Climate Change/TCFD Initiatives as an Asset Manager

Recognition of the External Environment

The Necessity of Climate Change Response

Climate change is an urgent and global-scale environmental issue that has major impacts on our lives, as well as a sustainability issue connected to other environmental and social issues. Accordingly, we believe that initiatives to address climate change are crucial to the business continuity of our customers and investees, and to the enhancement of our corporate value. As an asset manager, we will contribute to a smooth transition to a decarbonized society and to the achievement of a sustainable society through properly grasping the risks and the opportunities that climate change brings, cooperating with our varied stakeholders, and conducting dialogues (engagement activities) with investees.

MUFG Asset Management Initiatives

Launch of MUFG AM Sustainable Investment

In April 2023, MUFG Asset Management

(note) commenced activities under the name

MUFG AM Sustainable Investment (hereinafter MUFG AM Su). With a sustainable future as our aim, we are prioritizing initiatives for solving issues that would have major long-term impacts on our assets under management. Among these, we set out climate change as a key theme in asset management. As one action to address this, we have declared our intent to work toward net zero emissions through participation in the Net Zero Asset Managers (NZAM) initiative, and will aim to transition to a decarbonized society through sustainable investment.

- MUFG Asset Management (hereinafter MUFG AM) is a brand name formed by Mitsubishi UFJ Trust and Banking Corporation, an asset management company of Mitsubishi UFJ Financial Group (hereinafter MUFG), Mitsubishi UFJ Asset Management Co., Ltd., Mitsubishi UFJ Real Estate Asset Management Co., Ltd., Mitsubishi UFJ Asset Management (UK) Ltd., and Mitsubishi UFJ Alternative Investments Co., Ltd.

Approach to Engagement by MUFG AM

MUFG AM Su conducts engagement through three approaches: thematic engagement, collaborative engagement, and public engagement.

In thematic engagement, analysts with abundant management experience and research officers specialized in the area of sustainability conduct engagement with a focus on MUFG AM's four priority themes of climate change, biodiversity, human rights, and health and safety. With regard to the top-priority theme of climate change, we will hold constructive dialogue with 50 companies selected for engagement on the basis of factors including corporate GHG emissions (Scope 1 and 2) and investment amounts.

<Collaborative Engagement>

In collaborative engagement, we conduct engagement with investees by collaborating and cooperating with asset management firms in Japan and overseas through participation in initiatives related to key themes. Specifically, we will advance activities such as IAST APAC and the Access to Nutrition Initiative, with a focus on Climate Action 100+.

In public engagement, we make direct and indirect recommendations to stakeholders in government bodies and financial markets to solve sustainability issues. Through our activities in GFANZ and PCAF in particular, we will capture dynamically changing trends in global finance and take an active involvement in rule-making that promotes transformation.

Participation in Initiatives

On the theme of climate change, our activities include collection of up-to-date information on domestic and overseas trends in sustainability, building of relationships with financial institutions and stakeholders, setting of goals, disclosure of information, and proposal of rules by participating in initiatives including PRI, Climate Action 100+, TCFD, CDP, AIGCC, and NZAM. In measurement of GHG emissions, we will examine the setting of science-based goals and enhance the level of our analyses of risks and opportunities.

Setting Intermediate Targets for NZAM

In November 2021, MUFG AM announced its participation in the global Net Zero Asset Managers (NZAM) initiative by asset management firms, along with its intent to work toward net-zero emissions from investee companies by 2050 as a means of achieving the 1.5℃ target of the Paris Agreement. Our interim target for 2030 covers 55% of assets under management and will reduce GHG emissions per unit of economic intensity (absolute emissions amount (tCO2e) / balance of assets under management) by 50% compared to 2019 level. To achieve net-zero emissions by 2050, we will further strengthen collaborations involving MUFG AM and will promote cross-organizational initiatives focused on MUFG AM Su. We will also undertake the development of investment products aligned with the achievement of net-zero emissions by 2050 and will promote investment that contributes to solving the climate change problem. We will also review our interim targets every two years, and are studying the gradual increase of the target assets ratio until 100% of assets under management are covered.

