Governance

Disclose the organization's governance around climate-related risks and opportunities.

a.Describe the board's oversight of climate-related risks and opportunities. b.Describe management's role in assessing and managing climate-related risks and opportunities. |

|---|

MUFG's Governance for Countering Climate Change -Board Oversight of Climate Change Initiatives-

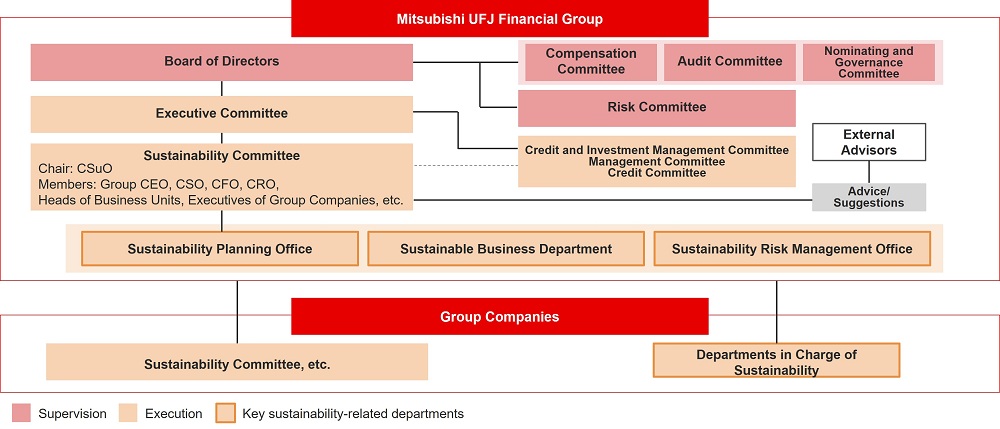

MUFG's Governance Structure for Countering Climate Change

At MUFG, the Sustainability Committee, which operates under the Executive Committee, is charged with periodically deliberating policies on and determining the status of the Group's response to opportunities and risks arising from climate change and other environmental and social concerns. MUFG has positioned climate change-related risk as one of the Top Risks that it must pay close attention to. Accordingly, these risks are discussed by the Credit & Investment Management Committee, the Credit Committee and the Risk Management Committee, all of which are under the direct supervision of the Executive Committee.The Chief Strategy Officer (CSO) presents and reports significant matters related to sustainability, including climate change, such as policies, strategies, frameworks, and initiatives, to the Board of Directors. Additionally, the Chief Risk Officer (CRO) presents and reports significant matters related to the management, policy and frameworks of sustainability risks, including climate change to the Board of Directors.

Conclusions reached by the above committees are reported to the Executive Committee‒which is tasked with deliberating and making decisions on important matters regarding business execution‒and, ultimately, reported to and discussed by the Board of Directors. In addition, matters discussed by the Credit & Investment Management Committee and the Risk Management Committee are also examined by the Risk Committee, which mainly consists of outside directors, and then reported to the Board of Directors. In these ways, the Board of Directors exercises supervision over MUFG's climate change-related initiatives.

