Publication of the MUFG Human Rights Report

MUFG has published Human Rights Report which summarizes our ideas and efforts to respect for human rights, based on the United Nations Guiding Principles Reporting Framework.

Click here for details of the MUFG Human Rights Report.

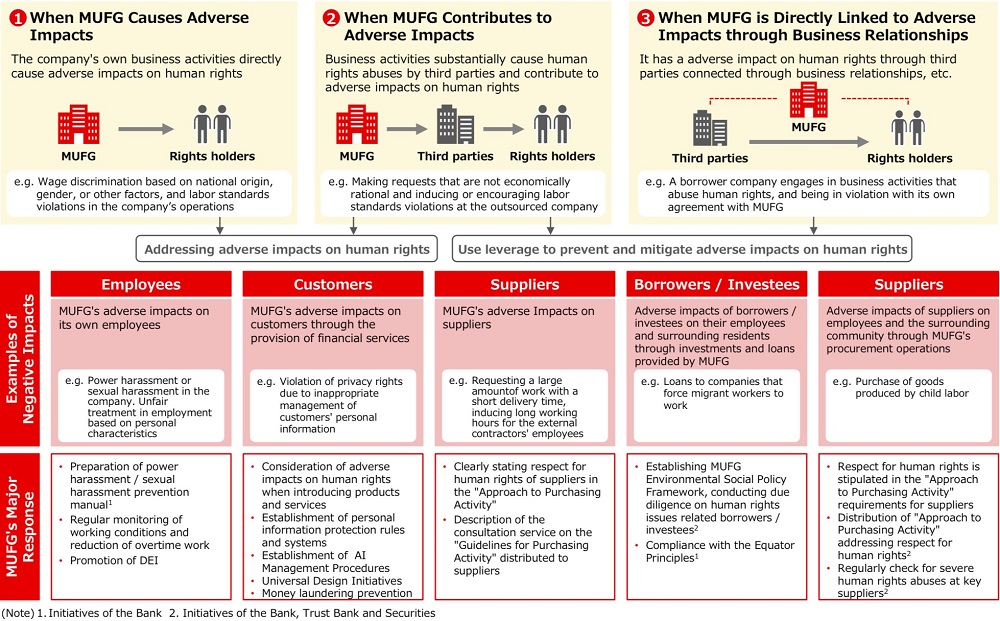

Respecting Human Rights as a Financial Institution

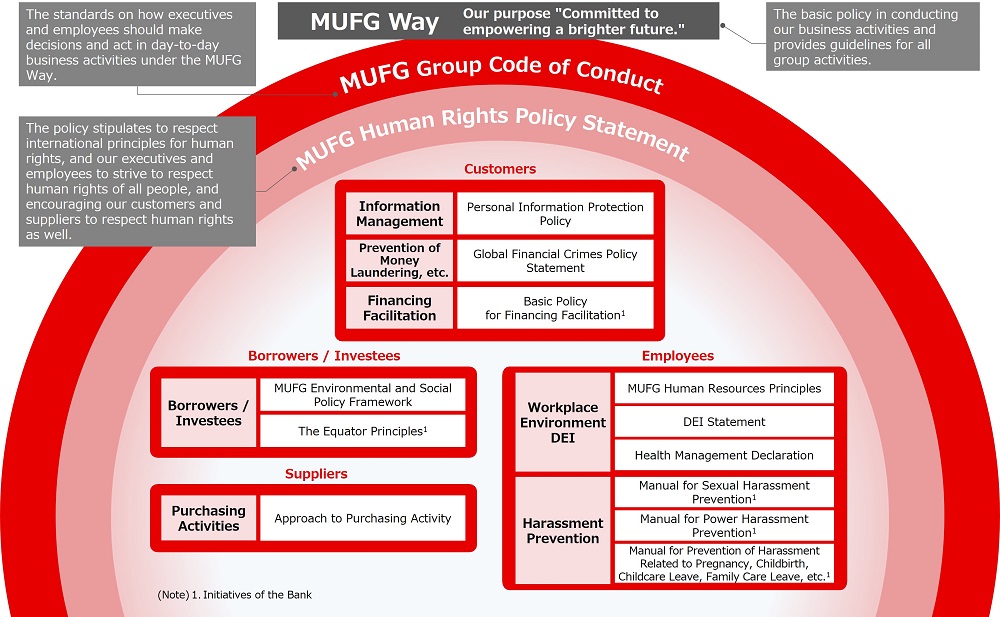

Human Rights Policy Commitment/System for Promoting Respect for Human Rights

Policy commitment and Rules on Respect for Human Rights

Dissemination of Human Rights Policy Statement and Promoting Human Rights Awareness

