Basic Policy

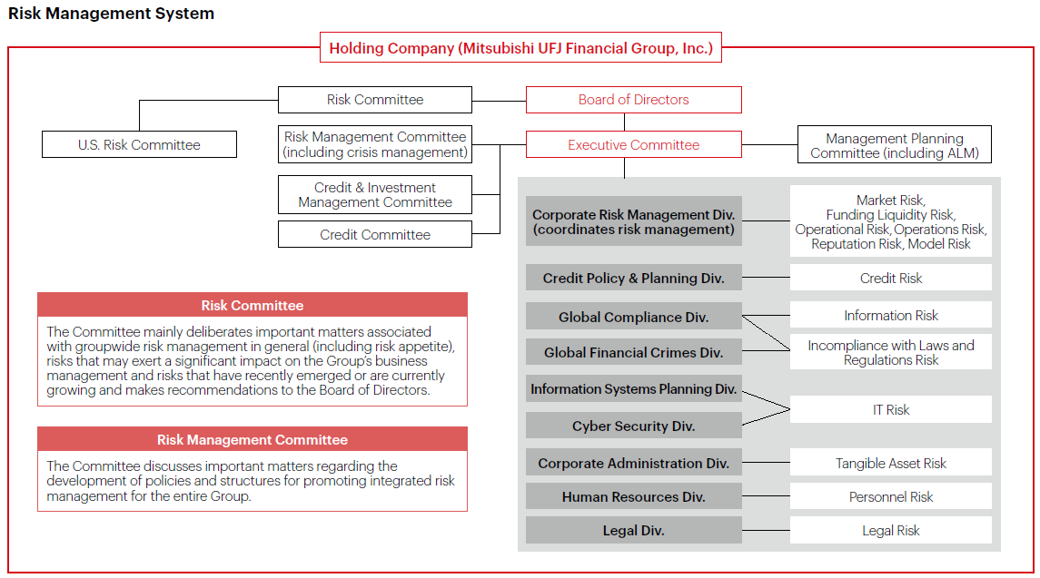

MUFG aims to strengthen its Group risk management through the diffusion of a risk culture that strengthens the structure of Group business management as well as integrated risk management. Our goal is effective risk governance that is consistent across regions, subsidiaries and the holding company.

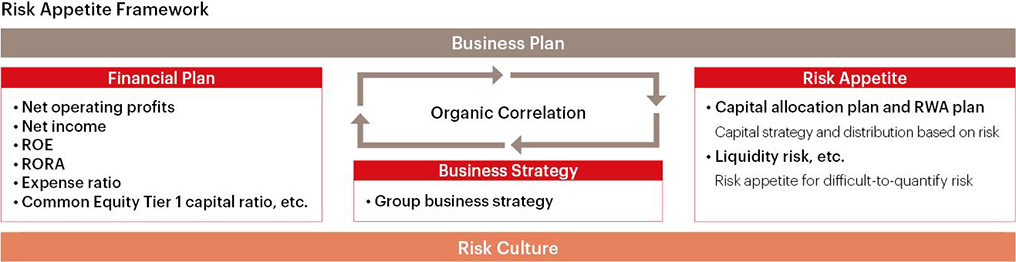

Furthermore, the Risk Appetite Framework provides guidelines for effective risk management that backs our business strategy and financial plan while supporting efforts to avoid unexpected losses and enhance risk return management.

MUFG formed Risk Committee under the Board of Directors.

With an outside director as Chairperson, the Committee mainly examines important matters associated with groupwide risk management in general, risks that may exert a significant impact on the Group’s business management and risks that have recently emerged or are currently growing and submits its recommendations to the Board of Directors to enhance its efficient Group risk management.

The Committee confirmed and discussed such matters as the status of risk appetite (allocated capital, etc.) in the course of business planning, the content of scenarios used in stress tests and the results of such tests and the assumed impact of the emergence of geopolitical risks and MUFG’s response as their main activity.

In addition, the Group CRO reports to the Board of Directors periodically regarding the status of risks and the Group’s initiatives in various risk areas, and the Board of Directors review and monitor effectiveness of risk management.

