MUFG recognizes that addressing climate change and environmental conservation is one of the most important management issues. We will respond to them by regarding them as business opportunities and risk management.

During this period, the movement to combat climate change gained tremendous global momentum. MUFG has taken another step forward by announcing the MUFG Carbon Neutrality Declaration in May 2021. Guided by this declaration, MUFG is implementing group-wide environmental measures globally, aiming to achieve net zero greenhouse gas (GHG) emissions from the financed portfolio by 2050 and net zero GHG emissions from our own operations by 2030.

In addition to addressing climate change, efforts aimed at conservation of natural capital and biodiversity and at transitioning to a circular economy have become increasingly important in recent years. MUFG is promoting related initiatives through means including investments, loans, and donations.

| MUFG’s recognition |

The ongoing trend toward decarbonization is expected to result in major changes in global industrial structure which, in turn, will position MUFG and its customers to face both risks affecting their business continuity and opportunities for growth. It is important to ensure smooth transition to a carbon-neutral society and a virtuous cycle of environmental and economic improvement in order to realize a sustainable society. The ongoing trend toward decarbonization is expected to result in major changes in global industrial structure which, in turn, will position MUFG and its customers to face both risks affecting their business continuity and opportunities for growth. It is important to ensure smooth transition to a carbon-neutral society and a virtuous cycle of environmental and economic improvement in order to realize a sustainable society. |

