Metrics and Targets Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

a.Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process. b.Disclose Scope1, Scope2 and, if appropriate, Scope3 greenhouse gas (GHG) emissions and the related risks. c.Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets. |

|---|

Key Metrics and Targets

- Based on the MUFG Environmental and Social Policy Framework, projects that contribute to initiatives for transitioning to a decarbonized society are excluded.

Other disclosure items:

・Measurement of financed emissions, by sector recommended for disclosure by TCFD recommendations

・Status of carbon-related assets (credit amounts)

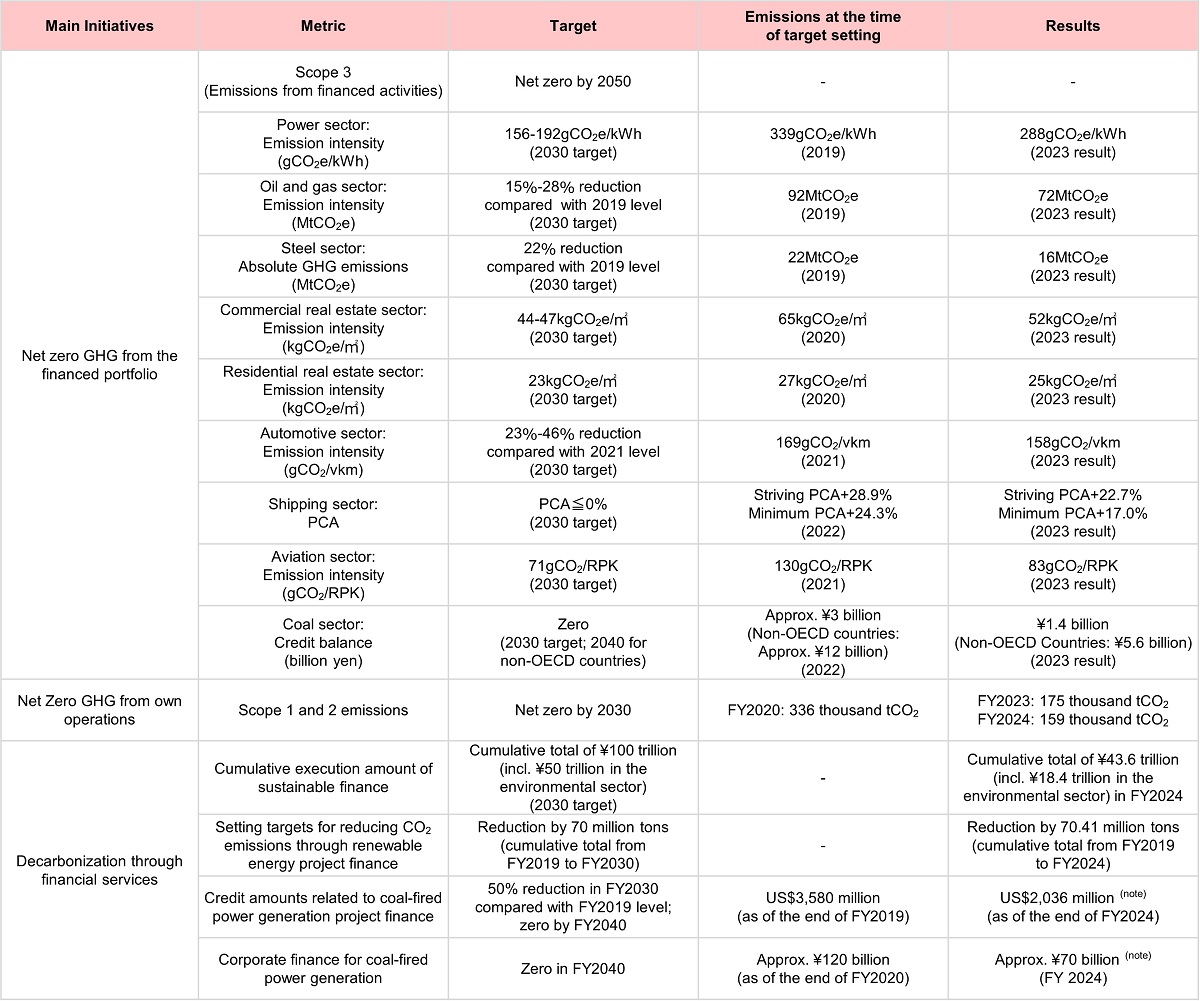

Net Zero GHG Emissions from the Financed Portfolio

| Metric | Absolute emissions (oil and gas, steel sectors) Emission intensity (power, real estate, automotive, aviation sectors) PCA (shipping sector) Credit outstanding (coal sector) |

