Publication of the MUFG TNFD Report

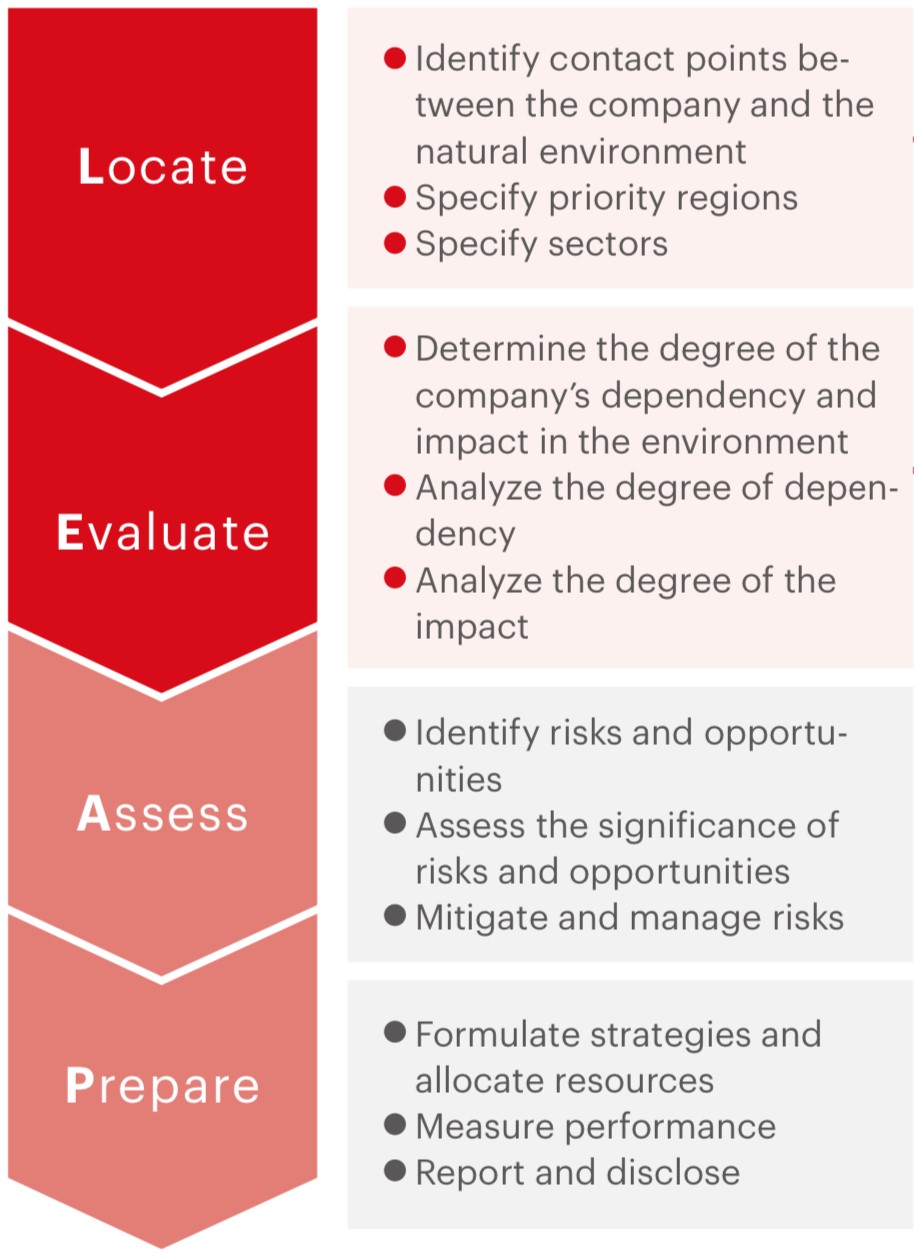

MUFG has organized and published our perspectives and activities related to natural capital in accordance with the TNFD (Taskforce on Nature-related Financial Disclosures) disclosure framework, issuing the MUFG TNFD Report. Click here for details of the MUFG TNFD Report.

For initiatives as an asset manager, please refer to MUFG Asset Management Natural Capital and Biodiversity 2024 (Japanese).

Domestic and Overseas Trends Related to Natural Capital

At COP15 held in 2022, the Kunming Montreal Global Biodiversity Framework was adopted, establishing an international agreement to achieve nature positive by 2030.

In 2023, the Taskforce on Nature related Financial Disclosures (TNFD) introduced a framework for nature and biodiversity related disclosure. Additionally, at COP16 held in Colombia in 2024, guidance on nature transition plans by TNFD and the Glasgow Financial Alliance for Net Zero (GFANZ) was published, steadily advancing the development of frameworks for achieving nature positive.

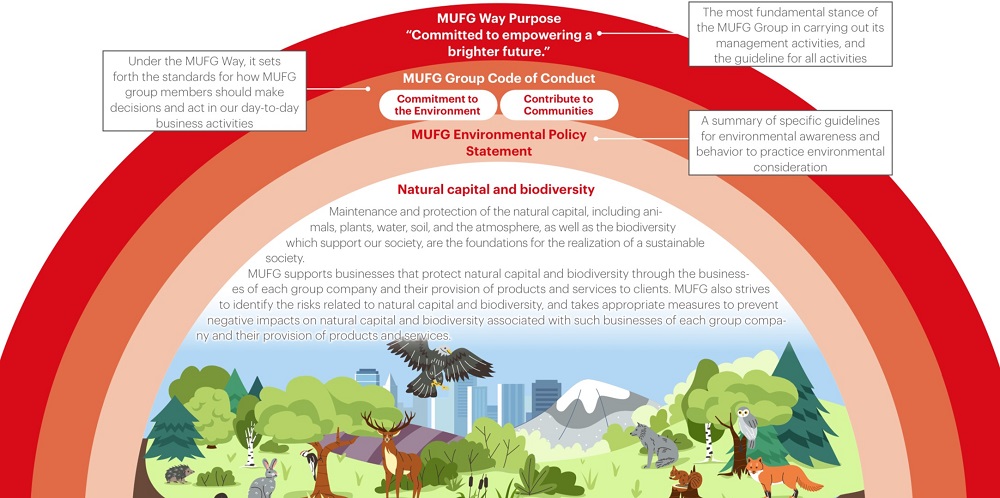

Policies for Natural Capital

The MUFG Group Code of Conduct established under the MUFG Way states “Commitment to the Environment” and “Contribute to Communities.”

The MUFG Environmental Policy Statement sets out guidelines for environmental awareness and behavior to implement these practices. Specifically, the policy is to support projects that conserve natural capital and biodiversity, while striving to identify risks and take appropriate measures to avoid negative impacts on natural capital and biodiversity.

Positioning of Natural Capital

MUFG positions “Drive Social & Environmental Progress” as one of the three pillars of the Medium Term Business Plan (MTBP) which began in FY2024. In the MTBP, we have identified priority issues for achieving a sustainable environment and society, including “Natural Capital and Biodiversity Restoration”.

Click here for details of “Priority Issues”.