Responses to TCFD as an Asset Manager

Endorsing TCFD as an asset manager, MUFG AM is advancing initiatives to analyze and evaluate the impacts of climate change on entrusted portfolios and the status of investees' response to climate change. MUFG AM performs disclosure in accordance with the four key elements involved in climate change-related risks and opportunities (governance, strategy, risk management, and metrics and targets), as recommended by TCFD. As an asset manager, the company will contribute to solving the climate change problem and developing a sustainable society by considering the impacts of climate change on investment decisions and by encouraging investees' responses to climate change.

<Links to companies' information disclosure materials>

● Mitsubishi UFJ Trust and Banking Corporation – Responsible Investment Report

● Former Mitsubishi UFJ Asset Management Co., Ltd. – Sustainability Report

● Former MU Investments Co., Ltd. (before October 1, 2023) – Initiatives toward the TCFD Recommendations

Consistency with the Paris Agreement

In measuring GHG emissions, calculation is performed using analytical methods and data collection through S&P. For GHG emissions in our portfolio, by analyzing allowable GHG emissions (carbon budget) consistent with the Paris Agreement together with emissions under MUFG AM's portfolio by 2030, we confirmed that the portfolio falls below the carbon budget and is consistent with the 1.5℃ target. To achieve net-zero emissions in the portfolio, we will monitor investees and work toward the reduction of GHG emissions through engagement.

GHG Emissions-Related Metrics

By analyzing GHG emissions, we confirmed that GHG emissions in MUFG AM's integrated portfolio (note) were 16.83 million tCO2e, and that the portfolio's figures were lower than benchmarks for domestic bonds, domestic stocks, and foreign bonds. The figure for foreign stocks exceeded the benchmark due to relatively large exposure to public utilities within its industry allocation.

GHG Emissions in the Integrated Portfolio of MUFG AM

| |

Total GHG emissions

(Scope 1, 2: million tCO2e)

|

Carbon intensity (economic intensity)

(tCO2e/US$ million)

|

Weighted average carbon intensity

(tCO2e/US$ million)

|

|---|

| Overall |

16.83 |

70.38 |

115.31 |

|---|

GHG Emissions-Related Metrics

- GHG emissions (Total Carbon Emissions): Total GHG emissions related to the portfolio

- Carbon intensity (economic intensity): Total GHG emissions divided by the market value of the portfolio

- Weighted average carbon intensity (WACI): Weighted average of emissions per unit of sales of investee companies, according to composition ratio in the portfolio

GHG Emissions in MUFG AM's Portfolio, by Asset

| |

Total GHG emissions

(Scope 1, 2: million tCO2e)

|

BM

|

Carbon intensity (economic intensity)

(tCO2e/US$ million)

|

BM

|

Weighted average carbon intensity

(tCO2e/US$ million)

|

BM

|

|---|

| Domestic bonds |

1.51 |

89% |

186.34 |

73% |

284.43 |

74% |

|---|

| Domestic stocks |

11.78 |

91% |

77.92 |

92% |

90.60 |

96% |

|---|

| Foreign bonds |

0.11 |

45% |

38.78 |

52% |

120.32 |

54% |

|---|

| Foreign stocks |

4.10 |

117% |

53.10 |

118% |

146.03 |

108% |

|---|

- Mitsubishi UFJ Trust and Banking Corporation and its subsidiaries Mitsubishi UFJ Kokusai Asset Management Co., Ltd., MU Investments Co., Ltd., Mitsubishi UFJ Asset Management (UK) Ltd. (The portfolio is based on the former company, so it is listed under the former company name)

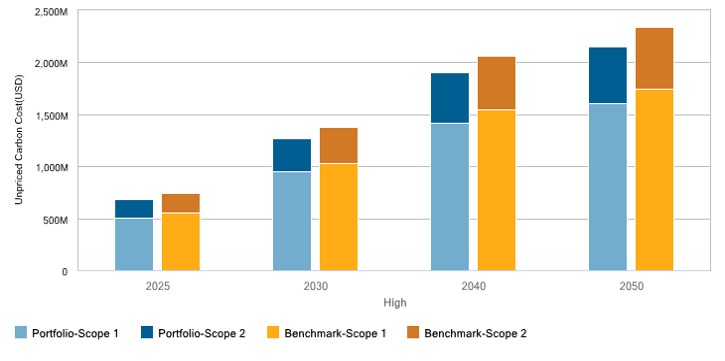

S&P provides Carbon Earnings at Risk Analysis as a quantitative assessment of transition risk. This model analyzes how much additional cost (Unpriced Carbon Cost) will be imposed on companies by changes in carbon prices under expected future decarbonization.

