Profile

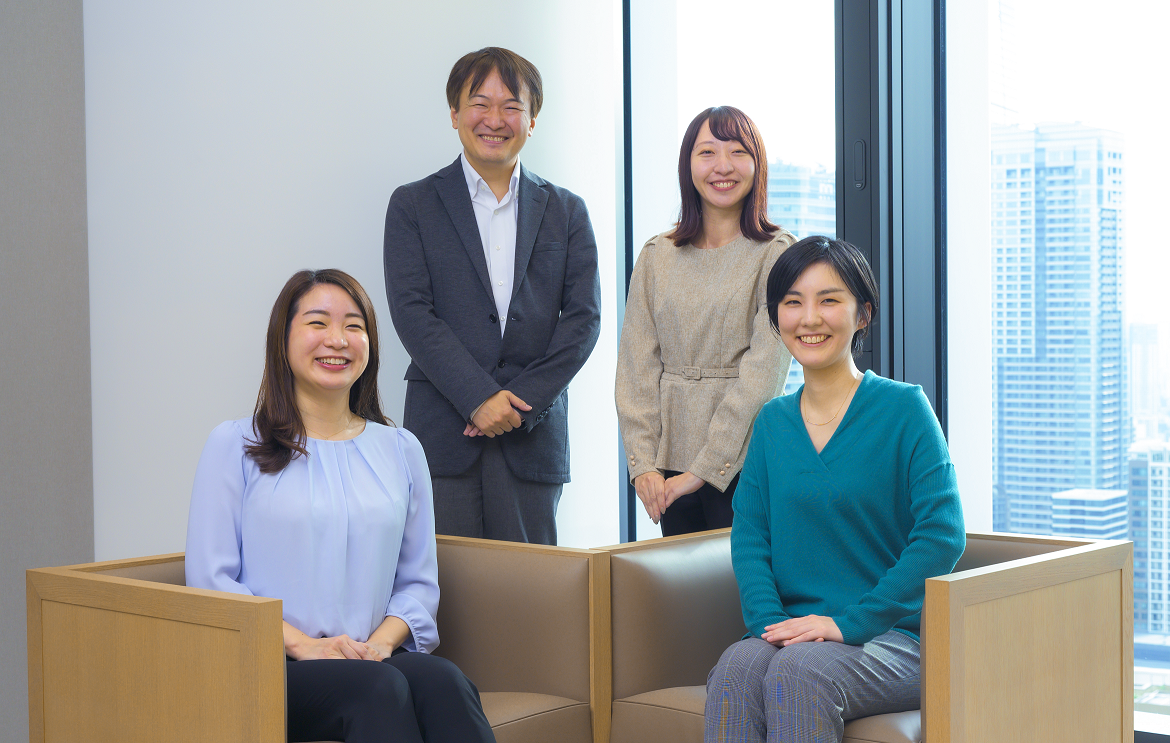

Yusuke Terajima

Chief Manager

Business Promotion Group, Domestic Investor Service Business Department

Investor Service Business Division

Mitsubishi UFJ Trust and Banking

Saki Hasebe

Manager

Operational Planning

Investor Services Planning Division

The Master Trust Bank of Japan

Ayaka Sasaki

Coordinator

Investor Services Sales Division

Mitsubishi UFJ Trust and Banking

Yukiko Adachi

Vice President

Operational Planning Investor Services Planning Division

The Master Trust Bank of Japan, Ltd.

The Japanese government aims to become a leading asset management center. To do so, it’s essential to promote the advancement of the asset management industry. This requires the rationalization and streamlining of operational management and the creation of an environment that allows for the entry of new asset management businesses. One challenge was Japan’s unique commercial practice—the double NAV calculation method of asset management companies and trust banks.

The standard for trust banks in countries outside Japan is the single-party NAV calculation method. If an asset management company wanted to do business in Japan, they were required to establish a system, along with staffing to handle the double NAV calculation method, impeding their entry into the market.

“Many global asset management companies lamented to us, asking how long Japan would continue using double NAV calculation,” said Mr. Terajima, who played a central role in this project.

Solving for this issue had been a topic of discussion within the mutual fund industry for many years, but it required significant changes to be made to the systems and operational flow of asset management companies and trust banks, making it difficult to take the first step.

We can change commercial practices because of who we are.

The long journey of contributing to customers continues.

In December 2022, the Trust Bank started collaborating with JAMP Fund Management and announced it would introduce single-party NAV calculation for the mutual funds it establishes and manages. It has been two years since the start of Japan’s first framework. After implementation, there were no major issues reported and moves to follow suit began to arise, indicating that the movement to adjust to the global standard will accelerate.

Ms. Sasaki said, “In order for new asset management companies that are considering entering the market and foreign asset management companies that we oversee consider the Trust Bank as a viable option, we must provide added value.” Ms. Adachi rolled up her sleeves, saying, “Therefore, it is our duty to provide financial infrastructure that’s long-lasting. Going forward I will think of a system for sustainable operations for everyone in charge of the business.”