- Capital Investment Expansion and Financing Opportunities

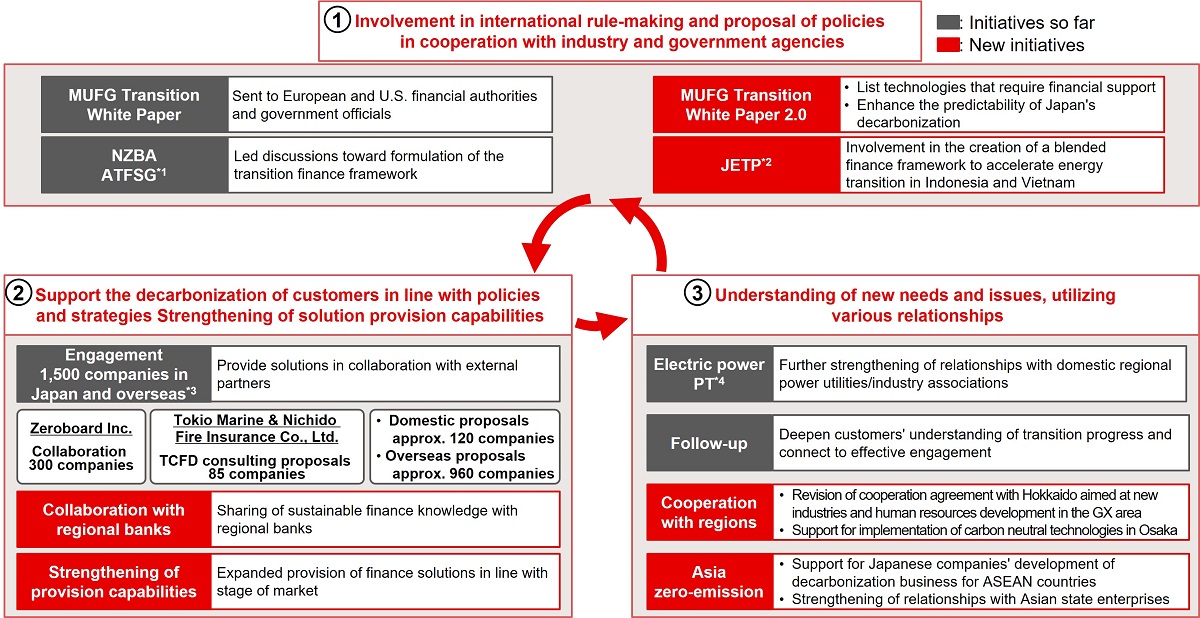

- MUFG's Approach to Carbon Neutralization

- Involvement in Discussions to Develop International Frameworks in Cooperation with Policy Makers and Industry

- Strengthening Capabilities to Provide Solutions that Support Client Decarbonization in Line with Government Policies and Strategies

- Using Relationships with Customers, Local Governments, and Industry Organizations to Grasp New Needs and Issues

- Initiatives by Partner Banks

- Investments Aimed at Solving Environmental and Social Issues

Opportunities Related to Climate Change

Capital Investment Expansion and Financing Opportunities

■ Demand for Capital Investment is Expected to Rise as a Result of the Acceleration of Net Zero Initiatives in Various Industries