Also, with regards to subcategory of operational risk, other C-Suites are reporting to the Board of Directors respectively in terms of risk related matters within each responsible area. For instance, Group CLO is responsible for managing legal risk, and Group CLO reports matters related to legal risk to the Board of Directors.

Furthermore, we are improving the Group’s risk management through several efforts such as conducting Crisis Management Training periodically with involving Managements, and holding seminars and training sessions for the Members of the Board of Directors by inviting external experts, and conducting annual in-house training on risk management for our employees and officers.

Risk Appetite Framework

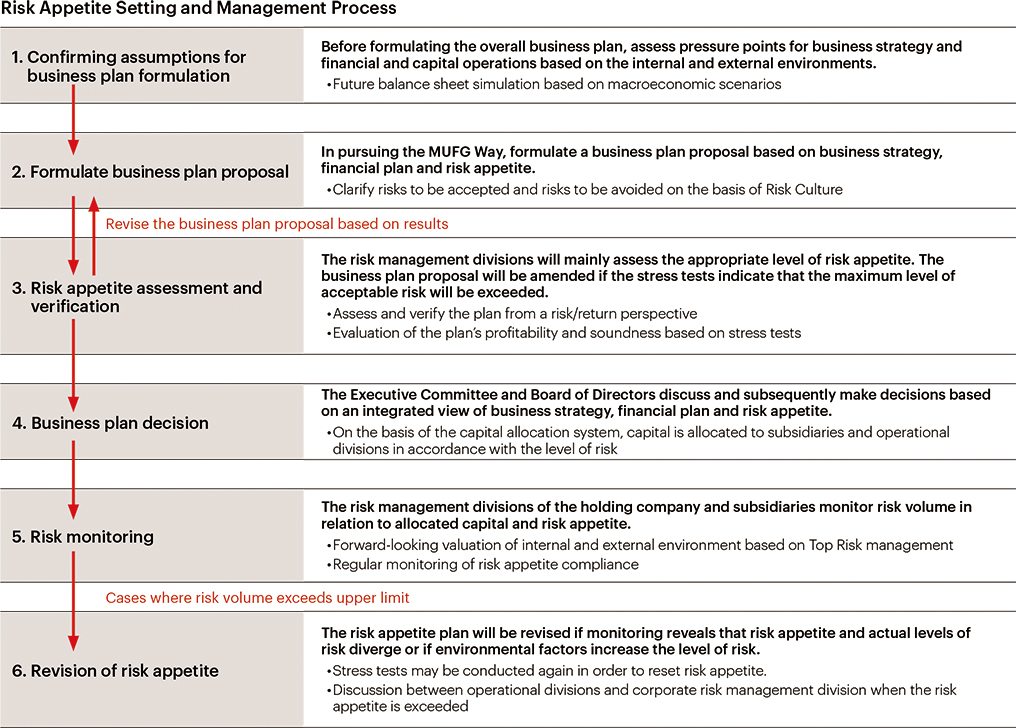

Risk Appetite Framework Management Process

The process of setting and managing risk appetite is set out below. In order to effectively implement the Risk Appetite Framework, risk evaluation and verification procedures (capital allocation system, stress tests, Top Risk management) will be applied at every stage of the management planning process.

Furthermore, even after the plan is formulated, we are ready to take immediate actions in emergency situations through monitoring of the set risk appetite.

Enterprise Risk Management

Enterprise risk management is then conducted while maintaining business stability and striving to maximize shareholder value. Enterprise risk management is a proactive approach, promoting stable profits commensurate with risk as well as the appropriate allocation of resources.

Enterprise risk management is composed of three main strands: the capital allocation system, stress tests and Top Risk management.

Capital Allocation System

Stress Tests

・Stress tests for capital adequacy assessment

Stress tests analyze both the internal and external environment, and use three-year-period preventative scenarios.