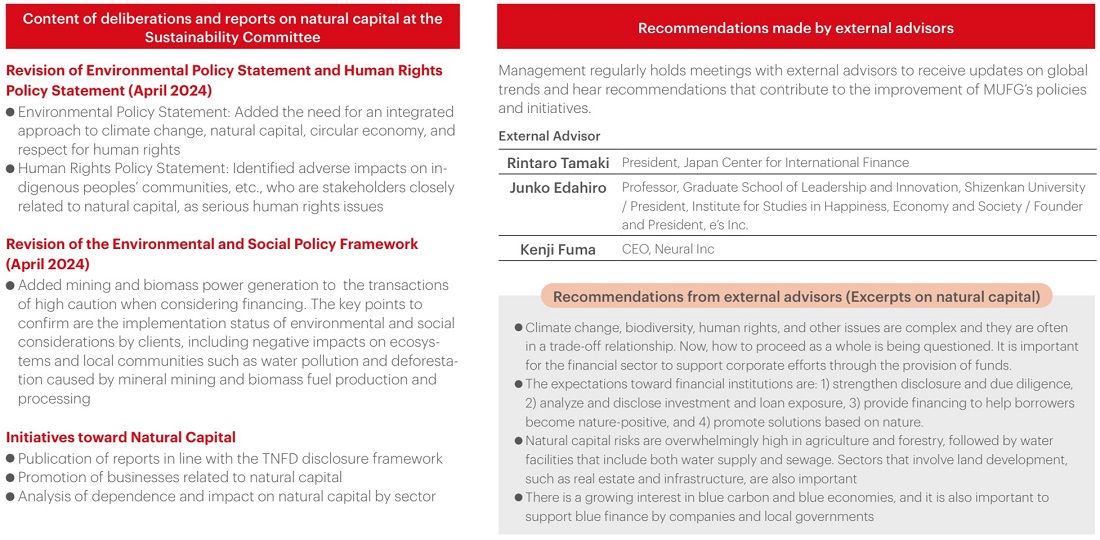

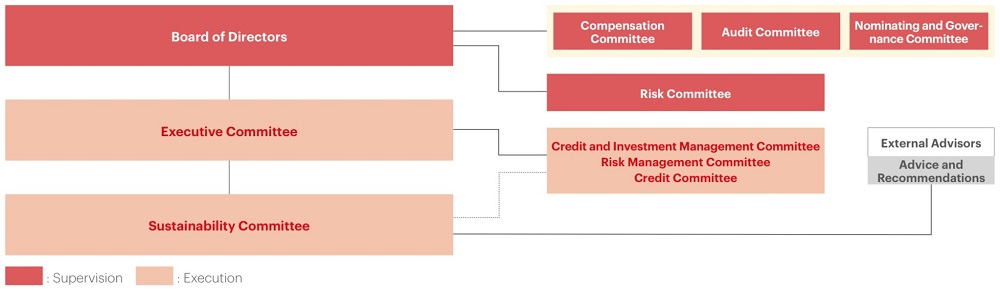

MUFG has established a governance structure in which the Board of Directors oversees initiatives related to sustainability promotion, including natural capital. The contents deliberated and reported by the Sustainability Committee under the Executive Committee are also discussed and reported by the Board of Directors.

Exchange of Opinions with External Experts

Study sessions for executives

In December 2024 we invited Professor Shunsuke Managi from the Faculty of Engineering at Kyushu University to engage with our executives in a discussion about international trends in natural capital and the necessary initiatives for social implementation.

Exchange of opinions with external advisors

MUFG's management regularly holds meetings with external advisors to exchange opinions and receive proposals that contribute to the enhancement of MUFG's policies and initiatives. In FY 2024, we engaged in discussions with executives on topics such as energy policy trends, draft guidance for TNFD and GFANZ transition plans related to natural capital, and the visualization of impact using SROI(note1). The external advisors emphasized the importance of active management involvement and the inclusion of diverse stakeholders in addressing social issues, including natural capital conservation.

- It stands for Social Return on Investment. Monetized social value divided by the amount of investment, a method for quantitatively calculating the social impact of an investment

- Appointed from April 2025

Governance on Respect for Human Rights related with Natural Capital

MUFG has established a governance structure to oversee initiatives related to respecting human rights, including human rights due diligence, through its Board of Directors and other various committees. In addition, MUFG’s Human Rights Policy Statement established in 2018 stipulates MUFG's commitment to collaborate with clients and suppliers to further uphold human rights in our business activities.

MUFG is committed to conducting business in a manner that minimizes adverse impacts on natural capital. Additionally, MUFG recognizes the importance of considering stakeholders closely connected to natural capital, including indigenous peoples and local communities. Based on this concept, MUFG is committed to human rights due diligence and providing remedies.

● Governance structure related to respect for human rights

The initiatives related to respect for human rights are deliberated in executive management meetings, including the Executive Committee, the Sustainability Committee, and the Risk Management Committee. Additionally these efforts are overseen by the Board of Directors and the Risk Committee. Furthermore, the MUFG Human Rights Policy Statement is regularly reviewed and approved by the Board of Directors.

● Exchange opinions with external experts

MUFG regularly invites external experts with knowledge in business and human rights to engage in discussions with top management. This exchange of opinions aims to advance initiatives that promote respect for human rights, with a comprehensive understanding of the responsibilities expected of financial institutions.

Human Rights Policy Statement

● MUFG Human Rights Policy Statement

In addition to advocating for the executives and employees of each Group company to respect human rights in their daily operations, the statement also advocates for clients and suppliers to respect human rights and states MUFG’s commitment to appropriately dealing with this issue.

● Respect for international standards and initiatives

MUFG respects international standards and initiatives related to respect for human rights. In countries where local legislations conflict with internationally recognized human rights standards, MUFG strives to adhere to international standards.

- Universal Declaration of Human Rights

- Declaration on Fundamental Principles and Rights at Work

- Guiding Principles on Business and Human Rights

- The OECD Guidelines for Multinational Enterprises

- The United Nations Global Compact

(Details of some excerpts can be found here. )

● Relation with natural capital

MUFG recognizes that climate change and the loss of natural capital and biodiversity impacts human rights (Human Rights Policy Statement, Article 2). Furthermore, MUFG has identified the adverse impacts on indigenous peoples' communities, who are closely related to natural capital, as serious human rights issues. MUFG conducts human rights due diligence and provides remedies to address these concerns.

Human rights due diligence

● Due diligence in finance

When considering financing, we assess the status for environmental and social considerations by our clients based on the MUFG Environmental and Social Policy Framework and the Equator Principles. For example, we recognize that large scale development projects often adversely impact the ancestral lands and rights of indigenous peoples who are closely connected to natural capital. Therefore, when evaluating financing, we ensure that our clients respect environmental and social considerations, such as adherence to FPIC(note1).

Key Points to Assess Risks / Impacts

[Adverse impacts on indigenous peoples’ communities]

- Relationship between the affected indigenous people and the business operations

- Communication processes (using a grievance mechanism, FPIC, etc.) for impacted indigenous peoples

[Involuntary resettlement(note2)]

- Whether or not the design and the timing minimize the adverse impact

- Development status of the resettlement and livelihood restoration plans to mitigate adverse impacts

- Free, Prior, and Informed Consent

- Forced relocation of indigenous peoples to accommodate large development projects

● Grievances and remedies

In addition to establishing a service window for employees and clients, we have joined the Japan Center for Engagement and Remedy on Business and Human Rights (JaCER). Through this membership, we have established remedial contact points for addressing adverse impacts on human rights that arise throughout the value chain, including for employees of investment and loan recipients, employees of suppliers, communities, local residents, and others.

● Dialogues with stakeholders

Up until 2024, through JaCER, MUFG received two allegations regarding adverse impacts on indigenous peoples related to investments and loans. In response, MUFG engaged in dialogues with the members of the affected communities. Top management and related departments are discussing how to respond to the opinions received on adverse impacts on indigenous peoples’ communities and the surrounding natural environment. Additionally, MUFG is engaging with the operators to encourage constructive dialogues.

For details on our efforts for the respect for human rights, please refer to the "

MUFG Human Rights Report."

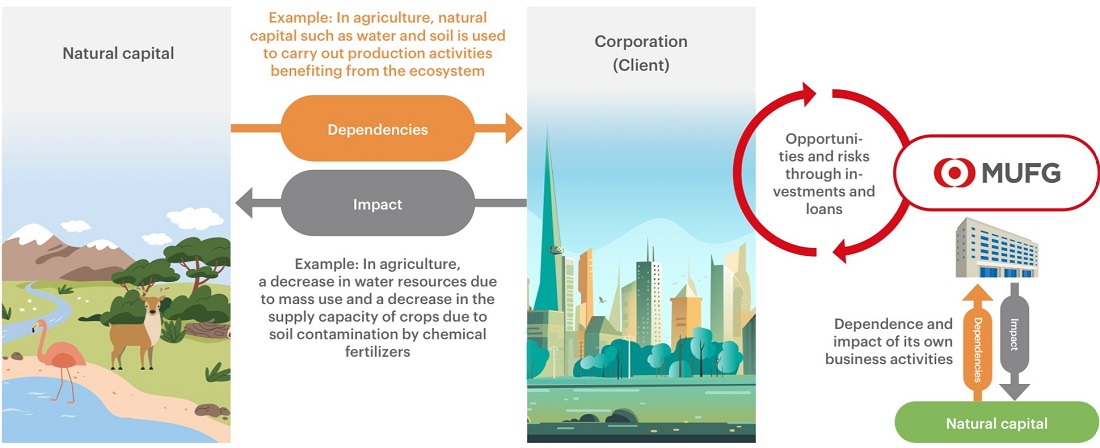

Relationship between Financial Institutions and Natural Capital

The business activities of companies (clients) depend on and have an impact on natural capital throughout the entire value chain, from procurement of raw materials to disposal. Financial institutions, including MUFG, not only depend on and have an impact on natural capital through own busine ss activities, but also have connections to the activities of clients and their supply chains through investments and loans. Therefore, financial institutions need to understand clients’ dependencies and impacts on natural capital in order to manage risks appropriately. In addition, providing financial products and services related to natural capital can lead to the acquisition of business opportunities.

