Strategy Disclose the actual and potential impacts of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning where such information is material.

a.Describe the climate-related risks and opportunities the organization has identified over the short, medium, and long term. b.Describe the impact of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning. c.Describe the resilience of the organization's strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario. |

|---|

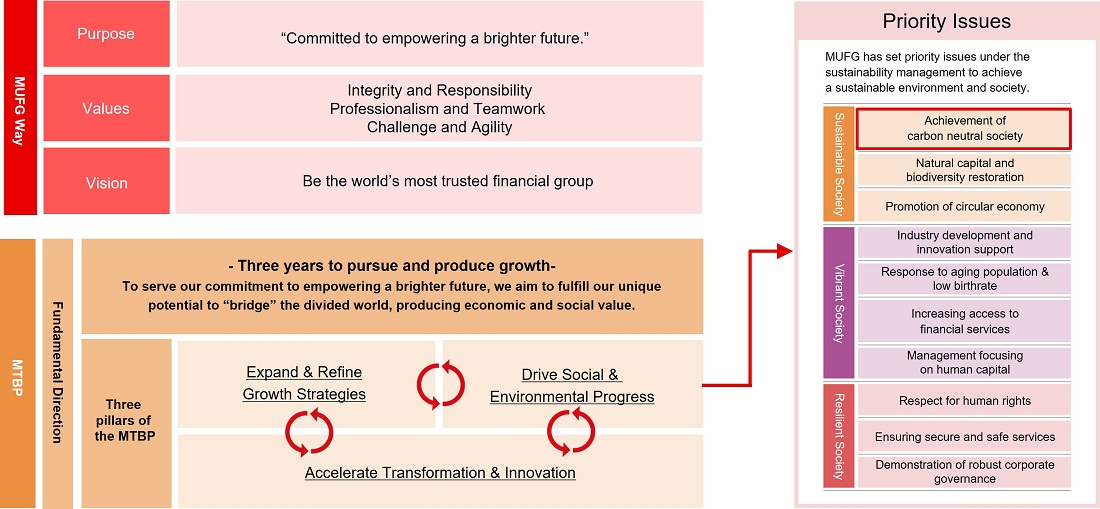

Strategies to Address Climate Change

Overview of Climate Change Measures: Positioning in the New Medium-Term Business Plan

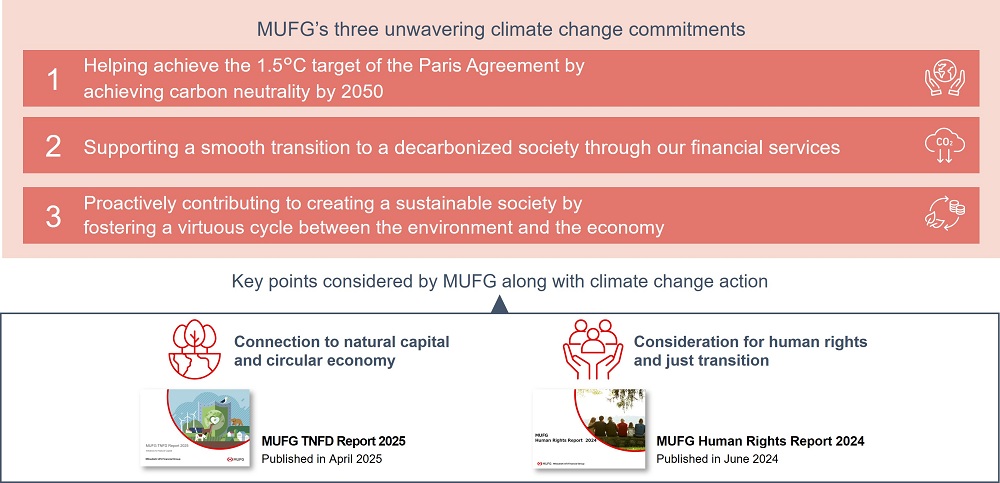

Three Unwavering Commitments

Roadmap for Achieving Carbon Neutrality

Transition Plan Based on GFANZ Guidance

Net Zero GHG Emissions in Our Financed Portfolio

2030 Interim Targets

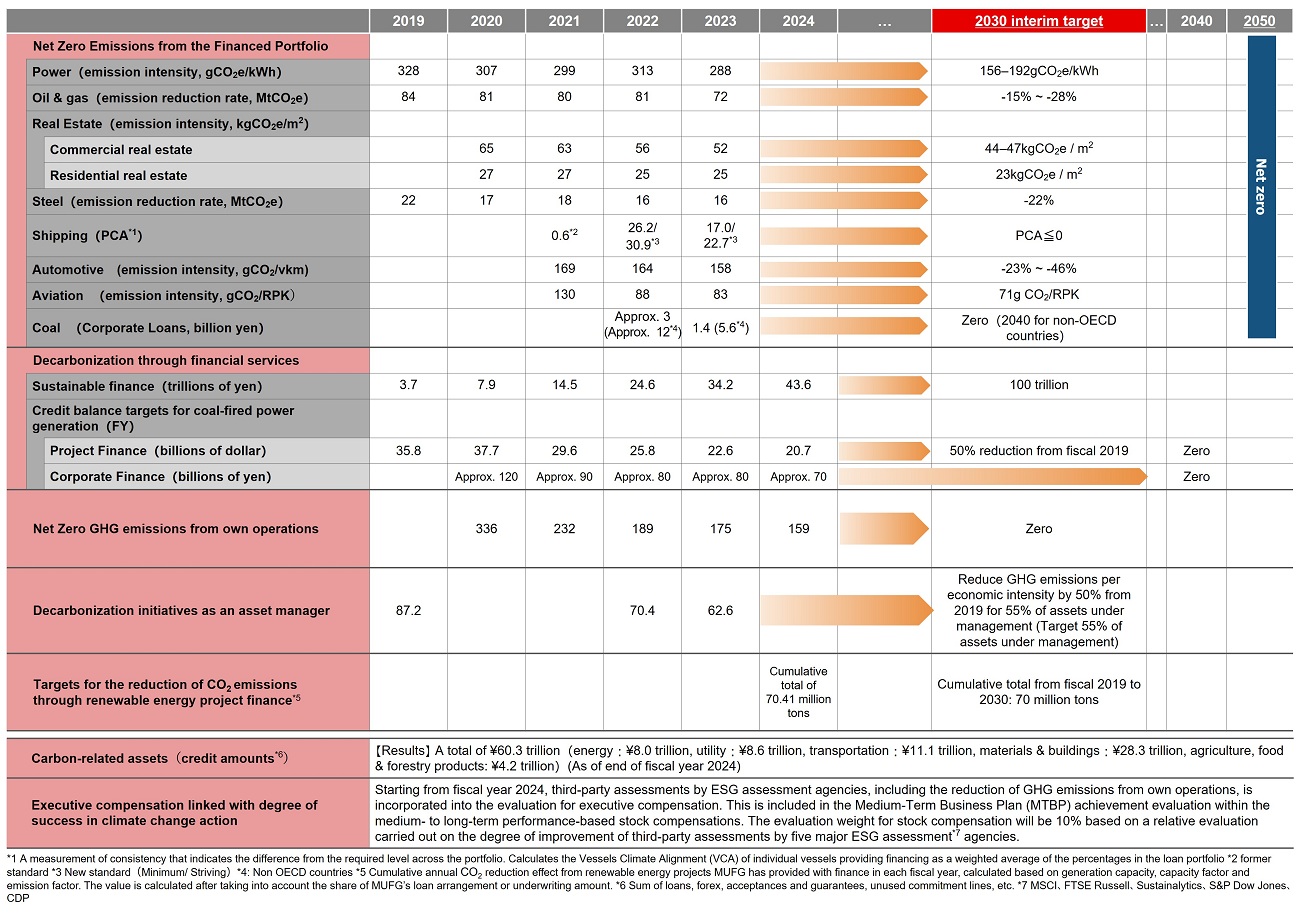

Based on the MUFG Carbon Neutrality Declaration released in May 2021, we are working to achieve net zero emissions in our finance portfolio by 2050.

