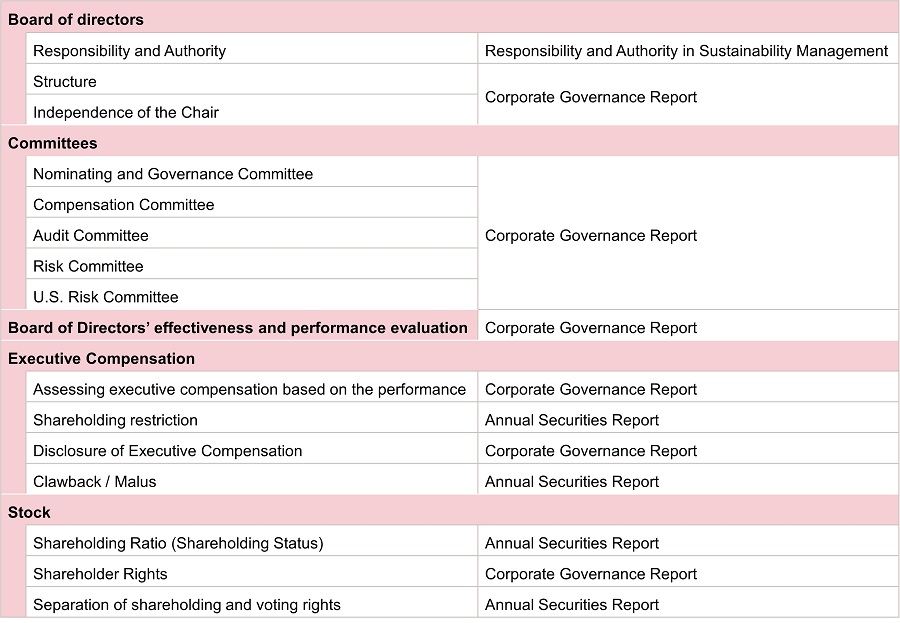

Corporate Governance System

Responsibility and Authority in Sustainability Management

Fundamental Concept

MUFG aims at its sustainable growth and increase in medium to long-term corporate value, based on the requests from stakeholders including shareholders, customers, employees and local communities.

MUFG is committed to fair, just and transparent corporate management and to the realization of effective corporate governance guided by the MUFG Corporate Governance Policies.