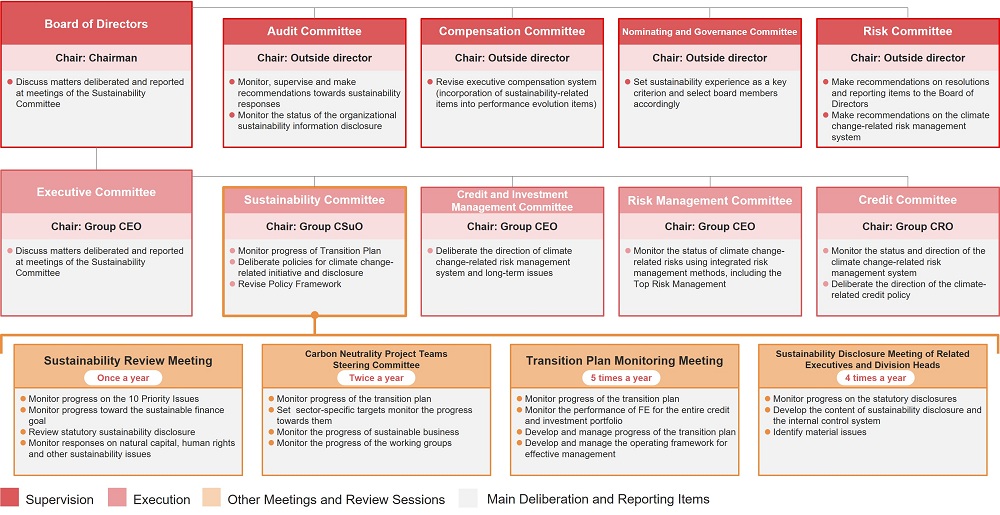

Overview of Committees Related to Climate Change

The Board of Directors has designated sustainability, including climate change, as a key deliberation item. The Board reviews initiatives related to business opportunities and risks associated with climate change on a regular basis, at least once a year. Through the Board of Directors and its subcommittees such as the Audit Committee, which are composed of directors with knowledge, expertise, and experience in sustainability, approximately 22 sustainability-related proposals were deliberated on in fiscal year 2024.

The Executive Committee discusses matters for deliberation and reporting related to the progress of transition plans, environmental policies, and revisions to the MUFG Environmental and Social Policy Framework as addressed by the Sustainability Committee. Under the umbrella of the Sustainability Committee, various meetings are held, including the Sustainability Review Meeting, the Steering Committee, the Transition Plan Monitoring Meeting, and the Sustainability Disclosure Meeting of Related Executives and Division Heads.

Carbon Neutrality Project Team and Committee

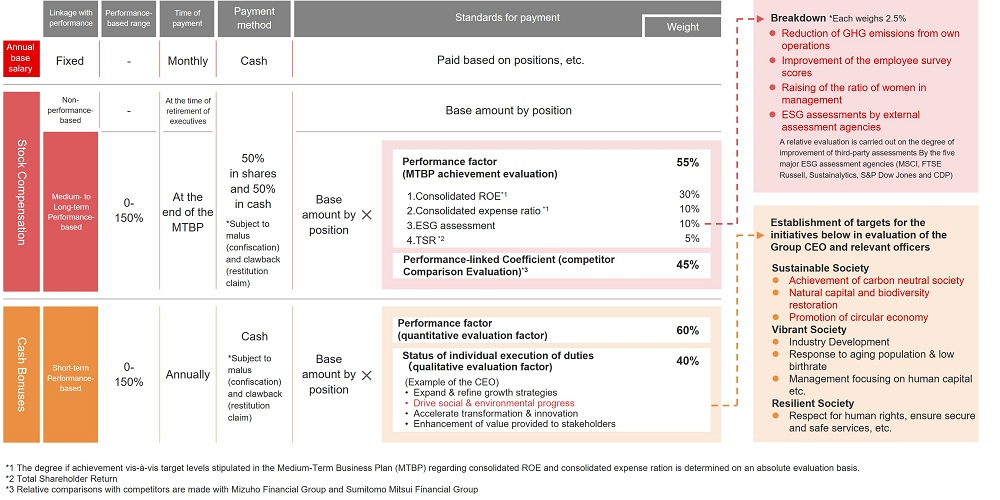

Applying ”ESG Assessment” as a Performance-Linked Indicator of Executive Compensation

