Main Initiatives

Asset Building/Contribute to Making Japan a Leading Asset Management Center

MUFG has positioned "contributing to making Japan a leading asset management center" as one of its growth strategies.

As a global comprehensive financial services group, we will promote investment and support asset formation through further enhancing our industry-leading asset management and investor services and providing customer-centered professional investment advisory services, diverse solutions, as well as financial and economic education.

MUFG Financial Education Institute

The Trust Bank established the MUFG Financial Education Institute for the purpose of providing practical and effective information on asset building and asset management from a neutral standpoint.

In fiscal 2024, aiming to achieve financial well-being (note) for the working generation, we conducted surveys on the relationship between employee well-being and corporate performance, as well as on the financial well-being of corporate employees. We disseminated this information through various channels.

At the symposium held in February 2025, we focused on financial education in companies, which is gaining attention as a way to improve friends with benefits. Together with experts, we discussed the significance and effective methods of financial education provided by companies, as well as how it impacts companies.

Going forward, we will continue to contribute to solving the social issue of promoting stable asset building for households by conducting research and disseminating information.

- A state in which economic satisfaction is sustained both now and in the future, allowing individuals to freely make their own choices in life.

Succession of Businesses and Assets

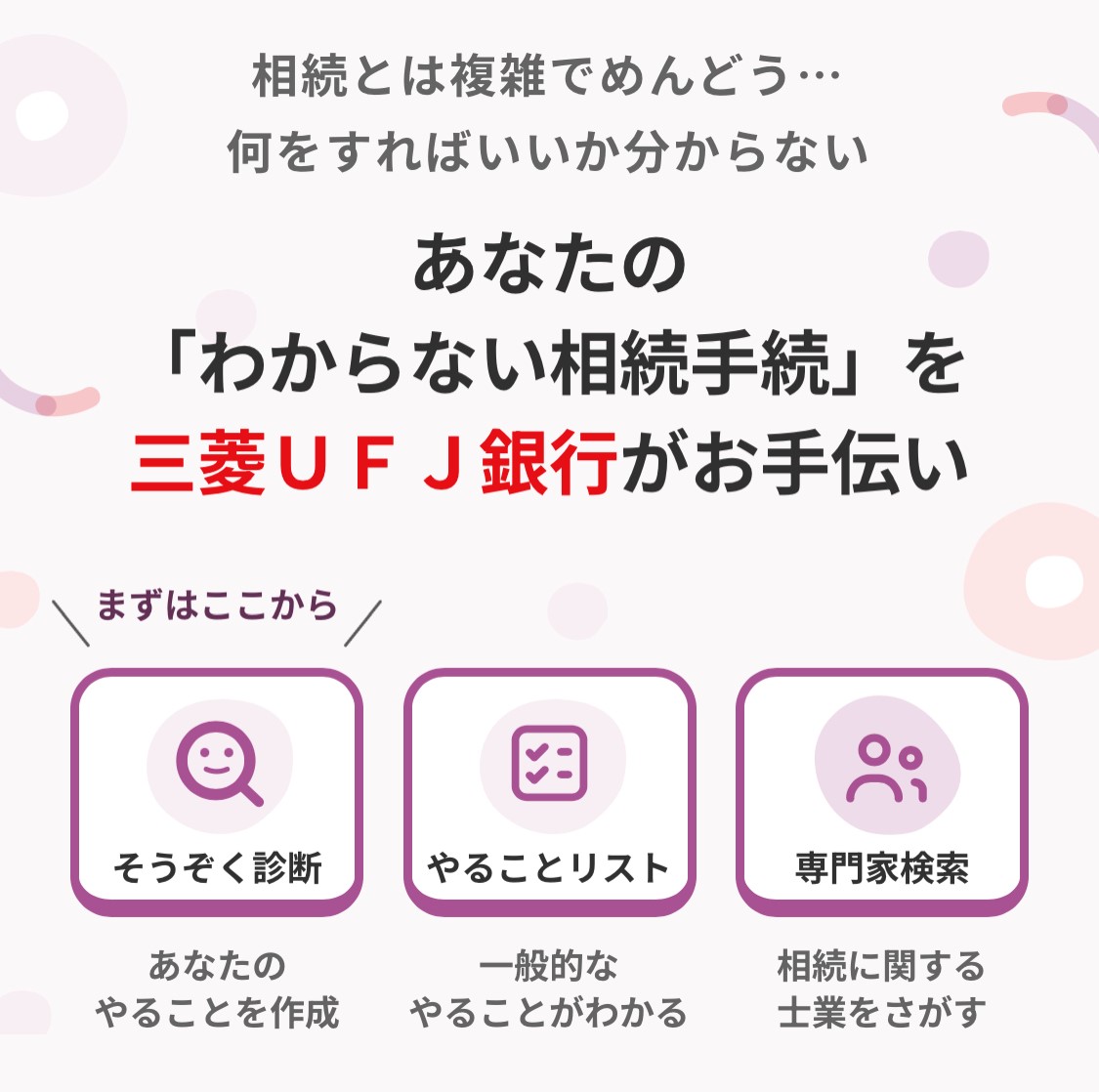

"Inheritance Guide" Online Service to Assist with Inheritance Procedures

In line with MUFG's Purpose, in July 2023 the Bank released the "Inheritance Guide" online service to assist customers with issues involving inheritance procedures.

The service lets customers create and manage to-do lists for estate planning and inheritance procedures based on responses to simple questions, as well as view informational articles and search for related experts such as attorneys, tax accountants, and judicial scriveners. The service is freely available with no requirement to submit personal information.

Details are available below.

MUFG Inheritance Research Institute

The Trust Bank has established the MUFG Inheritance Research Institute to conduct research on asset management for an aging society and the smooth transfer of assets to the next generation.

In fiscal 2024, we participated as a reference witness in the Civil Code (Will-related) Subcommittee of the Legislative Council of the Ministry of Justice, which requested our attendance to discuss new will systems utilizing digital technology. Additionally, we hosted a special seminar titled "Learn Easily with Experts: Useful Information on Inheritance Registration and Wills." In addition, anticipating the issues that an aging society faces, such as cognitive decline, we have been preparing for joint research with industry, government, and academia on the decline in cognitive functions and financial management capabilities.

Going forward, we will continue to work to resolve the social issues of smooth asset management and asset succession through symposiums, presentations of various reports, book publications, and joint research with industry, government, and academia.

Response to the Elderly

Excellent Club

