Climate Change Risks -Transition Risks and Physical Risks-

There are two kinds of climate change-related risk. First, there are risks arising in the course of the transition to a decarbonized society, such as stricter regulation and the introduction of decarbonizing technologies (transition risks), and second, there are risks arising from physical damage due to the growing occurrences of climate change-induced natural disasters and abnormal weather (physical risks).

Financial institutions are required to address both risks, which may directly impact their own business activities and indirectly affected due to impacts on clients.

Based on the suggestions of the TCFD, MUFG has summarized the examples of physical and transition risks for each of the major risk categories. The timelines (short, medium, and long term) are also organized by risk category.

In addition, to prepare for the risk of damage to our employees and assets due to an increase in natural disasters and extreme weather events, we conduct various drills and formulate a business continuity plan (BCP) to ensure business continuity.

Examples of transition risks |

|

|---|---|

| Policies, laws and regulations | ・Increase in the cost due to GHG emissions by the introduction of a carbon tax ・Strengthened obligation to report emissions ・Regulations on existing products and services ・Subject of lawsuits |

| Technology | ・Switch to existing products and services with lower GHG emissions ・Setback in the investment in new technologies ・Cost of transition to low emission technologies |

| Market | ・Changes in customer behavior ・Uncertainty in market signals ・Raw material price hike |

| Reputation | ・Changes in consumer preferences ・Narrowing of sectors ・Increased stakeholder interest and negative feedback to stakeholders |

Examples of physical risks |

|

|---|---|

| Acute | ・Increased severity of extreme weather events, such as typhoons and floods |

| Chronic | ・Changes in precipitation patterns and extreme fluctuations in weather patterns ・Increase of average temperature ・Sea level rise |

Examples of Impacts of Transition Risks and Physical Risks

MUFG has organized examples of impacts (examples of potential risks) of climate change on each of the major risk categories of the physical and transition risks.

Risks are classified mainly around the following six categories. In the future, the classification of the risks and examples will be reviewed in response to changes in the environment.

■ Example of Transition and Physical Risks

Risk categories |

Examples of transition risk | Examples of physical risk | Time frame(note) |

|---|---|---|---|

| Credit risk | ・Our corporate clients’ business activities and financial positions may be negatively affected if they cannot deal with government policies, regulatory requirements, customer requests or evolving trends in technological development. | ・Extreme weather may cause direct damage to assets held by our corporate clients and/or have a negative spillover effect on their business activities and financial positions by indirectly impacting their supply chains. | Short-to long-term |

| Market risk | ・The transition to a decarbonized society may negatively impact certain business sectors, making the value of relevant securities held by MUFG and/or financial instruments deriving from them highly volatile. | ・The impact of extreme weather may induce market turmoil and make the value of securities held by MUFG highly volatile. ・The value of securities held by MUFG may become volatile due to changes in market participants’ medium- to long-term outlook on the impact of extreme weather and their expectations regarding countermeasures against the phenomenon. |

Short-to long-term |

| Liquidity risk | ・If its credit ratings deteriorate due to such factors as delays in its response to transition risks, MUFG may face limitations on methods for funding from the market and thus growth in risks associated with fundraising. | ・Corporate clients suffering damage from extreme weather may choose to withdraw their deposits or utilize commitment lines to secure funds for reconstruction, leading to a growing volume of cash outflows from MUFG. | Short-to long-term |

| Operational risk | ・Spending on capital investment may grow due to the need for measures aimed at reducing CO2 emissions and enhancing business continuity capabilities. | ・Extreme weather may cause damage to MUFG’s headquarters, branches and/or data centers and lead to the disruption of their operations. | Short-to long-term |

| Reputation risk | ・ If MUFG’s plans and efforts to realize carbon neutrality are deemed inappropriate or insufficient by external stakeholders, it may suffer from reputational damage. ・MUFG may suffer from reputational damage and/or deterioration in its status as an employer due to the continuation of relationships with business partners who doesn’t give enough consideration to environmental concerns or delays in its transition to decarbonization. |