|---|---|

|

Main Initiatives

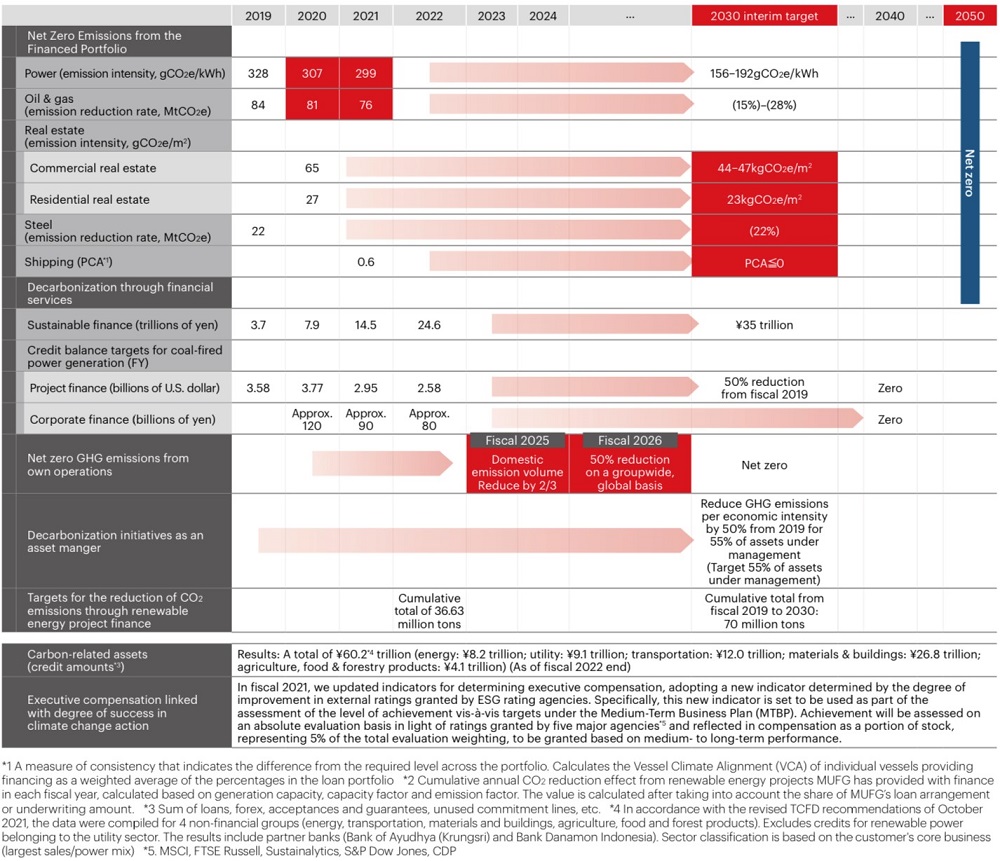

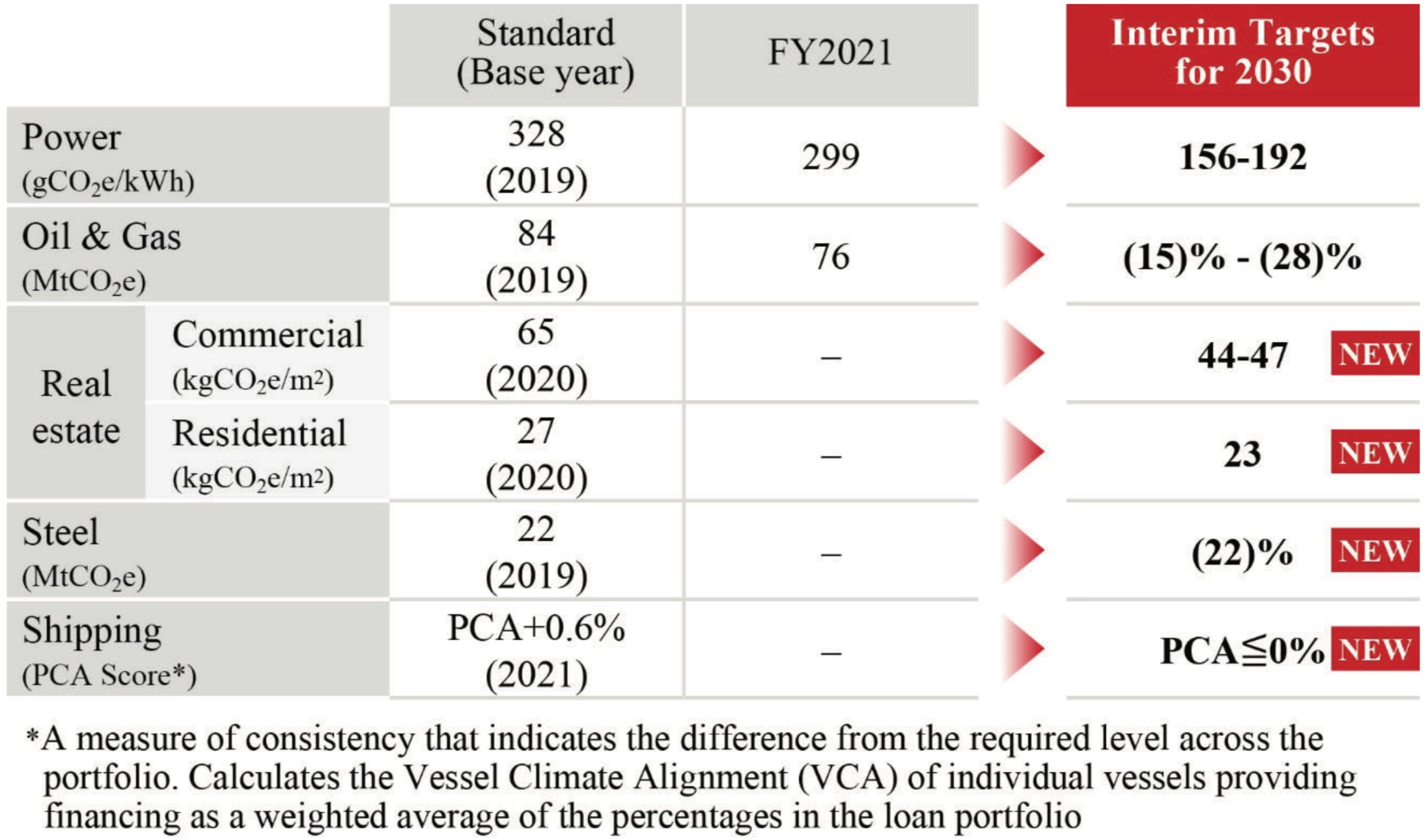

Moving Towards Carbon Neutrality

In May 2021, the MUFG Carbon Neutrality Declaration was announced. In line with this declaration, we are aiming for net zero GHG emissions from our financed portfolio by 2050 and net zero GHG emissions from our own operations by 2030.