Here, we conducted a scenario analysis (note) of domestic stocks with the highest total GHG emissions. The graph compares the domestic stock portfolio of MUFG AM to the benchmark. It shows that the portfolio companies remain at a lower level of impact than the benchmark at any point in time.

- Estimated scenarios based on OECD and IEA research, assuming the adoption of policies sufficient to achieve the 2℃ target of the Paris Agreement

Unpriced Carbon Cost, by Point in Time

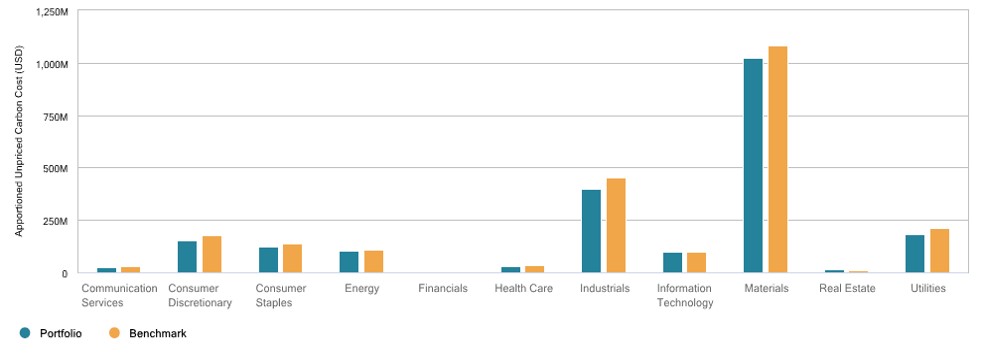

Unpriced Carbon Cost, by Industry

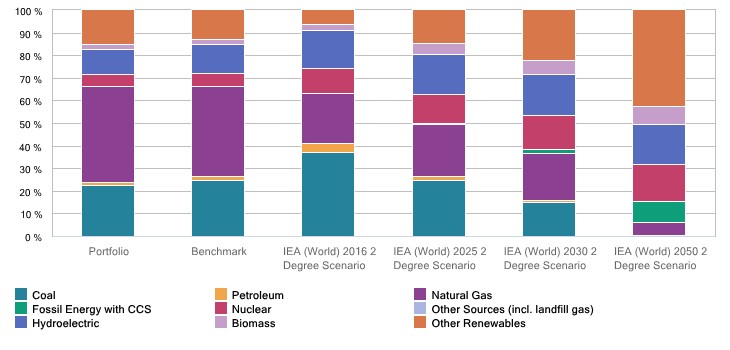

For the energy mix of portfolio constituent companies, S&P's tools allow evaluation of consistency with the Paris Agreement. For points in time, the graph below shows the energy mix of the portfolio (domestic stocks) and the benchmark (TOPIX) as of the end of March 2023, together with the energy mix that is consistent with the 2℃ scenario as estimated by IEA. Heading toward 2050, it is expected that the use of fossil fuels will decrease and the use of renewable energy sources will expand. Through engagement, MUFG AM will support the transition of investees.