For Employees

Raising human rights awareness through the Code of Conduct

Promoting Human Rights Awareness

| Bank | Trust Bank | Securities | |

|---|---|---|---|

| Activities |

|

|

|

| Participants |

|

・All employees ・Hierarchical training (newly appointed Branch Managers, newly appointed executives, new employees, etc.) |

・All employees ・Hierarchical training (current/newly appointed Branch Managers, current/newly appointed Managing Directors, new employees, etc.) |

| Number of Attendees of Training FY2024 | About 31,000 | About 7,000 | About 5,000 |

For Borrowers/Investees

For Suppliers

- The Bank: suppliers with ongoing transactions; The Trust Bank and the Securities: major suppliers

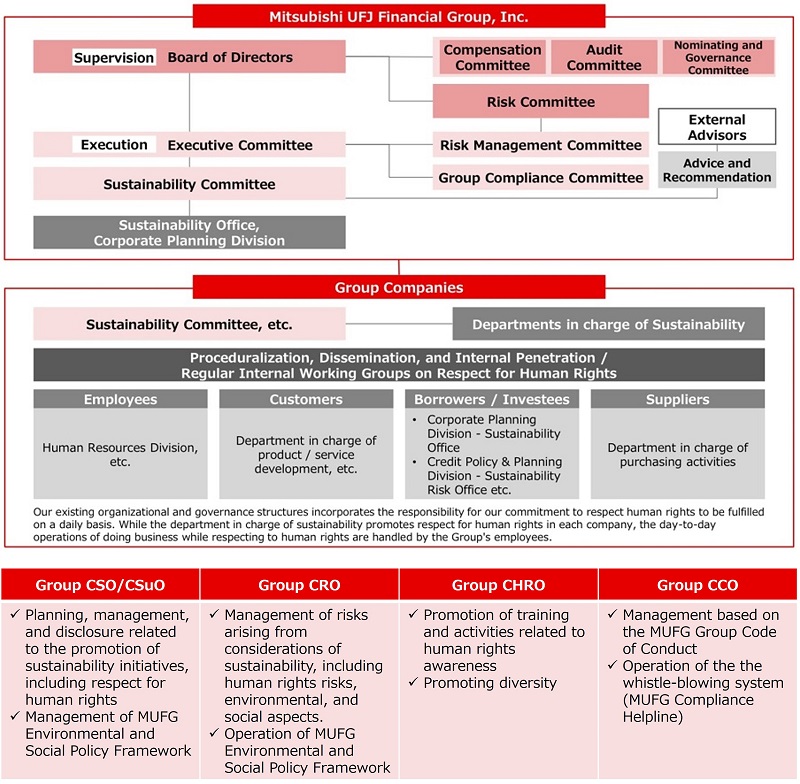

Governance & Implementation Structure for Promoting Respect for Human Rights

Discussion with an Outside Expert

Participants

Outside Participant

- ・Mr. Yusuke Yukawa (Attorney, Nishimura & Asahi, Foreign Law Joint Enterprise)

- ・Ms. Ayumi Yamori (Principal, Owls Consulting Group, Inc.)

Major Participants from MUFG

Major Agenda

- Outlook and trends in the legislation of human rights due diligence

- Approaches to stakeholder engagement

- How management should address business and human rights

- Efforts to address business and human rights in various industries (sectors)

- Actions of the Japanese government related to business and human rights

- Potential for proactive human rights responses: towards the creation of "human rights issue resolution business"

