CFO Message

1.Financial Management

Establishment of Financial Targets Focusing on Sustainable Growth and Enhancement of Productivity

Earnings review

Results of the Fiscal Year 2014 (ended March 31, 2015)

Gross profits grew during the Fiscal Year 2014, driven by overseas loans and the investment banking business. Net business profits for the fiscal year were ¥1,644.9 billion, an increase of ¥180.8 billion from the previous fiscal year as the growth in gross profits exceeded the increase in expenses. Bank of Ayudhya (Krungsri), which was newly consolidated from Fiscal Year 2014, contributed ¥107.8 billion to the increase in net business profits.

Net income for the Fiscal Year 2014 was ¥1,033.7 billion, an increase of ¥48.9 billion from the previous fiscal year, as increases in the earnings from equity method investees and extraordinary income more than offset an increase in credit costs and a decrease in net gain on equity securities. MUFG achieved its announced target for net income of ¥950 billion and recorded an historic high.

Progress on Financial Targets in the Previous Medium-Term Business Plan

With the exception of the consolidated expenses ratio, we achieved all the financial targets projected in the previous medium-term business plan. Expenses exceeded our target because we aggressively allocated our resources to overseas businesses where we expect significant growth in the near future. We also incurred higher expenses due to the cost of responding to increasingly more stringent global regulations. Details on "CEO Message - Review of Previous Medium-Term Business Plan (FY 2012-FY 2014)" on this>page.

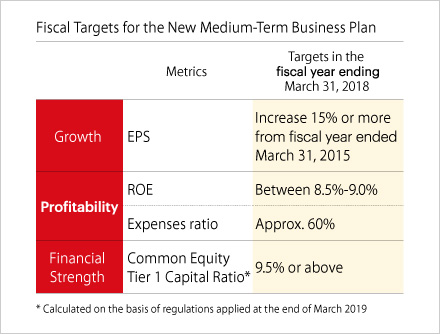

Financial Targets in the New Medium-Term Business Plan (ending March 31, 2018)

Concepts of the financial targets in the new medium-term business plan—Financial metrics for growth and productivity

MUFG will enhance productivity during the new medium-term business plan under the slogan of “evolution and reformation to achieve sustainable growth.” We have established multiple financial metrics as targets for growth and productivity and we are working to meet these targets.

The financial metrics for the final year of the mediumterm business plan are as stated in the following table.

Sustainable Growth

In the new medium-term business plan, we introduced “earnings per share (EPS)” as a new financial target to announce the top management’s goal of achieving sustainable profit growth. More specifically, in the next three fiscal years, we are aiming to increase EPS by 15% or more compared to the level recorded in the Fiscal Year 2014. In order to achieve this growth, which surpasses the economic growth rate in Japan, we will implement all the business strategies, including global business expansion, set forth in the medium-term business plan, and appropriate initiatives in capital management.

Enhancement of Productivity in Human Resources, Goods, and Capital

To enhance productivity, which has been a challenge since the previous medium-term business plan, we have set the following two productivity metrics as our financial targets. “Return on equity (ROE)” is a metric for capital productivity while the “expenses ratio” measures productivity for human resources and goods including staff and non-staff expenses.

Over the next three fiscal years, we will focus on sound financial management to meet these targets.

2.Capital Management

Capital management with an appropriate balance of financial soundness, strategic investments for sustainable growth, and further enhancement of shareholder returns

MUFG positions commercial banking as its core business, with a base in Japan, while also expanding its business globally. We believe that financial soundness is the foundation for us to take the role to provide both the economy and society with vitality and resources. We are implementing well-balanced management from the standpoint of financial soundness, strategic investment for sustainable growth, and further enhancement of shareholder returns.

Financial Soundness

As a Global Systemically Important Financial Institution (G-SIFI), MUFG is required to maintain higher capital adequacy ratios compared to non G-SIFIs. As of March 31, 2015, we had already met the Basel III capital ratio requirements for March 2019, as a result of strengthening our capital base well in advance of the deadline.

