With the conviction that environmental and social sustainability are essential to achieving sustainable growth for MUFG, we will engage in value creation employing an integrated approach in which the execution of management strategies goes in tandem with the pursuit of solutions for social issues.

Positioning in the Medium-Term Business Plan

Priority Issues

Identifying Priority Issues

MUFG has previously established priority issues in our sustainability management to realize a sustainable environment and society. We have revised such priority issues considering environmental changes, expectations from society, and importance to our business. (April 2024)

Pursuing economic and social values is the key to improving corporate value. We identified ten priority issues under the subheads “Sustainable Society,” “Vibrant Society,” and “Resilient Society” and set specific targets as KPIs to strongly promote initiatives for solution of social issues.

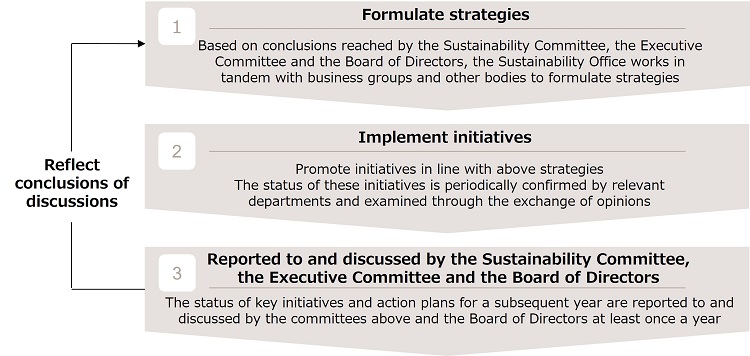

Process of Identifying and Resolving Priority Issues

Process for Identifying Priority Issues

Flow of MUFG’s Process of Reviewing the Priority Issues Initiatives

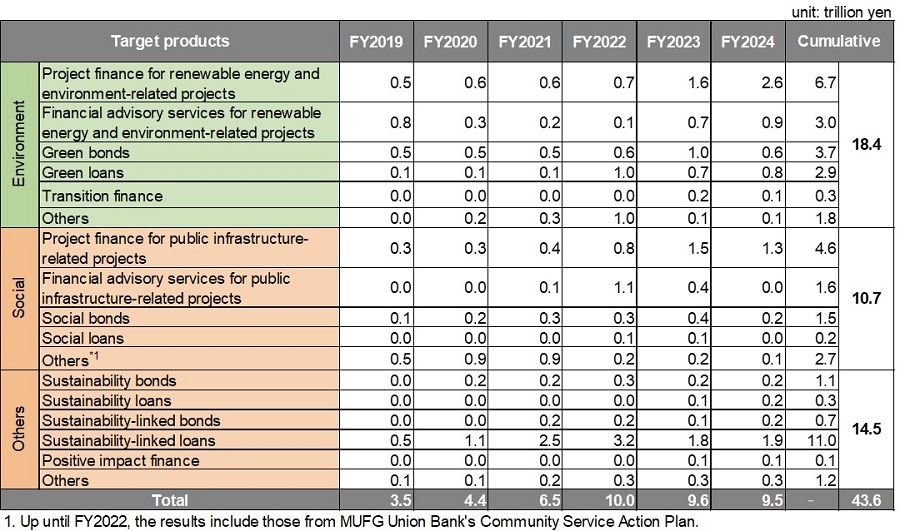

Sustainable Finance

Target and Progress

We have set the cumulative executed amount between fiscal year 2019 and fiscal year 2030 as our sustainable finance target for solving environmental and social issues. The cumulative execution amount up to FY2024 is ¥43.6 trillion (of which ¥18.4 trillion is in the environmental area).

