Approach to Talent Development

Talent Strategy to Foster Growth and Challenge

Unified Global Talent Management

To strengthen unified global talent management, we have established a common global framework and hold cross-regional talent management meetings for each business area, enabling talent development from a global perspective.

As a result of continuously enhancing these initiatives, the number of overseas employees in management roles has increased. As of March-end 2025, eleven overseas employees, including one woman, have been appointed as executive officers at the Bank. The expansion of such career paths not only boosts the motivation of overseas employees but also serves as a positive stimulus for domestically hired employees, creating a virtuous cycle in global talent development.

- the Bank, the Trust Bank, MUMSS, NICOS, and their respective subsidiaries

Acquiring and Nurturing Talent to Drive Transformation

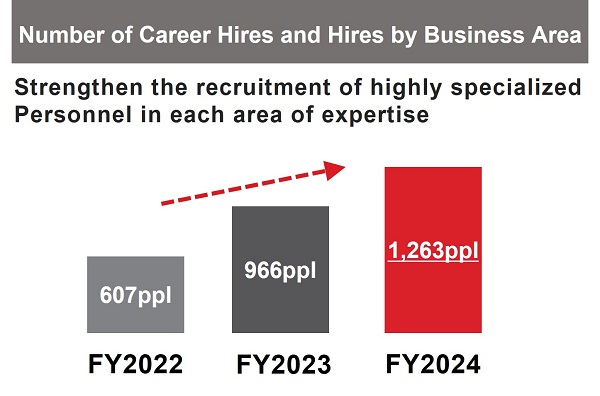

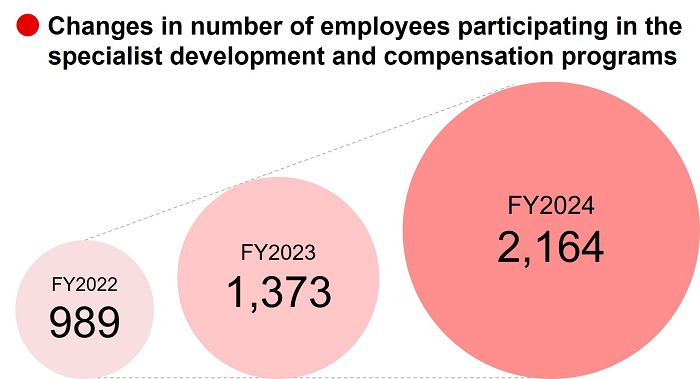

Highly Skilled and Specialized Professionals

Acquiring and Nurturing Specialized Professionals

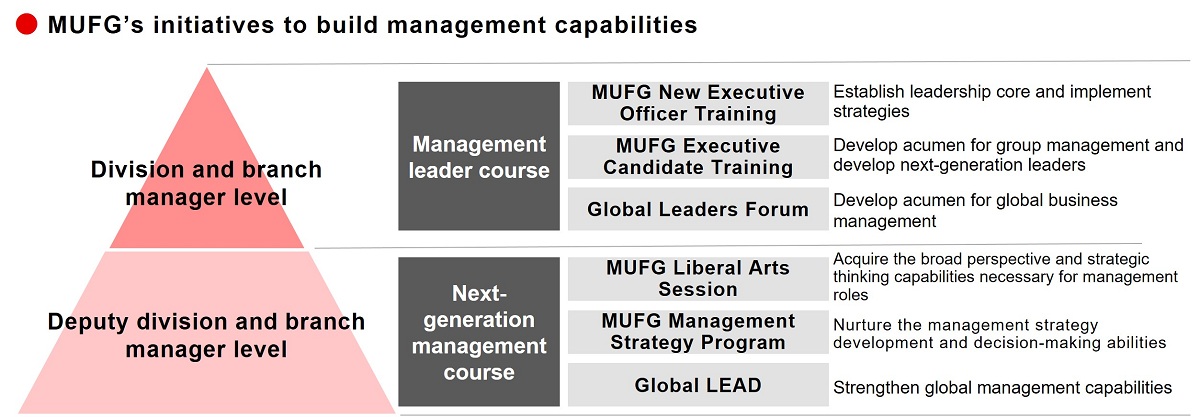

Nurturing Future Top Management

MUFG University offers two courses tailored to participant levels: the “Management Leader Course” and the “Next-Generation Leader Course.” The Management Leader Course targets branch manager-level employees and provides multi-layered training programs, including interactive lectures with external executives and academic experts. The Next-Generation Leader Course is designed for deputy branch managers and assistant managers, offering liberal arts programs to cultivate human skills and a broad perspective essential for future leaders.

In FY2025, MUFG introduced a new program jointly developed with Nagoya University of Commerce & Business Graduate School for selected mid-level employees. This program comprehensively incorporates business skill acquisition, self-assessment, and one-on-one coaching.