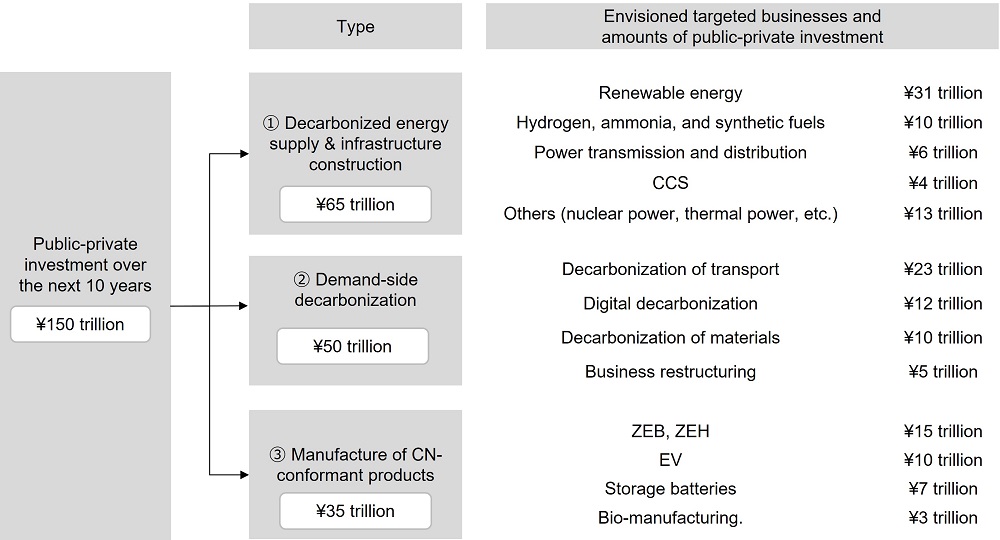

According to the IEA(note), global decarbonization-related investment is expected to reach approximately USD 4 trillion annually from 2026 to 2030. In addition, the Ministry of Economy, Trade and Industry estimates decarbonization-related public and private investment of approximately ¥150 trillion in Japan over the next 10 years in sectors including energy, automobiles, and construction, within which it forecasts ¥20 trillion in government-funded support through GX Economy Transition Bonds.

In addition to Green Bonds and Green Loans to underpin investment plans, support for transition innovation in industries will also become a significant business opportunity for financial institutions.

- October 2021 IEA Report, "World Energy Outlook 2021"

MUFG's Approach to Carbon Neutralization

- Asia Transition Finance Study Group: An initiative led by private-sector financial institutions, launched to promote transition financing in Asia with a focus on major financial institutions operating in ASEAN countries under the Asia Energy Transition Initiative (AETI)

- Just Energy Transition Partnership: A partnership led by the G7 to accelerate the early retirement of emission-intensive infrastructure and support investment in renewable energy generation and relevant infrastructure

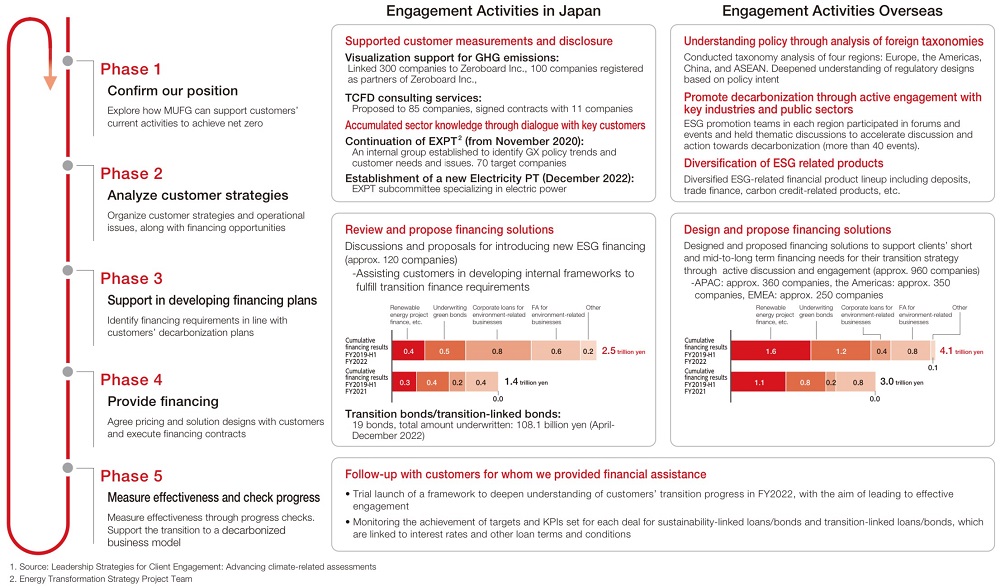

- Including: Introduced 300 companies to Zeroboard Inc. (100 companies registered as partners of Zeroboard); Proposed TCFD consulting services (collaborating with Tokio Marine & Nichido Fire Insurace Co.,Ltd) to 85 companies and signed contracts with 11 companies; Domestic discussions and proposals for introducing new ESG financing (approx. 120 companies); Overseas discussions and proposals for transition strategy and short / mid-to-long term financing needs (approx. 960 companies)

- Project Team

Involvement in Discussions to Develop International Frameworks in Cooperation with Policy Makers and Industry

■ Net-Zero Banking Alliance (NZBA)

■ Asia Transition Finance Study Group (ATFSG)

Led by private-sector financial institutions, this initiative was launched to promote transition finance in Asia with a focus on major financial institutions operating in ASEAN countries under the Asia Energy Transition Initiative (AETI).

MUFG has led discussions with more than 30 participating financial institutions, based on which the ATFSG has compiled practical guidelines to be used by financial institutions when they consider transition finance along with the ATFSG activity report and a list of recommendations for support from governments and other stakeholders. These documents were then publicized at the Asia Green Growth Partnership Ministerial Meeting (AGGPM) hosted by the Ministry of Economy, Trade and Industry in September 2022.

