Supporting advances in the Asia region

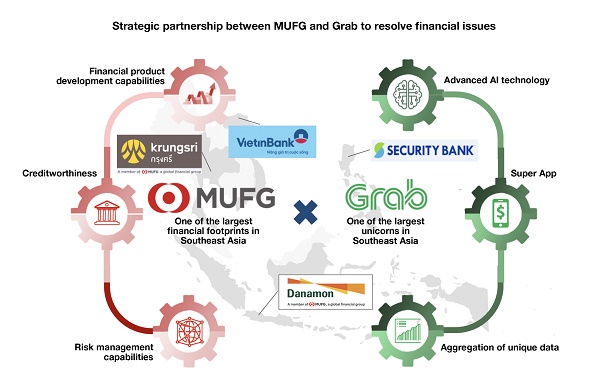

With MUFG’s stated corporate purpose of being “Committed to empowering a brighter future” and its more than 100 years of experience in Asia, the company aspires to provide a safe, secure, and trustworthy financial-services platform to many more clients throughout the booming region. Together with four partner banks in Thailand, Indonesia, Vietnam, and the Philippines, MUFG is working to serve the region’s needs and help resolve its issues. Taking into account the partner banks’ reach, MUFG has the largest branch network in Asia, but even this is insufficient to bring financial services to every corner in Asia.

“More needs to be done,” says Kamezawa. “‘Financial inclusion’ – making financial services accessible to everyone, especially those who’ve never been able to access them before – requires initiative from a host of parties, including providers like MUFG,” he says. “It’s a critically important social issue that needs to be addressed in Asia particularly, and MUFG is focusing our efforts there.”

MUFG Bank recently established Mars Growth Capital in Singapore, a joint venture with Israel-based fintech company Liquidity Capital, to provide debt financing for startups primarily in Asia. Kamezawa explains, “While supporting the growth of companies we help finance, we also provide support for their leadership by advising them on resolving management issues.”

MUFG has, as a Group, established funds for startups as well, with a particular focus on digital transformation (DX). After forming the MUFG Ganesha Fund with a total investment limit of USD300 million for India in March 2022, MUFG formed the similar Garuda Fund with a total investment limit of USD100 million for Indonesia in January 2023. Through these funds, MUFG supports innovative companies that might typically find it difficult to secure funding.

Southeast Asia is a region where bank accounts, credit cards, and financial services are not yet widely available. But new entrants in fintech, distinctly different from traditional financial institutions, have begun offering convenient payment services to financially underserved populations by harnessing the power of digital technology.

“A stream of new financial services that don’t follow business models of traditional financial institutions are emerging and gaining popularity,” says Kamezawa. “These services include Buy Now, Pay Later (BNPL) – a payment method that allows consumers to postpone payment for items purchased – and other forms of unsecured loans facilitated by digital technology,” he says. “The pace of change is remarkably fast. Platform operators that offer high-quality tools to simplify daily life, including local fintech and super apps firms, are capitalizing on data and AI technology, producing new services that combine financial and non-financial aspects.”

In 2020, MUFG Bank signed a strategic partnership agreement with Grab, a leading super app in Southeast Asia. Extending beyond Grab’s roots in mobility and food-delivery services, the app also offers financial services, such as digital payments, in line with its mission of empowering individuals across Southeast Asia. “By embracing the challenge of providing next-generation financial services together with Grab, we are committed to transforming society for the better,” says Kamezawa.

Strengthening collaboration with Grab to offer next-generation digital financial services

MUFG’s collaboration with Grab has deepened steadily and is yielding results; for instance the company has disbursed roughly 290,000 loans to Grab drivers in Thailand since it began offering them in September 2020. MUFG extended the same loan model to Grab food merchants in October 2020 and has disbursed approximately 80,000 loans to them so far. And in August 2022, the company extended loan offers beyond ride-share and food delivery providers to include all users of the Grab app.

“We are alert to new possibilities in this and other novel areas by maintaining broad and deep communication at the management level,” says Kamezawa. “We find that differences in culture and values do not have to limit the possibilities, and an endless cycle of trial and error is leading us to launch imaginative and useful new products.”

The collaboration with Grab is expanding beyond Thailand to other Southeast Asian countries. For example, in Indonesia, MUFG and Grab began collaboration on credit-card business in 2021.

“New initiatives have benefitted both MUFG and our partner banks not only by adding new customers, but also by developing our foundational knowledge of building digital financial services,” Kamezawa says. “We intend to use the knowledge we’ve gained through collaboration with Grab and others to provide next-generation digital financial services. For instance, we are developing a system for offering loans to pre-approved customers; a system that processes every step from loan application to execution with a few taps on an app without human intervention; the application of behavioral data for credit decisions; and other prospects for advancement of AI-based credit decisions.”