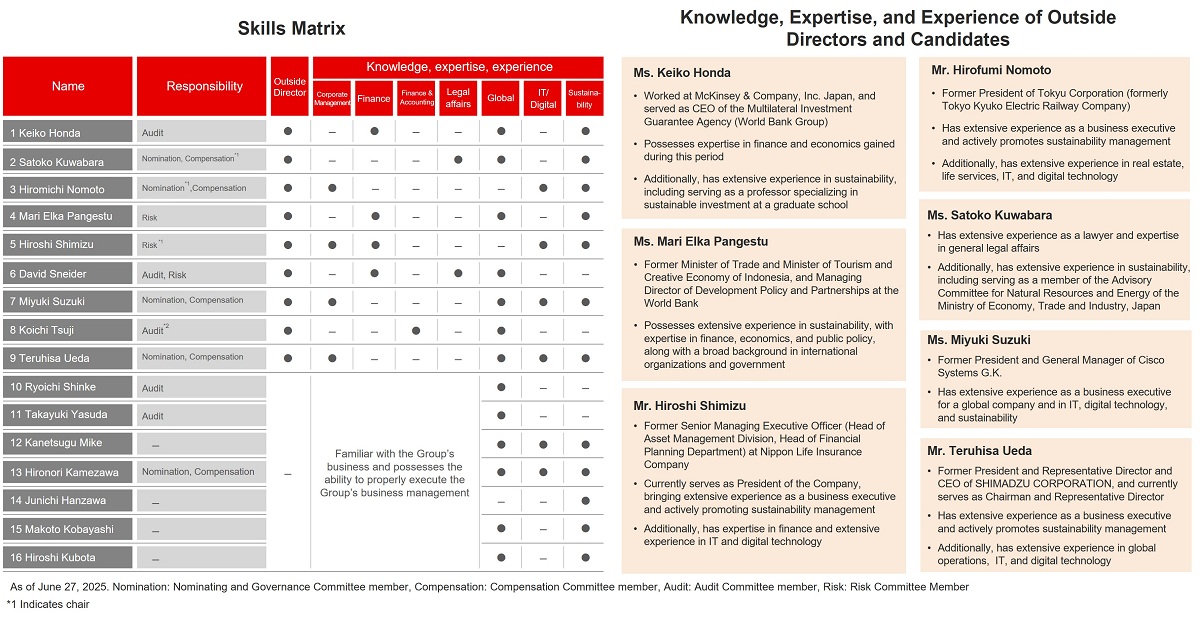

Director Skills Matrix/External Advisors

MUFG’s Board of Directors is comprised of individuals with experience in global operations in light of our business development as well as IT and digital technology and sustainability to take the lead in our digital shift and solving social issues such as climate change.

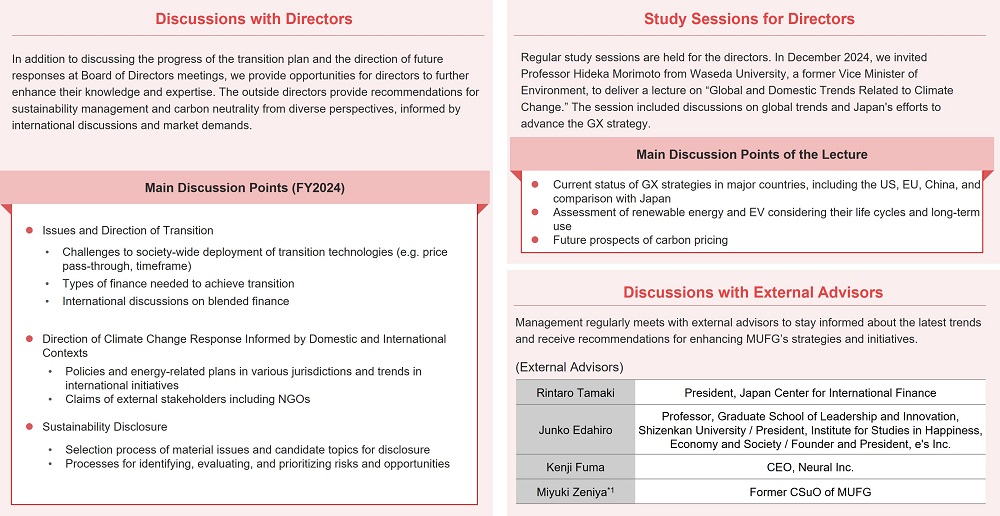

Sustainability initiatives, including those aimed at carbon neutrality, are regularly reported to and discussed with the Board of Directors. Additionally, measures to enhance the competencies of the directors, such as regular study sessions and discussions with external experts, are implemented.

MUFG Environmental Policy Statement

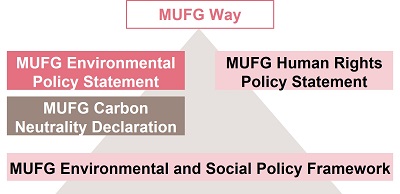

Under the MUFG Way, which guides all of our activities, MUFG has established the MUFG Environmental Policy Statement as a specific action guideline for practicing environmental considerations.

The MUFG Environmental Policy Statement has been the matter to be determined in the Board of Directors since May 2021. The Policy Statement clearly states the company's commitment to proactively disclose information on the environment, including climate change.

Additionally, on April 1, 2024, we revised the MUFG Environmental Policy Statement to address increasing expectations from various stakeholders and the diversification of environmental and social issues. The revisions include wording stressing the need for integrated efforts to address climate change, natural capital, a circular economy, and respect for human rights, as well as initiatives to enhance risk management related to climate change.

For more details on the MUFG Environmental Policy Statement, please refer to Policies and Guidelines.