|---|---|

| Target | Power sector: 156-192gCO2e/kWh (target for 2030) Oil and gas sector: 15%-28% decrease compared with 2019 level (target for 2030) Real estate sector ・Commercial: 44-47kgCO2e/㎡ (target for 2030) ・Residential: 23kgCO2e/㎡(target for 2030) Steel sector: 22% decrease compared with 2019 level (target for 2030) Shipping sector: PCA≦0% (target for 2030) Automotive sector: 23%-46% decrease compared with 2021 level (target for 2030) Aviation sector: 71gCO2/RPK (target for 2030) Coal sector: zero (target for 2030. Non-OECD countries: 2040) |

| Emissions at the time of target setting | Power sector: 339gCO2e/kWh (2019) Oil and gas sector: 92MtCO2e (2019) Real estate sector ・Commercial: 65kgCO2e/㎡ (2020) ・Residential: 27kgCO2e/㎡ (2020) Steel sector: 22MtCO2e (2019) Shipping sector: PCA 24.3% (Minimum), PCA 28.9% (Striving) (2022) Automotive sector: 169gCO2/vkm (2021) Aviation sector: 130gCO2/RPK (2021) Coal sector: Approx. 3 billion yen (2022. Non-OECD countries: Approx.12 billion yen) |

| Results | Power sector: 288gCO2e/kWh (2023) Oil and gas sector: 72MtCO2e (2023) Real estate sector ・Commercial: 52gCO2e/㎡(2023) ・Residential: 25gCO2e/㎡(2023) Steel sector: 16MtCO2e (2023) Shipping sector: PCA 17.0% (Minimum), PCA 22.7% (Striving) (2023) Automotive sector: 158gCO2/vkm (2023) Aviation sector: 83gCO2/RPK (2023) Coal sector: 1.4 billion yen (2023. Non-OECD countries: 5.6 billion yen) |

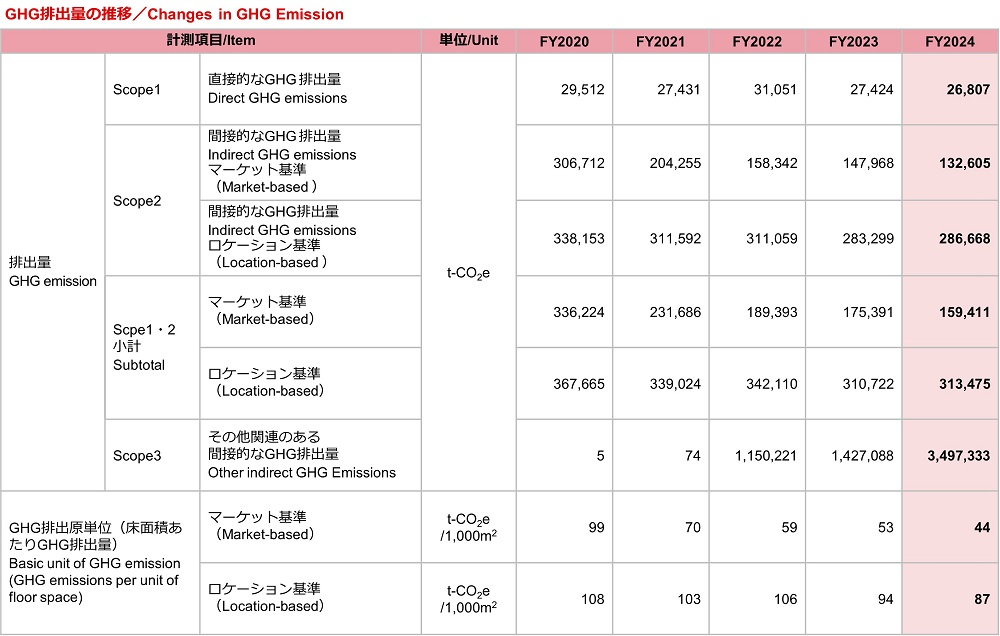

Net Zero GHG Emissions from Own Operations (Scope 1 and 2 emissions from MUFG)

Global Group-Wide

| Metric | Scope 1 and 2 emissions |

|---|---|

| Target | Net-zero GHG emissions from own operations in 2030 |

| Results(note1,2) | FY2023: Scope1+2 totaled 175,391tCO2 FY2024: Scope1+2 totaled 159,411tCO2 (Completion of conversion to 100% renewable energy for in-house contracted power at all MUFG consolidated subsidiaries in Japan in FY2022) |

- Scope of aggregation: MUFG, MUFG Bank, Ltd., Mitsubishi UFJ Trust and Banking Corporation, Mitsubishi UFJ Morgan Stanley Securities Co., Ltd., Mitsubishi UFJ NICOS Co., Ltd., ACOM, Mitsubishi UFJ Asset Management Co., Ltd., and consolidated subsidiaries.

