- Only the Sustainability Governance section is available on this page; all other content will be redirected to separate pages.

Sustainability Governance

Sustainability Governance Structure

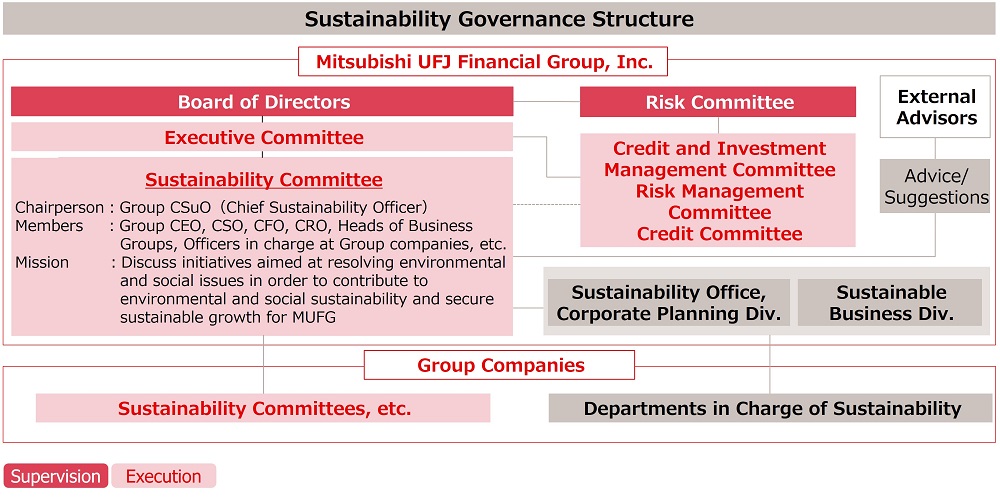

Sustainability-related issues are managed by the Executive Committee with various management sub-committees, subject to the oversight of the Board of Directors. The Sustainability Committee, which is a sub-committee formed under the Executive Committee and is chaired by the Chief Sustainability Officer, regularly deliberates policies on addressing sustainability-related matters, including risks and opportunities arising from such matters, and monitors the progress on the MUFG Group’s measures designed to address such matters. The committee reports to the Executive Committee and, as necessary, reports to the Board of Directors.

The Executive Committee is established as a decision-making body for business execution and discusses and decides on important matters related to management of the operations of the MUFG Group based on the basic policies determined by the Board of Directors. The Executive Committee reports to the Board of Directors from time to time as necessary.

The Board of Directors oversees management of sustainability-related matters in line with its business strategy, risk management and financial oversight. Such oversight is performed based on, among other things, a plan-do-check-act, or PDCA, cycle. The Board of Directors deems sustainability-related matters including climate change to be of high-priority importance and accordingly discusses and deliberates them regularly based on an annual schedule or as appropriate.

In addition, three external advisors have been invited to provide expert opinions on sustainability issues and risks at any time. These advisors exchange opinions with the members of the top managements and others and provide advice and recommendations from their professional standpoints on MUFG's sustainability initiatives.

Roles of Each Position and Department

Group Chief Sustainability Officer (CSuO)

External advisor

Sustainability Office, Corporate Planning Division

Sustainable Business Division

Sustainability Committee

Principal Themes of Discussion and Other Items Considered at the FY2023 Sustainability Committee

| Theme | Details |

|---|---|

1. Progress in environmental awareness and response to challenges

|

・Major domestic and international trends and environmental awareness related to sustainability issues ・Status of response to key sustainability issues |

| 2. Review of priority sustainability issues | ・10 priority issues and key initiatives |

| 3. Review of sustainable finance targets | ・Setting of new targets ・Positioning of the targets and transparency of the relevant finance |

| 4. Revision of the MUFG Environmental Policy Statement and the MUFG Human Rights Policy Statement | ・Revisions made in view of changes in the external environment and the current status of our initiatives |

| 5. Revision of the MUFG Environmental and Social Policy Framework | ・Addition of the mining and biomass power generation sectors |

| 6. Climate change | ・Additional 2030 interim emission reduction targets (automotive, aviation, and coal sectors) ・Results for sectors with previously established interim targets ・Issuance of the MUFG Climate Report ・Overall FE (financed emissions) measurement results ・Policy for initiatives in the coming fiscal year and beyond |

| 7. Focus themes | ・Natural capital and biodiversity: issuance of the TNFD Report, etc. ・Circular economy ・Respect for human rights ・Human capital and DEI (diversity, equity, and inclusion) ・Well-being |

| 8. Group companies’ initiatives | ・Initiatives undertaken by the Trust Bank and the Securities |

| 9. ESG assessment | ・Results of the fiscal 2023 ESG assessment and major factors behind variations |

| 10. Disclosure of non-financial (sustainability-related) information and establishment of internal controls | ・Updates on disclosure regulations and future schedule of company-wide projects |

| 11. Internal dissemination and education | ・Dissemination measures and future policy |

| 12. Report disclosure policy | ・Report disclosure policy for fiscal 2024 and 2025 |