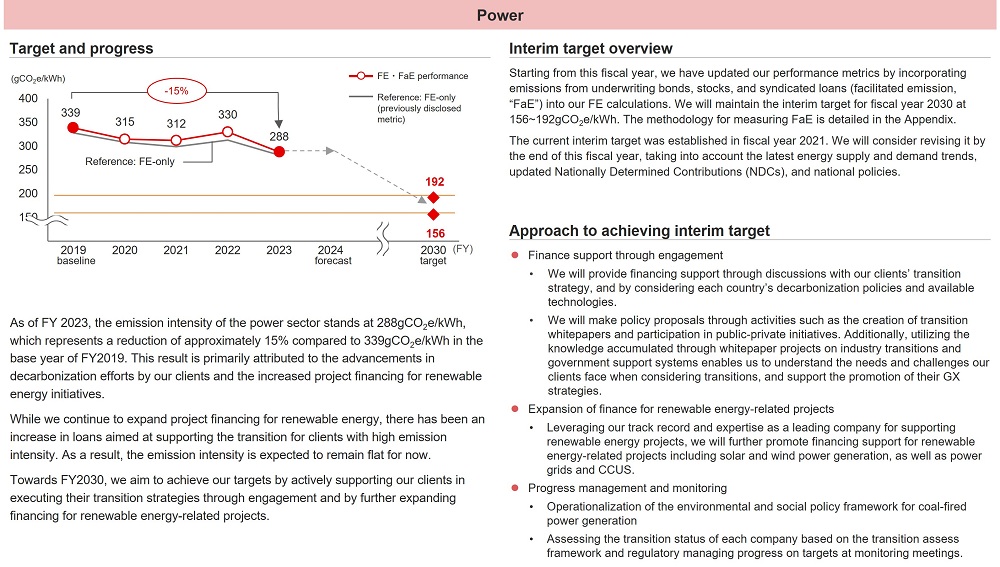

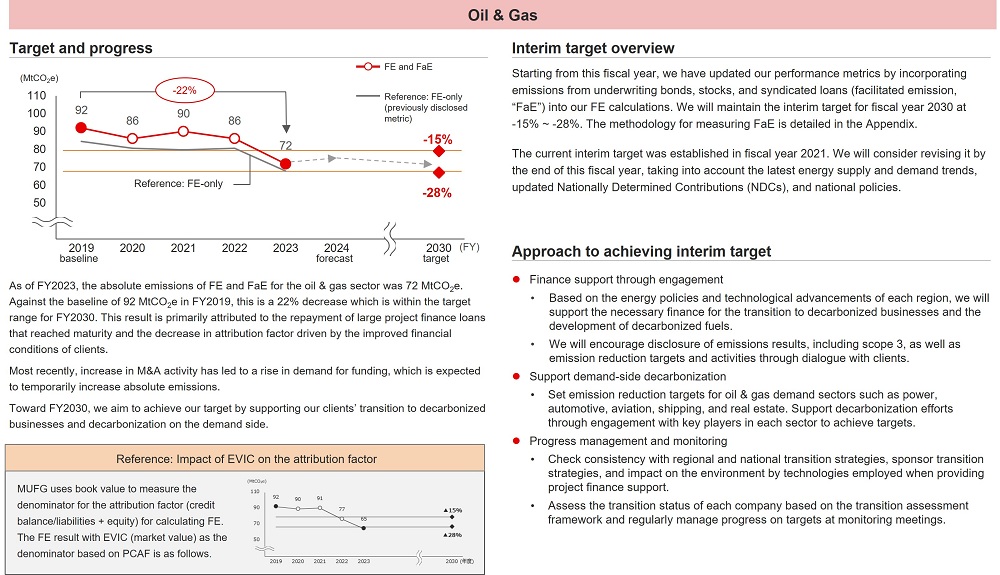

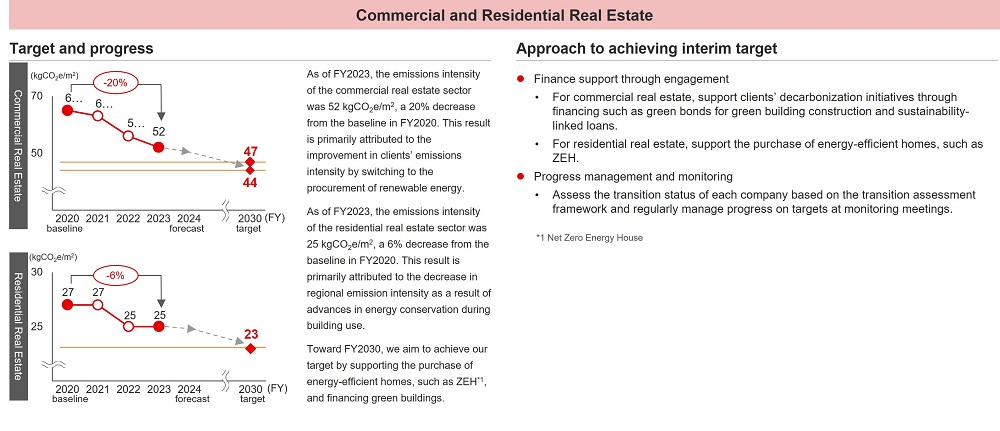

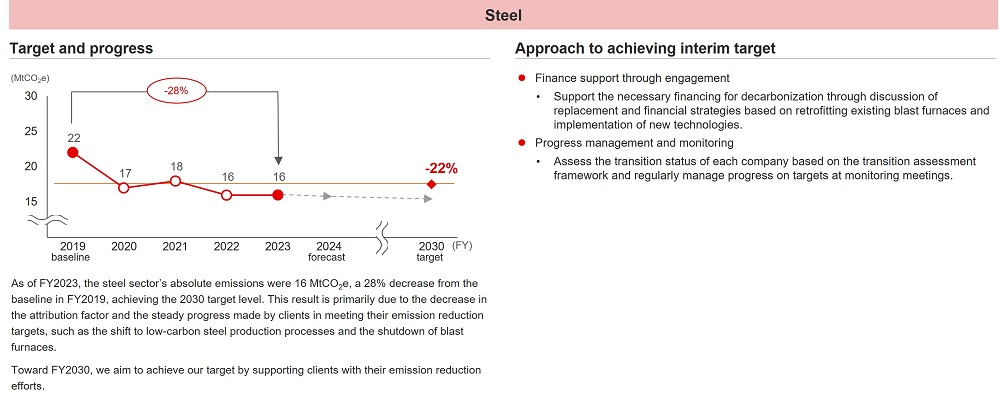

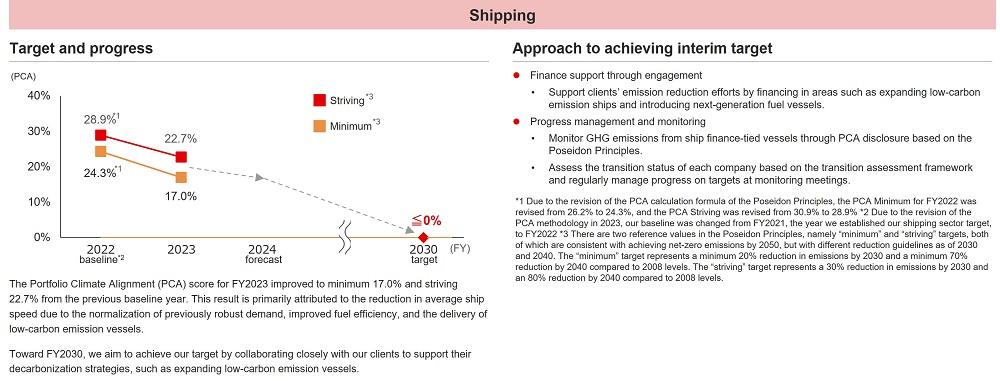

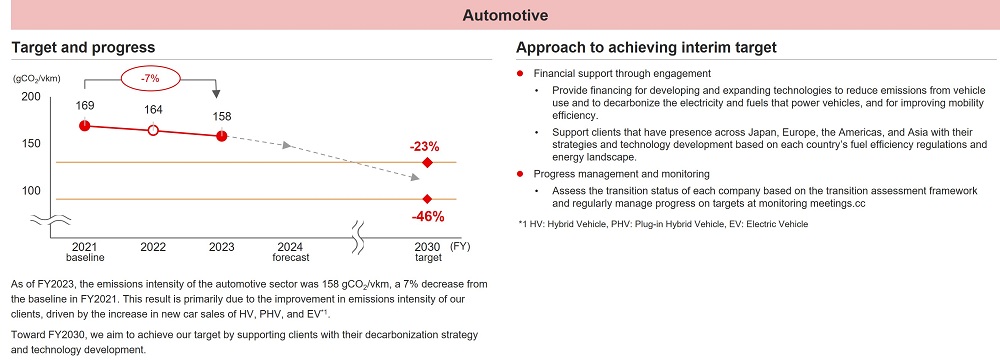

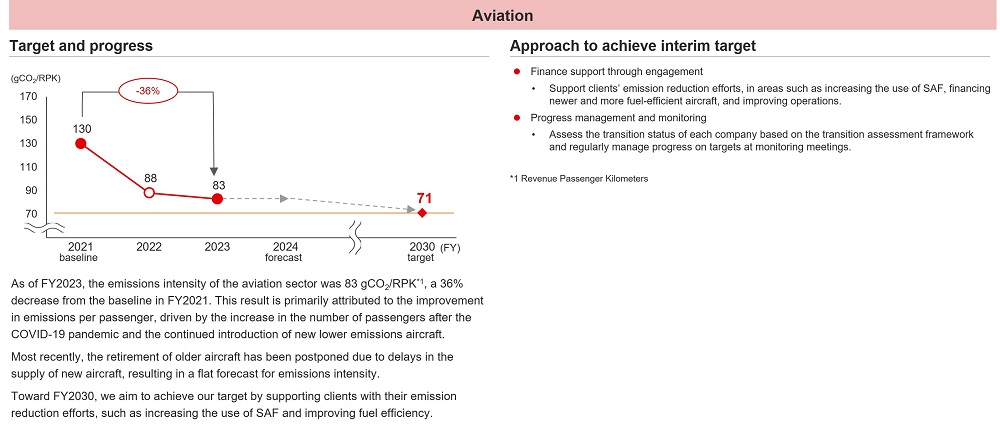

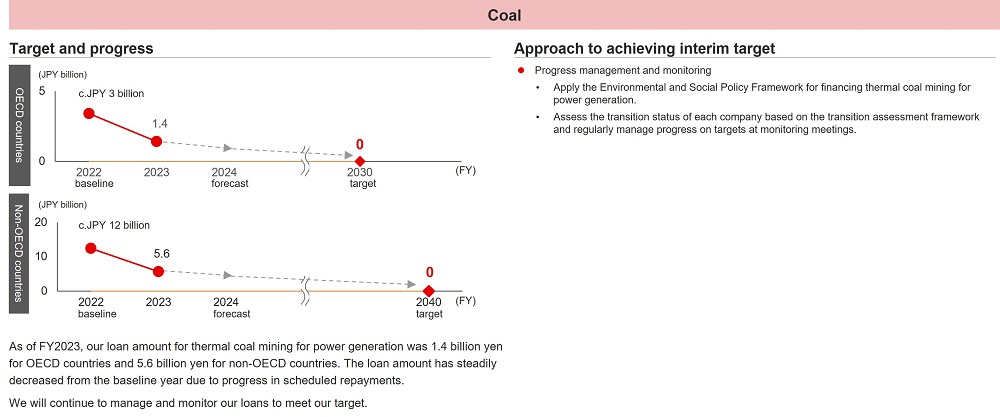

In April 2022, we set interim targets for 2030 at levels aligned with the Paris Agreement, and in April 2024, we added new target sectors. We recognize that the processes for achieving these targets vary depending on the characteristics of each region and business. We are also aware that our business is greatly affected by geopolitical risks and other factors, so we will share issues that we find through engagement (dialogue) with customers and support them to help resolve these issues.

Innovations which are still in the conceptual stage is another indispensable element for the world to achieve decarbonization. We believe that there is a gap between the real world and the goal that is yet to be materialized.

Therefore, our aspiration is to further contribute to the changes where the world advances more towards decarbonization by developing research on new technologies for implementation.