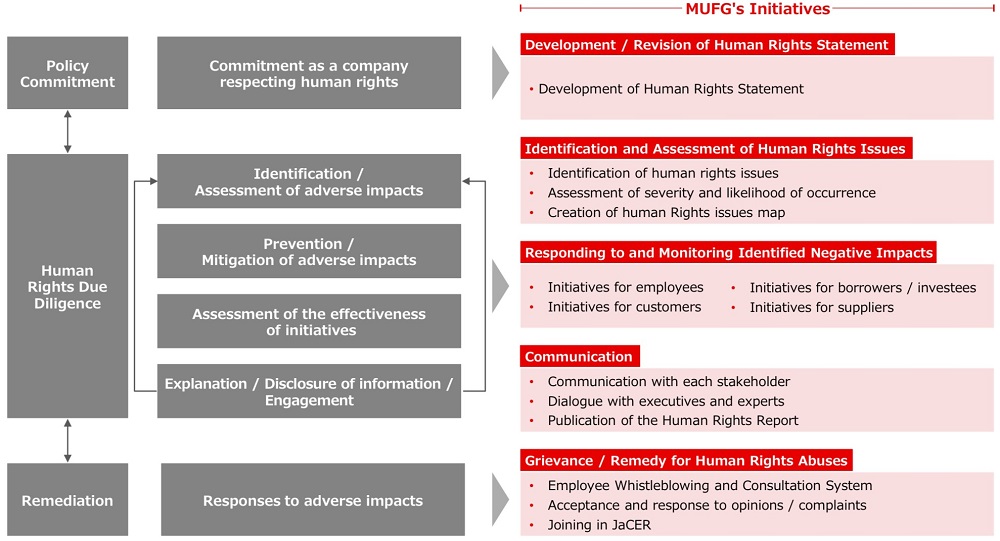

Due Diligence Process

Identification of Human Rights Issues and Assessment Methods

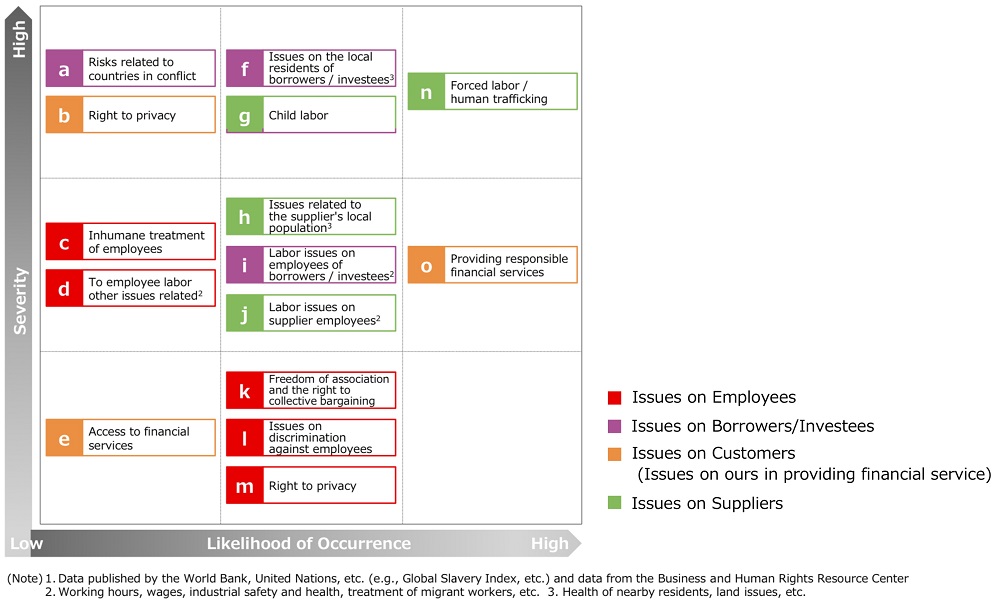

Human Rights Issues Map

Initiatives and Monitoring of Identified Adverse Impacts

Initiatives for Employees

● Prevention of Discrimination and Harassment

MUFG Group companies have established consultation desks for sexual harassment and power harassment to provide consultation services through various means, including meetings, telephone calls, e-mails, etc., in order to create a positive, safe and comfortable work environment. The Bank has established the Harassment Prevention Manual which presents types of harassment, precautions and guidelines as how to respond when harassment occurs, to deepen each employee’s correct understanding and awareness. Furthermore, the Bank conducts ongoing trainings to prevent harassment.

