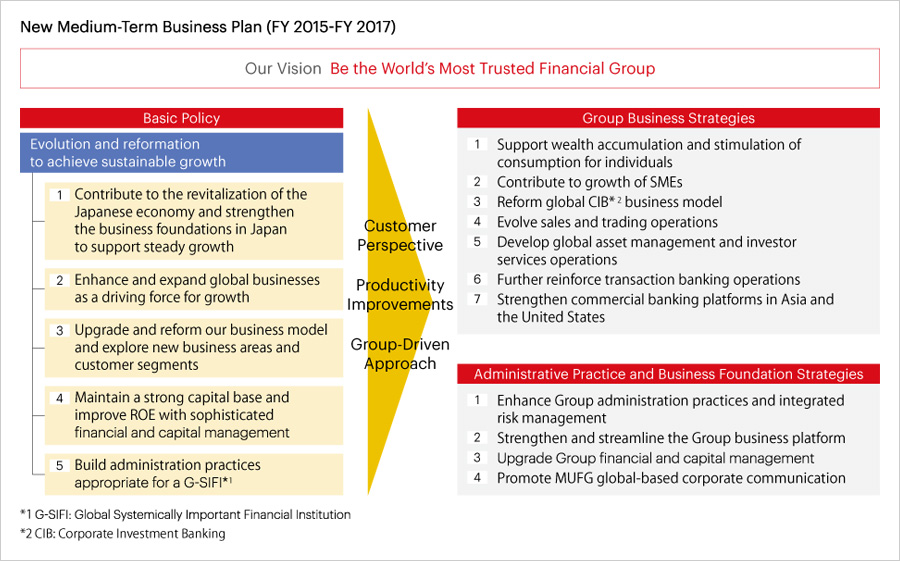

Our new medium-term business plan is based on our view of the environment in ten years’ time and the goals we hope to achieve. It includes five basic policy pillars under the theme “Evolution and reformation to achieve sustainable growth for MUFG”. Under this theme, MUFG will implement strategic initiatives driven by the shared focuses of “customer perspective”, “group-driven approach”, and “productivity improvements”.

“Customer perspective” calls on us to develop businesses based on an effective and accurate appreciation of changing needs. “Group-driven approach” urges us to emphasize inter-group company unity and find ways to optimize our business on an enterprise-wide basis. “Productivity improvements” is our commitment to boosting competitiveness by pursuing higher levels of effectiveness and efficiency. The intention is not simply to increase scale, but to pursue higher returns on capital and enhance capital efficiency. Based on our three shared group focuses, we have established seven group business strategies and four administrative practices and business foundation strategies linking all parts of our business both domestically and globally.

In Conclusion

Maintaining the bonds of trust and confidence

The market environment, including the financial sector, is constantly changing. Regulations are also in flux, often changing in tandem with economic and societal trends. However, for MUFG, one thing remains constant: no matter how much our environment changes, our fundamental social mission is the lifeblood of the economy. In addition, we want our business to contribute toward solutions that can help form a sustainable society.

The Japanese economy is on the path to recovery and we feel this is exactly the right time for us to continue to provide our unique and strong support.

As we pursue these initiatives, by far the most important element is the trust and confidence we have forged over a long period of time with our stakeholders. Through our long-term relationship of trust with our customers, we will grow together. We wish to share the results of this growth with our shareholders and investors and we are ever mindful of

our fundamental social role.

Thank you for your continued support and goodwill.

July 2015

Nobuyuki Hirano

President & Group CEO