■ Net Zero Asset Managers initiative (NZAM)

■ GFANZ (Glasgow Financial Alliance for Net Zero)

GFANZ is the largest pan-financial sector initiative in the world, bringing together independent, sector-specific Alliances such as NZBA and Net Zero Asset Managers initiative (NZAM). MUFG is the only Japanese bank participating in all five GFANZ workstreams (re)structured in 2023, where we have actively contributed to discussions to promote the various net-zero initiatives in GFANZ.

The GFANZ Japan Country Chapter was launched in June 2023 as the first GFANZ Country Chapter. Masamichi Kono, Senior Advisor of MUFG Bank, Former Deputy Secretary General of the OECD, was appointed as GFANZ Japan Advisor. MUFG will contribute to discussions in GFANZ Japan and two-way communication between GFANZ Global and GFANZ Japan.

■ JETP (Just Energy Transition Partnership)

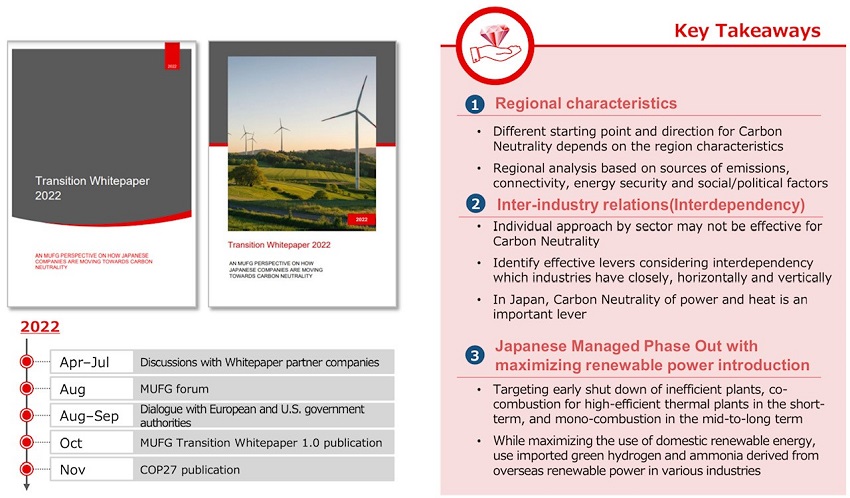

■ MUFG Transition Whitepaper 2022

<Transition Whitepaper 2023>

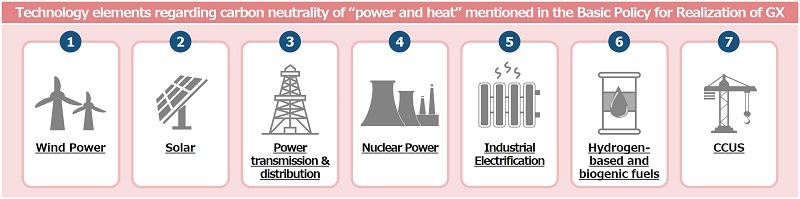

・Published in September 2023, the Whitepaper 2023 was developed in collaboration with partner companies and government authorities. ・Based on policy analysis in Europe, the US, China, and ASEAN, the Whitepaper 2023 presents the list of technologies and supply chains that will play important levers in advancing the path to carbon neutrality in Japan’s “electricity and heat” segment. The Whitepaper also highlights the need to extend financial support covering broader spectrum. We incorporated detailed information on various technologies explaining about their backgrounds, roles in the Japanese policy, and current development status. ・By summarizing the initiatives of the Japanese government and leading companies in English, the Whitepaper 2023 aims to improve global stakeholders’ understanding of Japan’s transition plan and financing opportunities entailed. Among the technologies outlined in the Japan's Basic Policy for Realizing GX, the Whitepaper highlights seven technologies related to carbon neutrality in “electricity and heat”.

|

■ COP27

■ Contributions to initiatives in Japan and internationally, etc.

Additionally, MUFG shares the content discussed in committees internally, particularly ensuring alignment between the policies of industry associations related to climate change response and MUFG's own policies. In cases of discrepancies, adjustments are made through discussions in various committees. Through this process, consistency with the stance of industry associations towards achieving carbon neutrality is maintained.