To reflect our stance mentioned above, we have set ranged interim targets in order to work together with our stakeholders to achieve net zero GHG emissions by 2050.

Four Approaches to Setting Interim Targets

We have adopted the following four approaches to setting the interim target.

Going forward, we will reflect the changes in the IEA (International Energy Agency) scenario and various guidelines, as well as the increase in the quality of data disclosed by our customers, as appropriate.

Science-Based

Following the NZBA Guideline, MUFG ensures that the interim target for 2030 is scientifically “well below 2˚C, preferably to 1.5˚C,” as agreed in the Paris Agreement.

As a benchmark for 1.5°C, we refer to scientific scenarios published by IEA and others.

Data Quality

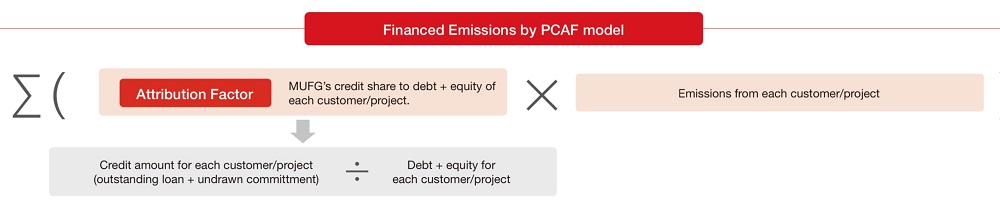

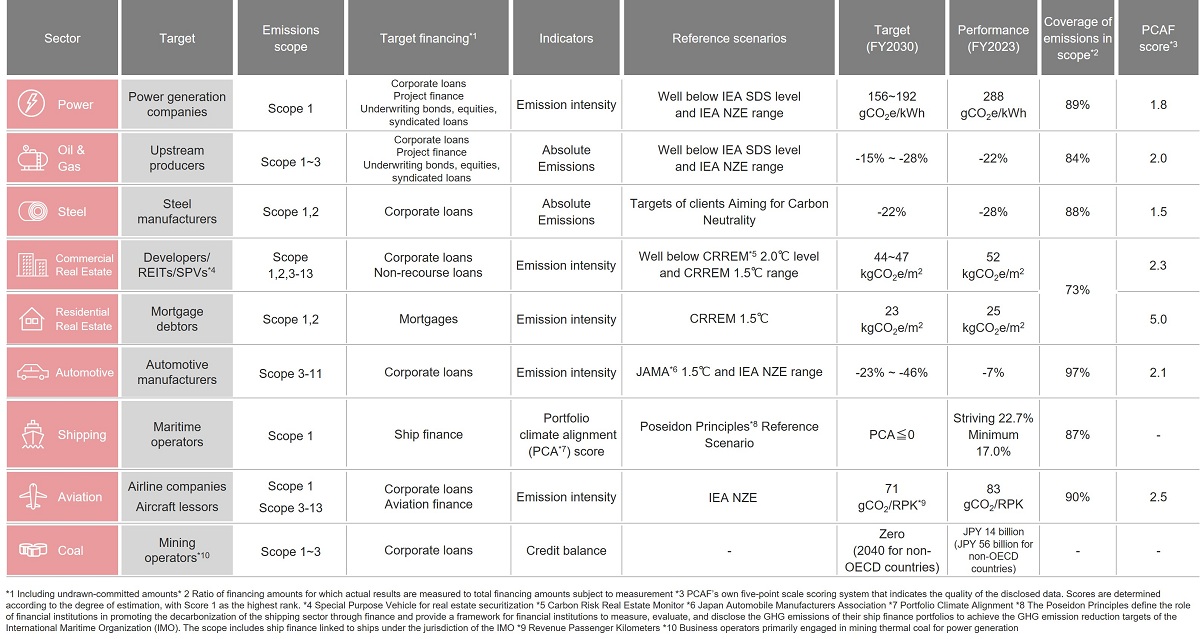

We use the best available data to set targets. However, there are limits to the amount and quality of data currently available, so we use the PCAF data quality score to check the quality of emissions data disclosed by MUFG.

