ESG Investment that Leads to Improved Medium- to Long-Term Returns and Reduced Risk

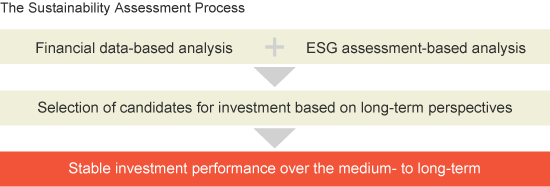

Global pension funds, and other investors pursuing stable investment returns, consider the business outlook and financial data when evaluating companies. They are also increasingly looking at a company's nonfinancial information such as environmental and social responsibility and corporate governance (ESG).

A consensus is starting to take hold that investing in companies with clear social responsibility policies and programs and strong corporate governance systems can increase returns over the medium- to long-term and reduce risk.

In addition, assessment methods that place higher value on corporate dialogue for verifying this nonfinancial information are also becoming more widespread.

Mitsubishi UFJ Trust and Banking Corporation, and its subsidiaries Mitsubishi UFJ Kokusai Asset Management Co., Ltd., MU Investments Co., Ltd., and Mitsubishi UFJ Asset Management (UK) Ltd., have formed the “MUFG Asset Management” (MUFG AM) brand as MUFG asset management companies. Through this, the Group aims to make a concerted effort towards actively engaging in solving social issues, while realizing sustainable business growth and enhancing the corporate value of companies receiving investment.

In May 2019, MUFG AM announced its principles for tackling the assessment management business as the “MUFG AM Responsible Investment Policy”, and has applied it since July 2019.

A consensus is starting to take hold that investing in companies with clear social responsibility policies and programs and strong corporate governance systems can increase returns over the medium- to long-term and reduce risk.

In addition, assessment methods that place higher value on corporate dialogue for verifying this nonfinancial information are also becoming more widespread.

Mitsubishi UFJ Trust and Banking Corporation, and its subsidiaries Mitsubishi UFJ Kokusai Asset Management Co., Ltd., MU Investments Co., Ltd., and Mitsubishi UFJ Asset Management (UK) Ltd., have formed the “MUFG Asset Management” (MUFG AM) brand as MUFG asset management companies. Through this, the Group aims to make a concerted effort towards actively engaging in solving social issues, while realizing sustainable business growth and enhancing the corporate value of companies receiving investment.

In May 2019, MUFG AM announced its principles for tackling the assessment management business as the “MUFG AM Responsible Investment Policy”, and has applied it since July 2019.

Promoting the Broader Use of Corporate Evaluations

Based on Nonfinancial Information

Drawing on its experience as a pioneer in ESG-based corporate assessment and asset management, Mitsubishi UFJ Trust and Banking (the Trust Bank) is working on creating and managing funds with selected equities that are expected to experience sustained growth. These funds have grown in size as more investors have come to recognize their performance and management strategies. Through seminars and other events, we also educate participants about methods of selecting companies for investment based on ESG principles, and we work to promote broader use of corporate assessment methods based on nonfinancial information.

The Trust Bank also became a signatory to the international Principles for Responsible Investment (PRI) (See Note) to propagate PRI-based investing activities in Japan.

The Trust Bank also became a signatory to the international Principles for Responsible Investment (PRI) (See Note) to propagate PRI-based investing activities in Japan.

- The PRI was announced by the then-Secretary General of the United Nations, Kofi Annan, in 2006. The PRI is intended to address decision making issues related to ESG for investments, to improve the long-term results of investments, and to reduce risk.

The Trust Bank endorses the aims of the Japanese Version of the Stewardship Code (the Code), which was formulated by the Financial Services Agency for the purpose of increasing the medium- to long-term return on investment for customers and beneficiaries. In order to increase the return on investment, the Code encourages institutional investors to improve the corporate value and stimulate sustainable growth of the company they are investing in through constructive dialogue and other means. The Trust Bank has publicly declared their compliance with the Code and, in order to fulfill its stewardship responsibility, the Trust Bank has disclosed its policy in response to the Code on its website.

(As of July 2019)