Customer Focus and Initiatives

Fundamental Concept

Fiduciary Duties

With the aim of ensuring the thoroughgoing practice of customer-oriented undertakings, the MUFG Group Code of Conduct addresses the importance of “Customer Focus” in Chapter 1, while the MUFG Basic Policy for Fiduciary Duties is publicized to provide unified guiding principles for the Group.

In line with this policy, all Group entities share a commitment to practicing customer-oriented undertakings and endeavor to improve their products and services.

Improvements Based on Customer Feedback

Enhancing our System for Collecting Customer Feedback

As a specific example of improvement, the Bank has received requests from customers who wish to complete various procedures without going to a branch. To enhance convenience, we have added features to our "Kantan Tetsuduki App" that allow customers to switch to a stamp-less account in case of a lost signature stamp, change the name for those with a card loan, and close accounts for those with a debit card. (Please note that there are some cases where name changes and account closures may not be available. For more details, please refer to the Kantan Tetsuduki App page on the Bank's website.)

At NICOS, the design and functionality of the MUFG Card app has been revamped, allowing customers to complete procedures such as exchanging points for electronic gift certificates and changing payment amounts within the app.

At ACOM, customers who find it difficult to receive new cards during the day were taken into consideration, and if registered mail containing a card is returned, ACOM now offers the option to have it resent via regular mail. (However, this service is not available if identity verification has not been completed.)

By taking customers' opinions and requests to heart and continuing our efforts to reflect these in our products and services, MUFG attracts customers and establish lasting relationships with them.