| Name of Initiative | MUFG’s Role | Operating body |

|---|---|---|

| ESG Finance High Level Panel | Committee members | Ministry of the Environment |

| Expert Panel on Sustainable Finance | Members | Financial Services Agency |

| Sustainability Standards Board of Japan | Committee members | Financial Accounting Standards Foundation |

| TCFD Consortium Planning Committee | Committee members | Ministry of Economy, Trade and Industry; Financial Services Agency; Ministry of the Environment; etc. (observers) |

| Working Group on Financial Institutions’ Efforts towards the Decarbonization of the Economy | Members | Financial Services Agency |

| Central Environment Council, Global Environment Committee, Comprehensive Policy Subcommittee, Carbon-Neutral Economic and Social Transformation Subcommittee | Committee members | Ministry of the Environment |

| Taskforce on Preparation of the Environment for Transition Finance | Committee members | Ministry of Economy, Trade and Industry; Ministry of the Environment; Financial Services Agency |

| Study Group on Financing from the Public Sector to Help Corporate Initiatives for GX (Green Transformation) in Industries | Committee members | Ministry of Economy, Trade and Industry |

| GX League | Members | Ministry of Economy, Trade and Industry |

| GSG The Japan National Advisory Board | Committee members | Social Innovation and Investment Foundation |

| National Movement for New and Prosperous Lifestyles toward Decarbonization | Members |

Ministry of the Environment |

| Monetary Authority of Singapore (MAS) Sustainable Finance Advisory Panel | Member | MAS |

| PRB2030 Core Group | Members |

UNEP-FI |

| NZBA Steering Group | Member |

UNEP-FI |

| NZBA Transition Finance Work Track | Chair | UNEP-FI |

| GFANZ Asia-Pacific Network | Advisory Board Member |

GFANZ |

- (Excerpts of major items, including past items)

Strengthening Capabilities to Provide Solutions that Support Client Decarbonization in Line with Government Policies and Strategies

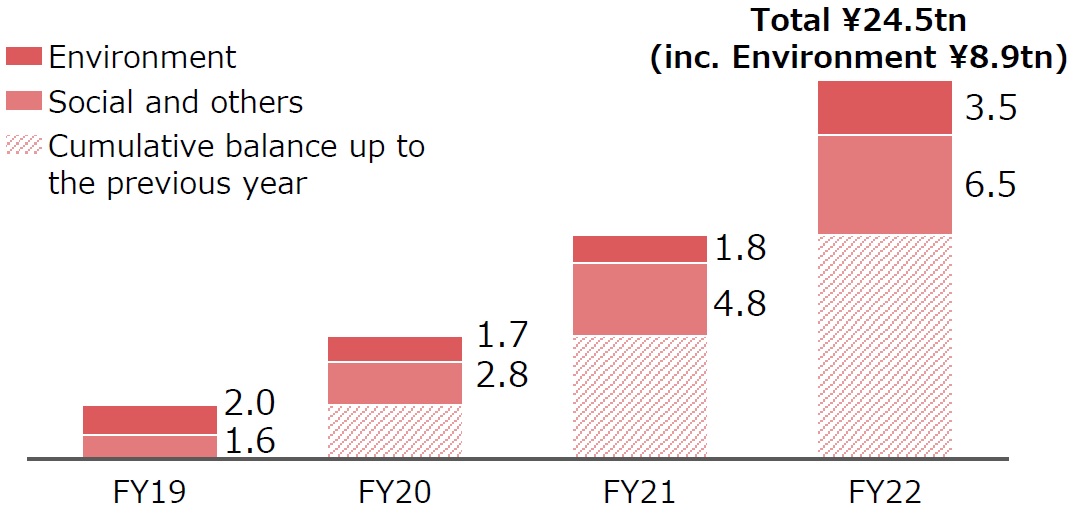

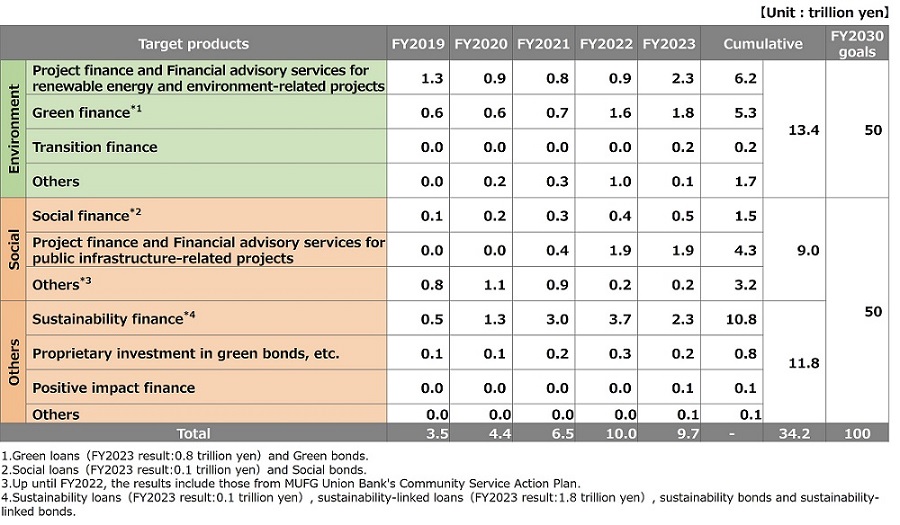

■ Sustainable Finance Targets (As of April 2024)

We have set a cumulative sustainable finance target for the period of FY2019 and FY2030 to address environmental and social issues. We steadily accumulated results of ¥24.5 trillion (including ¥8.9 trillion in the environmental area) through the end of FY2022.

