Tailored Retail and Commercial Banking Services for Local Individuals and Small and Medium-Sized Companies on the West Coast

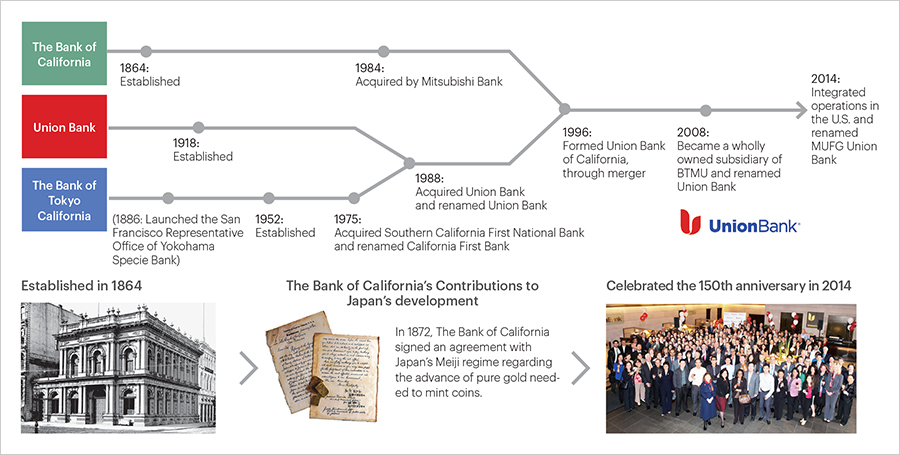

The foundations of MUFG Union Bank, N.A. in the U.S. were laid by three companies: The Bank of California, established in 1864; Union Bank, established in 1918; and The Bank of Tokyo California, established by The Bank of Tokyo, and local Japanese interests in 1952. When it first opened its doors, the latter’s customer base was limited somewhat to Japanese companies and individual customers from the local Japanese community. However, The Bank of Tokyo California acquired the locally based Southern California First National Bank in 1975, and Union Bank in 1988, to expand its scope of operations in the local business community.

In 1996, in conjunction with the merger of The Mitsubishi Bank and The Bank of Tokyo, The Bank of California, which was a subsidiary of Mitsubishi Bank, merged with Union Bank, thereby forming Union Bank of California. In 2008, Union Bank of California became a wholly owned subsidiary of The Bank of Tokyo-Mitsubishi UFJ (BTMU) and went on to promote the integration of Group operations in the U.S. Following consolidation with the branch-related operations of BTMU, in July 2014 it was renamed MUFG Union Bank.

Meeting the Financial Needs of Large Corporate Customers Who Pursue Regional Expansion Worldwide

MUFG’s East Coast operations targeting major corporate customers date back to 1880 when Yokohama Specie Bank, Ltd. opened a New York representative office. Since then, BTMU has steadily expanded its businesses in the Americas with a focus on serving such corporate customers as Japanese companies and other global enterprises. Today, BTMU is among the top listed banks in the league tables for syndicated loans and project finance and has gained significant recognition as a leading investment bank.

In addition, BTMU is currently working to strengthen its securities- related operations, such as corporate bond underwriting, as well as its lending operations. In April 2016, BTMU, its subsidiary MUFG Securities Americas and MUFG Union Bank integrated some financial products operations in order to be able to provide one-stop banking and securities services. Offering both lending and corporate bonds—instruments that previously had been obtainable only from separate conventional banks—the Group strives to meet a wide variety of needs for financial products and services, becoming a comprehensive debt house.

Securing Our Position among the Top Ten Banks in the U.S. Market

Integrating U.S. Operations

In July 2014, BTMU and Union Bank integrated portions of their operations. This move combined the former’s branch operations, handling sophisticated financial services targeted at major corporations; and the latter’s retail banking and other business functions, targeting mainly small and medium-sized businesses (SMBs) based on the West Coast. Then, in October 2015, MUFG reorganized its commercial banking functions, serving mainly West Coast-based SMBs, with the aim of providing services better tailored to the nature and scale of its customers’ operations and structuring a more efficient organization. These functions were eventually reorganized into the Regional Banking and U.S. Wholesale Banking departments. The Group is now better positioned to accommodate customer needs for financial services and has tightened risk management and compliance while ensuring stricter adherence to relevant regulations.

Hiring Experienced Management

MUFG is looking to expand its U.S. operations by promoting comprehensive financial services ranging from retail banking to corporate banking for major companies. To accomplish the Group understands that a management team with requisite experience in the U.S. financial sector is crucial. Such expertise is particularly important given the growing rigor of financial regulations and concurrent need for risk management.

Having appointed a new U.S. CEO in May 2015, MUFG welcomes professionals in such fields as risk management and IT wishing to join its management team. Eleven of 16 senior executives recruited to serve at regional Americas headquarters have been hired in the U.S. Seven of these also hold the title of corporate executive officer at BTMU (as of July 2016).

Reorganization to Integrate U.S. Operations and Step Up Segment Strategies

Growth Strategies

MUFG believes that securing diverse profit sources and robust deposits is crucial to becoming one of the top ten banks in the United States. Based on this recognition, Regional Banking plans call for a deposit growth strategy that combines the launch of a nationwide direct bank with the deployment of smaller branches in out-of-network markets and re-entering the credit-card business.

The Group also considers non-organic measures, including M&A, as viable options. However, MUFG will carefully assess if non-organic opportunity will address key strategic objectives—increasing liquidity, income growth, and lending diversification, scales/franchise expansion, as well as potential revenue and cost synergies.

Strictly Complying with U.S. Financial Regulations

Drawing lessons from financial crisis triggered by the bankruptcy of the Lehman Brothers in 2008, U.S. financial authorities have taken decisive steps to secure financial stability through various rules collectively referred to as “prudential regulations.” In accordance with these regulations, foreign banking organizations with US$50 billion or more of both consolidated gross assets and gross U.S. assets (excluding those of their U.S. branches) are required to establish a U.S. intermediate holding company (IHC) over U.S. subsidiaries they own or control, by July 1, 2016. Upon the announcement of this requirement MUFG quickly launched a project team. The team has prepared establishment of the IHC and the U.S, Risk Committee which oversees and monitors overall risk management in the U.S. and completed necessary actions. Going forward, cooperating globally according to the characteristic of each business, the MUFG Americas Holdings Corporation will manage the Group’s U.S. subsidiaries as an IHC and is in charge of submitting capital plans, managing liquidity and responding to other regulations, thereby helping maintain sound operations.