● Respect for Freedom of Association and Collective Bargaining Rights

MUFG is committed to respecting workers’ freedom of association and collective bargaining rights in accordance with its Human Rights Policy Statement, and ensures its compliance through awareness-raising activities. In the Bank, the Trust Bank, and the Securities, employee unions are organized in each company, and the company and the union regularly discuss various topics while respecting each other’s perspective and view.

| FY2021 | FY2022 | FY2023 | FY2024 | |

|---|---|---|---|---|

| MUFG(note) | 80.4% | 81.3% | 74.8% | 77.6% |

- The combined value of the Bank, the Trust Bank, the Securities, Mitsubishi UFJ NICOS, Mitsubishi UFJ Asset Management.(Mitsubishi UFJ Asset Management is included from the fiscal year 2023.)

● Protection of Employees’ Personal Information

At MUFG, each company is committed to the appropriate protection and use of employees' personal information in accordance with the "Act on the Protection of Personal Information" and the "Act on the Use of Number to Identify Specific Individuals in Administrative Procedures", and other relevant laws and regulations. The Bank, the Trust Bank, and the Securities established polices and regulations regarding handling and protection of employee information at each company, and are making efforts to continuously raise awareness among employees regarding handling of employee information and other related matters.

● Compliance with Laws and Regulations Related to Working Conditions

MUFG Group companies comply with the laws and regulations of the countries and regions in which they operate, and are committed to providing appropriate treatment to all employees regardless of employment type, by ensuring salaries exceed minimum wage and fully implementing the concept of equal pay for equal work.

In Japan, each company also complies with the Act to Promote Work Style Reform, which came into effect in April 2019. To ensure statutory annual paid leave is taken, systems have been established to encourage paid leave, and information about these systems is actively communicated. The payroll regulations stipulate that employees are paid as if they had worked their prescribed working hours during periods of paid leave.

Other monitoring items include checking for violations of the 36 Agreement on overtime work, compliance with minimum wage requirements, and the number of work-related accidents.

In the event of dismissal, the labor agreement stipulates that the reason for dismissal must be notified to the labor union in advance and discussed.

● Reducing Overtime

MUFG complies with the laws and regulations of the countries and regions in which our group companies operate, striving to reduce long working hours and eliminate excessive work, with the aim of further improving the workplace environment while ensuring that employees can stay healthy and achieve a fulfilling work-life balance.

For example, in Japan, the payroll regulations stipulate the payment of premium wages as required by the Labor Standards Act, and management ensures accurate tracking of each employee’s working hours to prevent unpaid labor. In addition, management operates with an awareness of limits set on working hours and the intervals between shifts. Overtime hours are also being reduced by optimizing operations through the use of RPA (Robotic Process Automation), setting target times for leaving the office, and establishing early finish days.

Initiatives for Customers

● Management of Our Customers’ Information

Since MUFG believes it is our social responsibility to handle customers' personal information properly, we established and published the Personal Information Protection Policy. In addition, in order to realize a unified management system within the Group companies, we have established the “MUFG Personal Information Protection Principle” (the “Principle”) and each Group company has established its own “Personal Information Protection Procedure”, etc. based on the Principle. The management methods for organizational, human, technical, and physical safety control measures are clarified in the relevant principles and procedures of each company, and regular education and training are provided to employees. We strive to protect and respect the privacy of our customers by continuously strengthening our information management system while keeping abreast of the ever-changing external environment and continuously reviewing related regulations and training programs. In addition to internal information management, we have prepared a system to check whether the information is managed by outside contractors in accordance with the Personal Information Protection Law and other relevant laws.

● Identifying Human Rights Impacts in the Planning and Development of Products and Services and The Publication of Advertising Materials

Group companies constantly check whether sufficient measures have been taken at the planning and development stages of products and services from the “customer’s perspective,” and risk assessments are conducted for new products and services, including customer protection and the customer’s viewpoint. When publishing advertising materials, we check for problematic expressions from the perspective of respect for human rights. We give full consideration to diversity and strive to ensure that our expressions are inclusive.

● Combating Financial Crimes

MUFG is committed to supporting the financial system and combating financial crimes, including money laundering and financing of terrorism, economic sanctions and bribery and corruption.

To that end, MUFG maintains compliance and risk management frameworks incorporating processes for the identification, assessment, treatment, and monitoring of customers for financial crimes risks, including criminal or unethical activities, such as human rights abuses.