Current State of the Energy Mix of the Portfolio

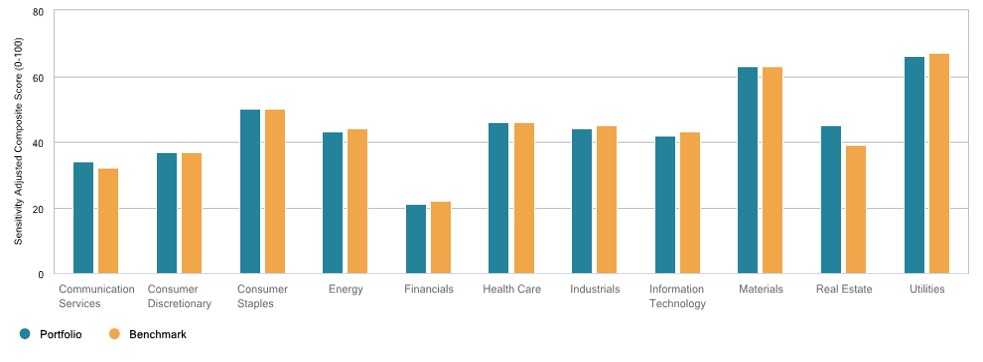

S&P performs analysis and scoring for eight major physical risks caused by climate change: Coastal Flooding, Fluvial Flooding, Extreme Heat, Extreme Cold, Tropical Cyclone, Wildfire, Water Stress, and Drought. The graph below (note) compares industry-specific physical risk scores for domestic stocks, which account for the greatest amount of GHG emissions in the MUFG AM portfolio. This confirms that physical risk is particularly high in Utilities and in Materials.

Physical Risk Scores, by Industry

- Measurement of amount of risk in 2050, based on the SSP5-8.5 scenario used in IPCC reports (low-mitigation scenario in which GHG emissions triple by 2075 and temperature rises by about 3.3 to 5.7℃ by 2100)