Progress in Sustainable Finance Goals

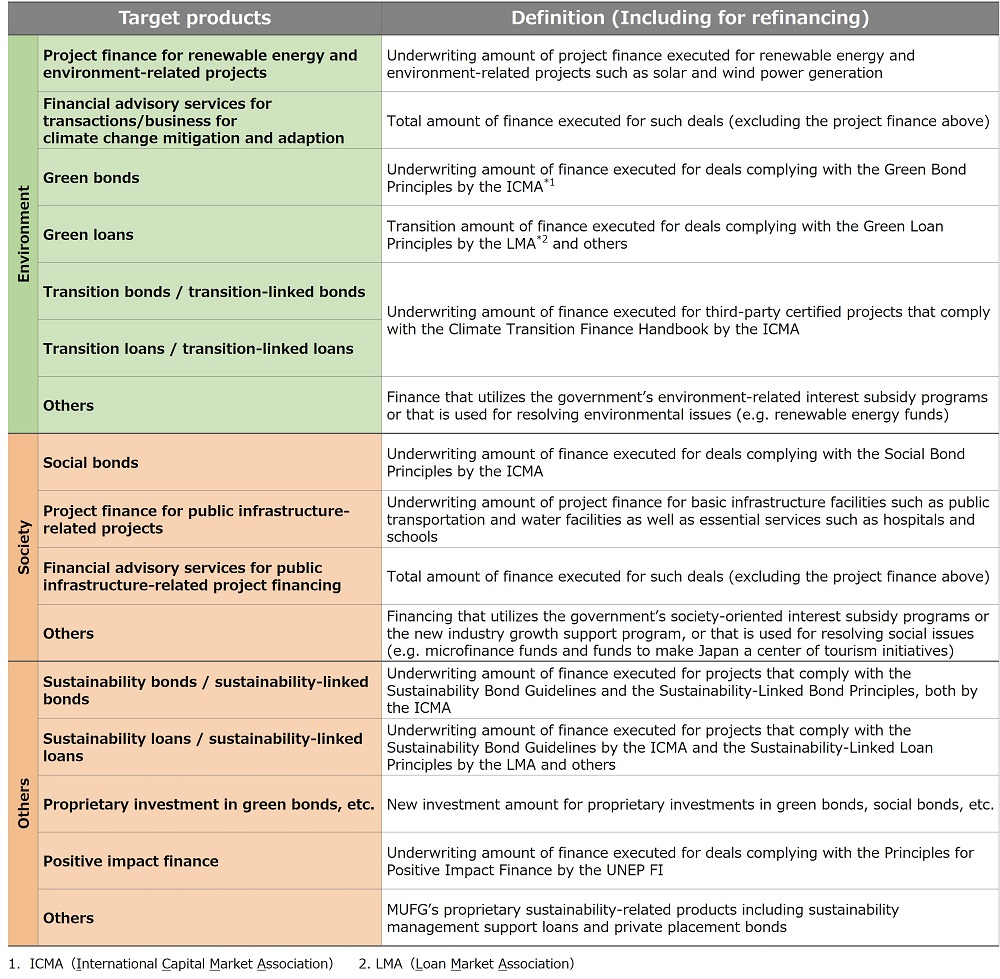

Definition of Sustainable Finance

Environmental Area

- Businesses contributing to the adaptation to and moderation of climate change, including renewable energy, energy efficiency improvement, and green buildings (e.g. arrangement of loans and project finance for renewable energy projects, underwriting and distribution of green bonds).

Social Area

- Businesses contributing to the development of startups, job creation, and poverty alleviation

- Businesses contributing to the energizing of local communities and regional revitalization

- Fundamental service businesses, including those involved in basic infrastructure such as public transport, waterworks, and airports, and essential services such as hospitals, schools and police.

(e.g. Emerging Industrial Technology Support Program, loans for regional revitalization projects such as MUFG Regional Revitalization Fund, arrangement of loans and project finance for public infrastructure, underwriting and distribution of social bonds).

Financing support: Target products for sustainable finance

Responding to Funds-Supplying Operations to Support Financing for Climate Change Responses

(Climate Response Financing Operations) at the Bank of Japan.

MUFG Bank and Mitsubishi UFJ Trust and Banking have been selected as counterparties of Funds-Supplying Operations to Support Financing for Climate Change Responses (Climate Response Financing Operations) at the Bank of Japan. The following include the criteria for eligible investment or loans for Climate Response Financing Operations by MUFG Bank and MUFG Trust and Banking.