● Considerations about Human Rights in Establishing AI Management Procedures

As a business entity engaged in the utilization of AI, MUFG recognizes the importance of AI governance in correctly managing AI risks and maximizing its benefits. To this end, we have established and published the MUFG AI Policy, and MUFG group companies have set related regulations.

Based on these policies and regulations, we verify and examine the use of AI to ensure that there are no issues from a human rights perspective and that no biases arise that should be avoided from the perspective of fairness.

MUFG is committed to introducing universal design in both software and hardware aspects to ensure that all customers can use our services with peace of mind, including customer service that takes all customers into consideration (hospitality) and safe and secure branch facilities (facilities).

● Initiatives to Ensure Equal Access to Financial Services

In the Asian region, ensuring equal access to financial services is a challenge due to the lack of bank branches and ATMs in remote and rural areas, and ignorance of the existence and use of available services. MUFG contributes to ensuring equal access to financial services in Asia by providing opportunities to access financial services and working to improve financial literacy.

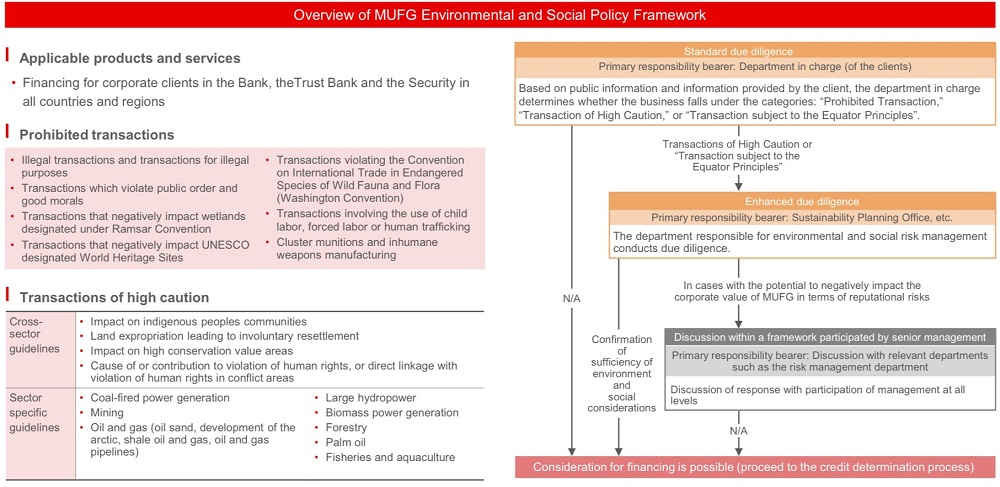

Initiatives for Borrowers/Investees

MUFG recognizes that the environmental and social risks arising from the business activities of each group company are important management issue to be addressed appropriately. Based on this recognition, we established MUFG Environmental and Social Policy Framework in 2018 as a framework to cease, prevent, and mitigate adverse impacts on environment and society, including human rights issues, in the process of providing financing for corporate customers. MUFG Environmental and Social Policy Framework is regularly deliberated at the Sustainability Committee for its revision, and is revised as necessary based on changes in business activities, business environment, and dialogue with stakeholders, and to comply with state and local laws.

In addition, large-scale infrastructure development, resource development, etc. may have adverse impacts on the project sites and the surrounding communities and natural environment. In accordance with the Equator Principles, the Bank identifies risks and impacts on the environment and society, including the status of human rights considerations in the business of the borrowers and confirms the mitigation measures taken by them.

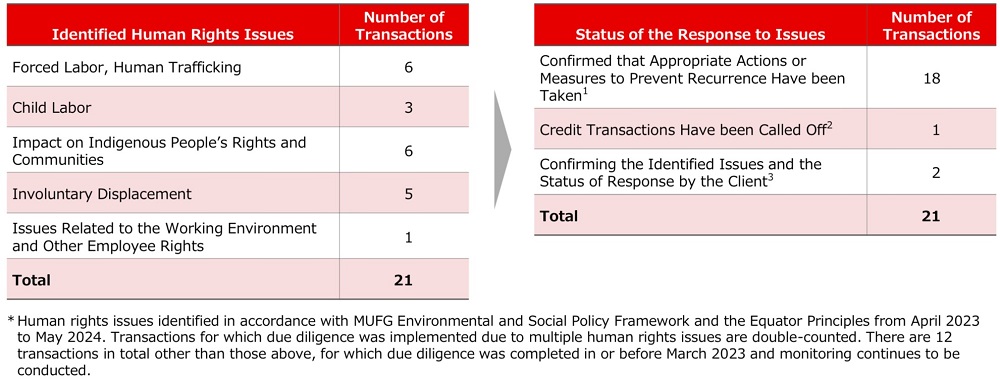

Initiatives for the Prohibited Transactions (child labor, forced labor, and human trafficking) designated in the MUFG Environmental and Social Policy Framework