Result for CS Surveys for Customers

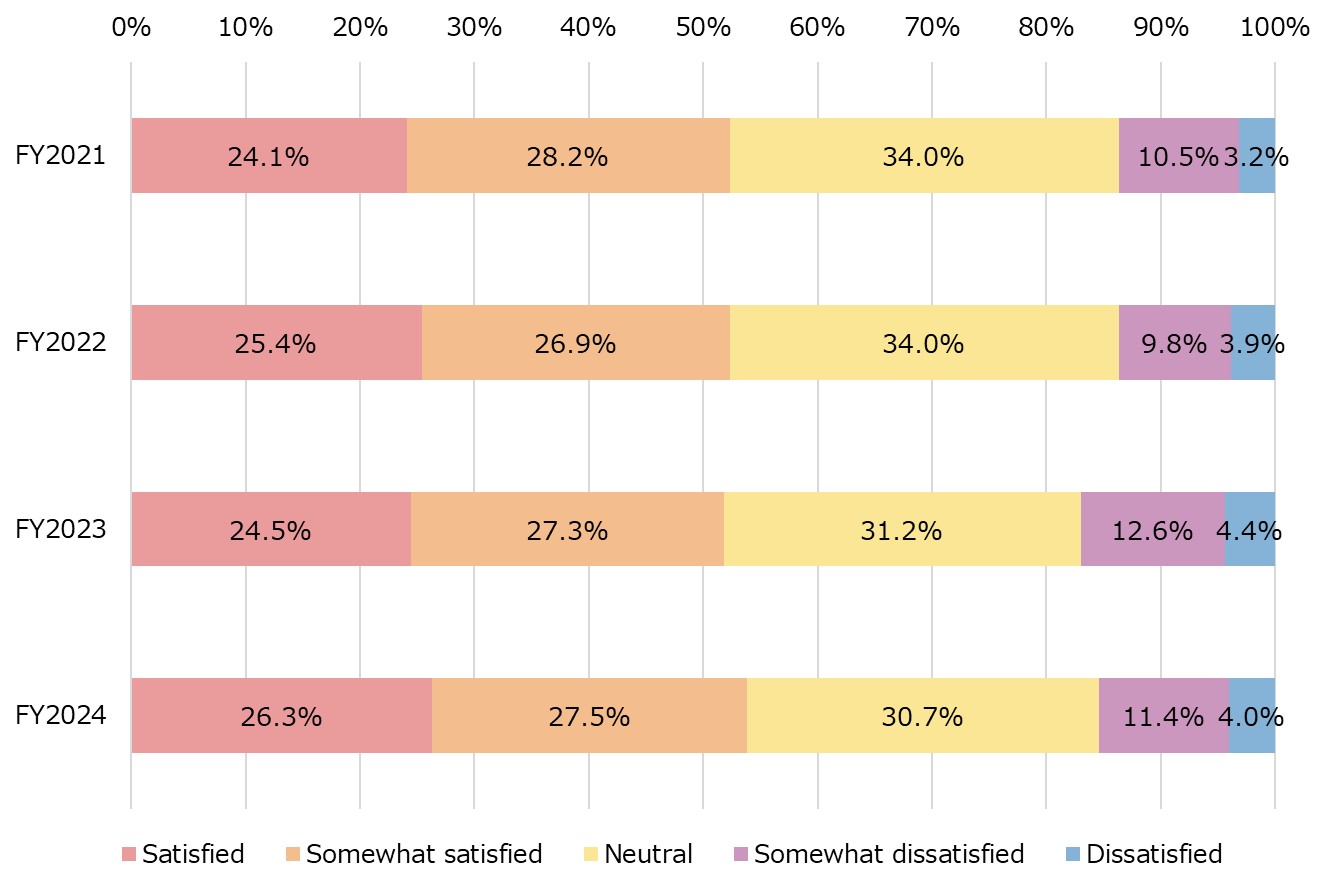

To confirm whether our efforts are meeting customer expectations, each Group company conducts questionnaires via postal mail and online, and regularly checks customer satisfaction (CS) and strives to improve the quality of our products and services.