・If MUFG’s efforts to support customers and communities affected by extreme weather are deemed insufficient, it may suffer from reputational damage or a resulting disruption of operations. | Short-to long-term |

| Strategic risk | ・If MUFG fails to live up to its public commitment to support the transition to a decarbonized society, its capabilities for strategic execution may be negatively affected by a deterioration in its reputation. | ・MUFG may fail to meet the goals of its strategies and plans if it fails to properly factor in the direct impact of extreme weather in the course of long-term management planning. | Medium-to long-term |

- Short-term: less than one year; medium-term: one to five years; long-term: more than five years

Scenario Analysis

The TCFD recommendations recommend conducting scenario analysis using multiple scenarios to demonstrate the flexibility and resilience of companies' plans and strategies to risks related to climate change.

Since the summer of 2019, MUFG has been a participant in the pilot project led by the United Nations Environment Programme Finance Initiative (UNEPFI) with the objective of discussing and developing methods for climate change-related financial information disclosure for the banking industry.

Based on the results of the pilot project, we conducted an analysis of transition risks up to the year 2050 and physical risks up to the year 2100. In addition to the results of the above-mentioned pilot project, the scenario analysis reflects the results of verification by external experts.

While engaging in dialogue with regulatory authorities, we also continuously examine ways to raise the level of our analytical approaches.

■ Transition Risks

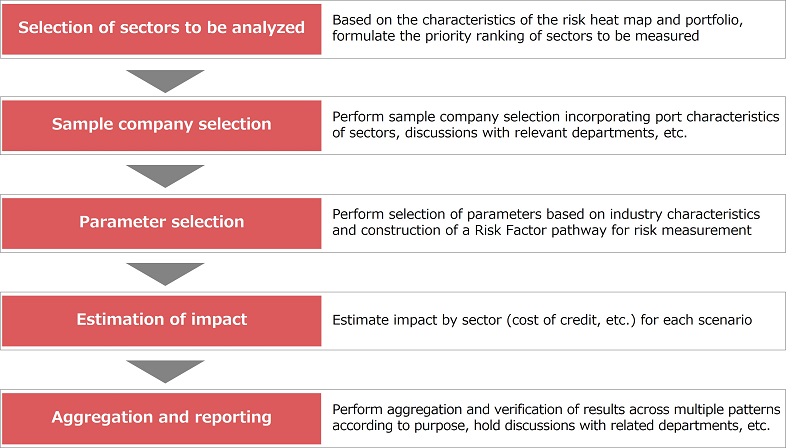

・The scenario analysis process

・Target sectors

| Target sector |

|---|

Energy (Japan, overseas) / Utilities (Japan, overseas) / Automotive (Japan, overseas) / Steel (Japan, overseas) / Air (Japan, overseas) / Maritime (Japan, overseas) |

・Methods and results

Based on the results of the UNEP FI pilot project, a comprehensive approach was adopted for the measurement method, combining the bottom-up method at the individual company level and the top-down method at the sector level to assess the impact.

In addition to the sustainable development scenario (the [well below] 2°C scenario) released by the IEA, the NGFS scenario was used as an assumption. Then, in addition to the (well below) 2°C scenario, the 1.5°C scenario was analyzed on the impact on the credit ratings under each scenario, as well as analyzing the financial impact on an applicable sector's overall credit portfolio.

| Scenario | ・Various scenarios, including the sustainable development scenario (the [less than] 2°C scenario) of the IEA and the 1.5°C scenario that the NGFS has released |

|---|---|

Analytical method |

・An integrated approach is adopted to assess the impact by combining the bottom-up approach at the individual company level and the top-down approach at the sector level. Using this approach, the impact on credit ratings in each scenario is analyzed along with the effect on the overall financial impact of the sector's credit portfolio. |

| Target sector | ・Energy, utilities, automotive, steel, air, and maritime sectors |

| Target period | ・Until 2050 using the end of March 2022 as the standard |

| Result of analysis | ・Single-year basis: 1.5 billion yen to 28.5 billion yen |

- No significant change under standards as of the end of March 2023

・Measures to reduce future migration risks

- Continued implementation of engagement with customers

- Support for customers' decarbonization initiatives through sustainable finance, support for GHG emissions visualization and strategy formulation, etc.