Through these programs, MUFG aims to deepen understanding of organizational management, embed MUFG’s culture, and strengthen communication between management and employees. This approach ensures the long-term development of cross-group and global leaders who can excel across diverse fields, while also enabling early identification of next-generation management talent, strategic placement in key positions, and steady expansion of MUFG’s management talent pool.

Global Talent Development

Under the current medium-term business plan, we aim to further embed the MUFG culture among both domestic and international employees by enhancing global leadership training programs.

Global management development programs such as the Global Leaders Forum and Global LEAD are conducted in collaboration with leading international business schools, deepening understanding of different cultural backgrounds, strengthening leadership capabilities to lead diverse organizations, and fostering a global mindset.

As a new initiative, we have launched the Global Executive Acceleration Program to help newly hired senior overseas employees quickly deepen their understanding of MUFG and become immediately effective in their roles. In addition to management programs, we also offer the Three-month Intensive Program for operational-level employees at overseas locations, providing short-term on-the-job training (OJT) opportunities at our Tokyo headquarters to expand the number of overseas employees with a global mindset.

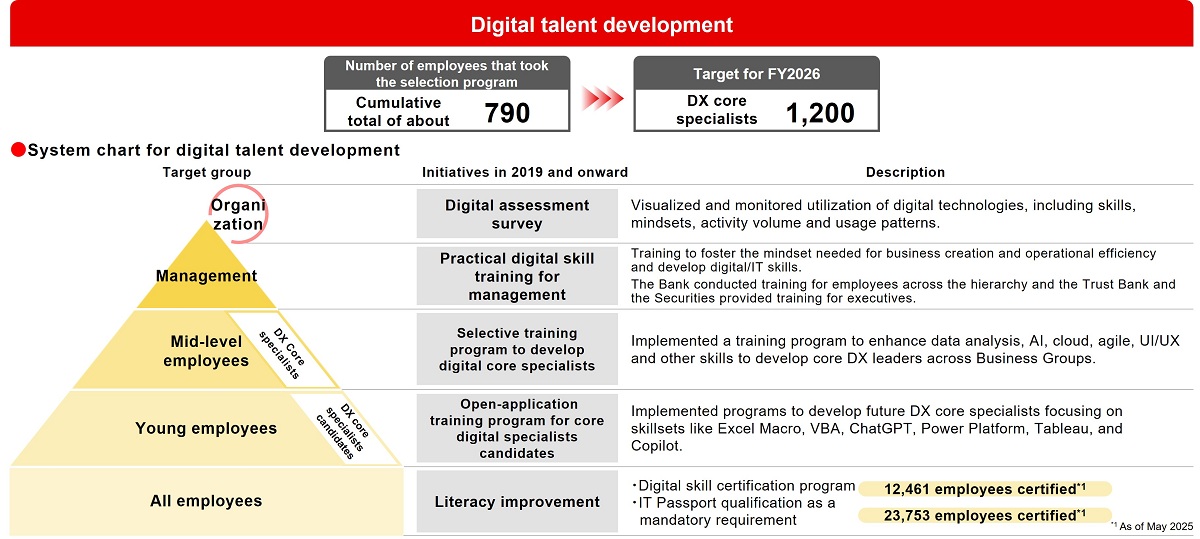

Digital Talent Development

To further enhance DX literacy, all employees are required to obtain the “IT Passport” certification or complete e-learning equivalent to IT Passport standards. We have also introduced a Digital Skill Certification System to encourage employees to acquire external qualifications.

Moreover, through initiatives such as hosting group-wide data science competitions and promoting job rotations, MUFG aims to strengthen the development of core digital talent and improve digital literacy across the organization.

Digital Talent Development Program (the Bank)

Other Training and Development Programs

Each group companies offer various training programs to ensure that employees possess high motivation and expertise, enabling them to provide high value-added services to customers.

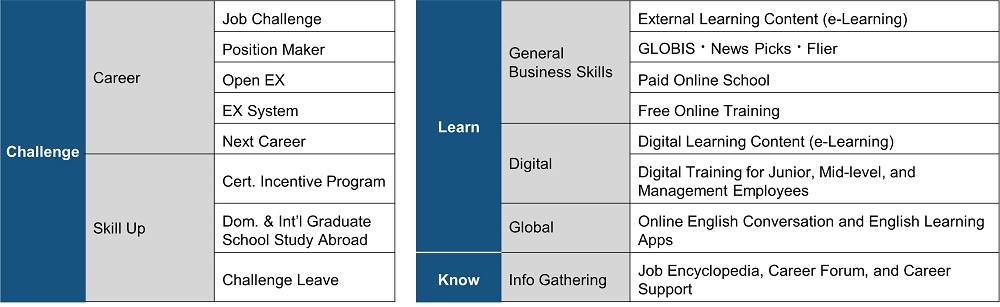

At the Bank, the desired talent is defined as “individuals who, based on their human qualities, can leverage their professional skills and expertise to achieve high levels of performance and contribution over the medium to long term”. To enhance human qualities, we offer bank-wide tiered training programs, and for the acquisition of skills and expertise, we provide department-specific skill training. Additionally, we offer career reflection training programs at key milestones for employees of all generations and levels. We also have a rich array of self-development support systems, providing autonomous and self-development learning opportunities tailored to each stage of growth.