- Electricity is calculated based on market standards.

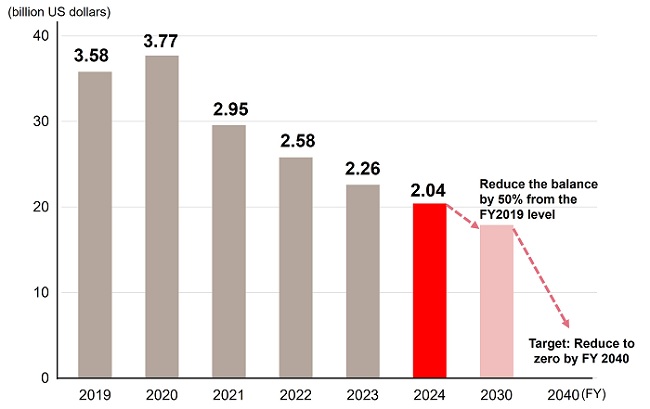

Credit Amounts Related to Coal -Fired Power Generation -Project Finance-

| Metric | Project finance for coal-fired power plants (balance of lending) |

|---|---|

| Target | Reduce the balance by 50% by FY2030 from the FY2019 level, and reduce it zero by FY2040(note) |

| Emissions at the time of target setting | US$3,580 million (as of the end of FY2019) |

| Results | US$2,036 million (as of the end of FY2024) |

- Projects that contribute to the transition toward a decarbonized society are exceptional following the MUFG Environmental

and Social Policy Framework.

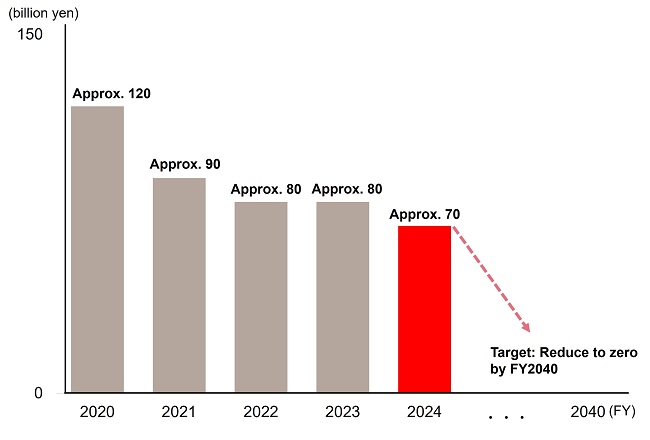

Credit Amounts Related to Coal-Fired Power Generation -Corporate Finance -

| Metric | Corporate finance for coal-fired power plants (credit amounts) |

|---|---|

| Target | Reduce the credit balance to zero by FY2040 (note) |

| Emissions at the time of target setting | Approx. 120 billion yen (as of the end of FY2020) |

| Results | Approx. 70 billion yen (as of the end of FY2024) |

In April 2022, we set a target to reduce to zero the balance of financing to coal-fired power generation projects by FY2040.

We will continue to promote investments and loans for green, transition, and innovation through engagement (dialogue) aimed to help customers decarbonize who are operating coal-fired thermal power generation.

- Projects that contribute to the transition toward a decarbonized society are exceptional following the MUFG Environmental and Social Policy Framework.

Sustainable Finance Target and Progress

| Metric | Cumulative execution amount of sustainable finance |

|---|---|

| Target | Cumulative total of 100 trillion yen (including 50 trillion yen in the environmental sector) in FY2030 |

| Results | Cumulative total of 43.6 trillion yen, including 18.4 trillion yen in the environmental sector (as of the end of FY2024) |

Contribution to CO2 Reduction (impact) through Renewable Energy Project Finance

| Metric | Contribution to CO2 reduction (impact) through renewable energy project financing |

|---|---|

| Target | Reduction by 70 million tons (cumulative from FY2019 to FY2030) |

| Results | Reduction by 70.41 million tons (cumulative total from FY2019 to FY2024) (note) |

On the other hand, MUFG’s estimated FY2024 result based on PCAF’s methodology option 3 “Fossil fuel mix produced” published in “The Global GHG Accounting and Reporting Standard for the Financial Industry Part A – Financed Emissions 2nd Edition (2022)” was 13.04 million tons.