External Advisors in the Environment and Social Fields

| Rintaro Tamaki | President, Japan Center for International Finance |

|---|---|

| Junko Edahiro | Professor, Graduate School of Leadership and Innovation, Shizenkan University / President, Institute for Studies in Happiness, Economy and Society / Founder and President, e's Inc. |

| Kenji Fuma | CEO, Neural Inc. |

Study Sessions for Management

Executive Compensations

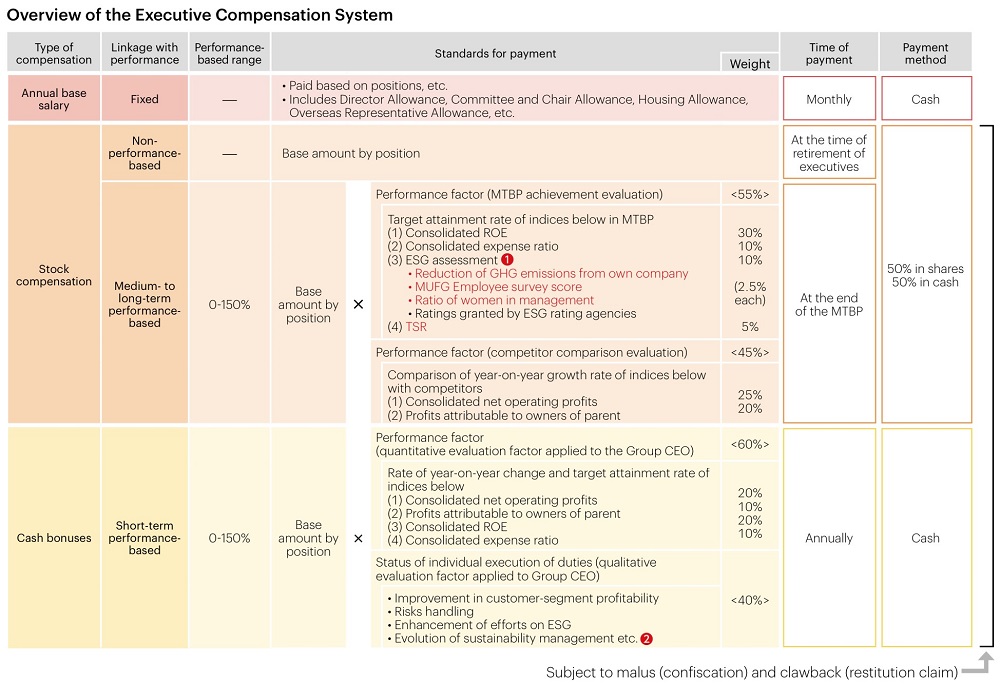

MUFG has incorporated ESG elements into its executive compensation system to achieve the medium-term business plan and execute sustainability management.

Starting in fiscal 2024, we have increased the evaluation weight for the medium- to long-term performance-based portion of stock compensation and adopted new own three indicators in addition to the existing one for the ratings granted by ESG rating agencies.

Additionally, for the qualitative evaluation method for bonuses to be paid to the Group CEO and other relevant officers, we have established approximately five evaluation items, such as improvement in customer-segment profitability, promoting structural reforms and strengthening the management foundation, risks handling, enhancement of efforts on ESG and evolution of sustainability management. Each item is evaluated based on its respective KPIs (key performance indicators), and the overall qualitative evaluation is conducted on an eight-point scale. Furthermore, ESG elements have also been incorporated into the bonus evaluations of each executive officer in accordance with the business strategies for the business they are responsible for.

- MUFG has set the reduction of Group/Global GHG emissions from own operations, improvement of the employee survey scores, and raising of the ratio of women in management as unique ESG self-assessment metrics, to support the further enhancement of sustainability management. Additionally, to assess the extensive initiatives toward ESG of MUFG from an objective standpoint, a relative evaluation is carried out on the degree of improvement (3-year) of third-party assessments by the five major ESG assessment agencies (MSCI, FTSE Russell, Sustainalytics, S&P Dow Jones and CDP).