In the environmental field, including response to climate change, we aim to deliver ¥50 trillion in financing for projects connected to the reduction of GHG emissions and preservation of the global environment. We will support a transition to a decarbonized society through the underwriting of MUFG Green Bonds for which proceeds from issuance are allocated to finance qualified Green Projects, provision of products and services aimed at reducing environmental impacts, and the promotion of renewable energy through project finance.

Definition of Sustainable Finance The term "Sustainable Finance" refers to the provision of finance for the following businesses (including loans, equity investment in funds, arrangement of project finance and syndicated loans, underwriting of equities and bonds, and financial advisory services) with reference to the relevant external standards (e.g. the Green Loan Principles, Green Bond Principles, and Social Bond Principles).

Environmental Area ・Businesses contributing to the adaptation to and moderation of climate change, including renewable energy, energy efficiency improvement, and green buildings (e.g. arrangement of loans and project finance for renewable energy projects, underwriting and distribution of green bonds).

Social Area ・Businesses contributing to the development of startups, job creation, and poverty alleviation ・Businesses contributing to the energizing of local communities and regional revitalization ・Fundamental service businesses, including those involved in basic infrastructure such as public transport, waterworks, and airports, and essential services such as hospitals, schools and police. (e.g. Emerging Industrial Technology Support Program, loans for regional revitalization projects such as MUFG Regional Revitalization Fund, arrangement of loans and project finance for public infrastructure, underwriting and distribution of social bonds). |

|---|

■ Products and Services that Support the Promotion of Our Customers' Sustainability

■ Transition Finance

■ Development and Provision of Solutions for Carbon Neutrality Based on the Needs of Customers

<Engagement Activities to Assist Decarbonization Efforts of Customers. According to Bank-client engagement model introduced by UNEP FI.*1>

■ Pushing Ahead with Support for Innovation

Through participation in various councils in new fields such as hydrogen, ammonia, and CCUS, MUFG will expand its contribution to the carbon neutrality for customers.

To support the realization of a sustainable society through a virtuous cycle of the environment and the economy, together with customers we will study and execute support for new businesses through financial services, from the stages of R&D to demonstration, with the aim of realizing innovative technologies such as renewable energy, hydrogen, next-generation energy, and carbon recycling.