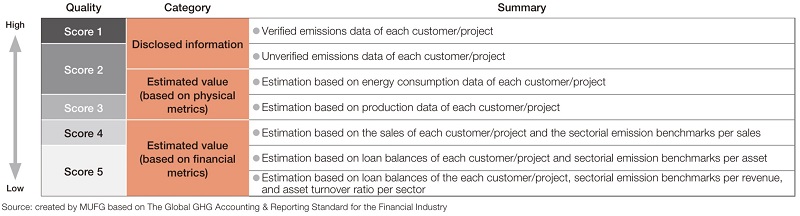

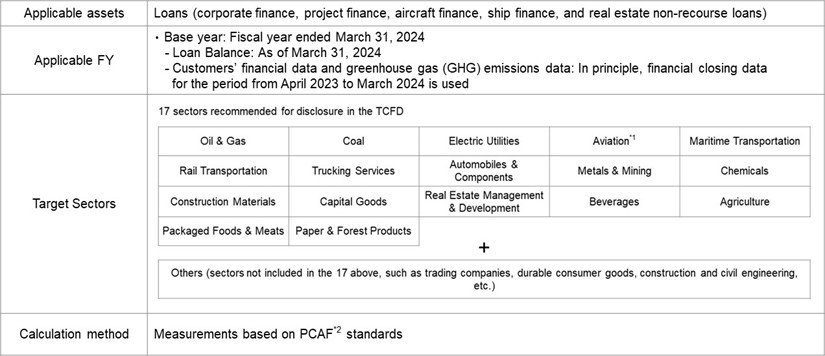

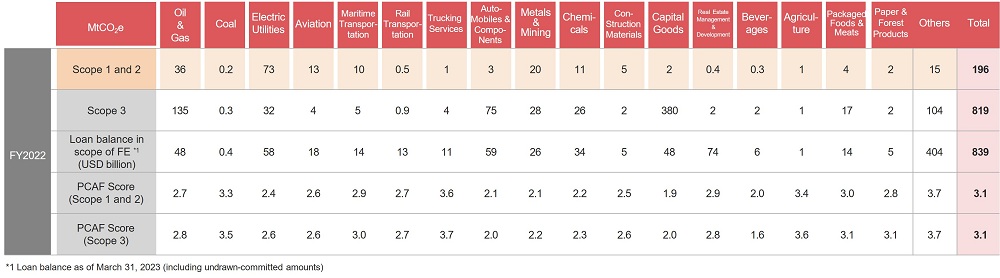

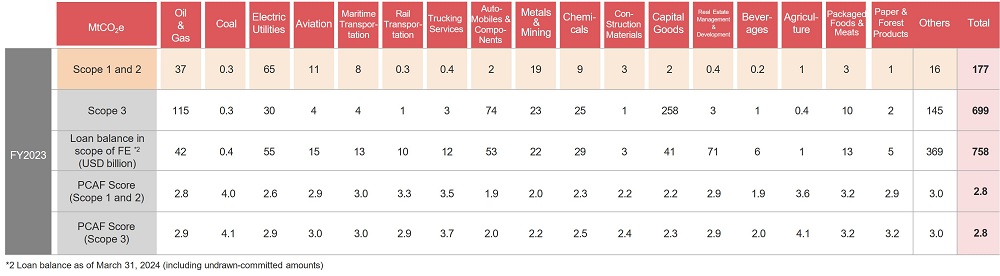

Measurement of Financed Emission (FE) by Sector in TCFD Recommendations for Disclosure

FE measurement was conducted for corporate finance, project finance, aircraft finance, ship finance, and real estate non-recourse loans, using the PCAF methodology, for each of the sectors recommended for disclosure in the TCFD (based on March 31, 2024).

Going forward, FE measurement results may change significantly as the availability and accuracy of data improves due to expanded disclosure by customers and advances in estimation methodologies. In FE measurement, we perform estimation using the emission factors in the IEA World Energy Outlook and the emission intensity (emissions per unit of revenue and per amount of loans) published in the PCAF database, in addition to customers' disclosed data. See details on assumptions and measurement methods, see here.

【Overview of Measurement】

- The aviation sector includes both passenger and freight transportation.

- The Partnership for Carbon Accounting Financials (PCAF) is an initiative that was launched in 2015 with the goal of standardizing the measurement and disclosure of financed GHG emissions.