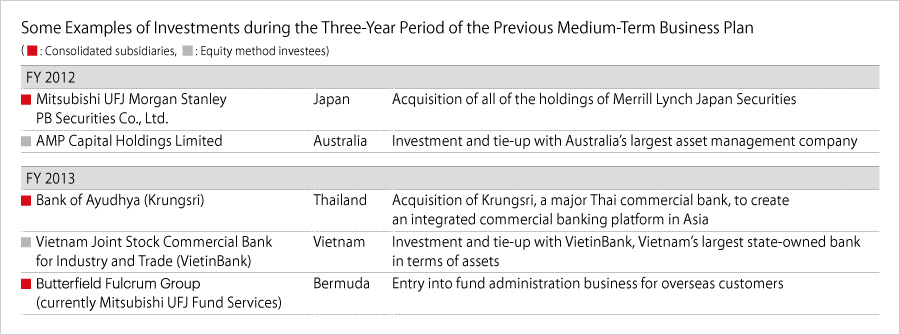

Strategic Investment for Sustainable Growth

We believe both organic growth based on our existing customer base and businesses, and non-organic growth through strategic investments including M&A to capture new customers and business, are important for our sustainable growth. We will use our capital in a timely and efficient manner to take advantage of opportunities for strategic investments, which support the long-term enhancement of our corporate value.

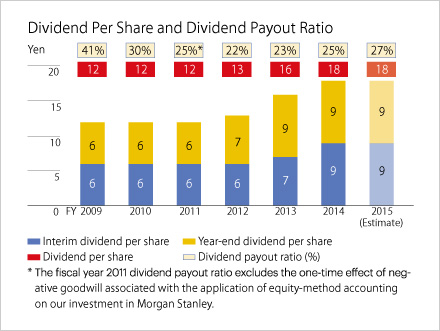

Further Enhancement of Shareholder Returns

Our basic policy is to achieve stable and sustainable increases in the “dividend per share (DPS)” by increasing our profits. We will also continue to consider repurchase of own shares, based on having a sufficiently strong capital base even after complying with regulatory requirements, and also even after considering payout for possible and foreseeable strategic investments for our future growth.

Seeking the Best Capital Mix

Basel Ⅲ is being progressively implemented and regulators in a number of countries are discussing the new capital requirements. In order to respond to those regulatory requirements and to enhance ROE at the same time, we will pursue the best capital mix among Common Equity Tier 1 Capital (i.e., capital and capital surplus); Additional Tier 1 Capital (i.e., perpetual subordinated debt); and Tier 2 Capital (i.e., subordinated term debt). During the Fiscal Year 2014, we issued Basel Ⅲ compliant bank capital securities in Japan, which was the first time for a Japanese bank to issue such bonds in the domestic market.

3.Framework Supporting Financial and Capital Management

“Financial and Capital Management to Support Our Sustainable Growth” and “Enhancement of Internal and External Communication”

Financial and Capital Management to Support Sustainable Growth

The followings are certain examples of our financial and capital management frameworks to support growth of the entire MUFG group.

Finance Committee

The Finance Committee is a sub-committee of the Executive Committee. Its purpose is to deliberate on the optimal capital mix, adequate and appropriate responses to regulations and other related matters. These topics are also actively discussed with outside directors and members of the Advisory Board.

Risk Appetite Framework

MUFG emphasizes the concept of “risk and return” in making management decisions. More specifically, we have introduced and are currently using the Risk Appetite Framework to take appropriate risks to achieve management targets and ensure that profits are consistent with our risk taking.

Investment Monitoring Committee

MUFG has criteria for making decisions about strategic investments. We require that the return from the investment should exceed our cost of capital in several years after the investment is made. We focus on the productive use of capital. The Investment Monitoring Committee regularly checks investments, and establishes guidelines stating how to cope with the investments which missed return targets, not excluding exit decisions, to ensure financial discipline.

Tax Management

In order to strengthen our group tax management functions, MUFG has introduced a consolidated tax payment framework. We are working to enhance the tax management framework which supports our global business expansion, taking into account the fact that authorities around the world are focusing on collecting the appropriate levels of tax.

Internal and External Communication

Dialogue with Shareholders and Investors

Our financial management mission includes providing stakeholders with our financial information in a transparent and timely manner. Our intent is to clearly and accurately communicate management intentions and strategic direction.

We work to build a constructive dialogue with shareholders and investors through earnings briefings and seminars as well as through other appropriate disclosure of financial information.