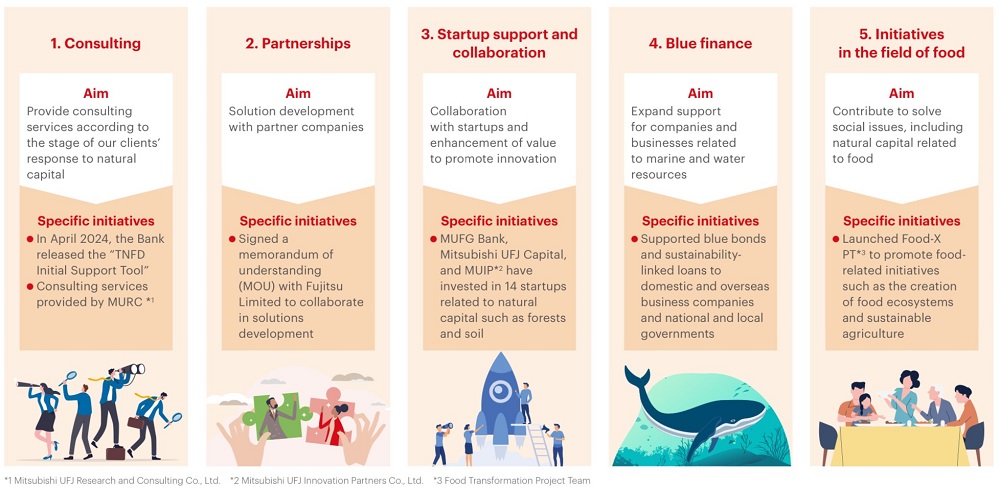

Opportunities for MUFG: Five Focus Areas

Among the various business opportunities related to natural capital, MUFG focused on five areas where MUFG Group can leverage its strengths. In addition to promoting dialogue with a wide range of stakeholders, we support our clients' initiatives for natural capital and collaborate with various companies and startups.

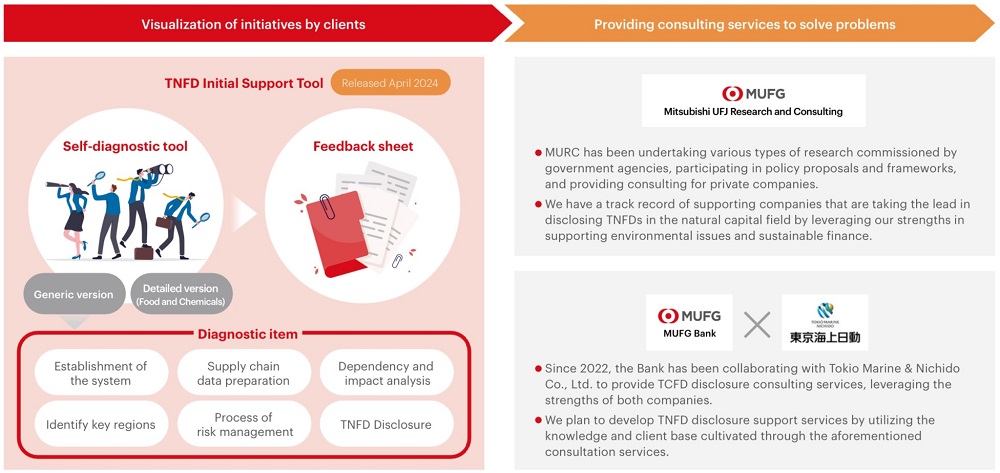

We are supporting our client' initiatives to achieve nature positive by providing a wide range of consulting services, including support for the formulation and implementation of strategies related to natural capital and TNFD disclosure.

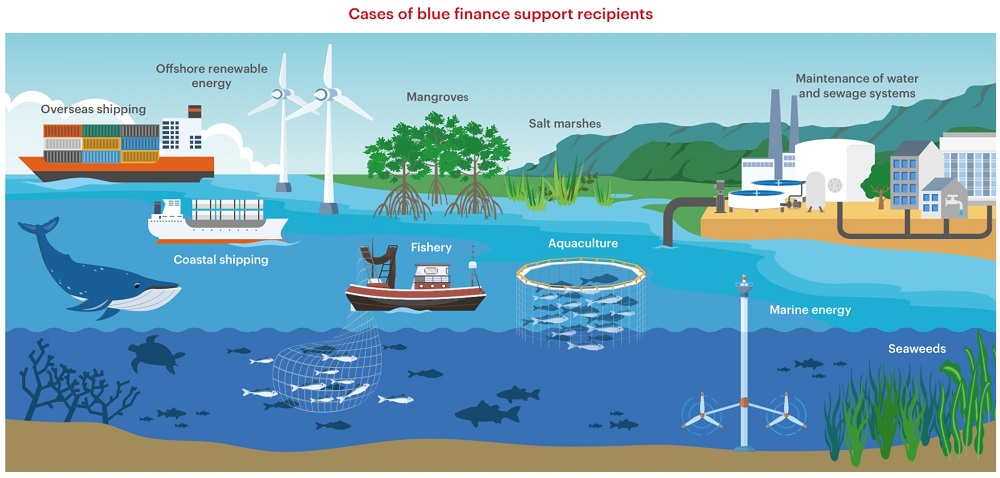

MUFG actively supports its clients' initiatives to achieve nature positive through green finance, blue finance, and sustainability linked loans (SLL). In November 2024, we launched the "Natural Capital Management Evaluation Loan," which integrates regular loans with evaluations of clients' natural capital management practices and provides feedback.

MUFG provides various types of financing for initiatives worldwide that contribute to the conservation of natural capital, including sustainable agriculture and forest conservation.

MUFG is working with stakeholders, including national and local governments and companies, to develop solutions and create businesses for achieving nature positive.

MUFG is utilizing satellites to observe CO2 absorption by forests and to build an ocean database. By visualizing the impact on the environment and society through satellite data, we aim to create a highly reliable market and apply it to MUFG’s business, including finance.

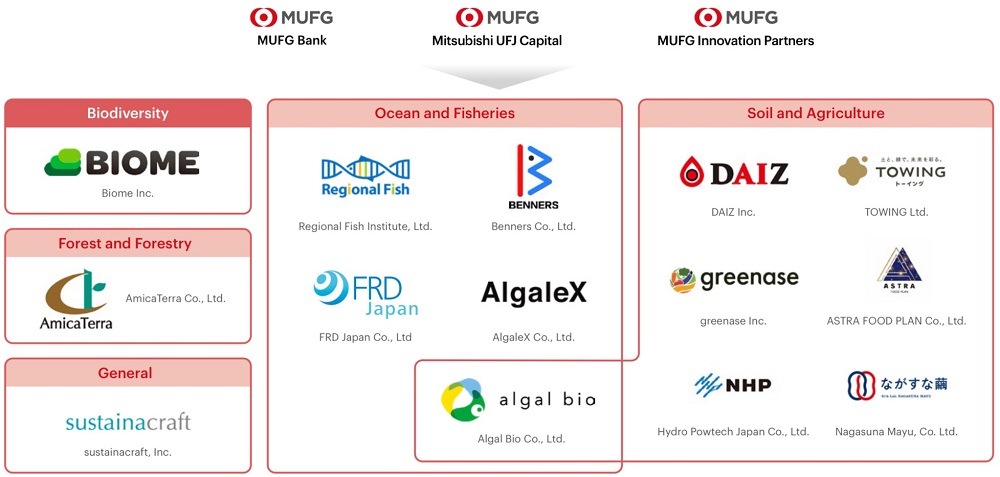

Startup Support and Collaboration

MUFG actively invests in startups that develop technologies to reduce environmental impacts and achieve nature positive outcomes, thereby supporting the promotion of innovation within each company. In FY 2024, we invested in six new startups. Additionally, we collaborate with various functions within our Group to enhance the value of the companies in which we invest.