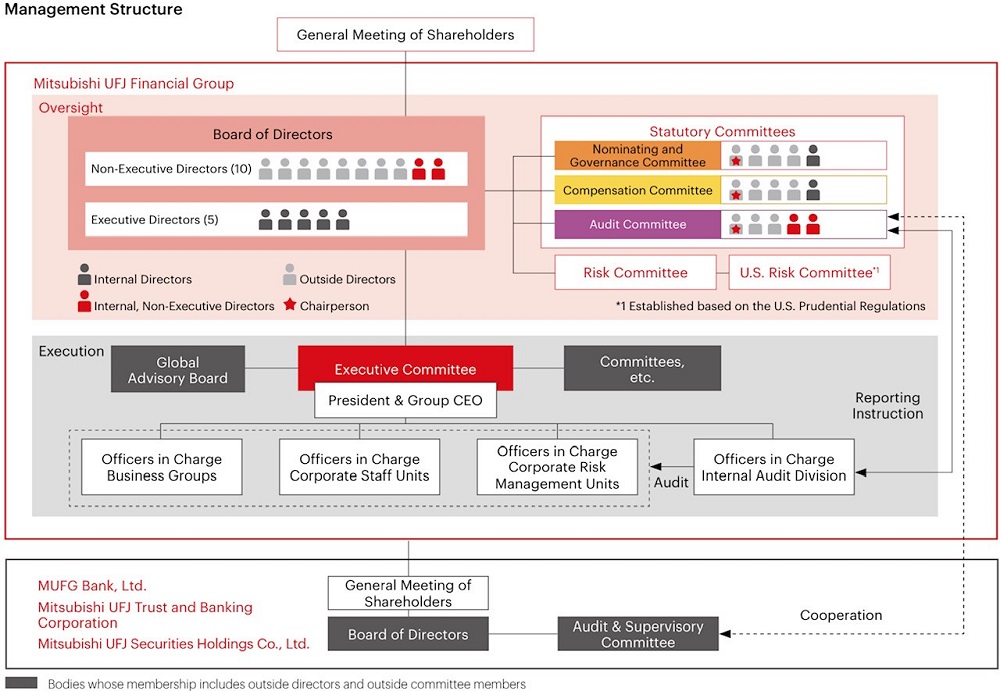

MUFG's Management Structure

Approach to ESG Issues

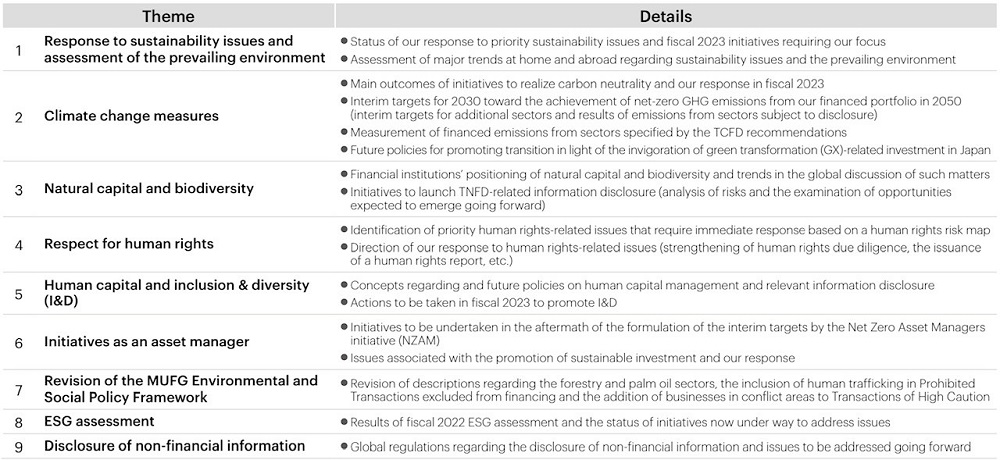

Sustainability Committee Meetings

MUFG holds regular committee meetings to identify ESG issues affecting corporate management, and report and discuss how the Group is responding to them.

In fiscal 2022, the committee meeting was held in January 2023 and deliberated on the business environment surrounding MUFG and reviewed the status of responses to priority issues. Details of the deliberations are as follows.

External Advisors in the Environment and Social Fields

Since 2019, we have engaged external experts in the environmental and social fields as permanent external advisors.

Opinions were exchanged between the experts and the members of the Board of Directors, allowing us to use their broad knowledge of ESG in our sustainability initiatives.

One such meeting held in December 2022 saw attendees engage in lively discussions covering a diverse range of topics that included the latest trends in international initiatives to counter climate change—the current highest priority topic—COP27 concerns and biodiversity—a subject whose importance is growing—as well as human capital and initiatives to ensure respect for human rights.

| Rintaro Tamaki | President, Japan Center for International Finance |

|---|---|

| Junko Edahiro | Professor, Graduate School of Leadership and Innovation, Shizenkan University / President, Institute for Studies in Happiness, Economy and Society / Founder and President, e's Inc. |