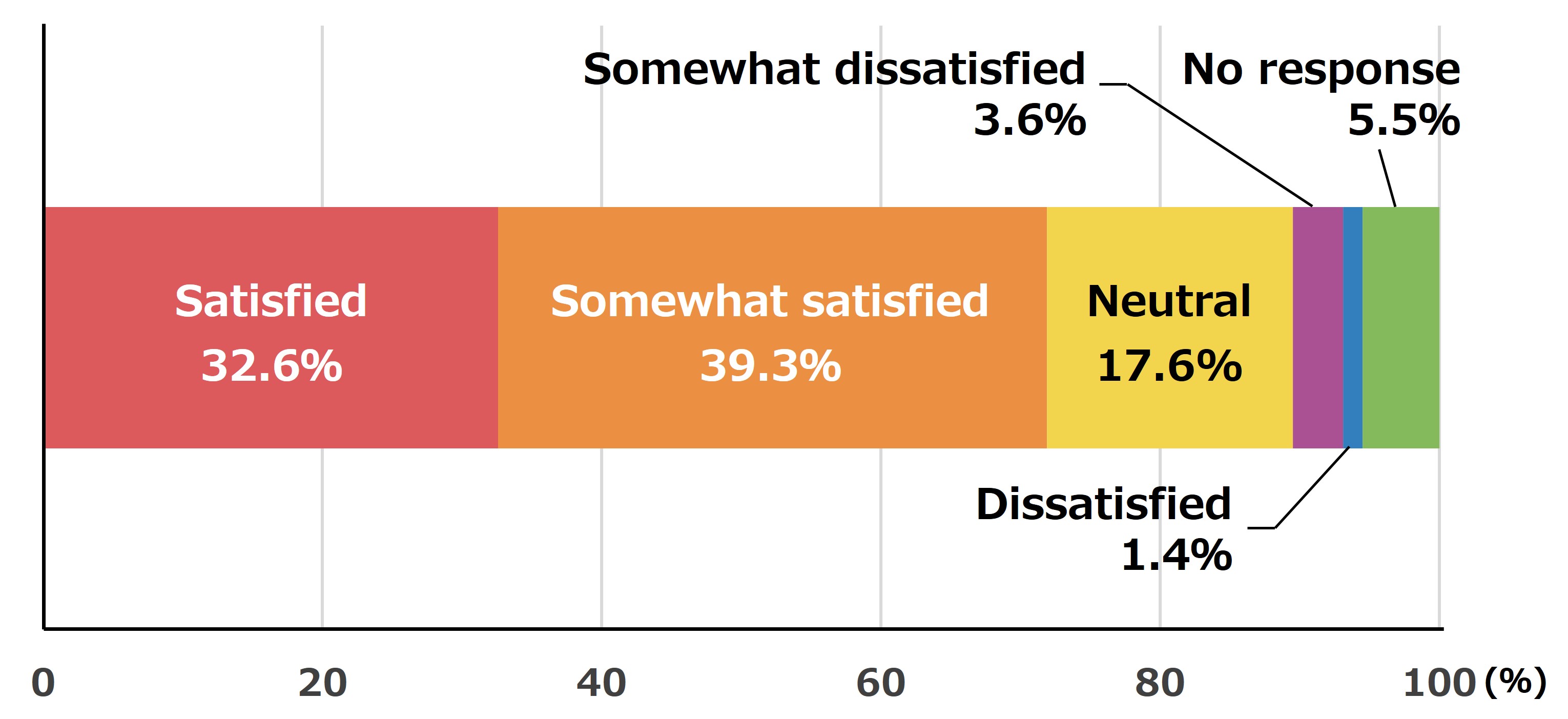

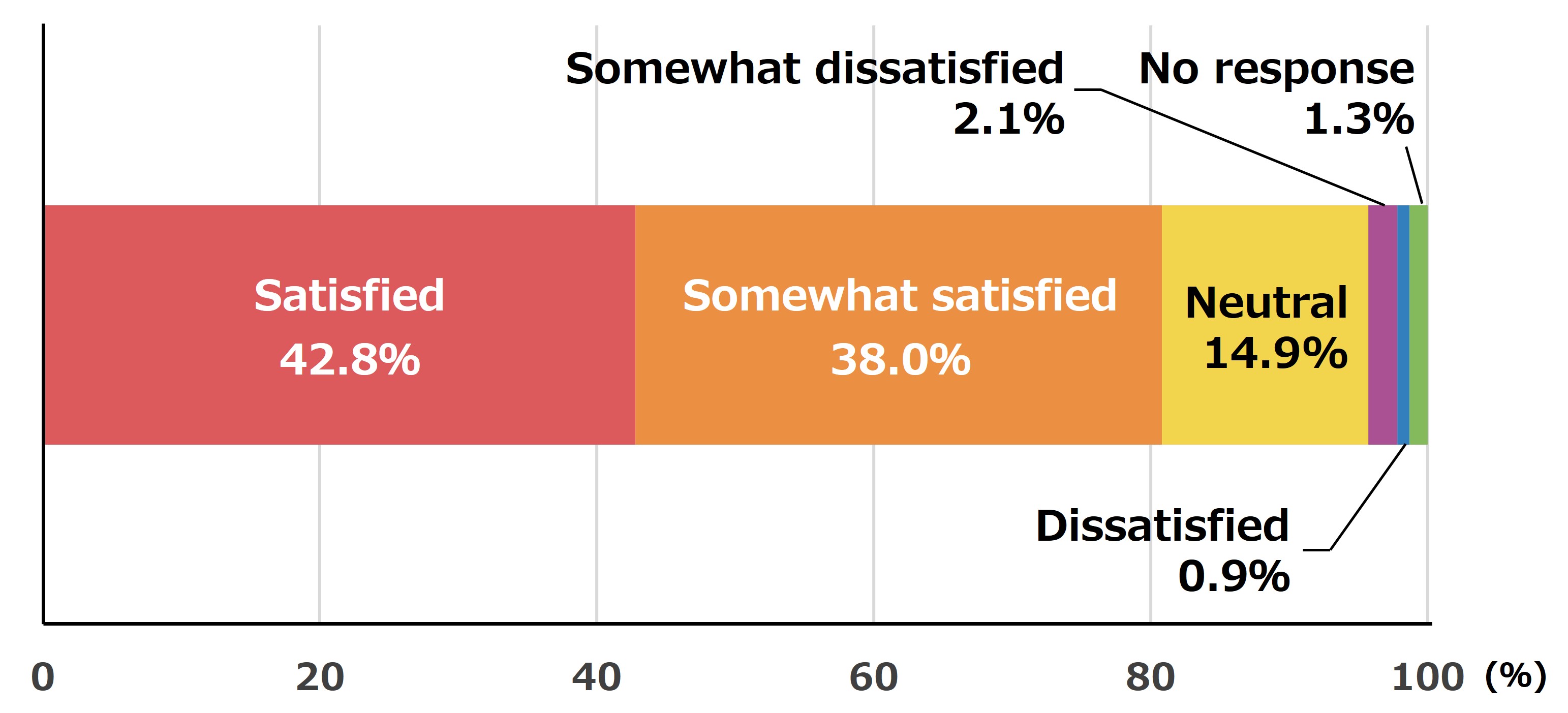

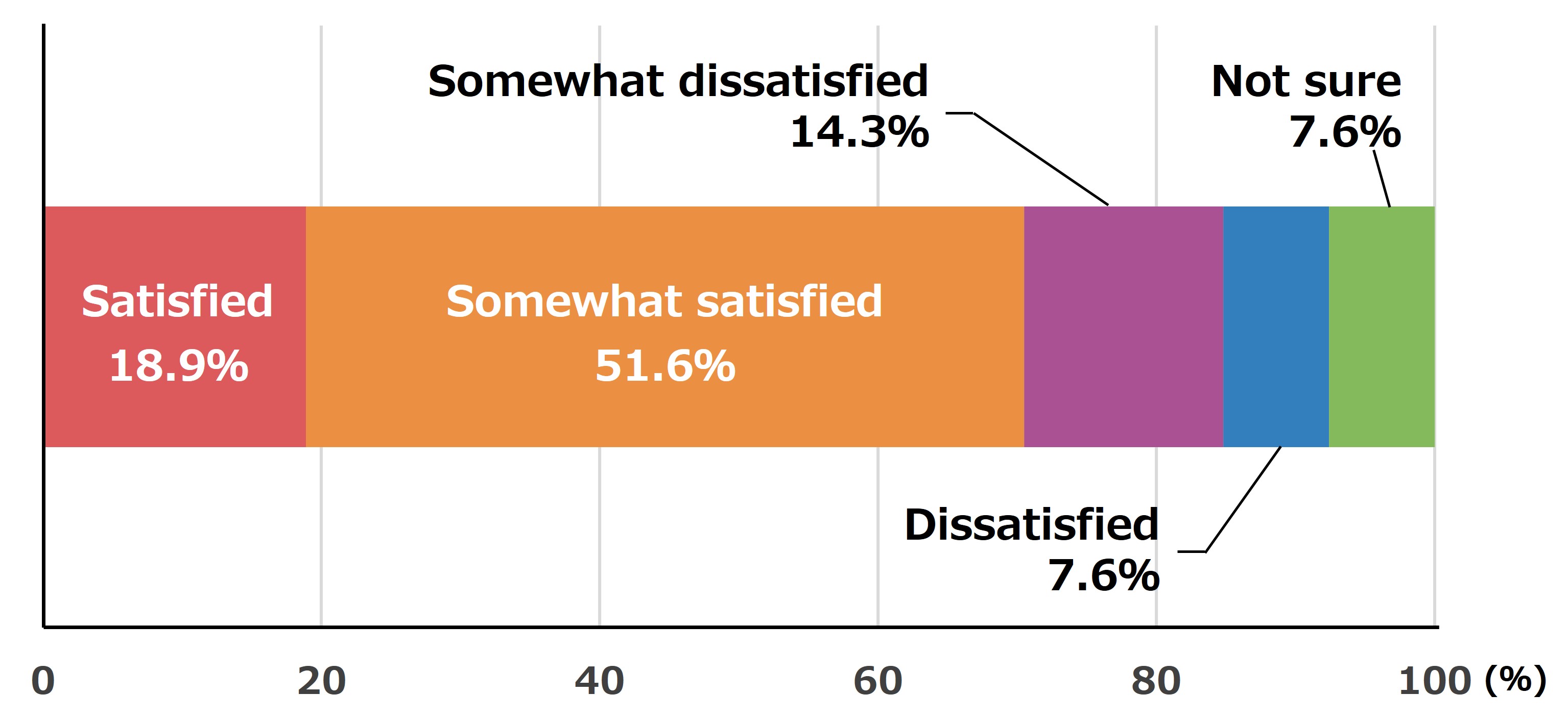

In a satisfaction survey conducted by individual five business categories in 2024, approximately 50-80% of customers rated their overall level of satisfaction with various transactions as "satisfactory" or "somewhat satisfied."

Each Group company will continue to analyze the factors for items that received low evaluations in the questionnaire and work for improvement.

Quality Improvement Initiatives

Quality Improvement of Products and Services

The Bank, the Trust Bank, the Securities, NICOS, and ACOM assess whether adequate measures are being taken to consider the customer's perspective in the planning and development of products and services.

Employees at both the head offices and local branch offices are always cognizant of the effect their daily work activities have on the customer's evaluation of the company, and therefore strive to provide products and services that exceed their expectations.

Checklist for Putting the Customer First

- Accurately meets customer needs

- Pros and cons have been clearly laid out for the customer, and cons, if any, have been properly explained

- All efforts have been made to make the product easily understandable, including the provision of advertising and information on comparisons with similar products

- All actions have been taken to prevent customer complaints from occurring, and measures for responding quickly to complaints have been prepared in the event of their occurrence

- Confirmation that our customers' families, like our customers themselves, have no anxieties about our products and services, have been taken.