Initiatives in the Field of Food

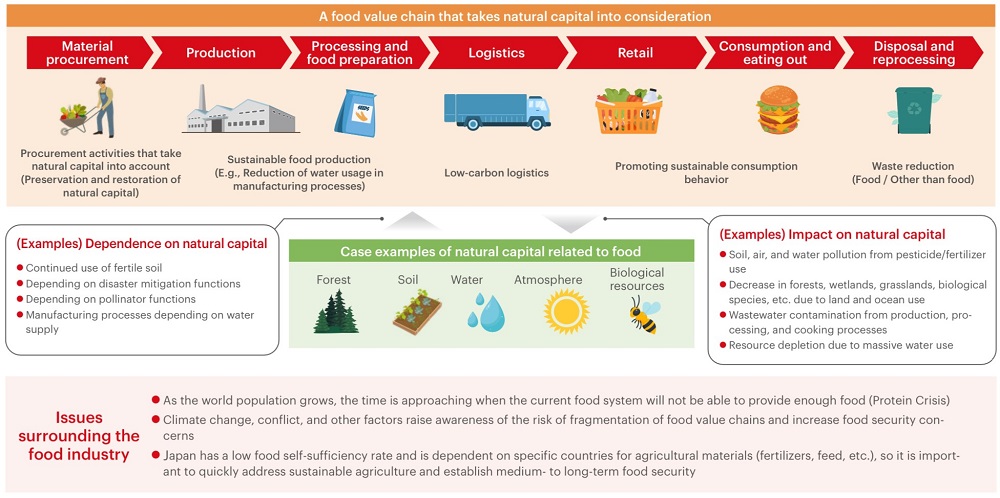

● The Relationship between Natural Capital and the Food and Agriculture

Food-related businesses are built on the blessings of nature throughout the supply chain, and it is increasing important to conserve, restore and rehabilitate natural capital, in order to enhance the sustainability of business.

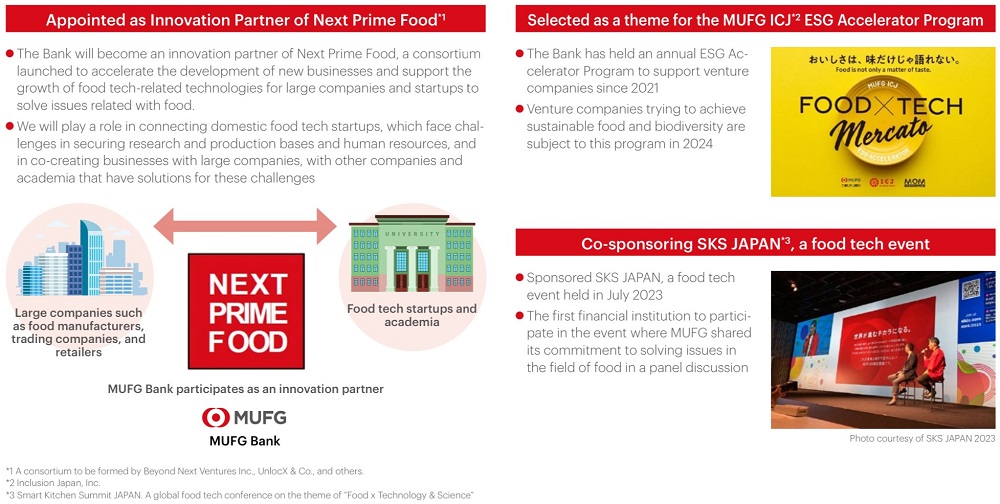

MUFG has launched the “Food-X Project” within the company with the aim of simultaneously achieving food system resilience and individual well-being. We are working with stakeholders from industry, government, academia, and financial sector, to build sustainable food value chains and create international frameworks.

● Creating Food Ecosystems

MUFG aims to contribute to the building of an ecosystem that contributes to solving food issues by connecting various food stakeholders, including a wide range of clients, startups, and academia.

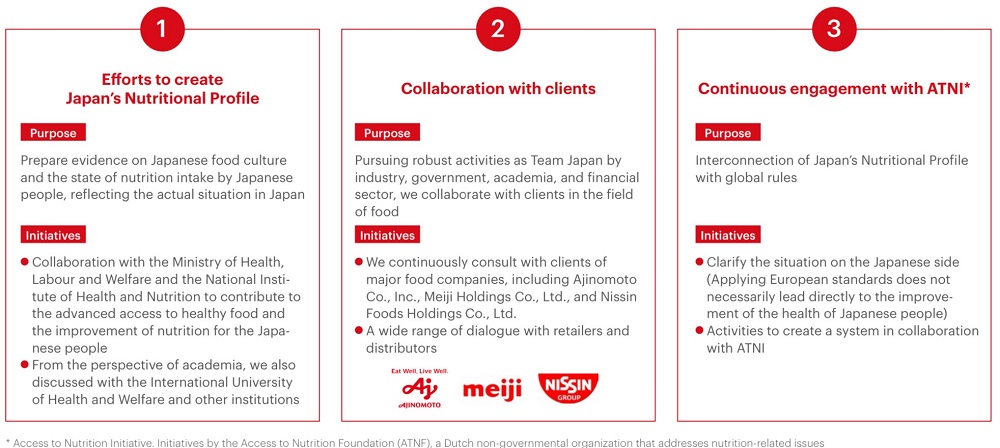

● Solving Nutrition Issues

In the field of “food,” in addition to the sustainable use of natural capital, nutrition is also an important issue. While the development of evaluation standards originating in Europe is progressing, there is a recognition that European standards do not necessarily lead directly to improvements in the health of the Japanese people. Therefore, we are participating in international rule-making through collaboration among industry, government and academia, and actively disseminating our opinions to ensure appropriate evaluation of the Japanese food industry.

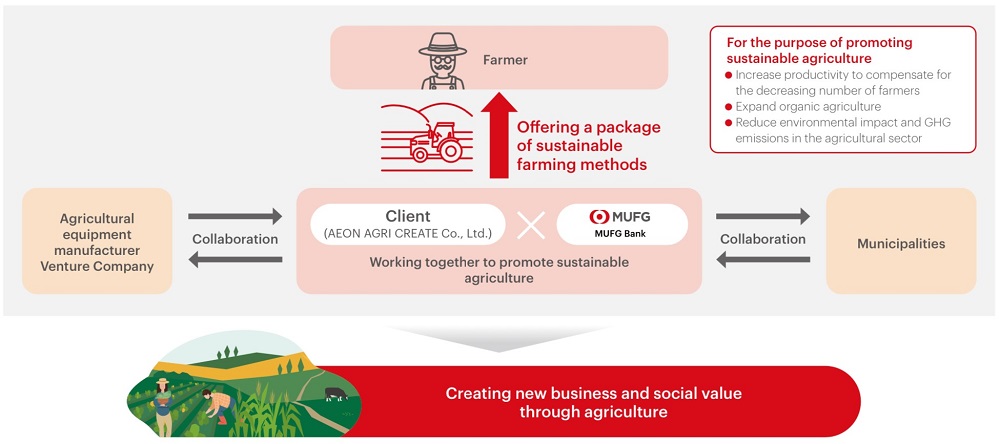

● Promotion of Sustainable Agriculture

In order to ensure a stable food supply for Japan, it is important to promote sustainable agriculture by reducing environmental impact while improving productivity. MUFG is working to promote sustainable agriculture through collaboration with food related clients.