Considering New Transactions |

・Branches or departments considering a new transaction check whether or not the borrowers/investees have highly severe human rights issue(note1) and determine whether the transaction falls under the prohibited transaction category based on available public information, information provided by the borrowers/investees, and external vendor data(note2), etc. ・If highly severe human rights issue of borrowers/investees is detected, MUFG confirms the detected issues and the status of their response(note3). ・If child labor, forced labor, or human trafficking is confirmed, MUFG will not provide financing. |

|---|---|

| Management during the Transaction Period | ・Using external vendor data, we perform regular screening for highly severe human rights issue of borrowers/investees. ・If highly severe human rights issue of borrowers/investees is detected in external vendor data or by external observations etc., we confirm the occurrence of the event and the status of the response to them. ・If child labor, forced labor, or human trafficking is confirmed, we will request borrowers/investees to take corrective actions and prevent its recurrence. ・If no action is taken by the borrowers/investees, we will carefully consider whether or not to continue with the transaction. |

![[Process of Due Diligence for Prohibited Transactions (Child Labor, Forced Labor, or Human Trafficking)]](/dam/csr/social/humanrights/index_img_007_en.jpg)

- Human rights issue related to child labor, forced labor, or human trafficking

- Referring to external data, etc., on the violation status of ten principles under the UN Global Compact Principles.

- Checks are conducted at each site. Consult with the departments in the headquarters (in case of the Bank, Sustainability Office) as necessary

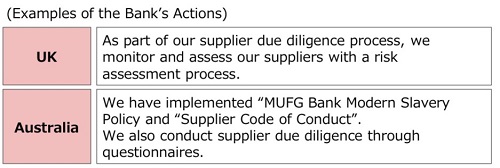

Initiatives for Suppliers

| Risk Identification and Assessment | |

|---|---|

| New Transactions |

|

| Existing Transactions |

|

| Responses when Risks are Detected | |

|---|---|

| Information Confirmation |

|

| Consideration of Responses | At the start of a new Transaction

Existing Suppliers

|

- The Bank: suppliers with ongoing transactions

- Implemented by the Bank and the Trust Bank

- Implemented at the Bank's European and Americas offices, etc.

- Major suppliers of the Bank, the Trust Bank and the Securities

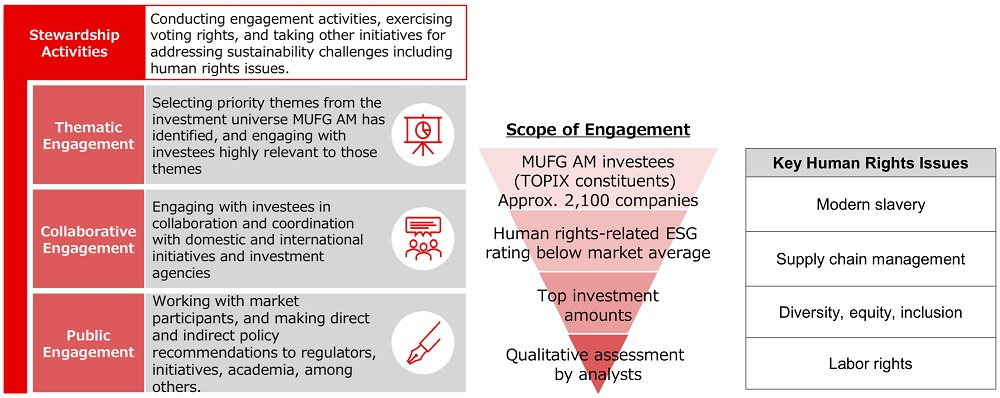

Initiatives as Asset Manager

- MUFG Asset Management (MUFG AM) is a brand name formed by Mitsubishi UFJ Trust and Banking Corporation, an asset management company of Mitsubishi UFJ Financial Group (MUFG), Mitsubishi UFJ Asset Management Co., Ltd., Mitsubishi UFJ Real Estate Asset Management Co., Ltd., Mitsubishi UFJ Asset Management (UK) Ltd., and Mitsubishi UFJ Alternative Investments Co., Ltd.

