Main Initiatives

Building a Digital Financial Platform in Asia

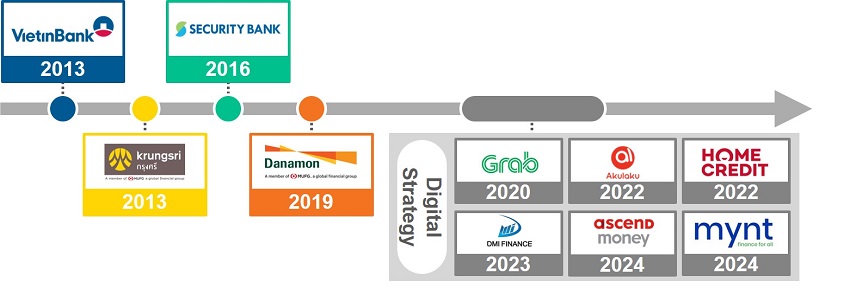

The need for digital financial services has grown rapidly in Asia against the backdrop of the proliferation of the internet and smartphones. To capture the growth of consumer finance in Asia, which is expected to further digitalize, and to capture the future leader in the field, MUFG has started strategic investment in digital finance services providers to build a foundation for the digital financial platform.

Under the new MTBP, we will pursue strategic investment opportunities for digital finance services providers under the “Asia x Digital” strategy. By focusing on supporting the growth of investees, we will capture the development of digital financial services in Asia that could not be fully captured through conventional financial services and contribute to financial inclusion in the region.

In addition, we will promote collaboration and knowledge sharing among the investee digital finance services providers, partner banks, and MUFG group companies, aiming to build MUFG’s unique digital economic sphere, which will also include external partners.

Fueling the growth of Asia

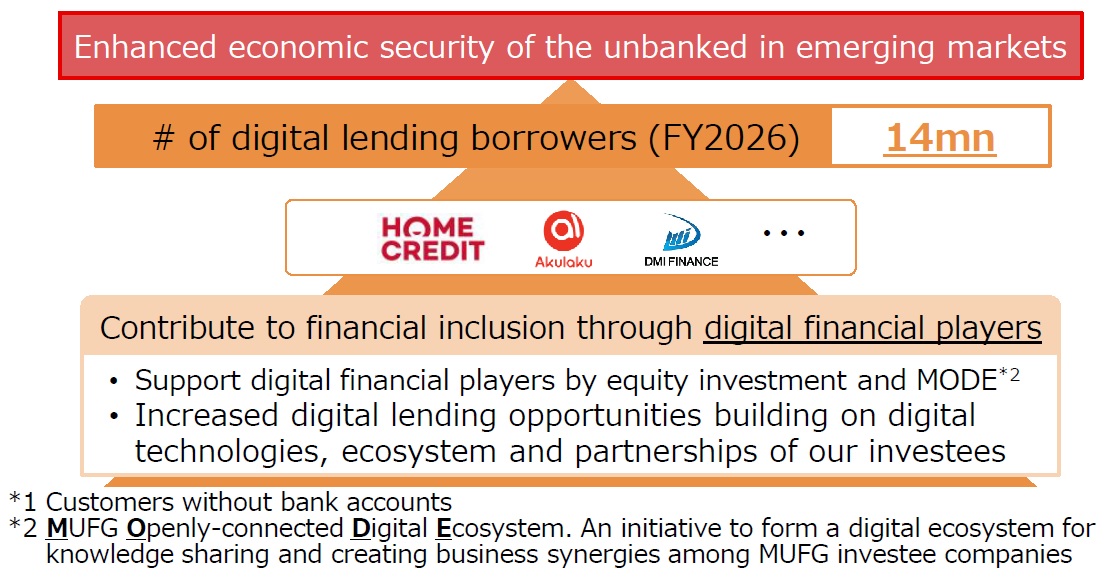

MUFG also focuses on accumulating expertise in consumer finance acquired through investments in digital finance service providers, knowledge sharing, and creating synergies among investees. This has led to the formulation of a unique ecosystem called MODE (MUFG Openly-connected Digital Ecosystem). By using these activities to expand opportunities to provide digital lending, we aim to promote financial inclusion and contribute to improving the economic stability of the unbanked population in emerging economies.

Aiming to cover approx. 1/4 of the ASEAN adult population(note1), while creating synergies between partner banks and investees in both lending and payment areas.

