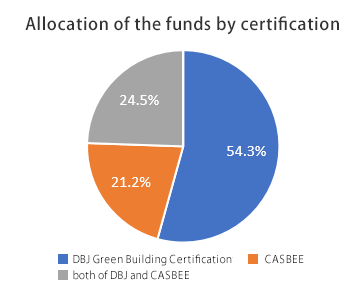

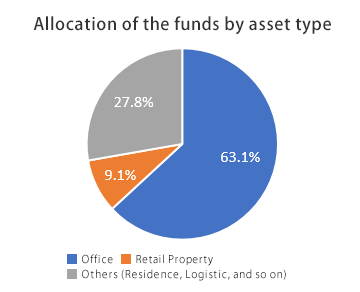

Allocation of funds (as of the end of March 2020)

The full amount of the net proceeds from the sale of the EUR 500 million MUFG Green Bonds issued in October 2018 is allocated to Eligible Green Projects. By type of certification, DBJ Green Building Certification, CASBEE and both of them accounted for 54%, 21% and 25%, respectively. In terms of asset type, Office represented the largest portion. All of them are located in Japan. (See the charts below for details for your reference.)

Environmental Impacts (as of the end of March 2020)

The avoided annual CO2 emissions from Eligible Green Projects to which proceeds from the MUFG Green Bonds issued in October 2018 are 1,924 tons, which is calculated in consideration of MUFG bank's share of financing for each J-REIT (note1), which possesses eligible green buildings. The annual avoided CO2 emissions are calculated based on the below formula.

CO2 emission reductions = Tracked CO2 emissions – Benchmark CO2 emissions

Benchmark CO2 emissions = Floor space (m2) × Benchmark energy consumption (note2) (MJ / m2)× Carbon intensity (kg-CO2 / MJ)

- MUFG Bank's share of financing for each J-REIT is derived as the proportion of MUFG Bank's loan to the total amount of interest-bearing debt

- Benchmark energy consumption is published by Comprehensive Assessment System for Built Environment Efficiency (CASBEE)

Annual CO2 emissions avoided (t-CO2)

| Office | Retail Property | Others | Total |

|---|---|---|---|

Office

1,047

|

Retail Property

133

|

Others

745

|

Total

1,924

|

Disclosure Policy (conducted in June 2019)

MUFG has received a report on the allocation of amounts equivalent to the net proceeds from the sale of its Green Bond issued in October 2018 from Sustainalytics in the Netherlands, and the CFO of MUFG has provided management assertions with respect to such allocation.

ESG evaluation loans for J-REIT

Among the eligible green building projects (note), loans to fund eligible green buildings owned by J-REITs that are rated within the top three by MURC through MURC's ESG evaluation methodology for J-REIT may be prioritized for green bond allocations when the loans are applied as “ESG evaluation loans for J-REIT”.

- Eligible green buildings are buildings which have received or will receive at least one of the following levels. We confine eligible projects to buildings of which the CO2 emission are trackable (62% of all the eligible green buildings).

- DBJ Green Building Certification: 5 Stars or 4 Stars

- CASBEE: S Rank or A Rank

- LEED: Platinum or Gold

- BREEAM: Outstanding or Excellent

United Urban Investment Corporation

Mallage Kashiwa

<Address> 2-3-1 Oyamadai, Kashiwa, Chiba

<Completed> June 2004

<Asset type> Retail Property

<Completed> June 2004

<Asset type> Retail Property

Advance Residence Investment Corporation

RESIDIA TOWER Meguro-Fudomae

<Address> 3-7-6 Nishigotanda, Shinagawa-ku, Tokyo

<Completed> January 2007

<Asset type> Residence

<Completed> January 2007

<Asset type> Residence

Kenedix Retail REIT Corporation

MONA Shin-Urayasu

<Address> 1-5-1 Irifune, Urayasu, Chiba

<Completed> October 1990

<Asset type> Retail Property

<Completed> October 1990

<Asset type> Retail Property

Daiwa Office Investment Corporation

Shinjuku Maynds Tower

<Address> 2-1-1 Yoyogi, Shibuya-ku, Tokyo

<Completed> September 1995

<Asset type> Office

<Completed> September 1995

<Asset type> Office

LaSalle LOGIPORT REIT

LOGIPORT Hashimoto

<Address> 4-7 Ooyama-cho, Midori-ku, Sagamihara-shi, Kanagawa

<Completed> January 2015

<Asset type> Logistics

<Completed> January 2015

<Asset type> Logistics

Mitsubishi Estate Logistics REIT Investment Corporation

Logicross Fukuoka Hisayama

<Address> 2781-1 Hara, Kubara, Kasuya, Fukuoka

<Completed> October 2014

<Asset type> Logistics

<Completed> October 2014

<Asset type> Logistics

SEKISUI HOUSE REIT, INC.

Garden City Shinagawa Gotenyama

<Address> 6-7-29 Kitashinagawa, Shinagawa-ku, Tokyo

<Completed> February 2011

<Asset type> Office

<Completed> February 2011

<Asset type> Office

Daiwa House REIT Investment Corporation

DPL Misato

<Address> 1-3-5, Inter-Minami, Misato City, Saitama

<Completed> July 2013

<Asset type> Logistics

<Completed> July 2013

<Asset type> Logistics

Global One Real Estate Investment Corp.

Toyosu Prime Square

<Address> 5-6-36 Toyosu, Koto-ku, Tokyo

<Completed> August 2010

<Asset type> Office

<Completed> August 2010

<Asset type> Office

(As of June 2020)