Analysis of Dependencies and Impacts

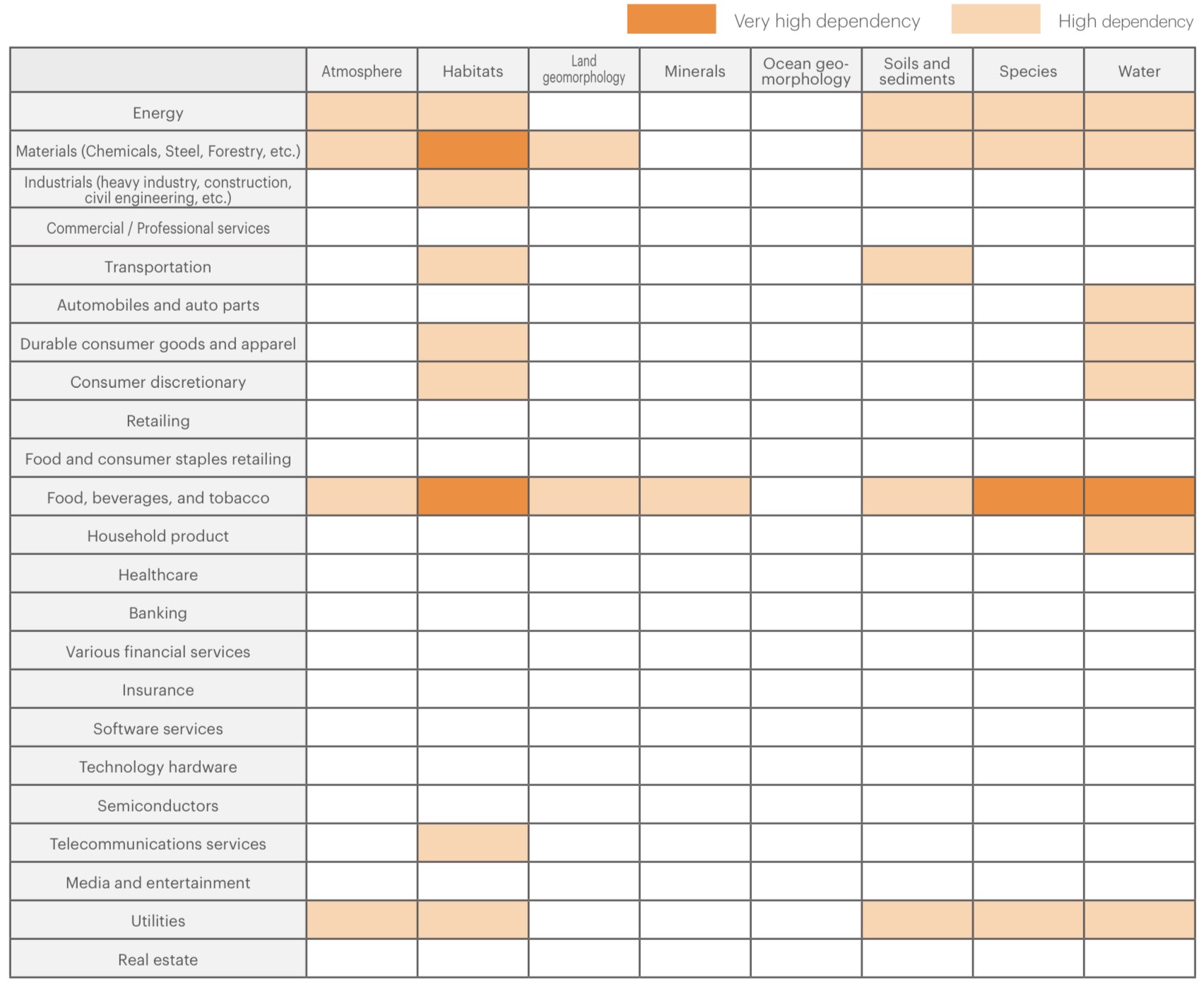

In order to identify opportunities and risks related to natural capital in business, it is important to analyze dependencies and impacts. MUFG is working to identify key sectors in terms of opportunities and risks by analyzing dependencies and impacts of each sector in its investment and loan portfolio. In addition, for some sectors, we conducted analysis based on client location information (location analysis).

Step 1. Evaluating Dependencies and Impacts by Sector

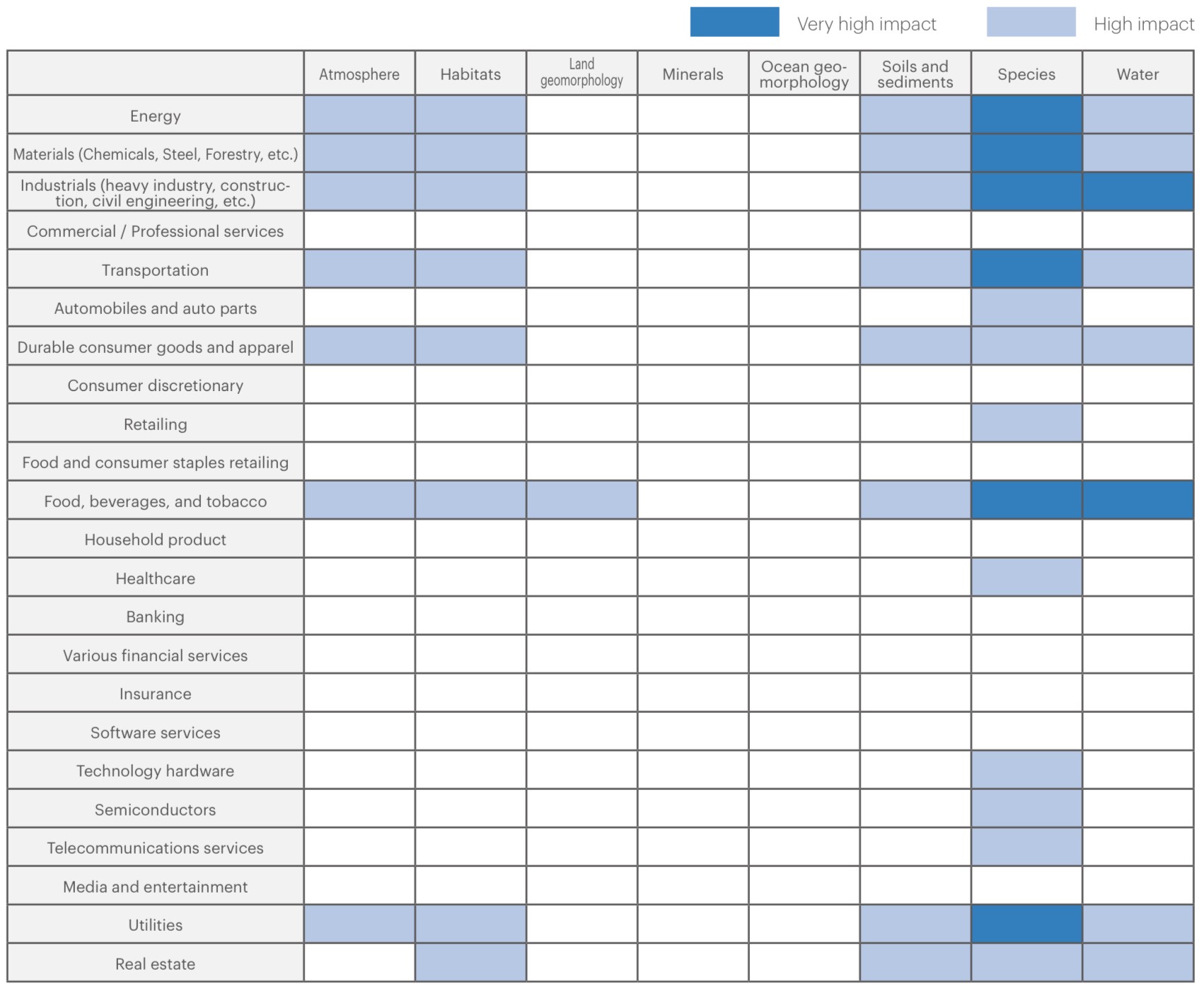

Using “ENCORE”, we analyzed each sector’s degree of dependencies on natural capital, and found that sectors such as construction and engineering; energy; food, beverages, and tobacco; healthcare; materials chemical, etc.); mining and metals; and utilities (electricity, water, etc.) are the most highly dependent on natural capital.

Using “ENCORE”, we analyzed each sector's impacts on natural capital and biodiversity and found that sectors such as construction and engineering; energy; food, beverages, and tobacco; materials (chemical, etc.); mining and metals; wholesale; transportation; and utilities (electricity, etc.) have large impacts on natural capital and biodiversity.

Step 2. Consideration of Exposure

We are in the process of identifying material sectors by analyzing dependencies and impacts on natural capital by sector while taking into account the amount of exposure in our investment and loan portfolio.