When data is updated or new data is disclosed, improvements in accuracy and quality will be reflected. MUFG will also contribute to improving data accuracy by being highly transparent when disclosing information.

Highly Standardized and Transparent

MUFG believes that targets should be set from a global perspective using widely accepted and transparent methods. We collect insights from various initiatives and reflect them in the targets we set.

We proceed with target setting, incorporating guidelines and rules developed by NZBA, PCAF, PACTA, and SBTi etc., as well as the outcomes of the global working groups which we participate in.

Sector-Specific

Pathways and the methods to achieve carbon neutrality vary by sector, so for each sector we take into consideration the characteristics of the business, the guidelines and the targets set by each customer.

By taking this approach, MUFG will identify issues in each sector and support customers’ efforts for achieving carbon neutrality.

Reducing Emissions from Our Financed Portfolio

Approaches by Sector

Capital Investment Expansion and Financing Opportunities

Demand for Capital Investment is Expected to Rise as a Result of the Acceleration of Net Zero Initiatives in Various Industries

According to estimates by the Ministry of Economy, Trade and Industry, Japan is aiming to mobilize over 150 trillion yen in funds from public and private investment. Private-sector investment will be attracted by implementing a combination of appropriate regulations and support measures, tailored to the business risks and environments of each sector.

In addition to Green Bonds and Green Loans to underpin investment plans, support for transition innovation in industries will also become a significant business opportunity for financial institutions.

| Overall | Scale | Scope |

|---|---|---|

150 trillion yen

Total public and private investment from 2023 to 2032 |

Approximately 60 trillion yen~ Promotion of non-fossil energy sources |

Mass introduction of renewable energy Nuclear power (research and development of innovative reactors, etc.) Hydrogen, ammonia, etc. |

Approximately 80 trillion yen~ Promotion of the transformation of the industrial structure and full-scale energy conservation through integrated supply and demand |

Energy conservation and fuel-switching in manufacturing (e.g., steel, chemicals, cement, paper, automobiles) Digital investment aimed at decarbonization Establishment of the storage battery industry Structural transformation of the shipping and aviation industries Next-generation automobiles Housing, buildings, etc. |

|

Approximately 10 trillion yen~ Resource circulation, carbon sequestration technologies, etc. |

Resource Circulation Industry Bio Manufacturing CCS etc. |

- Source: Prepared by MUFG from materials released by the Ministry of Economy, Trade and Industry

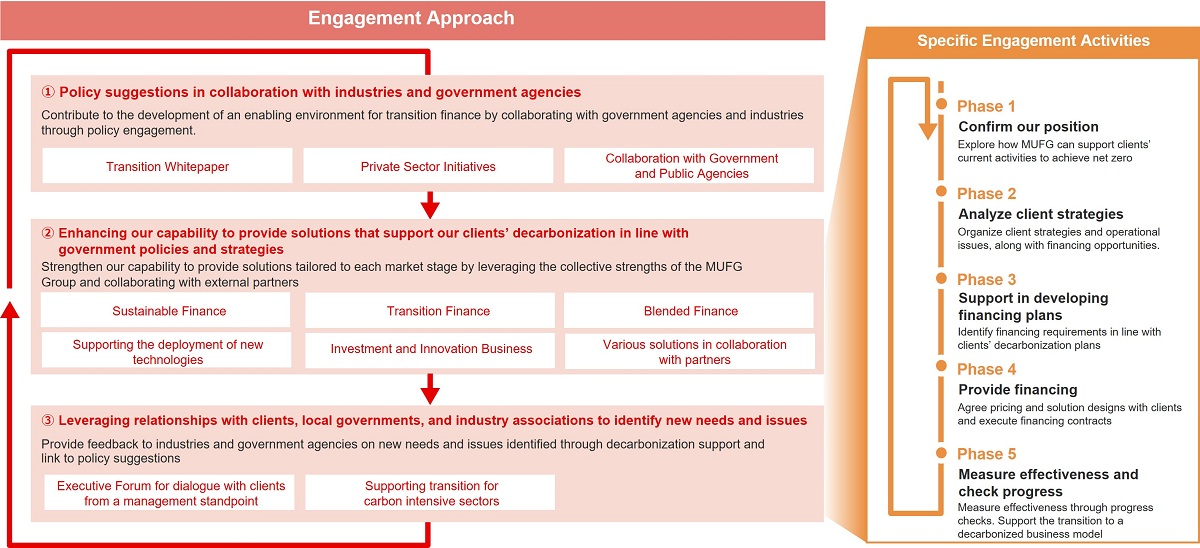

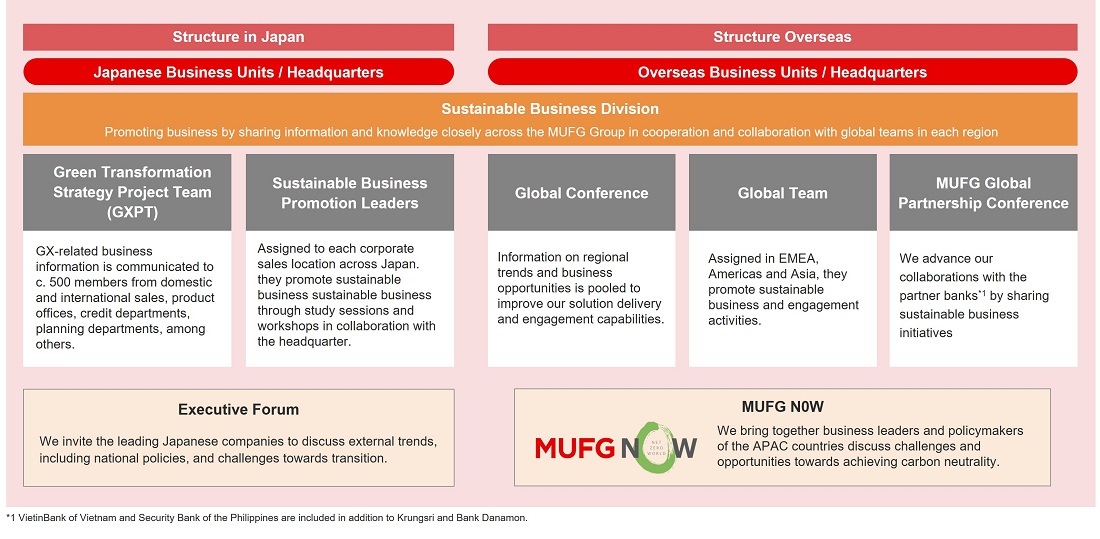

Engagement Approach

Client Engagement Structure

Financing Support

- The main financial institution that plays a central role in organizing each loan