■Green Deposit

■ESG Investment

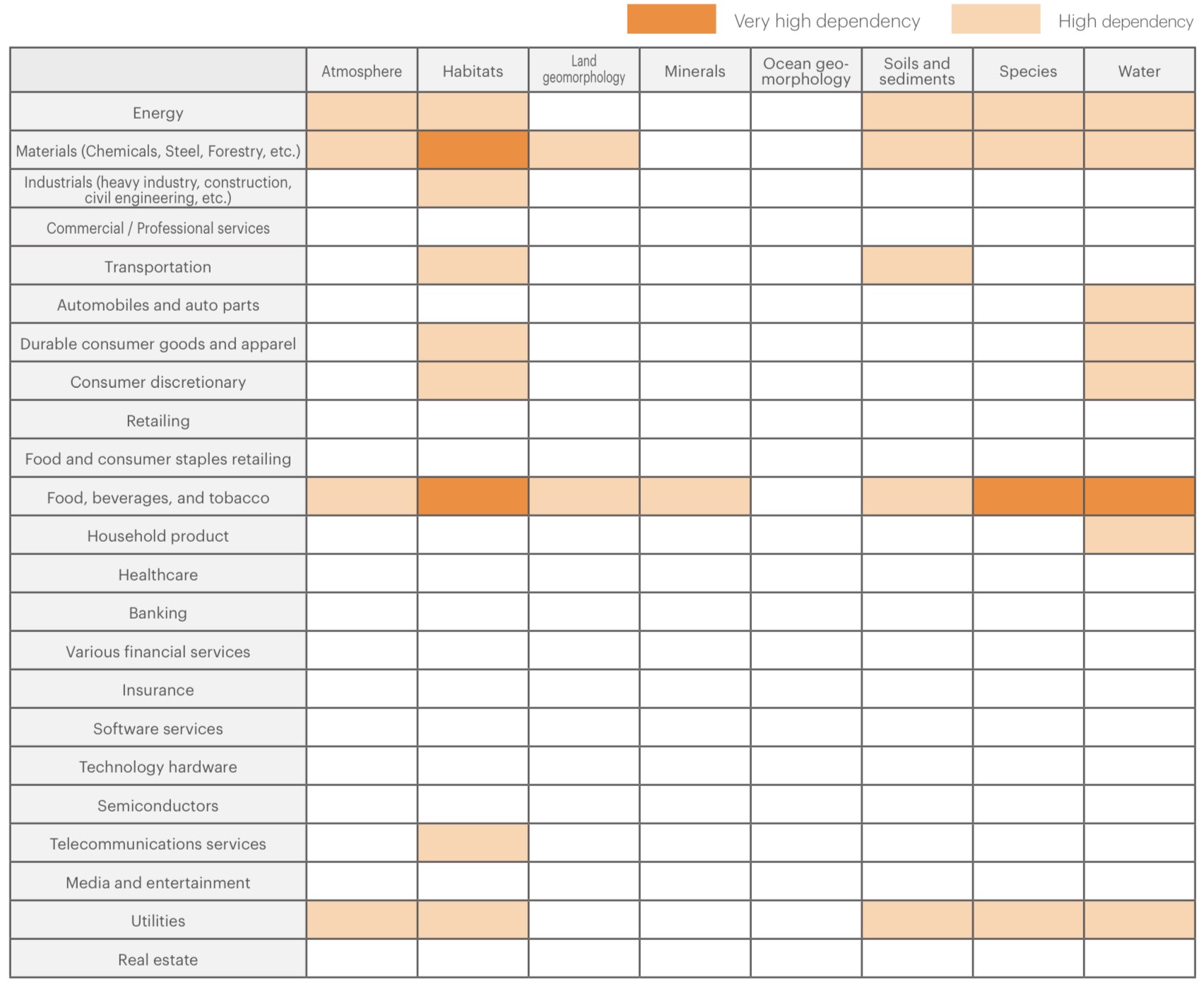

Investments that take into account ESG factors are expected to support companies and various organizations working to achieve a sustainable society and improve their long-term returns; thus, there is a growing interest in it, especially among institutional investors, such as public pension funds.

MUFG's treasury business diversifies the investment target to government bonds, foreign bonds, stocks, and corporate bonds, as well as green bonds and other types of investments. In order to strengthen MUFG's financial earnings and contribute to sustainable economic growth through ESG investments, MUFG is going to promote ESG investments by finding the right balance between risks and returns.

Using Relationships with Customers, Local Governments, and Industry Organizations to Grasp New Needs and Issues

■ Support for the Implementation of Carbon Neutrality Technologies in Japan and the Creation and Development of New Industries

Accelerating Japan's carbon neutrality will require enhancing the credibility of Japan's initiatives, attracting investment from within and outside the country, and implementing effective technologies and supply chains for Japan's carbon neutrality at an early stage.

Although Hokkaido faces social issues such as population decline, it has the greatest potential for introducing renewable energy in Japan and is the regions with one of the highest potentials for the implementation of effective technologies to achieve carbon neutrality, as described in MUFG Transition White Paper 2.0.

In 2022, we hosted "MUFG Hokkaido Oshigoto Audition," a contest for municipalities-led projects with a purpose of solving social issues in Hokkaido to apply for donations to fund the project. In the process of project screening and publicizing projects from municipalities by using social media, we acted in collaboration with Boku to Watashi and. Inc, a company engaged in next-generation marketing.

To highlight the potentials for carbon neutrality in Hokkaido and motivate investment in Hokkaido, we published the "Hokkaido Carbon Neutrality Report" in Japanese and English in May 2023. At the same time, we entered into a partnership agreement in the GX area with the Hokkaido Government, which is advancing "Zero Carbon Hokkaido" measures. We will work with Hokkaido to build a model case that achieves both a carbon neutrality and revitalization of the local economy by developing new industries in the region and creating a human resource development framework through donations to a new GX promotion fund set up by Hokkaido.

In June 2023, we participated in the new "Team Sapporo-Hokkaido", a consortium consisting of industry-academia-government-finance organizations, to accelerate GX initiatives in Hokkaido by attracting GX-related projects, human resources, and funds from around the world. This is a model case of a promotion council bringing together local government, regional companies, financial institutions, and other parties to encourage local GX investment and financing.