We have published the MUFG Progress Report to update stakeholders on the progress of our initiatives.

Roadmap for Achieving Carbon Neutrality

Net zero GHG Emissions from Financed Portfolio: Disclosure of Progress and New Targets

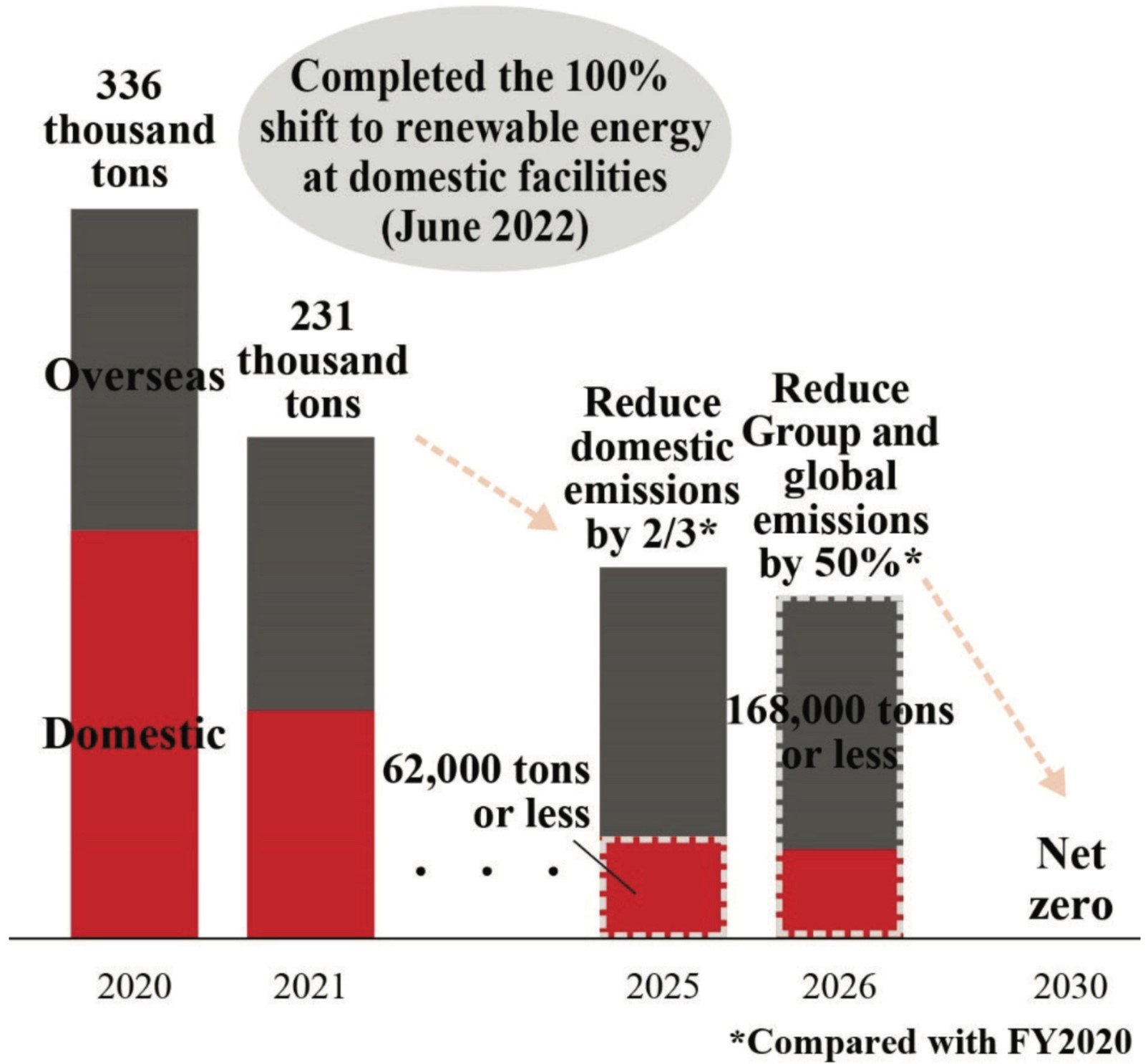

Net Zero GHG Emissions from Our Own Operations

In FY2022, MUFG accomplished switching to 100% renewable power sources for in-house contracted electric power at all consolidated subsidiaries in Japan, and set interim targets to accelerate initiatives for achieving net-zero emissions from our own operations by 2030.

<Interim targets>

FY2025: Reduction of GHG emissions from the business in Japan by two-thirds compared to FY2020

FY2026: Reduction of GHG emissions from the group by 50% compared to FY2020

Formulation of a Transition Plan

Approach to Achieving Carbon Neutrality

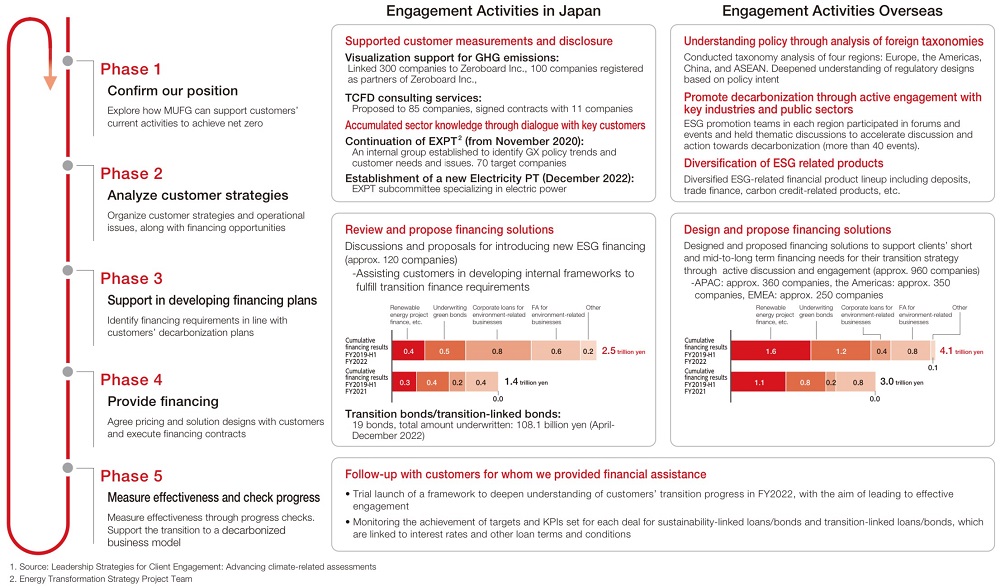

Customer Engagement and Support

MUFG has extended our engagement activities to around 1,500 corporate customers.

With an aim to address issues and needs identified through customer engagement, we develop and provide a diverse range of solutions, including those designed to help visualize the volume of GHG emissions, strategy formulation assistance through TCFD disclosure-related consulting services, investment and financing assistance, and the introduction of overseas carbon credit to Japanese corporations.

Contributing to Global Initiatives

Through participation in climate change-related initiatives, MUFG is actively involved in discussions to develop international frameworks. Given that no pathway toward carbon neutrality will be identical among Europe, the U.S., Japan, and Asia, we advocate on behalf of a leading financial institution based in Asia.