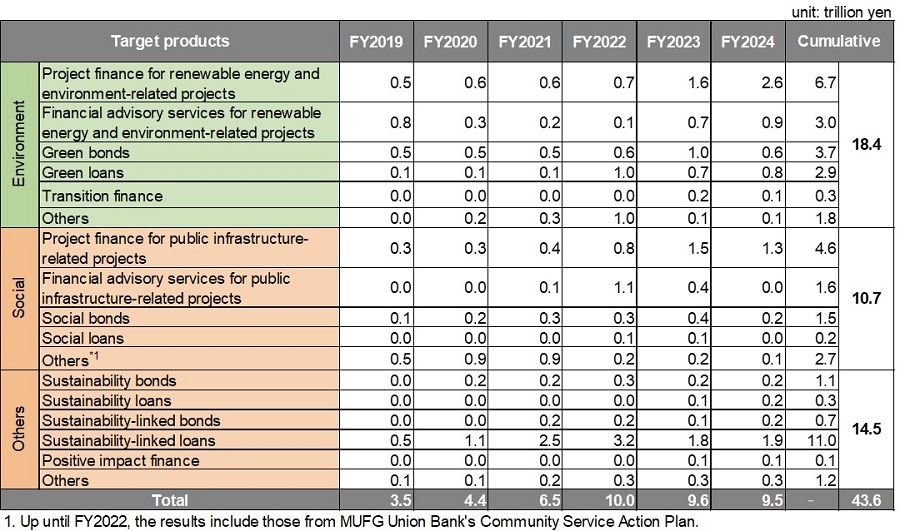

Financing Support: Sustainable Finance

Products and Services that Support the Promotion of Our Customers

Investment and Innovation Projects

- A general term for technologies addressing climate change issues

Sustainable Business Investment Strategy

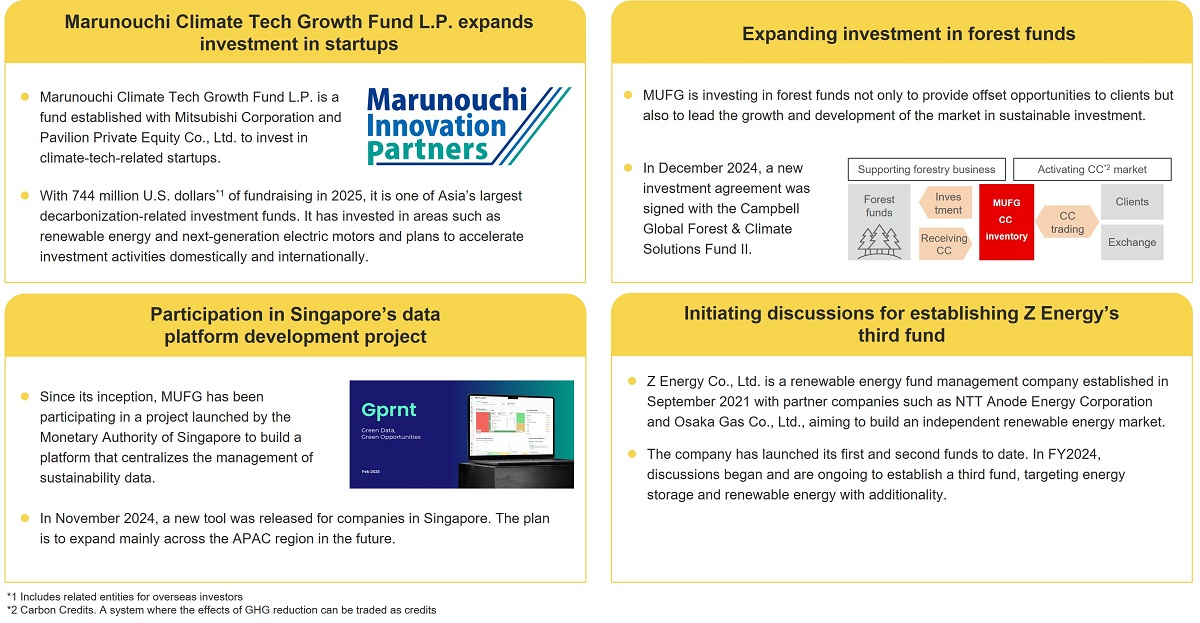

Under our Sustainable Business Investment Strategy (hereinafter “the Investment Strategy”), we invest in funds that contribute to solving environmental and social issues. Through the Investment Strategy, we seek to acquire knowledge and explore new business opportunities. In addition, we aim to solve issues through our fund investment activities by creating positive impacts and innovation, and nurturing of new industries.

Generally, companies that engage in financing and investment, including banks, consider costs and returns when making investment decisions. For the funds under the Investment Strategy currently set by our bank, we are able to make investment decision taking account of the effect of carbon cost reduction added to the investment returns, in addition to the effects of the investment itself, through converting the reduced carbon cost, calculated by multiplying the reduction amount by the internal carbon pricing(note), into revenue adjustments, in respect of the investments with disclosed impacts, especially those expected to reduce CO2 emissions.

Based on this Investment Strategy, we have made seven investments in advanced funds that incorporate impact investment mechanisms into their management processes and conduct impact evaluations. As a result, our bank's share of the investment is expected to generate an impact (CO2 reduction effect) of approximately 144,000 tons annually. The internal carbon pricing used in this investment decision was USD 40/tCO2 (as of the fiscal year 2024). By incorporating environmental impact into investment and financing decisions, in addition to risk and return, we are conducting equity investments. We aim to accumulate know-how and consider investments based on the international direction and development status of impact evaluation methods, to capture and disclose a broader range of environmental and social impacts in our business (investment and financing).

- This concept is used by organizations to independently price their own CO2 emissions and to reduce the carbon footprint of their corporate activities. It is used mainly by business corporations for investment decisions.

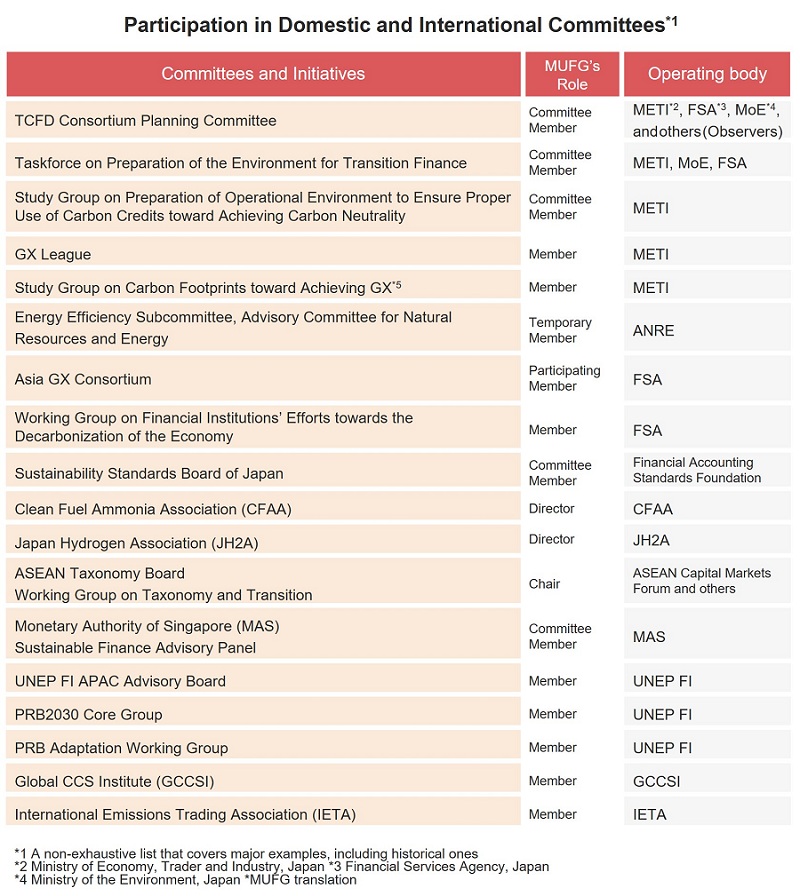

Contributions to Initiatives in Japan and Internationally, etc.

Our Approach to Support Transition

How We Define Our Role in Achieving Carbon Neutrality

MUFG believes that financial institutions can achieve carbon neutrality through realizing clients’ carbon neutrality, in other words decarbonizing the real economy. To achieve decarbonization in the real economy, it is more important for financial institutions to support decarbonization of the real economy including carbon intensive sectors, rather than focusing on greening their balance sheets (also the so-called “paper decarbonization”). MUFG believes that such support for decarbonization is the key purpose of transition finance.

The decarbonization of the real-economy requires development and implementation of transition strategy which reflects regional characteristics, industry structure and relative strength, inter-dependency among industries, and differences in energy mix. Japan and Asia’s unique challenges include transition timelines and pathways being different from those of Europe and the United States because Japan and Asia are still highly dependent on fossil fuels, coal-fired plants in this region are relatively young, and potential to scale up renewable energy is limited at this moment. Also, it is crucial to balance the economic growth and decarbonization in Asia where energy demand is expected to continue to increase in the coming years. As a global leading financial institution with an extensive footprint across Asia and Japan, we believe it is important to facilitate a whole-of-economy transition in a responsible way by engaging with broad stakeholders, and acknowledge as well as respect regional, sectoral or individual client’s pathways.