| Kenji Fuma | CEO, Neural Inc. |

Study Sessions for Management

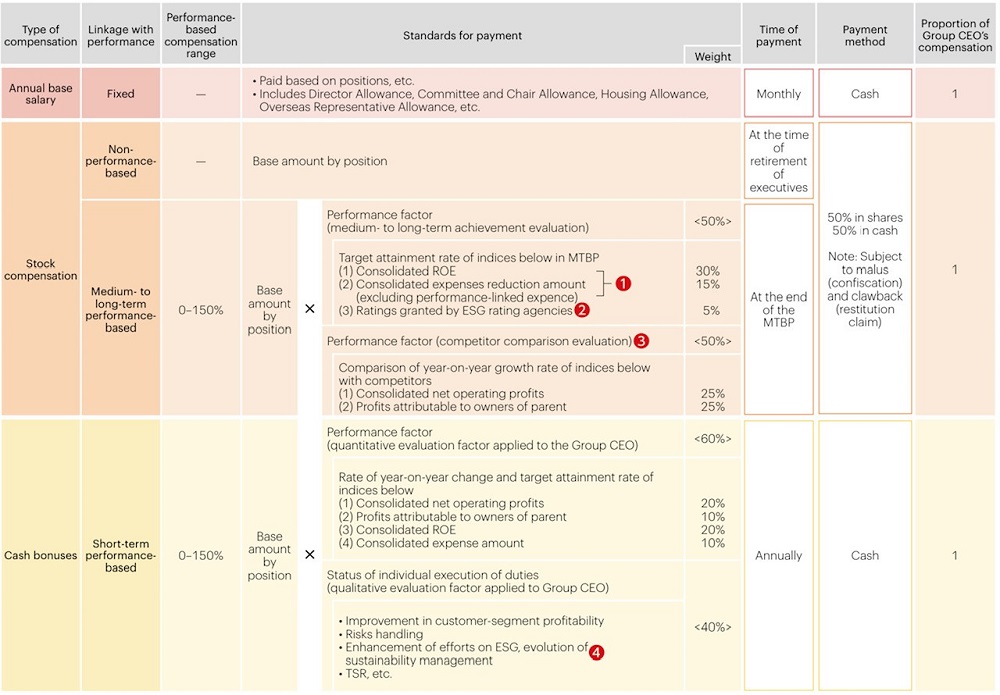

Executive Compensations

Introduction of a Heightened Metric for ESG-Related External Ratings as a New Key Performance Indicator for the Executive Compensation System

MUFG has revised its executive compensation system to achieve the medium-term business plan and implement sustainability management, and has newly installed a heightened metric for ESG-related external ratings as a medium- to long-term performance-linked indicator for stock-based compensation.

The system is designed to reflect the degree of improvement found through the external ratings granted by five major ESG rating agencies(note) for executive compensation. The intention is to align MUFG's corporate activities with the interests of its diverse stakeholders.

- MSCI, FTSE Russell, Sustainalytics, S&P Dow Jones, CDP

- To incentivize efforts to improve MUFG’s earnings power, capital efficiency and profit structure, each of which is considered a management issue requiring the utmost priority, the degree of achievement vis-à-vis target levels stipulated in the Medium-Term Business Plan (MTBP) regarding consolidated ROE and consolidated expense reduction (excluding performance-linked expense) is determined on an absolute evaluation basis.

- In addition to incentivizing recipients to advance sustainability management, the degree of improvement in external ratings granted by the five major ESG rating agencies (MSCI, FTSE, Russell, Sustainalytics, S&P Dow Jones and CDP) is determined on an absolute evaluation basis, with the aim of objectively assessing the recipient’s contribution to MUFG’s initiatives to address ESG issues in a variety of fields.

- Relative comparisons with competitors are made with Mizuho Financial Group and Sumitomo Mitsui Financial Group.

- In bonus-related qualitative evaluations of performance of duties by the president and other relevant officers, we have set targets related to contribution to the resolution of environmental and social concerns, the promotion of inclusion & diversity, and the strengthening and upgrading of MUFG’s governance structure. In fiscal 2023, we further added targets related to human rights, biodiversity, and human capital.

(Malus・Clawback)

- In regards to stock compensation and cash bonuses of Officers etc., the unpaid portion may be forfeited (malus) or repayment of the amount that has already been paid may be demanded (clawback), in the event that a serious violation has been committed regarding the delegation agreement, etc. between MUFG and Officers, etc. in relation to the duties of Officers, etc., a person resigns during his or her term of office due to personal circumstances against the wishes of MUFG, and situations such as when modifications to the financial statements after-the-fact due to significant accounting error or fraud are resolved by the Board of Directors.

- For the remuneration of certain high earners other than executives, it is stipulated that in cases of significant amendments to the financial statements, serious violations, etc. of applicable laws, and the company's regulations, the remuneration may be subject to reduction, suspension, forfeiture, cancellation, offset with other remuneration, or return after payment. Furthermore, the variable remuneration for these high earners is operated within an approximate range of 0% to 200%.

Internal Audit

(As of August 2024)