- Implementation of active discussions through regulatory authorities, policy committees, external experts, etc.

- Active participation in discussions through NZBA and other external initiatives

■ Physical Risks

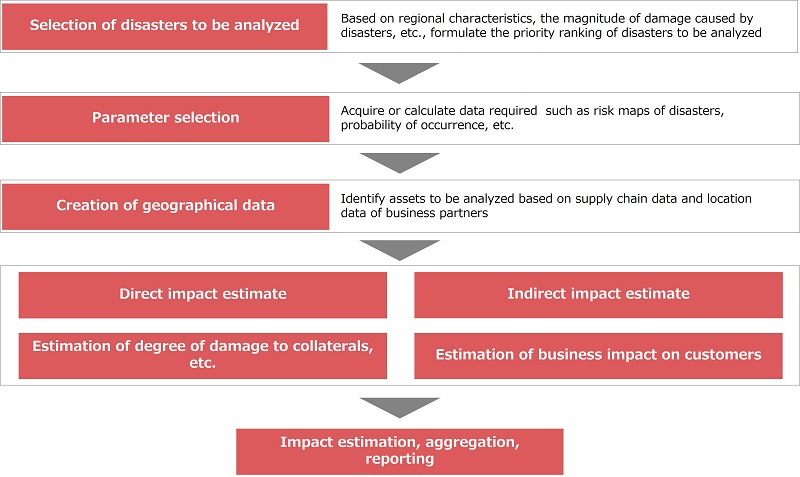

・The scenario analysis process

・Results

Among the risks associated with physical damage caused by climate change, we adopted an approach to measure the impact on the overall credit portfolio using the default probability of a borrower that has changed because of the occurrence of floods, which have been particularly prominent in Japan and other countries in recent years in terms of both frequency of occurrence and damage level.

The climate scenarios are based on the RCP2.6 (2°C scenario) and RCP8.5 (4°C scenario) scenarios from the Coupled Model Intercomparison Project 5 (CMIP5) released by the Intergovernmental Panel on Climate Change (IPCC). The RCP8.5 scenario, which expects floods to be more frequent and larger in magnitude, was analyzed to estimate the damage caused by floods using data(note) provided by various organizations.

In calculating financial impacts, in consideration of discussions conducted within the UNEP FI pilot project, we have reflected business suspension periods, loss arising in held assets and so on.

- Source: Hirabayashi Y, Mahendran R, Koirala S, Konoshima L, Yamazaki D, Watanabe S, Kim H and Kanae S (2013)

Global flood risk under climate change. Nat Clim Chang., 3(9), 816- 821. doi: 10.1038/nclimate1911

| Scenario | ・RCP 2.6 (the 2°C scenario) and 8.5 (4°C scenario) published by the Intergovernmental Panel on Climate Change (IPCC) |

|---|---|

Analytical method |

・Estimated damage in the event of a flood is analyzed, and an approach to measure its impact on the overall credit portfolio using the change in default probability that the occurrence of floods would have on the credit portfolio is adopted. ・In the calculation of financial impact, the period of the suspension of the business of the borrower and the loss of assets, among other aspects, are reflected. |

| Target of analysis | ・Flood |

| Target period | ・Until 2100 using the end of March 2022 as the standard |

| Result of analysis | ・Cumulative total: Approximately 115.5 billion yen |

- No significant change under standards as of the end of March 2023