As the Chair of the Net-Zero Banking Alliance (NZBA) Transition Finance Working Group (formerly known as the "Financing & Engagement" Working Group), and as a member of the secretariat of the Asia Transition Finance Study Group (ATFSG), we led discussions in each initiative to develop frameworks for transition finance.

・NZBA: NZBA Transition Finance Guide (released in October 2022)

・ATFSG: ATF Activity Report, ATF Guidelines (released in September 2022)

Also, MUFG is the only Japanese bank participating in all five Glasgow Financial Alliance for Net-Zero (GFANZ) workstreams (re)structured in 2023, where we have actively contributed to discussions to promote the various net-zero initiatives in GFANZ.

The GFANZ Japan Country Chapter was launched in June 2023 as the first GFANZ Country Chapter. Masamichi Kono, Senior Advisor of MUFG Bank, Former Deputy Secretary General of the OECD, was appointed as GFANZ Japan Advisor.

MUFG Transition Whitepaper 2022, MUFG Asia Transition Whitepaper 2023

In October 2022, we published the MUFG Transition Whitepaper 2022 to communicate the importance of recognizing different regional characteristics, interdependency among industries, and individual efforts in maximizing renewable energy to achieve carbon neutrality in Japan.

In September 2023, we published the MUFG Transition Whitepaper 2023, to present the list of technologies in supply chains that are important in advancing the path to carbon neutrality in Japan’s “electricity and heat” segment.

Additionally in November 2023, we published the MUFG Asia Transition Whitepaper 2023 (Asia Whitepaper) in collaboration with our Partner Banks to further contribute to decarbonization efforts in Asia. The Asia Whitepaper assesses the market environment and decarbonization challenges of power sectors in Indonesia and Thailand and proposes tangible solutions – from a financial institution’s perspective – towards decarbonization.

We aims to deepen our initiatives towards carbon neutrality in Japan and Asia through the series of whitepapers and ultimately support our clients’ transition efforts.

Environmental and Social Risk Management in Finance

- Credit, bond and equity underwriting for corporate clients of MUFG's main subsidiaries, the Bank, the Trust Bank and the Securities HD.