A transition implies a major overhaul of the whole-of-economy, and therefore requires significant amount of capital mobilization and risk-taking. In doing so, public finance plays a critical role in crowding-in private finance. MUFG is committed to creating an enabling environment where both real-economy and financial institutions can proactively promote transition.

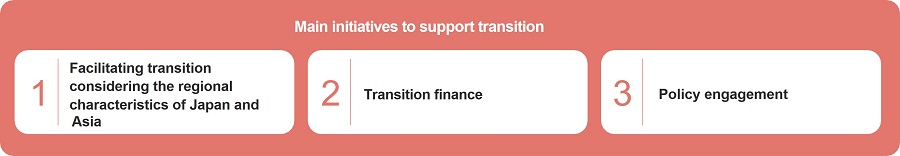

Below three items are the main initiatives for transition support. For details, please see MUFG Climate Report 2025 (P29-P39).

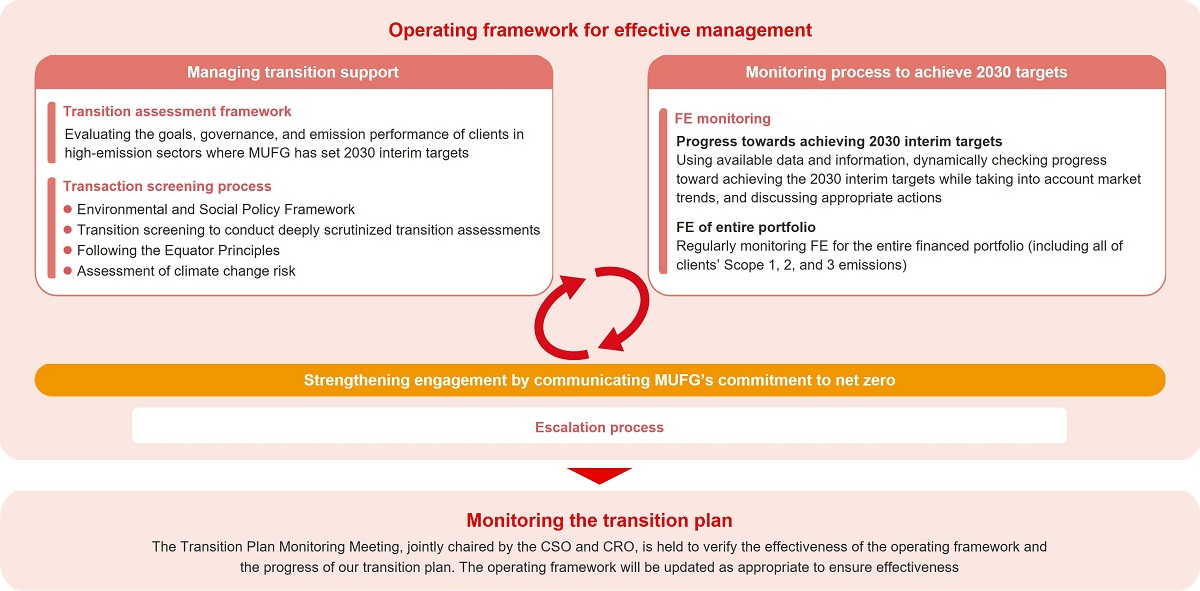

Operating Framework for Effective Management

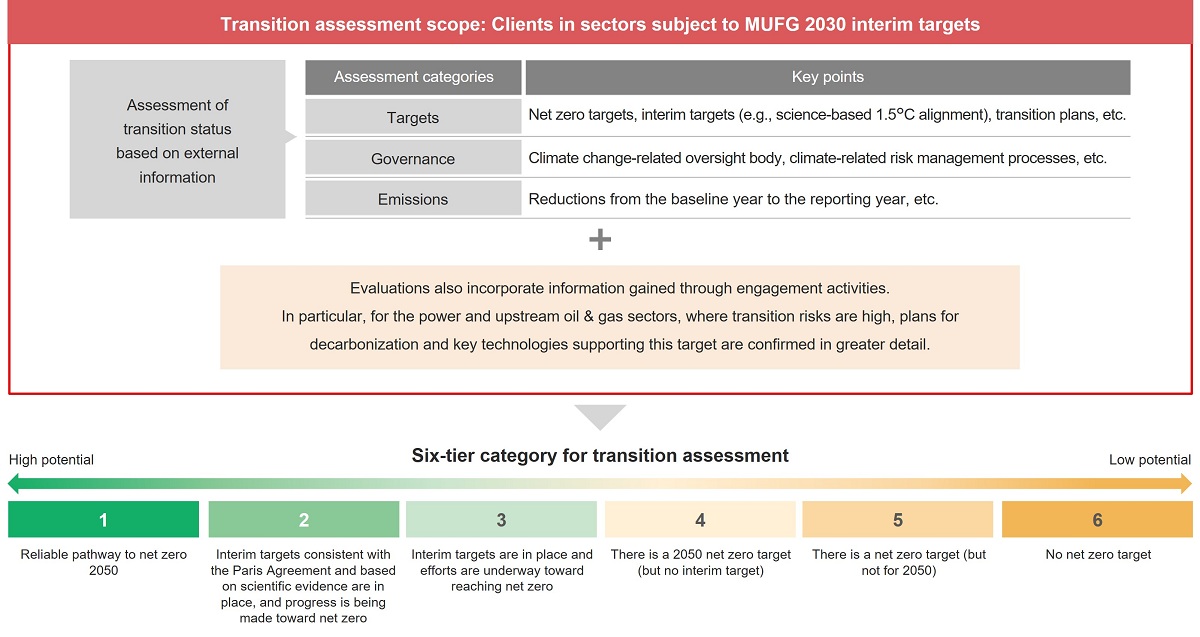

Transition Assessment Framework

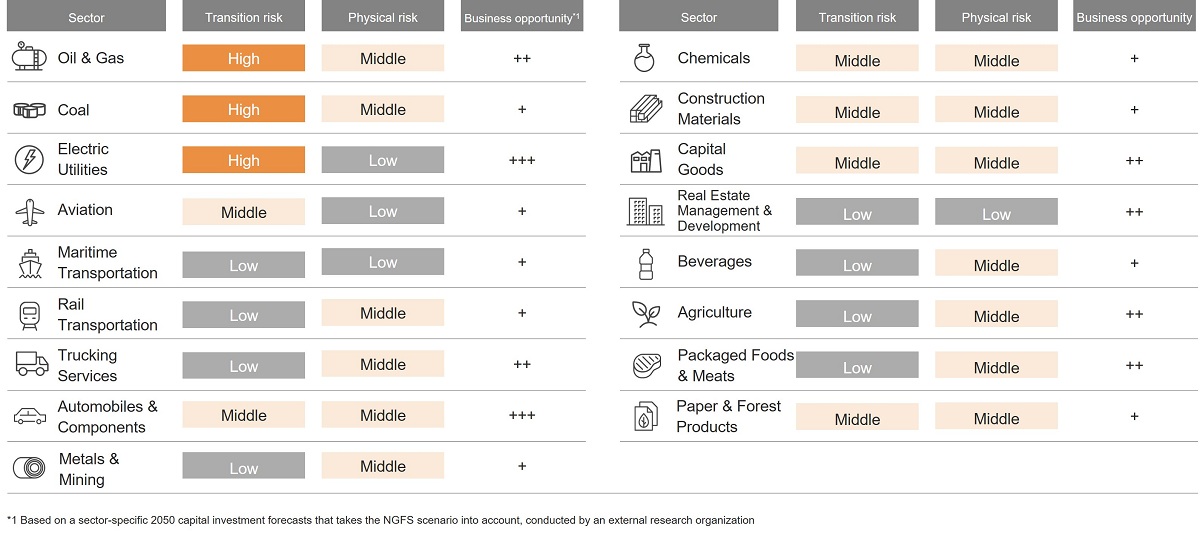

Climate Change Risks -Transition Risks and Physical Risks-

There are two kinds of climate change-related risk. First, there are risks arising in the course of the transition to a decarbonized society, such as stricter regulation and the introduction of decarbonizing technologies (transition risks), and second, there are risks arising from physical damage due to the growing occurrences of climate change-induced natural disasters and abnormal weather (physical risks).

