Supporting SME Growth, Regional Economies

Regional Revitalization, Revitalizing Local Communities and Economies

MUFG offers financial support to its customers who are tackling region-specific issues while collaborating with administrative organizations and local financial institutions to create employment and vitalize local communities.

Financially Supporting Customers Tackling Region-Specific Issues

MUFG Regional Revitalization Fund

Bank of Tokyo-Mitsubishi UFJ launched “MUFG Regional Revitalization Fund” aimed at providing customers with smooth financing for facility procurement and working capital as well as advice to help customers get their projects on track. Our efforts focus on helping customers meet four basic targets under Japan’s plan for the Dynamic Engagement of All Citizens covering community, people and employment.

Having started out with a maximum solicitation amount of ¥100 billion in January 2016, this fund has increased its total cap to ¥200 billion in April, with more than 40 companies using this fund.![]() (As of June 2016)

(As of June 2016)

Interview with a Fund User

In the face of burgeoning tourism from China and ASEAN nations, the Nagoya region is confronting a chronic shortage of hotel rooms coupled with a lack of land for hotels. Amid these circumstances, Bank of Tokyo-Mitsubishi UFJ provided us with business matching opportunities and real estate brokerage services through its banking-related companies. Thanks largely to support from Bank of Tokyo-Mitsubishi UFJ, we were able to acquire a building and land for commercial use in front of Nagoya station for a new hotel.

Mr. Ryoichi Mori, Corporate Executive Officer, General Manager of the Accounting and Finance Department; Mr. Mitsuru Kozawa,

Assistant Manager;

Washington Hotel Corporation

Finance Using the Government Subsidized Interest Payment Program

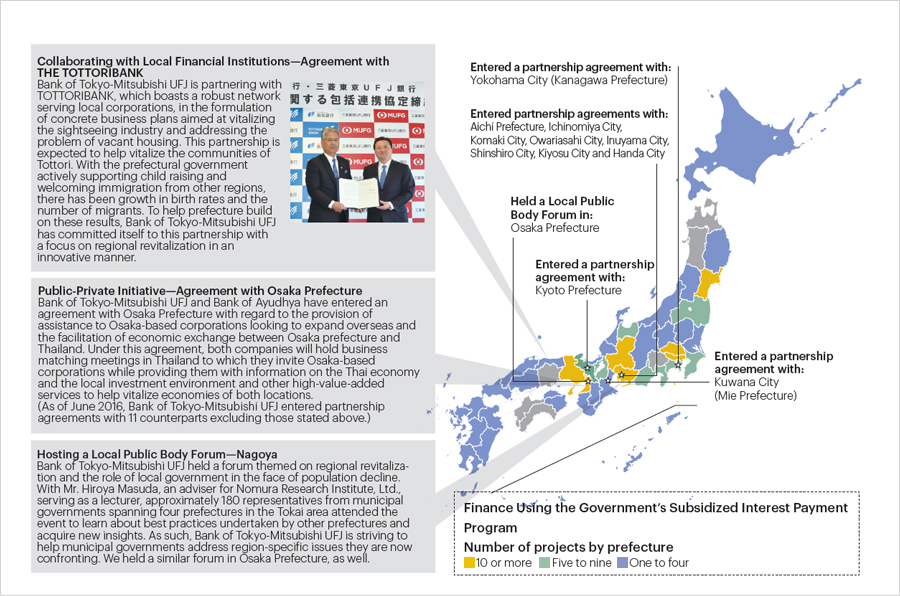

In fiscal 2015, Bank of Tokyo-Mitsubishi UFJ and Mitsubishi UFJ Trust and Banking invested a total of ¥29.4 billion in 41 projects using the government’s subsidized interest payment program for regional revitalization. Since the inception of this program, we have provided these loans to more than 200 projects![]() in regions around Japan.

in regions around Japan.

*2 Please see the map at right for a breakdown by prefecture.

Supporting Municipal Governments by Providing Services Aimed at Vitalizing Local Communities

Developing Cashless Settlement Platforms

Mitsubishi UFJ NICOS is promoting the introduction of “J-Mups Cloud-Based Multi-Payment System,” capable of handling multiple settlement methods, including credit cards, the China Union Pay card, and electronic money, targeting commercial facilities in rural regions and sightseeing hotspots. It also accommodates foreign currency-denominated settlement, thereby enabling businesses to meet the diverse settlement needs of domestic sightseers, foreign tourists and other guests. In this way, we are contributing to the vitalization of the tourist industry in regions around Japan.

[Examples of targeted sightseeing locations] Regions around Onuma Quasi National Park (Hokkaido Prefecture), Ise-Shima region (Mie Prefecture), Kinugasa shopping street in Yokosuka City (Kanagawa Prefecture)

Supporting the Growth of SME Customers

Using its nationwide network, MUFG provides various services to SMEs in accordance with their stage of growth and development.

Foundation ~ Business Support for Potential Growth Areas

Business Support Program “Rise Up Festa”

This program aims to fully utilize the Group’s business network and know-how to assist SMEs and growing companies engaged in novel and creative segments as well as those trying to extend the boundaries of existing business, with MUFG serving as their long-term business partner.

In April 2016, MUFG hosted the third round of “Rise Up Festa,” recognizing four outstanding companies and seven excellent companies in four growth fields: bio and life science; robotic and other cutting-edge technologies; information and internet services; and social business. MUFG offers various forms of support to these companies.

Growth Phase ~ Providing Smooth Financing and New Opportunities

Business Link “Shobai Hanjo”

This is a large-scale business matching conference we have organized annually since 2005. In February 2016, we held the 13th Business Link “Shobai Hanjo” Conference under the themes “Act Globally” and “Get Innovation” in Nagoya. With representatives from approximately 3,400 companies attending this event, the number of business matching negotiations totaled around 8,300, which is almost double the number recorded at the ninth round held in the same city.

Mature Phase ~ Ensuring Smooth Business Succession

Bank of Tokyo-Mitsubishi UFJ has developed a service structure to assist customers in undertakings ranging from urgent stock acquisitions to determining long-term succession strategies. Under this structure, we deploy business succession specialists who provide customers with optimal advice in accordance with their circumstances and management plans.

Meanwhile, Mitsubishi UFJ Trust and Banking offers a wide range of consulting services, from corporate business succession to individual asset transfer. Our management financial diagnosis program (the “ownership” program) is used to analyze a client’s current asset and business situation and identify key issues to address to ensure a smooth succession. It helps corporate clients clarify crucial issues affecting their business.

Growth Phase - Mature Phase ~ Corporate Reconstruction

Bank of Tokyo-Mitsubishi UFJ and Mitsubishi UFJ Trust and Banking offer consultation in a timely and appropriate manner for customers facing challenges in borrowing conditions and other management issues. When necessary, we introduce experts from inside and outside our organization to customers.