Moreover, it is crucial to enhance the effectiveness of reflecting workplace experiences in employee growth. To this end, we focus on creating a nurturing environment within the workplace. For example, we promote “1on1 Guidebooks” and “Career Interview Guidebooks” to support 1-on-1 meetings aimed at enhancing the quality and quantity of communication between supervisors and subordinates. We also offer coaching programs not only for new managers but also for current management, and we expand mentoring and instructor systems for the development of younger employees. These initiatives aim to foster a culture of nurturing people and strengthen the organization.

① Cross-Departmental Tiered Training to Enhance Human Qualities

Upon joining MUFG, all new employees participate in introductory training designed to instill a professional mindset and build foundational skills. During the on-the-job training (OJT) period for new graduates, we provide regular online supplementary sessions and group training, tailored to each individual’s work experience and skill acquisition status. We also offer training for OJT instructors, creating an integrated development framework that links formal training, OJT, and collaboration between training departments and workplaces.

Subsequently, milestone-based programs are conducted to further enhance human qualities. For example, training for newly appointed assistant managers and branch managers provides foundational knowledge to promote self-awareness, strengthen leadership and subordinate development, and improve organizational management capabilities. Through interactive discussions with other participants, individuals articulate their desired management style.

② Department-Specific Skill Training Aimed at Acquiring Skills and Expertise

For each job category, we define the required skills and future career paths. Particularly for new appointees, we provide support not only through on-the-job training (OJT) but also through off-the-job training (Off-JT) at appropriate times to accelerate development and integration into the workforce, thereby enhancing professional proficiency.

To strengthen proposal capabilities aligned with customers’ diverse life events and both explicit and latent needs, we focus on training for Life Plan Consultants (LPCs) and Financial Planners (FPs) who handle individual customer sales at branches. Highly skilled professionals active on the front lines serve as instructors, supporting the acquisition of specialized skills in areas such as asset management, insurance, inheritance, and real estate-related services.

For example, at the Bank, more than 2,000 employees participated in LPC training programs in FY2024. In the foreign exchange domain, in addition to OJT for operational tasks, specialized foundational training programs are provided to reinforce expertise through both practical and classroom learning. OJT includes rotations across multiple sections, enabling employees to acquire the specialized knowledge and skills required for foreign exchange operations in a structured, phased manner.

③ Self-Development and Career Support Programs

In the era of 100-year lifespans, achieving autonomous career development requires employees to regularly reflect on their strengths and challenges, take stock of past experiences, and articulate future aspirations. At the Bank, we provide mandatory career reflection programs at key milestones, starting with career training in the second year of employment and continuing at ages 30, 40, and 50.

To further support career advancement, we offer a variety of career support systems, including internal job posting programs, as well as extensive paid and unpaid self-development programs and qualification support schemes. For example, our weekly “Online Self-Development Seminar” (commonly known as ELP training) has attracted approximately 35,000 participants across the Group, including contract employees.

Regarding qualification support, in FY2024, 6,370 employees utilized the program, which covered 60 types of certifications such as FP (Financial Planner), securities analyst, and SME consultant. In FY2025, we expanded the scope to 113 certifications and increased incentive amounts, adding new qualifications such as the G Test, AWS certifications, compliance officer, and IFRS certification. In addition, we have established various systems to help employees challenge themselves and achieve their goals.