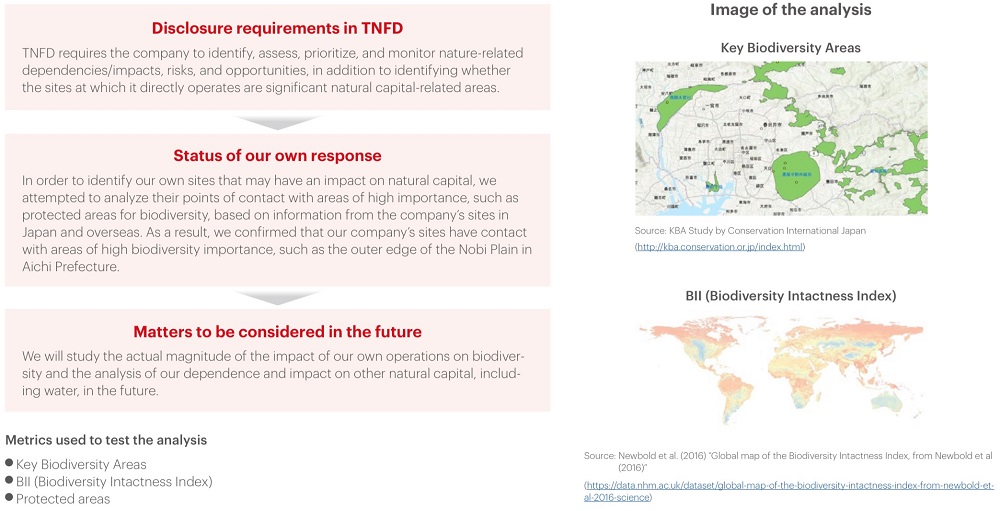

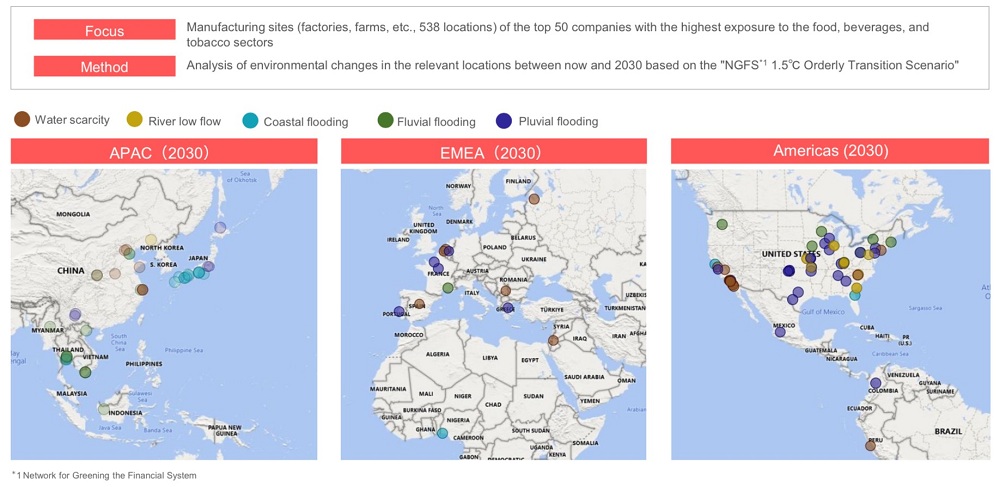

Step 3. Location Analysis

For the food, beverages, and tobacco sectors, which have high dependencies and impacts, we are working on location analysis based on the location of our clients’ manufacturing sites. As a case study, we identified areas that are likely to experience water shortages (droughts) and flooding in the future. Through analyses like this, we aim to understand the impact of environmental changes and other factors on the businesses of our clients, and to identify nature related opportunities and risks.

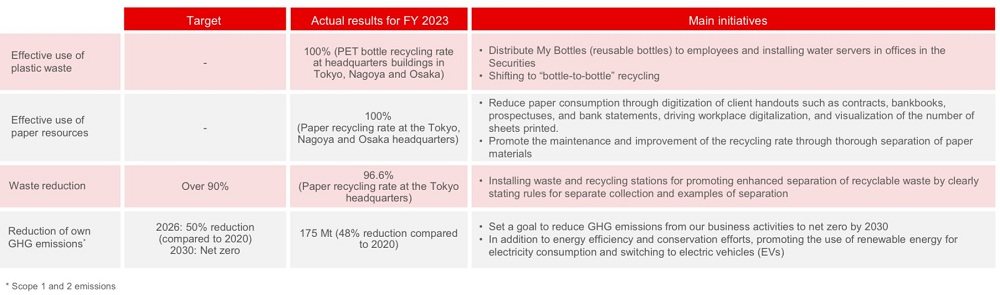

Initiatives to Manage Dependencies and Impacts at Our Sites

MUFG is promoting initiatives such as effective use of plastic waste and paper resources, recycling of waste, and reduction of GHG emissions in order to reduce dependencies and impacts on natural capital from our business activities.

See

here for an analysis of our own locations.

Risk and Impact Management

Risk Management of Investments and Loans

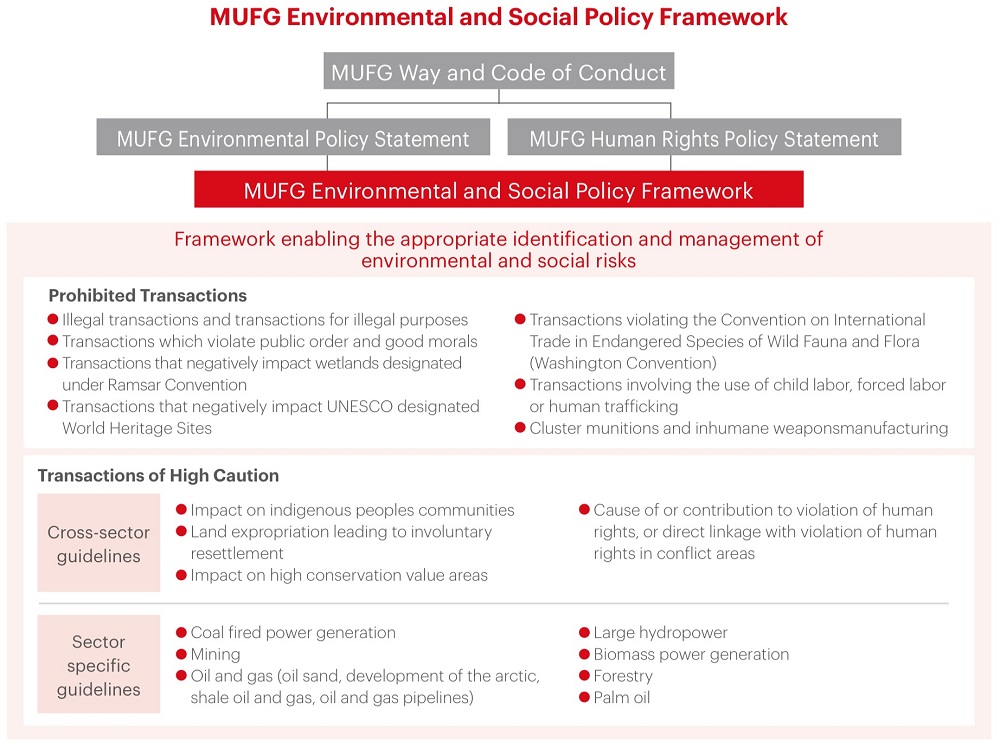

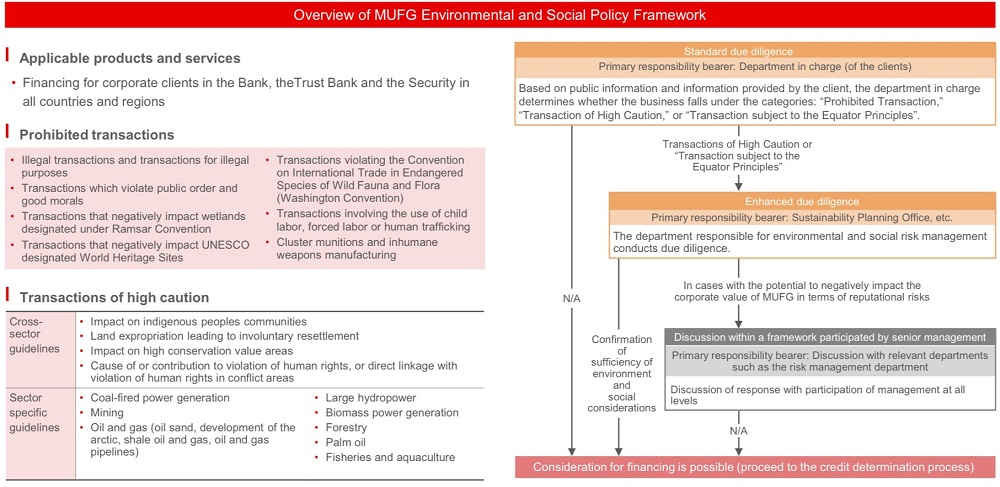

MUFG Environmental and Social Policy Framework

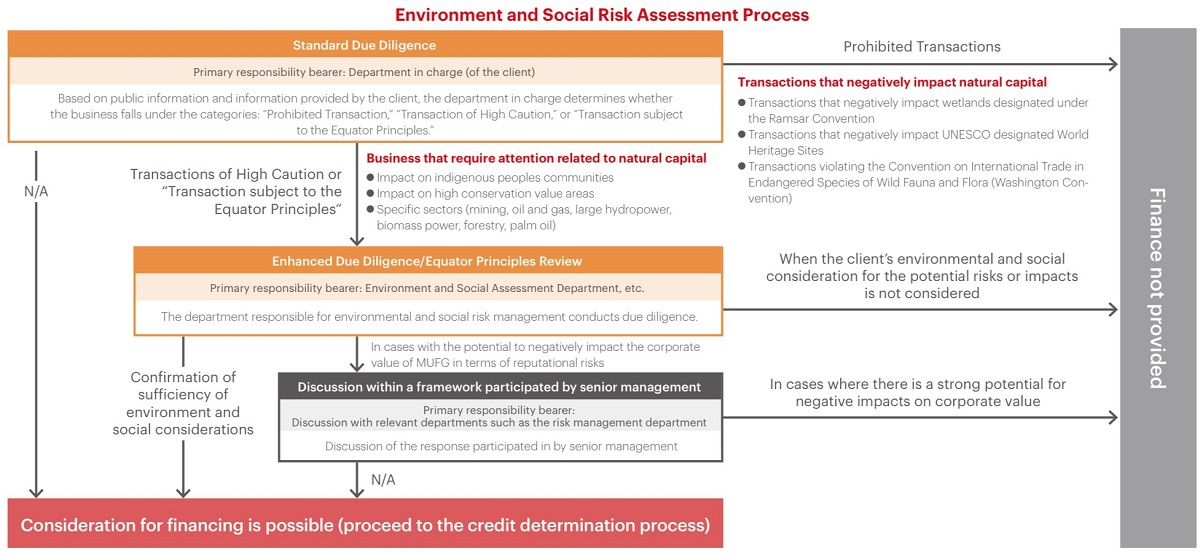

As a framework to understand and manage the environmental and social risks in consideration of Finance(note1), the MUFG Environmental and Social Policy Framework has been established. This framework is applied in compliance with local laws and regulations.