Communication with Stakeholders

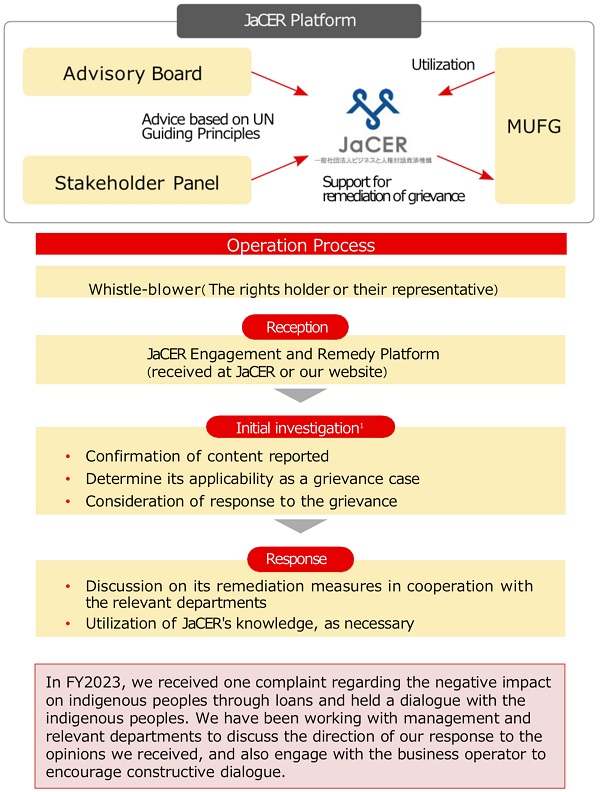

Grievance Mechanism/Remedy for Human Rights Violations

Initiatives for Employees

| MUFG Compliance Helpline |

|

|---|---|

Employee Consultation Desk |

|

| DEI Consultation Desk |

|

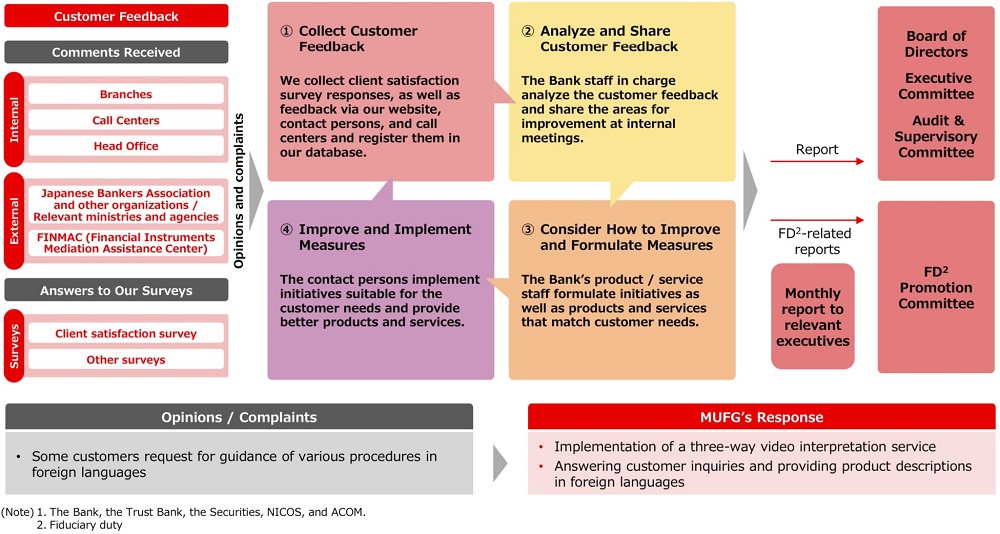

Initiatives for Customers

Flow of Handling Customer Feedback and Complaints (Case of the Bank)

Initiatives throughout the Value Chain