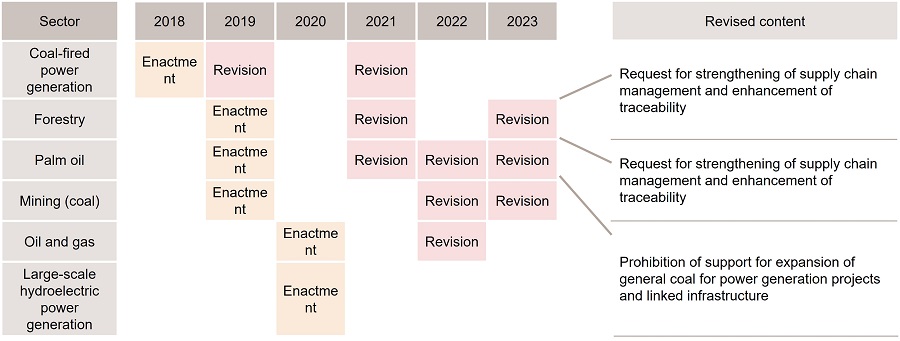

Policies on the Sectors Related to the Environment, Including Climate Change

Initiatives for Protecting Natural Capital and Biodiversity

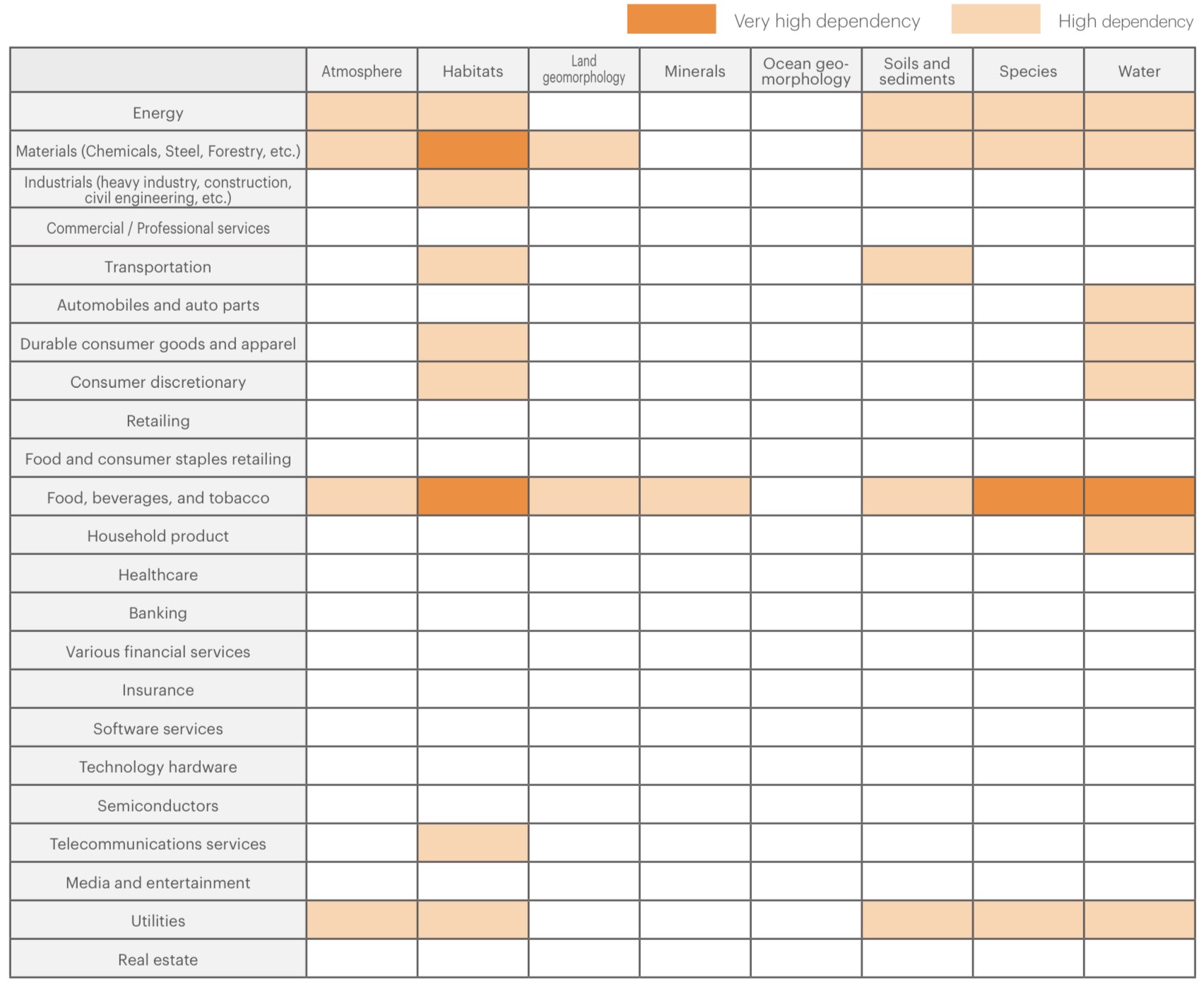

Natural capital is a stock, composed of animals, plants, water, soil, and air, which provides various merits, including water, food, and minerals to businesses and society through ecosystem services such as water purification as well as climate control.

Biodiversity is the diversity of animals and plants that are part of natural capital, functioning to maintain the natural capital in a healthy and stable state through recovery from natural disasters such as floods and droughts, support for the carbon cycle, the water cycle and soil formation.

Financial institutions face investment and financing risks caused by loss of natural capital and biodiversity. As companies' responses to the conservation of these can also create business opportunities for financial institutions, we believe that properly evaluating the risks and opportunities is important.

Initiatives to Address the TNFD Disclosure

Analysis Process Utilizing the LEAP Approach