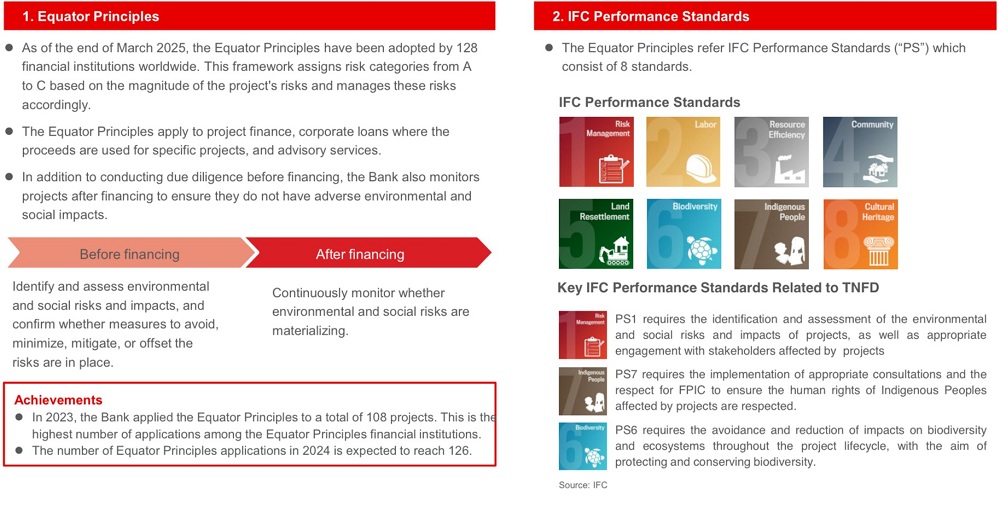

Additionally, when financing large scale projects such as infrastructure and resource development, an environmental and social risk due diligence based on the Equator Principle(note2) is conducted.

- Providing credit and bond/equity underwriting for customers of the Bank, Trust Bank, and Security

- Bank approach

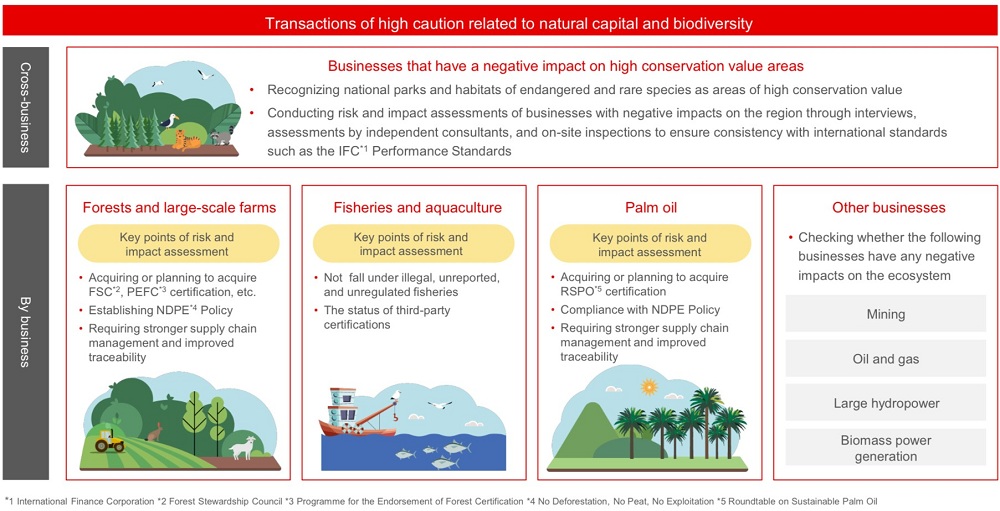

MUFG has designated businesses with a high likelihood of existing negative impacts on natural capital and biodiversity as transactions of high caution. When considering financing, we confirm our clients’ implementation of environmental and social considerations through a process of identifying and evaluating environmental and social risks or impacts. In April 2025, fisheries and aquaculture businesses, which are highly dependent on and have an impact on natural capital, were newly designated as businesses to be considered.

The Equator Principles are a framework for identifying, assessing, and managing environmental and social risks when providing financing for large-scale development projects. The International Finance Corporation (IFC) Performance Standards, which are referenced during due diligence conducted under the Equator Principles, stipulate considerations for biodiversity and the respect for the human rights of Indigenous Peoples. In addition to conducting due diligence before financing, the Bank also monitors projects after financing to ensure they do not cause adverse environmental and social impacts.

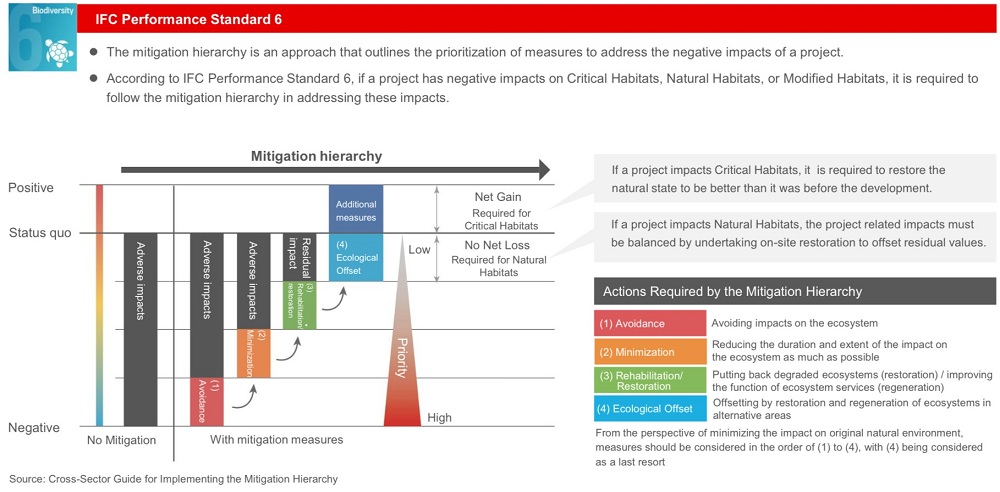

The standards concerning natural capital and biodiversity conservation (IFC Performance Standard 6) require that impacts on natural capital and biodiversity be minimized in accordance with the mitigation hierarchy. This approach involves prioritizing the “Avoidance” of impacts, “Minimization” of unavoidable impacts, “Rehabilitation and Restoration” on site, and finally, using “Biodiversity offsets” to compensate for any remaining impacts.