In FY2022, we made a donation to a subsidy framework run by Osaka prefecture. The framework subsidizes a portion of necessary expenses for business operators that will develop or demonstrate carbon neutrality technologies for the Osaka-Kansai Expo 2025 and for a decarbonized society. In FY2023, the budget for the subsidy was increased to support business expansion associated with transition from development stage to the demonstration stage and to enhance support for new businesses. MUFG therefore made additional donations to the framework, as it had in the previous year. We will support the creation and promotion of energy businesses based in Osaka, raise recognition of efforts initiated from Osaka for carbon neutrality, and the further implementation of technologies for carbon neutrality.

MUFG will continue to work with its varied stakeholders to support the implementation of carbon neutrality technology in Japan and the creation and development of new industries and will undertake construction of sustainable social models that contribute to the vitalization of local economies.

■ Blended Finance – Exploring the Establishment of a Public-Private Partnership Debt Fund to Promote Decarbonization in Asia

The Bank signed an agreement with Nippon Export and Investment Insurance (NEXI) on blended finance at the ASEAN-Japan Business Week event with the aim to support decarbonization in Asia.

Blended finance is a financing method that combines public and private funding and is viewed as an effective means of support initiatives aiming to resolve challenges emerging countries are facing.

Under the agreement, NEXI and the Bank will explore the establishment of a blended finance scheme to tackle climate change issues in line with the Asian Zero Emission Community (AZEC)’s objectives.

At the event, Minister of Economy, Trade and Industry Yasutoshi Nishimura said, "We want to advance a carbon-neutral society together with ASEAN. We will do so through the AZEC concept and other means, and through specific projects such as the introduction of renewable energy, construction of a hydrogen-ammonia supply chain, and decarbonization on the demand side including factories and industrial parks."

The Asia Energy Transition Initiative (AETI) put forth by the Japanese government is studying ways to provide comprehensive support towards Asia’s decarbonization, such as launching the Asia Transition Finance Study Group (ATFSG) which consists of major financial institutions in ASEAN countries. As a member of the ATFSG Secretariat, MUFG has led discussions with financial institutions and government agencies and has worked on the formulation of international guidelines.

The initiatives outlined in the agreement aligns with the goals of the Japanese government led AZEC and AETI. We will further contribute to the sustainable development of Asia and support the region’s step-by-step approach to achieve energy transition by providing financing and utilizing our risk management capabilities towards resolving environmental and social issues alongside leveraging our knowledge and expertise gained through ATFSG.

■ System for Promoting Engagement

・Green Transformation Strategy Project Team (GXPT)

In November 2020, the Bank launched the Energy Transformation (EX) Strategy Project Team (PT) to develop the climate change-related business. Since then, the Bank has striven to strengthen its capabilities to engage with customers pursuing carbon neutrality, understand their needs and provide them with high-quality products and services by periodically holding meetings at EXPT with relevant executives and managements to consolidate and share internal insights.

Meanwhile, in February 2023, the Cabinet approved on the Basic Policy for the Realization of Green Transformation (GX) , announcing national strategies to realize investment in GX through the mobilizing more than ¥150 trillion funding from both government and private sources. Against this backdrop in April 2023 the Bank rebranded the EX Strategy PT as the GX Strategy PT, updating its role to facilitate the creation of tangible business and the delivery of information required to GX-related investment and financing. This PT currently consists of around 500 members, including relationship managers in both Japan and overseas. individuals from Product Offices (POs), credit division and corporate planning departments.

・Support movements toward carbon neutrality throughout Japan by conducting dialogue with customers, industry organizations. and government agencies ・Provide added value throughout the value chain, from research functions to solution proposals ・Explore visions for transition support aligned with reality in Japan and Asia ・Leverage group companies' and global knowledge to support customers' business transitions through collaboration among sales departments, the Solutions Unit (including the Sustainable Business Department), Sustainability Office, and other related departments |

・Assignment of Sustainable Business Promotion Leaders

The Bank has assigned "Sustainable Business Promotion Leaders" (hereinafter "Promotion Leaders") at corporate sales branches nationwide. Information on sustainable business collected at headquarters as well as in-house tools for sustainable business, are propagated throughout Japan by the Promotion Leaders who serve as hubs connecting headquarters and branches.

In FY 2022 the Promotion Leaders periodically organized, study sessions on sustainable finance and other solutions in collaboration with headquarters to reinforce expertise of relationship managers at branches and enhance capabilities for engagement.