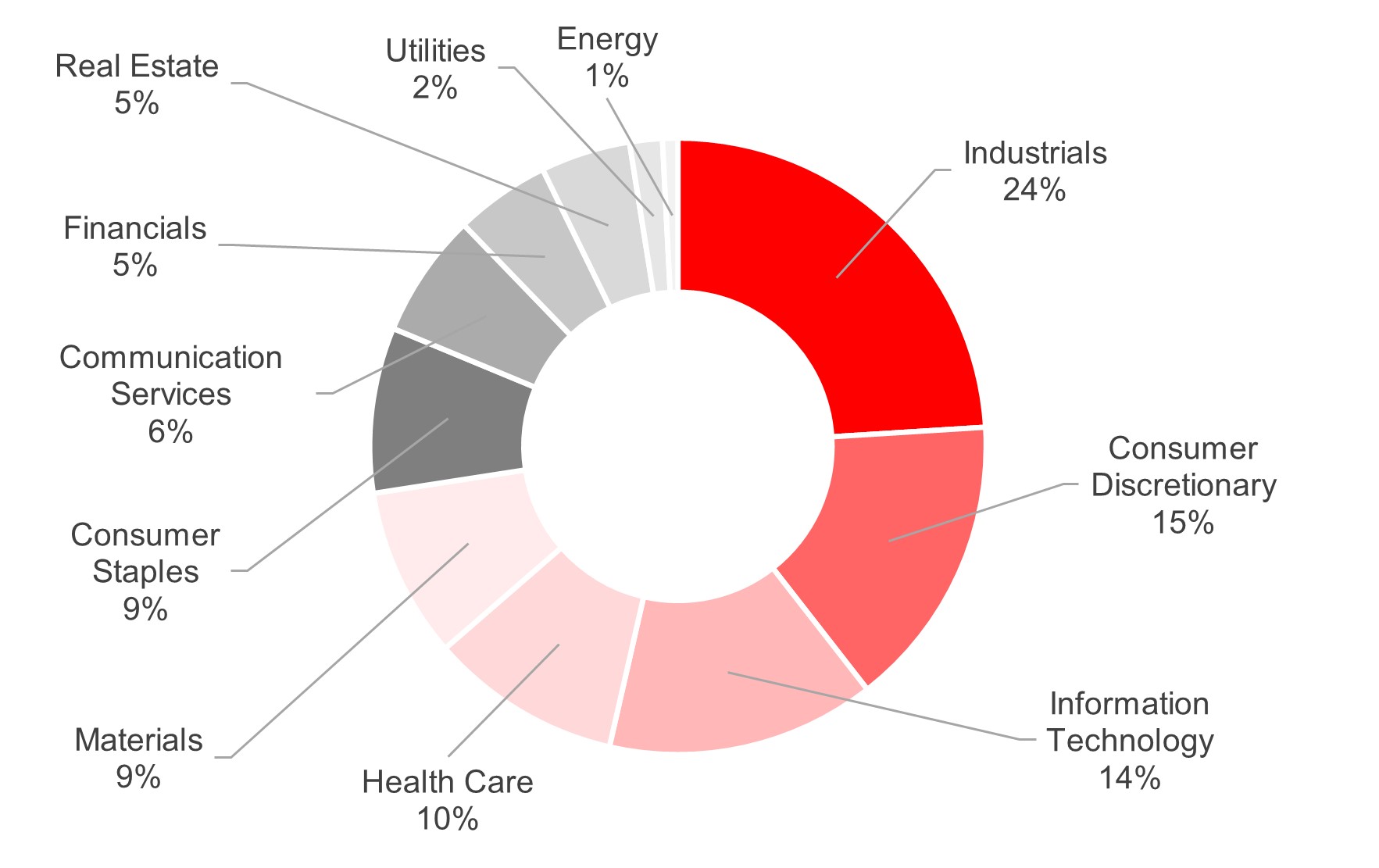

To confirm the degree of impact on the portfolio from physical risks to each industry, the composition ratio was aggregated with weights of holdings taken into account. The result shows large physical risk in some industries including Industrials, Consumer Discretionary, and Information Technology.

Portfolio Composition Ratio of Physical Risk Scores, by Industry

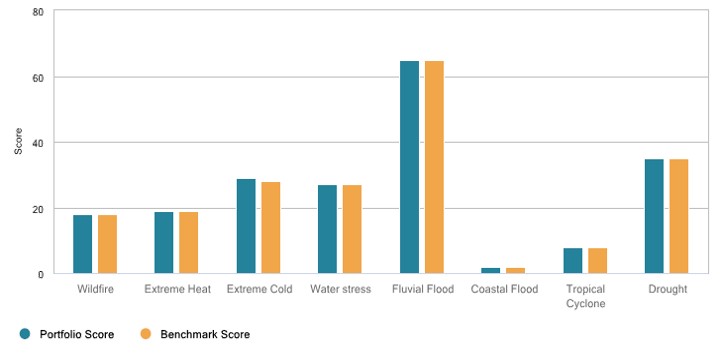

In scores by hazards, i.e., the elements that make up physical risk scores, physical risk due to fluvial flooding was confirmed to be the highest, but no major discrepancy from the benchmark (TOPIX) was found. In this way, MUFG AM strives to assess physical risks and to use that information as reference in allocation and engagement.

Score Comparison, by Hazard

As found in the above analysis, differences exist in industries at high risk, depending on transition risks and physical risks. These results point to the importance of risk management tailored to differences among industries. MUFG AM calculates ESG evaluations and carries out engagement activities by identifying the materiality of individual companies, taking into account the differing risk characteristics of industries.

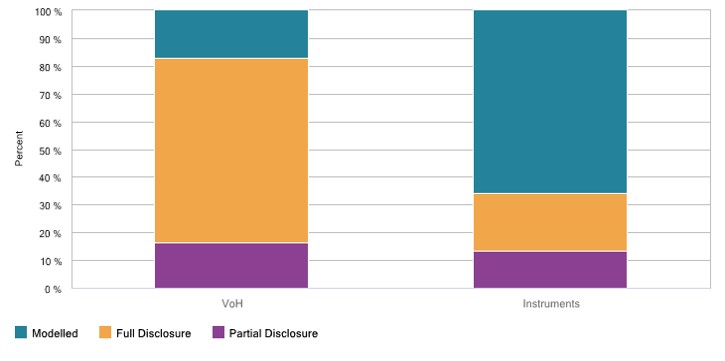

Future Issues in Analysis

Future issues in analysis include the reliance on estimates, not on actual disclosed data, for a large portion of the disclosed company data used in measurement of GHG emissions-related metrics and scenario analyses. For domestic companies, about 70% of the data is based on estimated values, resulting in a lack of full awareness of the state of individual companies' emissions. We will actively encourage investee companies to enhance their disclosed data.

Composition of Data Sources Used to Calculate GHG Emissions (Domestic Stocks)

VoH (Value of Holdings): Composition ratio by balance under management; Instruments: Composition ratio by stock

Risks and Opportunities Related to Climate Change

Climate change has adverse impacts on society, and companies may bear numerous additional costs for decarbonization. Accordingly, there is a tendency for only negative aspects of climate change to stand out at a glance. However, we believe that climate change also offers companies opportunities to grow, such as by developing new technologies or by reviewing their business portfolios to expand business. We will continue to request further disclosure of information from investee companies, and through our engagement activities will back up companies in addressing climate change.