MUFG Bank

- Criteria for eligible investment or loans for Climate Response Financing Operations and disclosure of specific procedures for judgement on suitability(in Japanese) (PDF / 91KB)

- Outstanding of investment or loans for Climate Response Financing at the end of each fiscal year(in Japanese) (PDF / 112KB)

MUFG Trust and Banking Corporation

- Criteria for eligible investment or loans for Climate Response Financing Operations and disclosure of specific procedures for judgement on suitability(in Japanese) (PDF / 144KB)

- Outstanding of investment or loans for Climate Response Financing at the end of each fiscal year(in Japanese) (PDF / 108KB)

Issuance of Green, Social and Sustainability Bond

MUFG is one of the few issuers in Japan with a track record of issuing green, social, and sustainability bonds as one of the largest financial institutions in Japan. The proceeds from bonds issued by MUFG will be used for sustainability-related financing.

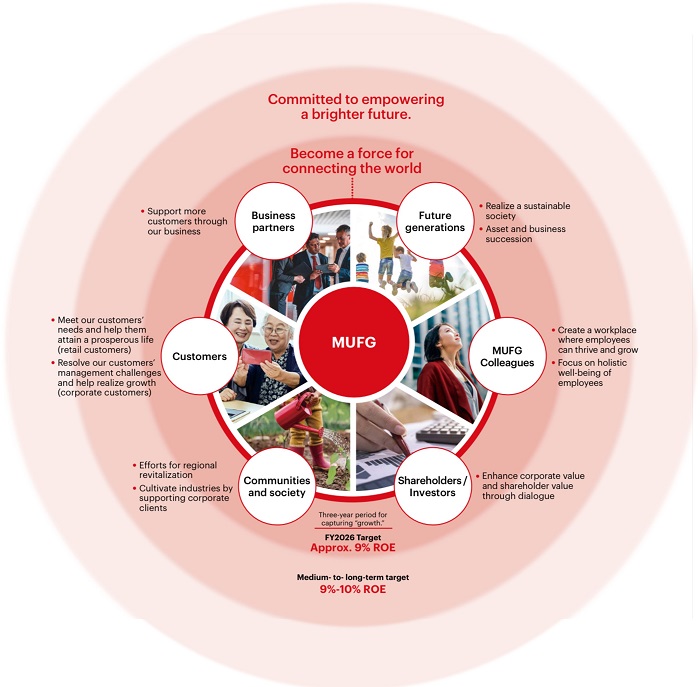

Stakeholder Engagement

In these rapidly changing times, all of our stakeholders are overcoming challenges to find a way to the next stage, toward sustainable growth. We at MUFG will make every effort to help realize these goals. This will be our unchanging purpose now, and into the future.

MUFG will continue to actively engage in constructive dialogs with stakeholders in order to gain new insights and deepen mutual understanding. We strive to build a relationship of trust and cooperation with our stakeholders by responding appropriately to their concerns and issues, and to help MUFG achieve sustainable growth and enhance its corporate value over the medium to long term.

Medium- to Long-Term Vision

The ideal state is for MUFG to embody our purpose, and it should be consistent across the mid- to long-term.

MUFG group companies also have the unique ability to build meaningful bridges connecting our diverse stakeholder communities. With these abilities, MUFG intends to play a cohesive societal role by bringing various stakeholder communities together through financial empowerment. This concept is central to embodying our purpose through our new MTBP.

| Key Stakeholder Groups | Initiatives Towards Achieving the Desired Vision |

|---|---|

Future Generations |

・Realize a sustainable society ・Asset and business succession |

Business Partners |

・Support more customers through our business |

Customers |

・Meet our customers’ needs and help them attain a prosperous life (retail customers) ・Resolve our customers’ management challenges and help realize growth (corporate customers) |

Communities and Society |

・Efforts for regional revitalization ・Cultivate industries by supporting corporate clients |

Shareholders / Investors |

・Enhance corporate value and shareholder value through dialogue |

| MUFG Colleagues | ・Create a workplace where employees can thrive and grow ・Focus on holistic well-being of employees |

Employee Capability Building