Financial institutions are required to address both risks, which may directly impact their own business activities and indirectly affected due to impacts on clients.

Based on this understanding, we are taking measures to mitigate the impact of business interruptions due to flooding by formulating a Business Continuity Plan (BCP) and other measures, considering physical risks for our assets.

Additionally, for financing that is deemed to have significant transition risks or physical risks, or both, we comprehensively examine our clients' responses towards these risks and proceed with the financing accordingly.

Based on the suggestions of the TCFD, MUFG has summarized the examples of physical and transition risks for each of the major risk categories. The timelines (short, medium, and long term) are also organized by risk category.

Examples of transition risks |

|

|---|---|

| Policies, laws and regulations | ・Increase in the cost due to GHG emissions by the introduction of a carbon tax ・Strengthened obligation to report emissions ・Regulations on existing products and services ・Subject of lawsuits |

| Technology | ・Switch to existing products and services with lower GHG emissions ・Setback in the investment in new technologies ・Cost of transition to low emission technologies |

| Market |

・Changes in customer behavior ・Uncertainty in market signals ・Raw material price hike |

| Reputation | ・Changes in consumer preferences ・Narrowing of sectors ・Increased stakeholder interest and negative feedback to stakeholders |

Examples of physical risks |

|

|---|---|

| Acute | ・Increased severity of extreme weather events, such as typhoons and floods |

| Chronic | ・Changes in precipitation patterns and extreme fluctuations in weather patterns ・Increase of average temperature ・Sea level rise |

Examples of Impacts of Transition Risks and Physical Risks

MUFG has organized examples of impact (potential risk scenarios) of transition risks and physical risks arising from climate change in each major risk category, based on our recognition that these risks may affect MUFG's entire value chain.

Risks are classified mainly around the following six categories. In the future, the classification of the risks and examples will be reviewed in response to changes in the environment.

■ Example of Transition and Physical Risks

Risk categories |

Examples of transition risk | Examples of physical risk | Time frame(note) |

|---|---|---|---|

| Credit risk | ・Our corporate clients’ business activities and financial positions may be negatively affected if they cannot deal with government policies, regulatory requirements, customer requests or evolving trends in technological development. | ・Extreme weather may cause direct damage to assets held by our corporate clients and/or have a negative spillover effect on their business activities and financial positions by indirectly impacting their supply chains. | Short-to long-term |

| Market risk | ・The transition to a decarbonized society may negatively impact certain business sectors, making the value of relevant securities held by MUFG and/or financial instruments deriving from them highly volatile. | ・The impact of extreme weather may induce market turmoil and make the value of securities held by MUFG highly volatile. ・The value of securities held by MUFG may become volatile due to changes in market participants’ medium- to long-term outlook on the impact of extreme weather and their expectations regarding countermeasures against the phenomenon. |

Short-to long-term |

| Liquidity risk | ・If its credit ratings deteriorate due to such factors as delays in its response to transition risks, MUFG may face limitations on methods for funding from the market and thus growth in risks associated with fundraising. | ・Corporate clients suffering damage from extreme weather may choose to withdraw their deposits or utilize commitment lines to secure funds for reconstruction, leading to a growing volume of cash outflows from MUFG. | Short-to long-term |

| Operational risk | ・Spending on capital investment may grow due to the need for measures aimed at reducing CO2 emissions and enhancing business continuity capabilities. | ・Extreme weather may cause damage to MUFG’s headquarters, branches and/or data centers and lead to the disruption of their operations. | Short-to long-term |

| Reputation risk | ・ If MUFG’s plans and efforts to realize carbon neutrality are deemed inappropriate or insufficient by external stakeholders, it may suffer from reputational damage. ・MUFG may suffer from reputational damage and/or deterioration in its status as an employer due to the continuation of relationships with business partners who doesn’t give enough consideration to environmental concerns or delays in its transition to decarbonization. |

・If MUFG’s efforts to support customers and communities affected by extreme weather are deemed insufficient, it may suffer from reputational damage or a resulting disruption of operations. | Short-to long-term |

| Strategic risk | ・If MUFG fails to live up to its public commitment to support the transition to a decarbonized society, its capabilities for strategic execution may be negatively affected by a deterioration in its reputation. | ・MUFG may fail to meet the goals of its strategies and plans if it fails to properly factor in the direct impact of extreme weather in the course of long-term management planning. | Medium-to long-term |

- Short-term: less than one year; medium-term: one to five years; long-term: more than five years