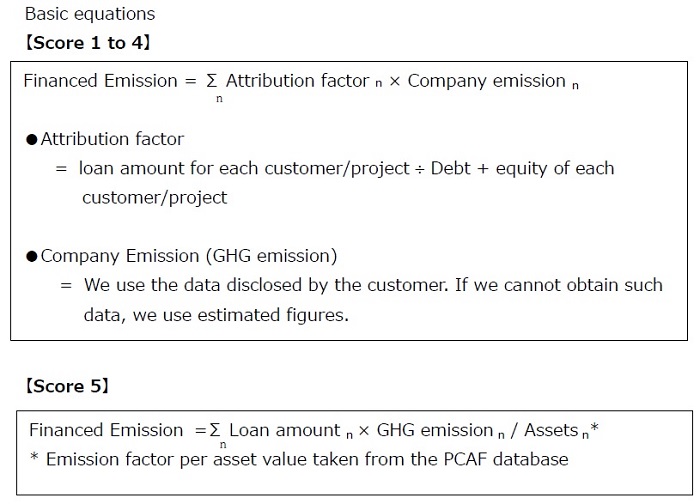

【Basic Calculation Formula Based on PCAF Standards】

(Reference)

Financed emissions (FE) in our portfolio Sector-specific Details

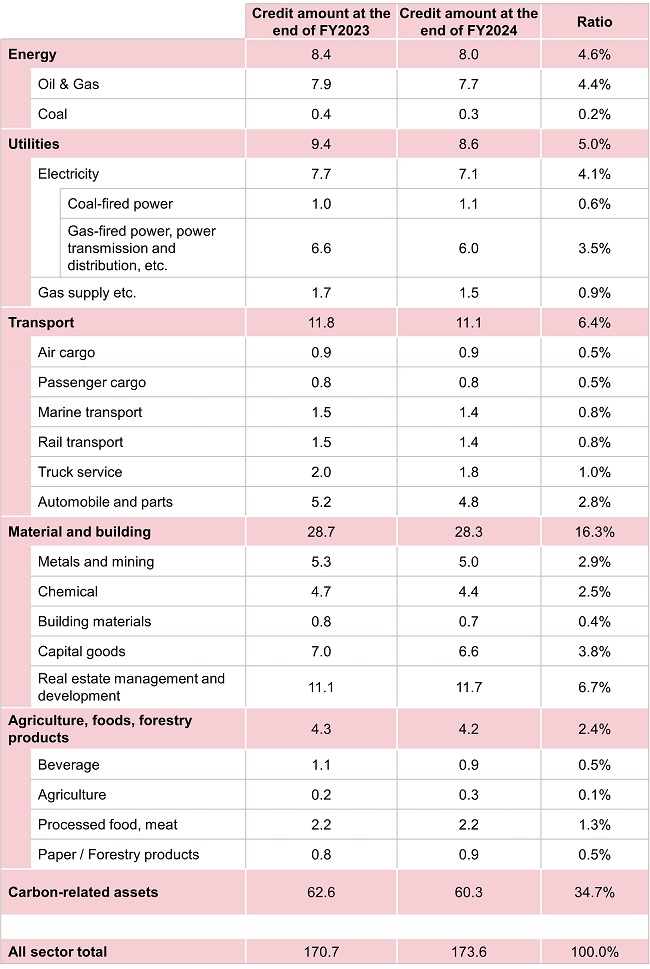

Status of Carbon-Related Assets (Credit Amount)

| Metric | Carbon-Related Assets (Credit Amount) |

|---|

Based on the TCFD's recommendations, the status of credit balance(note1, 2) for carbon-related assets is disclosed in order to quantify the risks related to climate change.

The total amount at the end of FY2024 was 60.3 trillion yen(note3) (Energy: 8.0 trillion yen; Utilities: 8.6 trillion yen; Transportation: 11.1 trillion yen; Materials and Buildings: 28.3 trillion yen; Agriculture, Food and Forest Products: 4.2 trillion yen).

Carbon-Related Assets (Credit Amount)

- Total of loans, trade finance, letter of credit & guarantees and undrawn commitment facility, etc.

- Excluding interbank transactions, credit to government agencies and central banks, etc.

- Based on the revision of the TCFD Recommendations in October 2021, the scope has included energy and utilities transportation, materials and buildings, and agriculture, food, and forest products. Credit to renewable power generation is excluded from credit amount related to the utility sector.

The total includes partner banks (Krungsri (Bank of Ayudhya), and Bank Danamon). Sector classification based on the primary business (largest sales) of the borrower.