MUFG Bank (the Bank) supports its clients' environmental and social risk management and contributes toward building a sustainable world by adoption of and adherence to the Equator Principles, a risk management framework for determining, assessing, and managing environmental and social risks and impacts for large-scale projects.

The Bank has issued its initial Equator Principles Progress Report which illustrates its initiatives and activities related to the Equator Principles.

For details, please refer to the first edition of the Equator Principles Progress Report(PDF / 3.68MB) (Updated on June 9).

Environmental and social impact assessment and risk management through the Equator Principles

The Bank recognizes that large-scale infrastructure and natural resources development projects may have adverse impacts on local environment and surrounding communities.

The Bank, as a financier and/or a financial advisor, works in partnership with its clients to determine, assess, and manage environmental and social risks and impacts related to the projects.

The Bank adopted the Equator Principles in 2005 to ensure that the projects it finances and advises on are developed in a socially responsible manner and to establish good environmental management practices to minimize, mitigate, and/or offset environmental and social risks and impacts. During the loan life, the Bank monitors the projects to identify and assess the environmental and social impacts that have come to being.

The Bank supports its clients' environmental and social risk management and contributes toward building a sustainable world through implementation of the Equator Principles, a risk management framework for determining, assessing, and managing environmental and social risks and impacts for large-scale projects.

The Equator Principles is a financial industry benchmark for determining, assessing and managing environmental and social risk and impacts in projects, which is intended to serve as a common baseline and framework for all the financial institutions adopting the Equator Principles (EPFIs). EPFIs ensure that the projects they finance and advise on are developed in a manner that is socially responsible and reflects sound environmental management practices. As of the end of March 2025, 129 financial institutions worldwide have adopted the Equator Principles.

EPFIs commit to implementing the Equator Principles in their internal environmental and social policies, procedures, and standards for financing projects. EPFIs will not provide loans to projects where the client will not, or is unable to, comply with the Equator Principles. Additionally, in cases where significant environmental and social risks are identified, the Bank may voluntarily apply the Equator Principles to the cases.

The Bank confirms that environmental and social considerations have been appropriately taken into account by clients according to “Implementation Guidelines for the Equator Principles”.

Implementation Guidelines for the Equator Principles(PDF / 250KB)

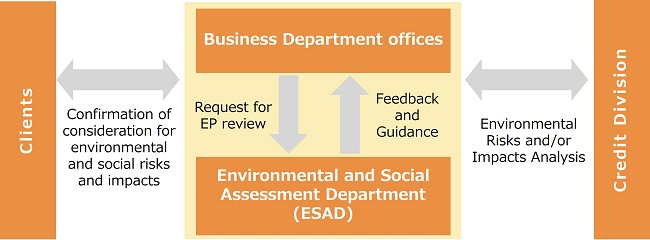

Confirmation of Environmental and Social Considerations by Environmental and Social Assessment Department, Sustainability Office, Corporate Planning Division

Process for Confirmation of Environmental and Social Considerations

- Environmental and Social Screening

- Environmental and Social Review (Equator Principles Review)

For projects that are subject to the Equator Principles application, ESAD conducts an environmental and social review of the projects based on the Equator Principles.

To begin with, in accordance with Principle 1 of The Equator Principles, ESAD assigns categories to the projects proposed for financing based on the magnitude of their potential environmental and social risks and impacts. Following categorization, ESAD confirms whether the projects meet the environmental and social requirements in accordance with the assigned categories.

The results of the environmental and social review are notified to the credit division in charge, which will take these results into consideration when making credit decisions.

| Principle 1 | Definition of the Categories |

|---|---|

| Category A | Projects with potential significant adverse environmental and social risks and/or impacts that are diverse, irreversible, or unprecedented |

| Category B | Projects with potential limited adverse environmental and social risks and/or impacts that are few in number, generally site-specific, largely reversible, and readily addressed through mitigation measures |

| Category C | Projects with minimal or no adverse environmental and social risks and/or impacts |

The Equator Principles is based on the International Finance Corporation (IFC) Performance Standards and the World Bank EHS Guidelines.

Please refer to IFC website for more information on the IFC Performance Standards and the World Bank EHS Guidelines.

As part of the Environmental and Social review, ESAD conducts site visits as appropriate to assess the implementation of environmental and social considerations by clients at project sites around the world.

- Environmental and Social Monitoring

Financial Advisory Service Support

Education and Training

The Bank conducts training for its employees with the objective of deepening their understanding of environmental and social considerations and promoting the philosophy and practices of the Equator Principles.

The training is primarily targeted at employees in charge of project finance and credit. The Bank also utilizes internal communication measures to promote better understanding of social and environmental considerations by all employees. Additionally, for new appointees, the Bank will provide training on internal procedures for implementing the Equator Principles and case studies that illustrate projects' environmental and social considerations.

The Bank also provides training for customers at their request.

Environmental and Social Consideration and Categorization Report

The Bank discloses the numbers of the project finance transactions and the project-related corporate loans that applied the Equator Principles achieved financial close every year, and the number of the project finance advisory services where the Bank was mandated during the same period in “Environmental and social consideration and categorization report” in accordance with the Equator Principles and the Bank’s Implementation Guidelines for the Equator Principles.

The Bank categorizes the projects proposed for financing based on the magnitude of their potential environmental and social risks and impacts in accordance with the Bank’s Implementation Guidelines for the Equator Principles, referring to the IFC’s Performance Standards and World Bank Group Environmental, Health, and Safety Guidelines. Especially when assigning Category A to a project, the Bank categorizes the project in accordance with the definition of a Category A project in the Equator Principles referring as appropriate to other guidelines including OECD’s Common Approaches and relevant public institution’s guidelines.

- Starting in 2024, reports under the Equator Principles must be conducted on a calendar year basis, from January to December.

Previously, the Bank conducted its reporting/disclosure based on the fiscal year, which runs from April to March next year.

To comply with the new requirements, the Bank discloses its 2023 results over a 9-month period, from April to December, as a transitional measure.