- ESG-related evaluation items subject to qualitative evaluation include contribution to the resolution of environmental and social issues through the promotion of DEI, the strengthening and upgrading of MUFG’s governance structure, and evolution of initiatives to promote natural capital, a circular economy, and human rights.

(Malus・Clawback)

- In regards to stock compensation and cash bonuses of Officers etc., the unpaid portion may be forfeited (malus) or repayment of the amount that has already been paid may be demanded (clawback), in the event that a serious violation has been committed regarding the delegation agreement, etc. between MUFG and Officers, etc. in relation to the duties of Officers, etc., a person resigns during his or her term of office due to personal circumstances against the wishes of MUFG, and situations such as when modifications to the financial statements after-the-fact due to significant accounting error or fraud are resolved by the Board of Directors.

- For the remuneration of certain high earners other than executives, it is stipulated that in cases of significant amendments to the financial statements, serious violations, etc. of applicable laws, and the company's regulations, the remuneration may be subject to reduction, suspension, forfeiture, cancellation, offset with other remuneration, or return after payment. Furthermore, the variable remuneration for these high earners, in principle, is operated within a range of 0% to 200% of the base amount of performance-linked compensation.

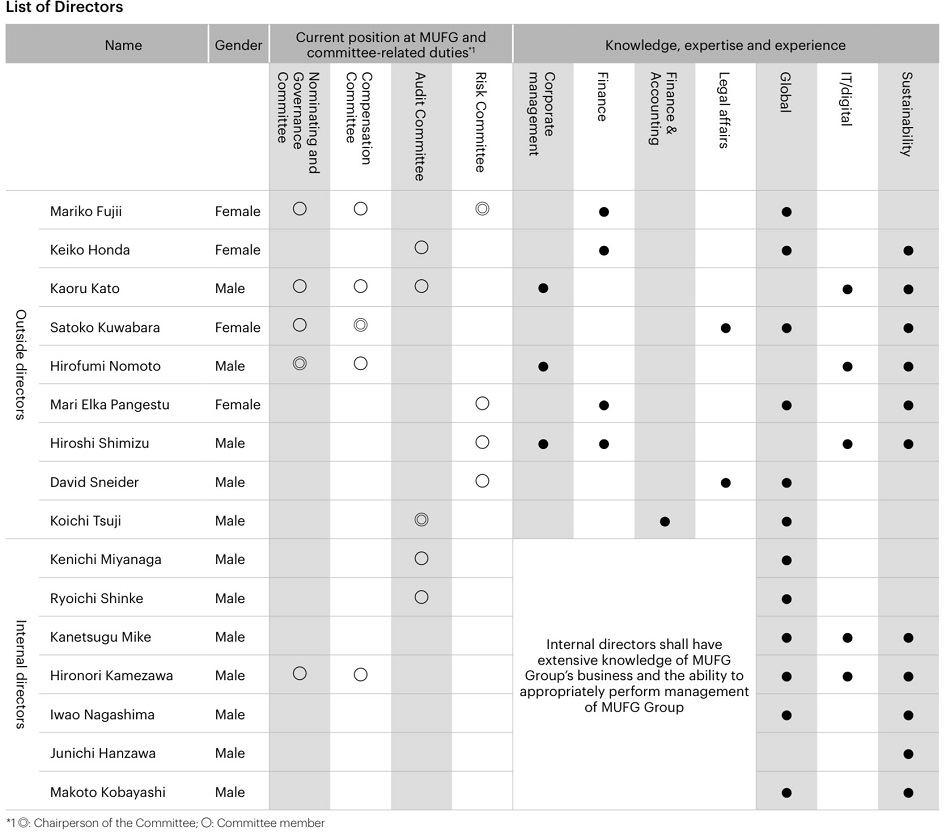

Skill Matrix of Directors

Our Board of Directors is composed of 16 directors who bring a well-rounded mix of diverse knowledge and expertise. Nine of the members, a majority, are outside directors. As shown in the Skill Matrix, directors possess deep knowledge of MUFG's business and have been selected for their expertise in finance, financial accounting, legal compliance, and other areas.

In addition, MUFG has secured human resources with experience in “global” fields, “IT/digital,” and “sustainability,” all of which are deemed to be matters of growing importance for its business operations.