Employee Education for Customer Trust

MUFG is actively engaged in educational training and study group efforts that are carefully aligned with the “customer-first principles,” including fiduciary duty and professional ethics. These programs target employees involved in customer-facing operations and are conducted regularly. We endeavor to raise each individual employee’s level of customer satisfaction awareness and skill.

Each Group company mentioned above is working to improve not only specialist skills but also communication skills and skills related to realizing customer satisfaction.

Universal Support

Responding to Customers in a Universal Manner

Enhancing Reception and Response to the Elderly and People with Disabilities

The Bank and the Trust Bank are working to enhance their response to the elderly and people with disabilities by learning through fundamental case studies about providing in-facility guidance and explanations tailored to various physical characteristics.

The Guidebook for Reception and Response to the Elderly

The Bank and the Trust Bank, in order to deepen understanding and improve response to the needs of the elderly, has published its Guidebook for Reception and Response to the Elderly, and pay close and careful response to the needs of its elderly customers.

Coordination with regional comprehensive support centers

The Bank and the Trust Bank have established the manual for smooth cooperation with the Regional Comprehensive Support Center, to ensure that the dementia customers and their families receive each service safely and securely.

LGBT Response Handbook

The Bank and the Securities have compiled the “LGBT Response Handbook” containing basic know-how and key points when dealing with LGBT, and we aim to conduct service and respond in a manner that makes customers feel comfortable.

Creating Universal Branches

MUFG is engaged in the installation of tactile paving for the visually impaired, the elimination of steps through the introduction of ramps, the installation of automatic doors, and other initiatives to improve the convenience and safety of branch entrances, so that all customers can access our facilities with comfort and peace of mind.

The Bank and the Trust Bank websites contain information about barrier-free facilities, allowing customers to check out branch facilities beforehand.

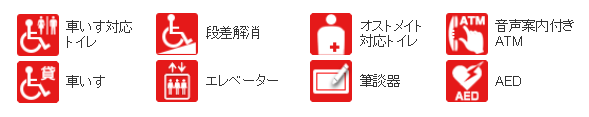

Pictogram

The Bank and the Trust Bank homepages feature barrier-free related information about their respective branches so that customers can confirm the kinds of facilities there.

Barrier-free

Braille Block Use

ATMs for the Visually Impaired

Providing Universal Services

Application of ATM Transfer Fees

We have applied over-the-counter transaction fees to the same level as ATM transfer fees for customers who have visual disabilities or use wheelchairs.

Simplification of Administration by Proxy

Simplification of procedures to allow payment by proxy when the intent of the depositor cannot be verified

- Depending on the payment method, the relationship of the proxy to the depositor, and the documents required, there might be cases where the Bank and the Trust Bank unable to comply with such requests.

Handling Braille Cards and Notification Forms

To meet the needs of customers with visual disabilities, the Bank provides cards with customer name and other information indicated in Braille, and Braille is used on notification forms to indicate balance information. From July 2016, the Bank began providing ordinary deposit statement notifications in Braille, in addition to monthly account balances.

Telephone Relay Service (public infrastructure)

The Bank, the Trust Bank, the Securities, NICOS and ACOM have adopted the Telephone Relay Service. The Service is provided by the Nippon Foundation Telecommunication Relay Service as public infrastructure to enable mutual communication over the phone through an interpreter operator between sign language or text and spoken language.

* Available features of the Service may vary by company.

* For details of the Service, please see MIC’s website.

Services Using Sign Language, Written Messages

The Bank and NICOS provide interpretation services, separately from the Telephone Relay Service, for customers with disabilities involving the ears and spoken language, using videophones to connect customers to sign language operators and communicate in writing.

*At the Bank, the services are available only in case of lost or stolen card/passbook (presently in a pilot operation phase).

Communication Board

To accommodate customers with hearing and speech impairments, in addition to tools like writing pad and communication boards, the Bank branches are equipped with tablet devices with applications which support communication by using videophones to connect customers to sign language operators, and handwriting and speech recognition systems.

Consultation Service for People with Disabilities

The Bank and the Trust Bank provide a consultation service enabling customers with disabilities to make a complaint or comment related to their disabilities via a dedicated phone line or web form.