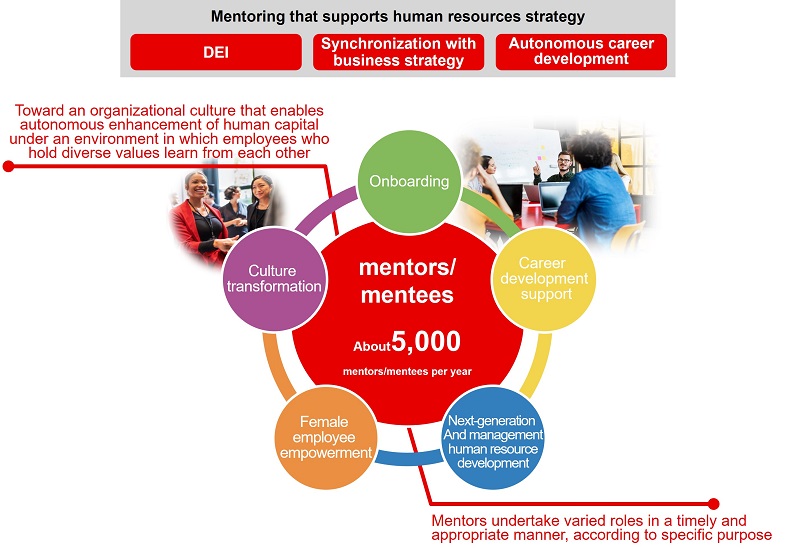

④ Mentoring Program to Support Growth

We are expanding our mentoring system in various ways, where employees learn from each other. In addition to mentoring aimed at supporting the retention of young employees and mid-career hires, we offer executive mentoring for the development of next-generation leaders and mentoring for female managers. In an environment where employees with diverse values learn from each other, we are fostering an organizational culture that mutually supports career development for individuals. The mentoring system includes programs organized by the Human Resources Department and different business units, promoting a culture of mutual learning.

⑤ External Dispatch Program

We have partnered with external educational institutions to offer more than 10 external dispatch programs, covering a wide range of topics such as liberal arts, MBA skills, and innovation. Employees who participate in these external dispatch programs engage in discussions and interactions with employees from other companies who have diverse values and experiences. Through this process, they reflect on themselves and achieve personal growth. Additionally, by providing these diverse opportunities for cross-industry competition, we help participating employees enhance networking, which in turn enhances MUFG's presence.

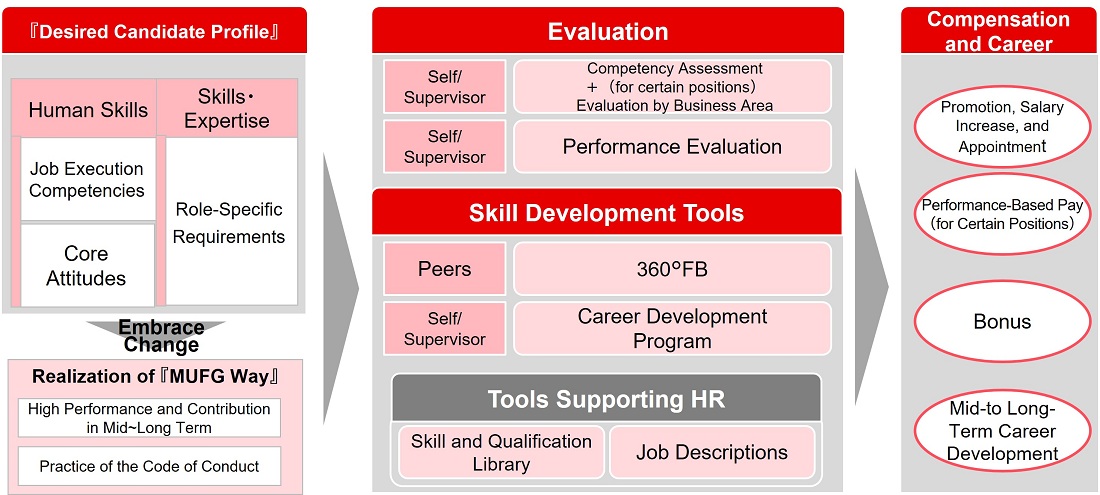

Our Approach to Evaluation of Human Resources at MUFG

In order to achieve MUFG's vision of the future, each employee is expected to be a professional with high human skills and expertise as defined by the "ideal employee profile," and to anticipate changes and take on challenges to achieve high performance and contributions in the medium to long term.

The Bank’s human resource evaluation system is built on a framework that supports the pursuit of “professionalism,” “transformation and speed,” and “autonomous career development,” which are key to achieving the ideal employee profile. Specifically, the system consists of two evaluations: competency evaluation and performance evaluation.

To strengthen career development, we provide various career support programs, including internal job posting systems, as well as a wide range of paid and unpaid self-development programs and qualification support schemes. For example, the weekly “Online Self-Development Seminar” (commonly known as ELP training) is part of a comprehensive approach that incorporates four competency development tools: 360-degree feedback, career development programs, skill and qualification libraries, and job descriptions (for certain job grades).

In performance evaluation, individual missions are set based on branch policies determined by branch managers, and goals are established accordingly. Evaluations reflect not only individual performance but also alignment with team objectives.

■ Competency Evaluation

In addition, the evaluation process incorporates one-on-one meetings with supervisors to confirm required skills and expertise, align on expected behaviors, and provide feedback on evaluation results—thereby promoting medium- to long-term competency development.

■ Performance Evaluation