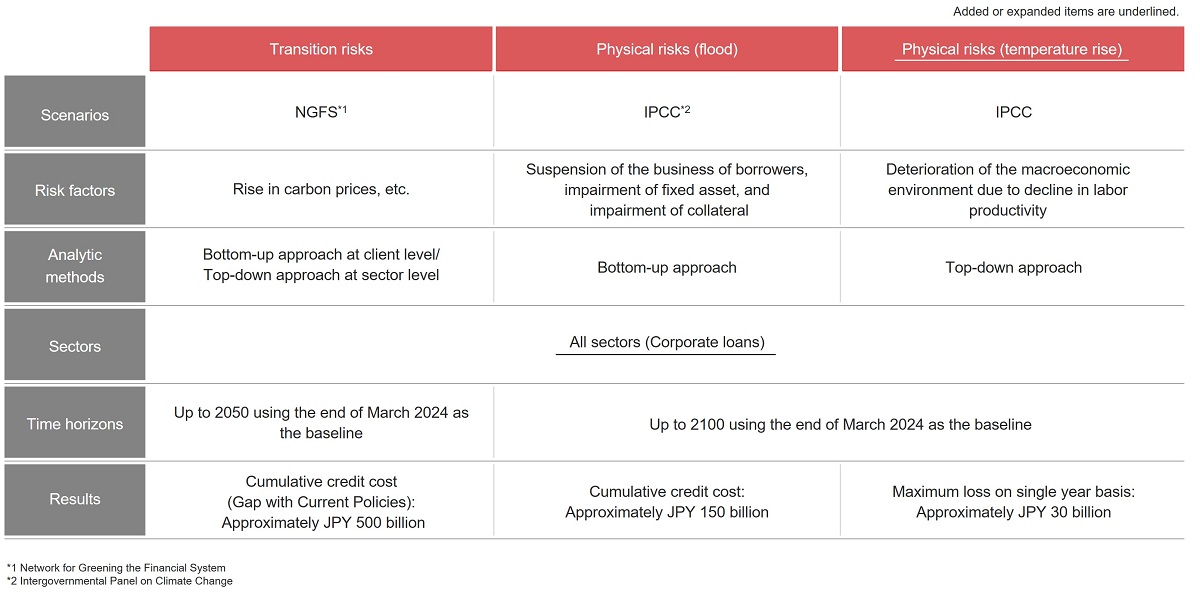

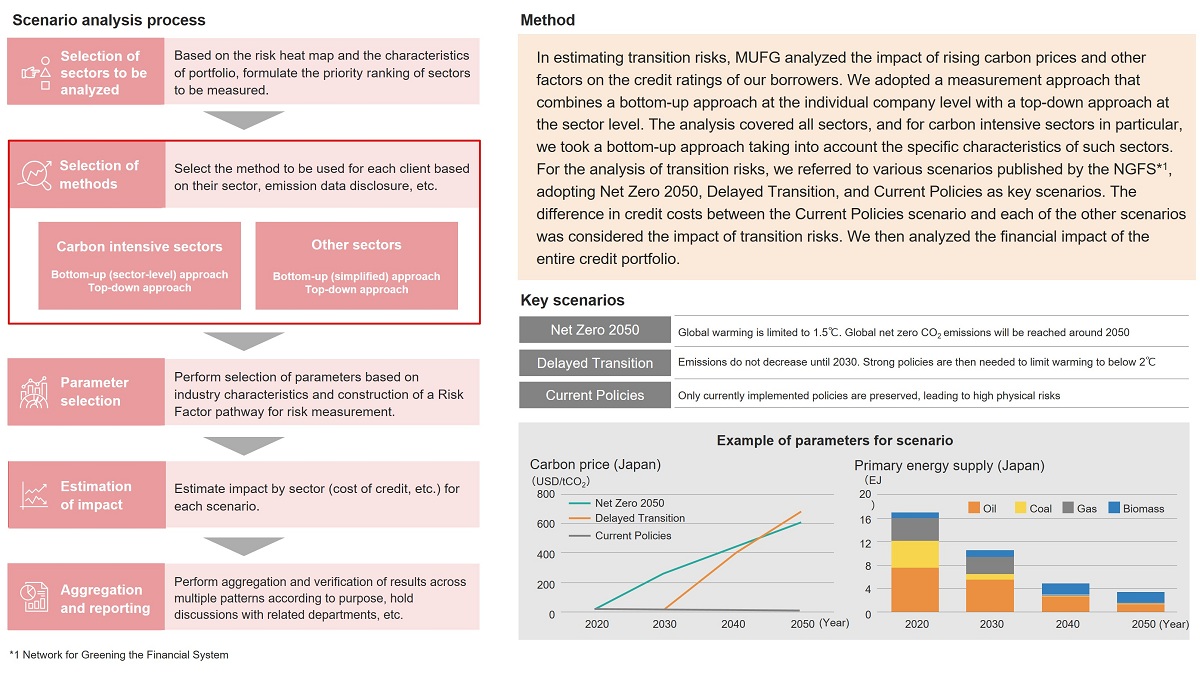

Scenario Analysis

Transition risks

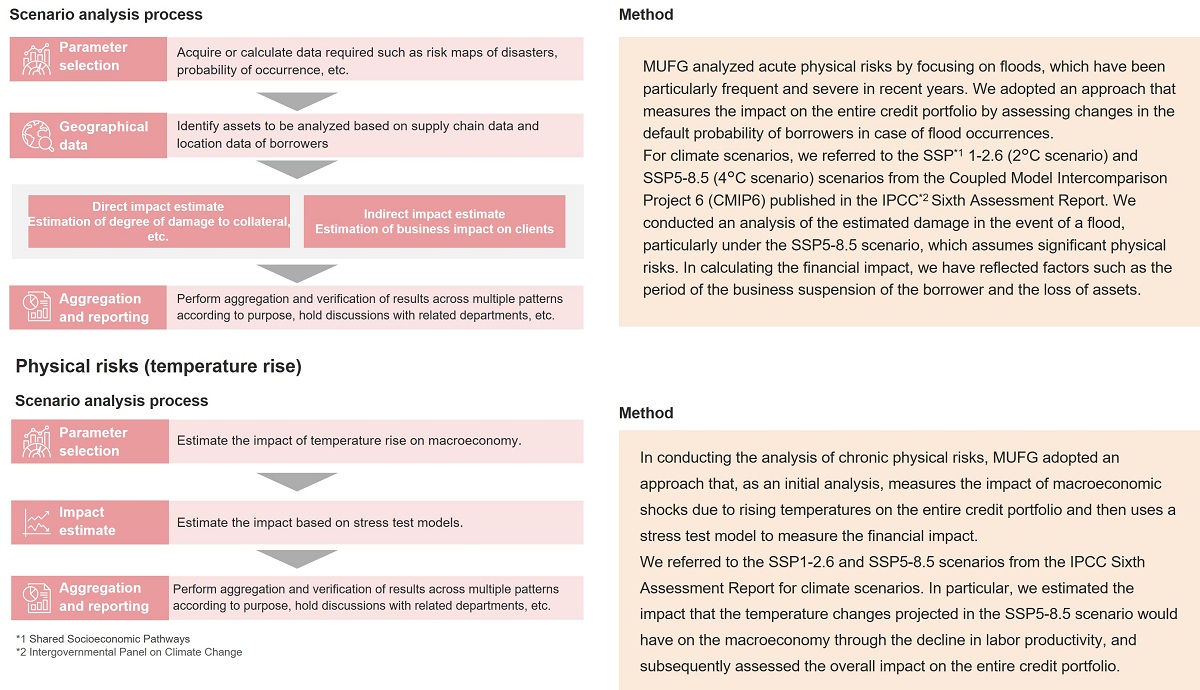

Physical risks (flood)

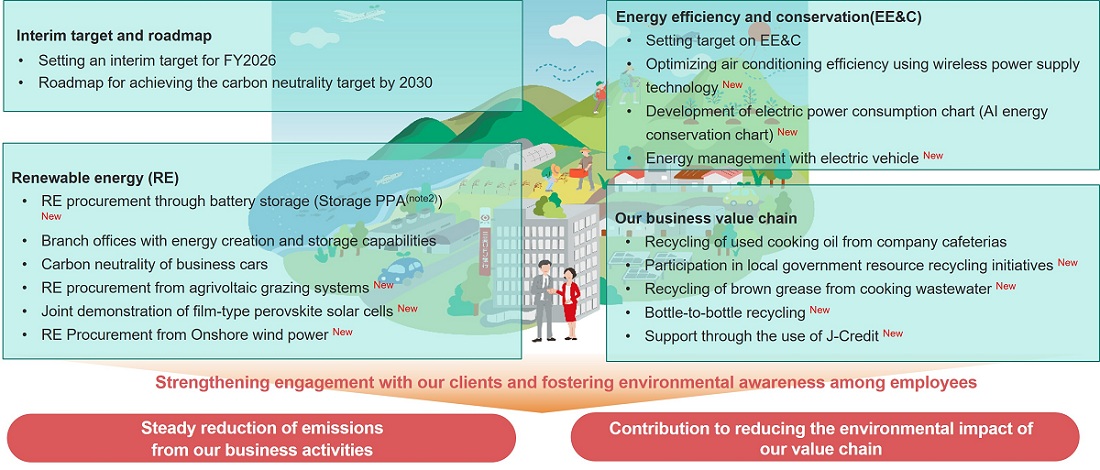

Net Zero GHG Emissions from Our Own Operations

Approach to Reducing Emissions from Own Operations

- Refer to the website “SUSTAINABILITY AT WORK” for an overview of the initiatives (in Japanese).

- Power Purchase Agreement

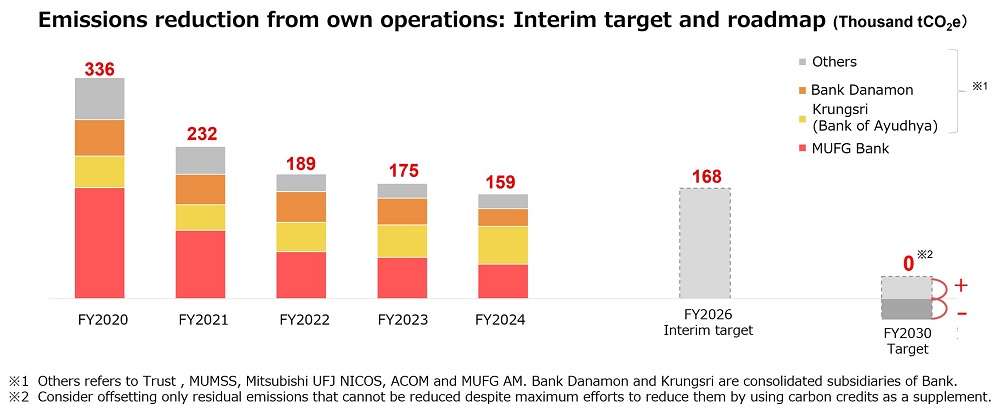

Interim Target and Roadmap

In FY2024, GHG emissions was 159 thousand tCO2e, which is a 16 thousand tCO2e (9%) decrease from the previous year (175 thousand tCO2e). This results in achieving our FY2026 interim target (50% reduction from FY2020) ahead of schedule.

To achieve our remaining targets, we will continue to promote energy efficiency & conservation, convert electricity contracted by other companies to renewable energy, achieve carbon neutrality with our business vehicles, and utilize of insights gained from proactive decarbonization efforts in the Chubu region in Japan. In addition, we will further contribute to reducing our environmental impact by strengthening procurement of renewable electricity with additionality(note).

- Additionality refers to the effect of encouraging an increase in new renewable energy facilities.