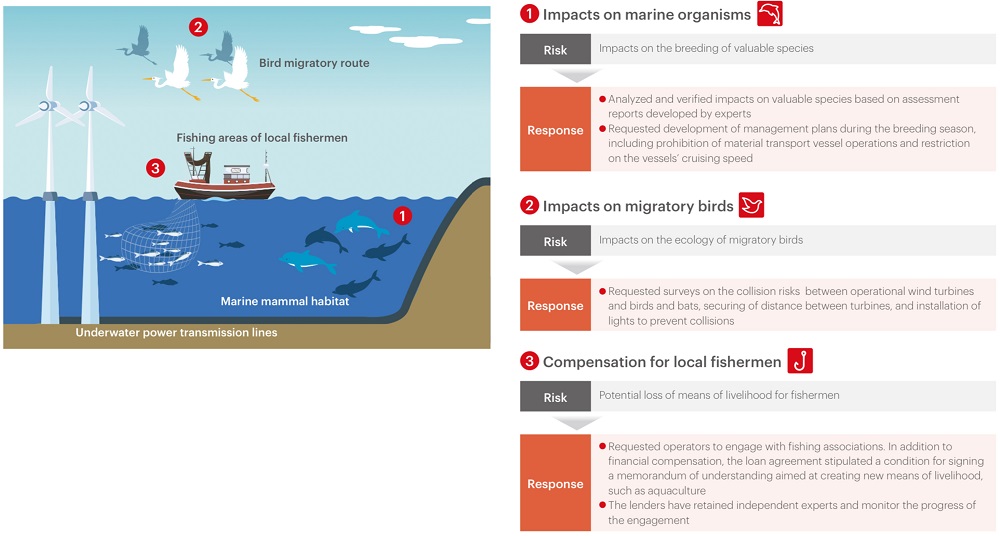

Case Study on Risk Management in Investments and Loans

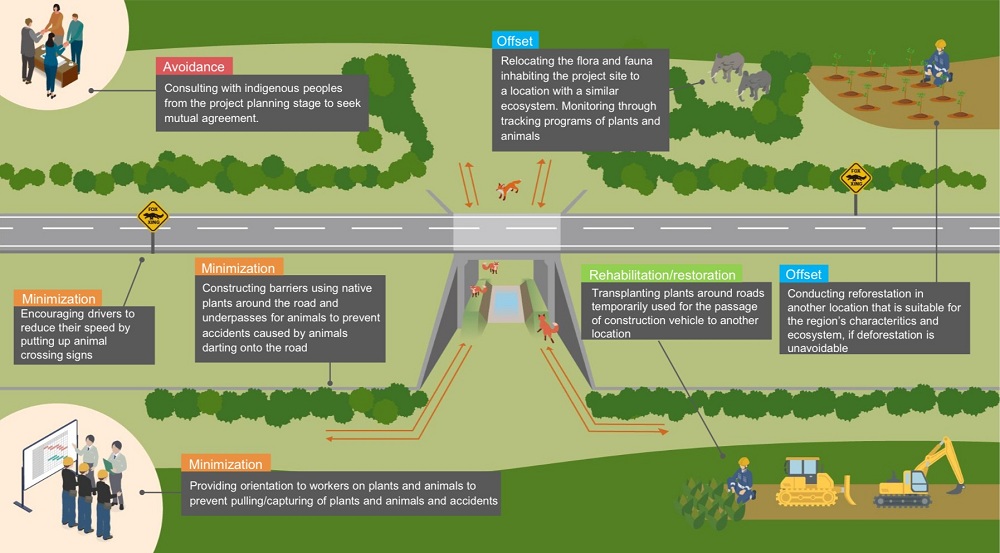

● Examples of Road Construction and Expansion Projects

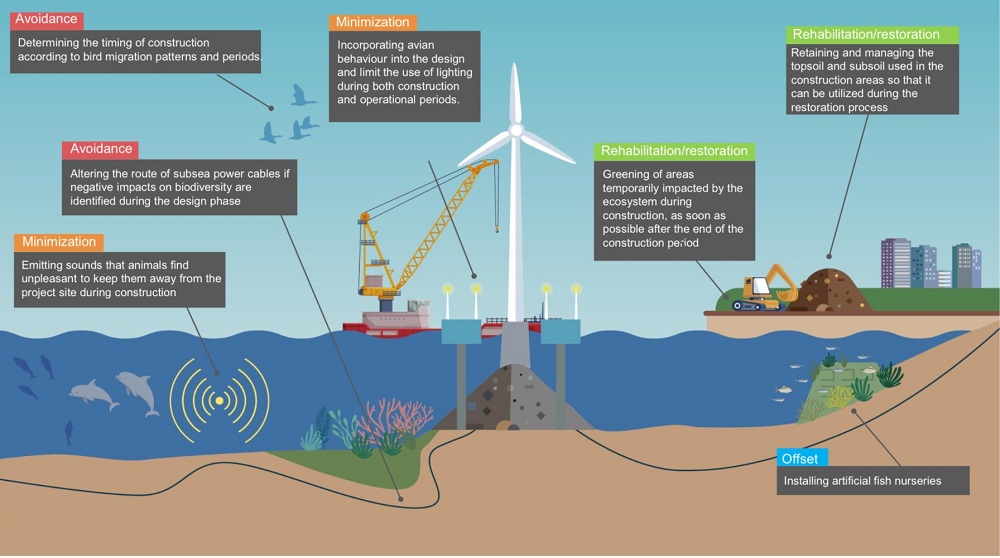

● Examples of Offshore Wind Power Projects

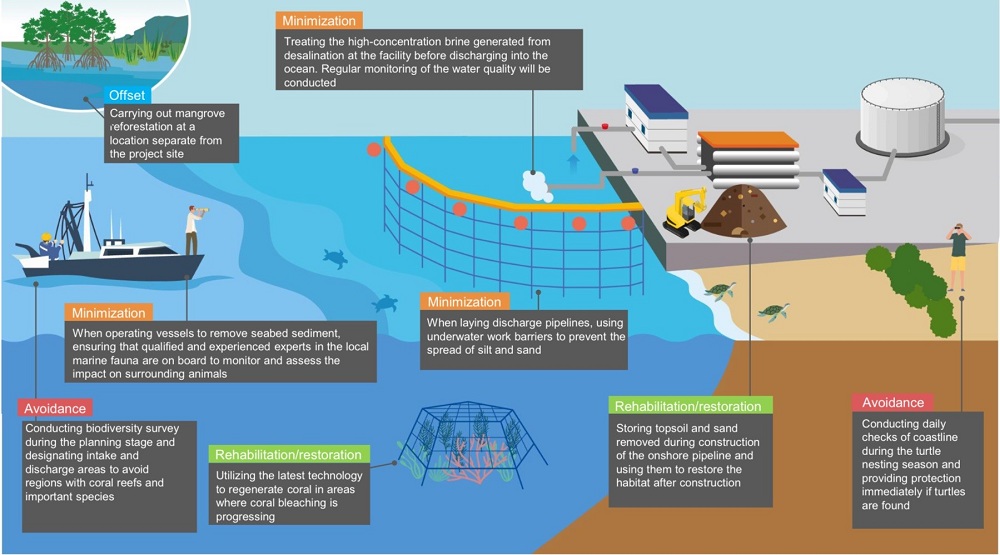

● Examples of Desalination Projects

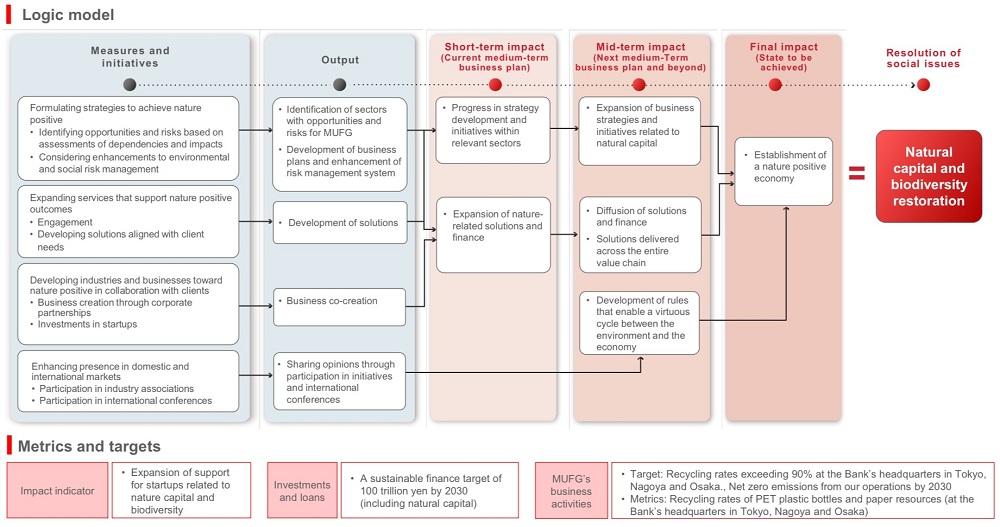

Logic Model / Metrics and Targets

MUFG has systematically structured its actions towards realizing a societal vision and addressing short to long term impacts using a logic model framework. As part of this initiative, we have established "expanding support for nature related startups" as a key impact indicator. Additionally, we have set quantitative targets, including a sustainable finance goal and benchmarks for recycling rates.

MUFG will promote the following four initiatives toward achieving nature positive across the entire value chain.