- The proportion of digital finance users within total adult population of approximately 400mn in partner bank countries (Thailand, Indonesia, Vietnam, Philippines) (Source: UN Population Prospects)

- # of borrowers and payment users of investees. Initial target has been achieved. Revised target towards FY34 includes payment users (FY24 actual :67mn)

Partner Bank

Provision of Microfinance through Hattha Bank Plc.

Krungsri (Bank of Ayudhya Plc.), our Partner Bank in Thailand, provides opportunities for customers in emerging and developing countries to access financial services through Hattha Bank Plc. (HTB) in Cambodia, as well as other markets.

In addition to providing microfinance services, HTB as a key sponsor also supports initiatives that enhance education and improve the quality of life of underprivileged youth in Cambodia. These initiatives include a program conducted in collaboration with Credit Bureau Cambodia, namely the Digital Financial Literacy program, which focuses on educating customers during the onboarding process on responsible borrowing and credit history awareness. These efforts contribute to improving customers’ living standards in the long term.

| HTB 2024 Results | |

|---|---|

| Outstanding Loan balance (USD, million) | 1,072 |

| Number of branches | 161 |

Issuance of Gender Bonds by Krungsri (Bank of Ayudhya): Krungsri Women SME Bond (Gender Bond)

Krungsri (Bank of Ayudhya Plc.), our Partner Bank in Thailand, has issued social bonds (gender bonds) to support the financial needs of women entrepreneurs.

Proceeds from the bond issuance are used to finance women-led small and medium-sized enterprises in Thailand. Through the issuance of these bonds, the bank provided opportunities for the underserved women in SME segment to access financial services and contributed to the development of the fast-growing social bond market in Asia.

| FY2024 Results | |

|---|---|

Loan Outstanding WSME Bond |

20,048 million baht |

New Loans Booked WSME Bond |

3,824 million baht |

| Employment | 14,896 people (of which 7,871 are in upcountry areas, and 7,025 in Bangkok and vicinity) |

| Use of Proceeds | The proceeds from the Women Bonds will be used to refinance existing facilities or finance new facilities that fund social projects of the following categories: ・Employment generation through women-owned SME financing and microfinance for women ・Socioeconomic advancement and empowerment through financing to women with low income, or disadvantaged female groups |

| SDG Linkage | SDG5: Gender Equality SDG8: Decent work and Economic Growth SDG9: Industry, Innovation, and Infrastructure SDG10: Reduced Inequalities SDG17: Partnerships for the Goals |

Krungsri (Bank of Ayudhya Plc.)’s Initiatives to Enhance Financial Literacy:Krungsri Financial Literacy: Simple to Manage Project

Krungsri (Bank of Ayudhya Plc.), our partner bank in Thailand, is implementing the Krungsri Financial Literacy: Simple to Manage Project to enhance financial literacy among farmers, who are the most vulnerable groups to climate change and household debt in Thailand.

In collaboration with the Social Enterprise Thailand Association (SE Thailand), the project aims to improve farmers’ knowledge of household financial management, borrowing and repayment, savings, marketing, and local product development, thereby contributing to the improvement of people’s quality of life.

| FY2025 Performance | |

|---|---|

| Number of participants | 472 farmers in 16 subdistricts of Phitsanulok and Sukhothai Provinces |

Bank Danamon’s Initiatives to Enhance Financial Literacy

Bank Danamon Indonesia implements a wide range of financial literacy initiatives through the Group Marketing Division, the Sharia Business Unit, the Branch Network, and the Sustainability Finance Division.

In FY 2024, a total of 5,582 participants including underbanked(note) individuals as well as financial dependents (e.g., students) took part in face‑to‑face financial literacy activities.

- Population with limited access to a full range of banking services

- Literasi Keuangan untuk Semua

This program aims to enhance financial knowledge and promote economic self reliance across all segments of society.

In addition to core financial education, the program integrates sustainability literacy, including environmental awareness and disaster preparedness, reflecting Danamon’s broader commitment to advancing sustainability values. - Tour D’Banking Program

This program specifically targets students across Indonesia, providing them with knowledge about the banking industry and fundamental financial knowledge.

In 2024, a Financial Literacy Seminar was held at Gadjah Mada University, under the theme “Learning Strategies to Navigate the Cycle of Financial Life.” The seminar provided students with essential financial planning insights relevant to different stages of the financial lifecycle.

The initiative was delivered in partnership with the MUFG Group — MUFG Jakarta, Danamon, Adira Finance, Home Credit, and Zurich Asuransi Indonesia —demonstrating a joint commitment to improving financial literacy among youth and supporting the development of financially resilient future generations.