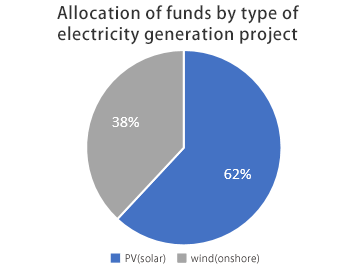

Allocation of funds (as of the end of March 2020)

Environmental Impacts (As of the end of March 2020)

The annual energy generation from Eligible Green Projects to which proceeds from the MUFG Green Bonds issued in Oct 2019 is 721 million kWh per year with avoided annual CO2 emissions of 0.36 million tons. MUFG bank's estimated proportion of the CO2 avoidance is 0.09 million tons, which can be obtained as an aggregate amount of multiplying MUFG Bank's share of financing for each eligible green project by CO2 emissions avoided of the project. The annual energy production is calculated based on the below formula with the average capacity factor published by the International Renewable Energy Agency.

Annual energy generation (kWh) = capacity of energy generation (kW) × Hours of operation × Average capacity factor (%)

The estimated CO2 avoidance is calculated based on the average emission factor published by the International Finance Corporation as below.

CO2 emission reductions= Annual energy production (kWh) × Average emission factor (gCO2 / kWh)

| Category | Sub category | Annual energy generation (kWh) |

Annual CO2 emissions avoided (t-CO2) |

|---|---|---|---|

| Renewable Energy | Solar photovoltaic power | 184,485,600 | 92,981 (MUFG Bank's proportion 46,888) |

| Wind (Onshore) | 536,112,000 | 270,200 (MUFG Bank's proportion 38,600) |

|

| Total | 720,597,600 | 363,181 (MUFG Bank's proportion 85,488) |

|

Disclosure Policy (conducted in June 2020)

Warradarge Wind Farm