・Organizational Structure to Promote Global Sustainable Business

Initiatives by Partner Banks

■ Initiatives by Krungsri

Support for Decarbonization by Customers

・Sustainable finance target by 2030

・Support for Green Bond issuance by Export-Import Bank of Thailand

・Support for Installation of Rooftop Solar Panels

The Solar Roof Lending Program was launched in 2022, which provides financial support to customers in installing solar panels in their factories, offices, and homes to promote decarbonization in a wide range of customer segments.

・Support for Visualization of Customers' Emissions

Staged Phase-out of Investment and Financing for Coal-fired Power Plants

Decarbonization of GHG Emissions from Own Operations by 2030

Krungsri’s Race to Net Zero Action Plan was established, which entails digital transformation, efficient resource management, and greater use of renewable energy as the key pillars to decreasing GHG of own emissions.

■ Initiatives by Bank Danamon

Support for Decarbonization by Customers

・Setting of Sustainable Finance(note1) Targets

Bank Danamon established a target to increase their Sustainable Finance (SF) loan portfolio ratio(note2) to 25% by 2027. In 2022, the SF loan portfolio ratio has increased to 21%, and are steadily progressing to realize their target.

・Sustainability-Linked Loans with the KPI of CO2

Contribution to the Achievement of Net-Zero GHG Emissions from Own Operations at MUFG by 2030

Installed solar panels in branches to promote decarbonization of own emissions.

Enhancement of Environmental and Social Policies and Guidelines

- Aligned with local regulations

- Ratio of Sustainable Finance in the overall portfolio

- Excluding projects equipped with environmentally friendly technologies

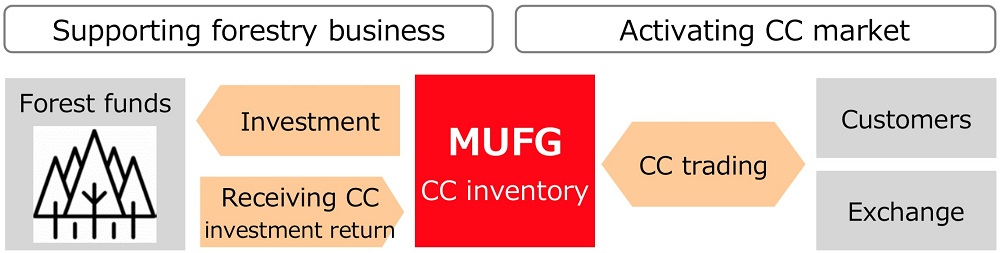

Investments Aimed at Solving Environmental and Social Issues

■ Sustainable Business Investment Strategy

Under our Sustainable Business Investment Strategy (hereinafter “the Investment Strategy”), we invest in funds that contribute to solving environmental and social issues. Through the Investment Strategy, we seek to acquire knowledge and explore new business opportunities. In addition, we aim to solve issues through our fund investment activities by creating positive impacts and innovation, and nurturing of new industries.

The internal carbon pricing(note) used in our investment decisions was US$40/tCO2 (as of FY2022). Going forward, we will assess investment opportunities based on the international impact measurement methods while considering their updates in a timely manner.

- This concept is used by organizations to independently price their own CO2 emissions and to reduce the carbon footprint of their corporate activities. It is used mainly by business corporations for investment decisions.

・Investment Projects Based on the Sustainable Business Investment Strategy

Investment (fund name) |

Asset manager | Target of investment |

|---|---|---|

| MPower Partners Fund L.P. | MPower KK |

Domestic and overseas venture companies in the fields of healthcare/wellness care, fintech, next-generation work styles/education, next-generation consumers/retail, and the environment |

| Carbon Neutral Fund 1 Investment Limited Partnership | Z Energy Co., Ltd. | Renewable energy generation business in Japan |

・Establishment of a Growth Investments Fund in Climate Tech-related Startups (Marunouchi Climate Tech Growth Fund L.P.)

In May 2023, together with Mitsubishi Corporation and Pavilion Private Equity Co., Ltd., the Bank established Marunouchi Climate Tech Growth Fund L.P. (hereinafter "the Fund"). The Fund has Marunouchi Innovation Partners Co., Ltd. as its general partner, and will invest mainly in climate-tech-related startups for growth(note).

Formed with a US$400 million commitment by investors, the Fund plans to engage in further investor recruitment to eventually expand to a scale of US$800 to 1,000 million.

In the area of climate tech, the development of advanced technologies and proliferation of solutions are essential in achieving a carbon neutral society, and high demand for funding is expected in the medium to long term.

Through growth investments in climate tech-related startups by the Fund, the Bank will promote commercialization and scaling up for these companies' advanced technologies and the penetration of their technologies into society, enhancing the corporate value of investee companies while providing support for the achievement of a carbon-neutral society.