As lifespans increase and customers’ needs and questions concerning life plans diversify, financial institutions are expected to go beyond financial services to offer comprehensive solutions that include alliances with non-financial service providers. Against this backdrop, in August 2022, the Bank launched the MUFG Bank Excellent Club, a free membership-based service. As of the end of July 2025, more than 50,000 customers have signed up as members. In addition to providing preferential MUFG financial services, the Club also offers non-financial services that provide "special experiential value" to enrich customers' daily lives. "Exceptional moments in everyday life. A life of richness." The Excellent Club will continue to deliver a higher level of satisfaction that brings a sense of richness to the heart and high-quality peace of mind that supports daily life.

Please click the link below for service details and membership criteria:

The Trust Bank has already developed a similar membership service, “Excellent Club,” prior to the Bank, which is used by more than 300,000 members.

The Trust Bank:Excellent Club (in Japanese)

Housing Loan Products with Options Linked with the Assumed Residual Value of Properties

In the coming era of centenarians, the ways people live and design their lives are expected to become increasingly diverse and transcend the scope of conventional concepts centered on the three life stages of student, worker and retiree. In addition to flexibly accommodating needs arising from changes in modes of education and workstyles, financial institutions are being called upon to help customers secure funds for post-retirement living and to provide other financial solutions that enable, for example, housing loan borrowers to complete repayment even after retirement. In addition, amid the ongoing diversification of lifestyles, these institutions need to respond to the housing-related funding needs of customers wishing for flexibility in their choice of accommodation.

With this in mind, the Bank provides housing loan products with options linked with the assumed residual value of properties. These products are designed to provide borrowers with various choices aligned with an increasingly diverse range of life design, for example, options to reduce monthly payments or to secure funds for future relocation.

Financial Gerontology

Since 2018, the Trust Bank has been advancing research in "financial gerontology," a field that analyzes how changes in cognitive function due to aging affect economic activities and financial behavior, and studies services that enable elderly individuals to utilize their assets in ways they desire. Through this research, we aim to develop products that prepare for cognitive decline and contribute to the health and longevity of our customers.

Following the proof-of-concept experiments conducted in fiscal 2023 as part of our joint research with industry and academia, we plan to introduce an AI application in fiscal 2024 that can estimate cognitive function (an AI application to support checking the suitability of financial products). Additionally, we aim to implement a mechanism to check understanding of wills in fiscal 2025.

Going forward, we will continue to expand services that contribute to resolving the challenges of an aging society.

Financial and Economic Education

Strengthened Group-based initiatives for encouraging people to design their own lives and ways of living by making clever decisions grounded on correct information.

Increased fiscal 2026 KPI from 500,000 to 800,000 people.

For details, please refer to Financial Economic Education.