・Liquidity stress test

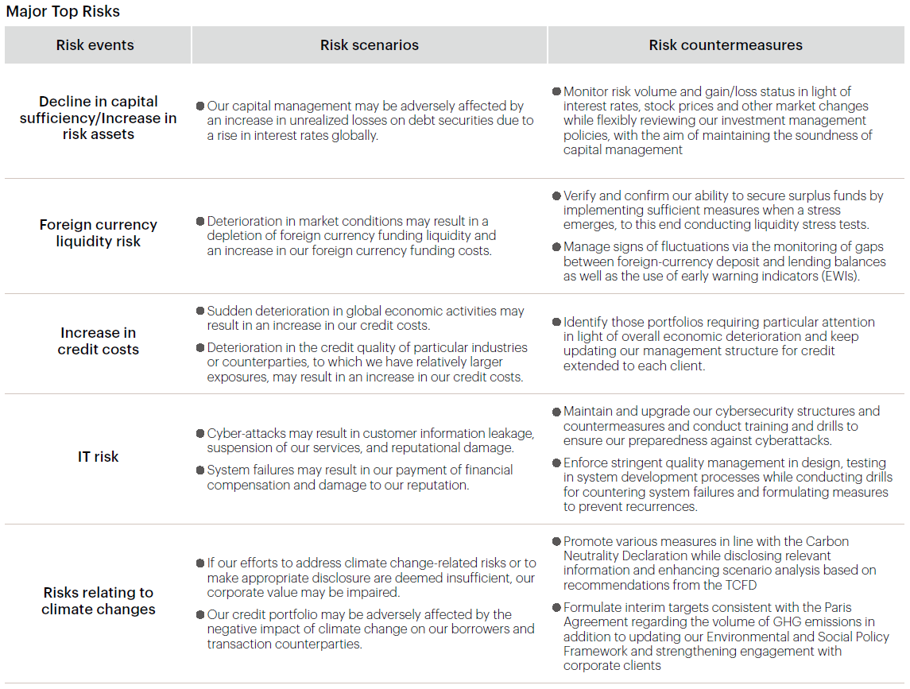

Top Risk Management

At MUFG and its core subsidiaries, management is regularly engaged in discussions aimed at addressing Top Risks to ensure that the understanding of these risks is shared throughout their organizations. By doing so, management is implementing effective countermeasures against Top Risks. (Major Top Risks identified by MUFG are as listed below.)

Significant External Risk Events and Risk Management

In recent years, the environment surrounding financial institutions has changed dramatically. At MUFG, we identify significant external risk events including emerging risk and use them in our top risk management.

One key external risk event we monitor is geopolitical risk due to rising tensions among foreign countries. We gather information on international conflicts and political situations and assess the impact on various risks by conducting stress tests etc., to develop appropriate responses.

Additionally, the external risk environment is becoming more complex with the increase in cyberattacks, the development of new technologies such as AI and the occurrence of large-scale natural disasters, etc. To prepare for such crises, we are focusing on strengthening our operational resilience and IT/cyber risk management as top priorities.

Enhancing the Effectiveness of Risk Management

The Risk Appetite Statement elucidates the Risk Appetite Framework which embodies MUFG's attempts to achieve an integrated group strategy along with effective risk management. The Risk Appetite Statement contains an overview of the Risk Appetite Framework (basic policy and management process) as well as specific business strategies, financial plans and risk appetite details.

A summary of the Risk Appetite Statement is distributed throughout the Group in an effort to spread the basic philosophy behind the Risk Appetite Framework.

From FY2019, Business Group Risk Appetite Statement has been implemented by each Business Group as a tool for undertaking its operations while having risk ownership. Each Group Head is responsible for understanding and managing risks at the first line.

Through the penetration of risk appetite framework, we will take actions in anticipation of environmental changes both inside and outside of the Group, while the environment continues to be uncertain.

In addition, we produce new products or new services with a customer-centric approach by identifying and evaluating risks from a wide range of perspectives in advance. We particularly focus on evaluating aspects related to the protection of customers' assets and information, as well as whether the product design and explanation methods are appropriate from the customers' perspective. To enhance the effectiveness of such a risk assessment framework, in addition to risk assessments, guidance and advice from risk assessment departments, we hold Product and Business Decision Meetings composed of relevant departments, and discussions are conducted among relevant executives and at the Executive Committee as necessary. Furthermore, the management is responsible for establishing and ensuring an appropriate risk management system for products and services, and the status of risk management related to products and services is reported to the Executive Committee semi-annually and as needed.

As part of efforts to enhance the effectiveness of risk management, internal audits were conducted on risk management processes for operational risk, market risk, and other risks in FY2023. (As of August 2024)